Title: Hennepin Minnesota Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Introduction: A Hennepin Minnesota Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a crucial step in the financial decision-making process of a limited liability company (LLC). When an LLC requires additional funds to support its operations, expansion, or capital-intensive projects, a resolution is passed during a formal meeting of the members to authorize the borrowing of capital from a designated bank. This resolution ensures that all members are in agreement and that the LLC can access the necessary financing to achieve its objectives. Keywords: Hennepin Minnesota, resolution, meeting, LLC members, borrow capital, designated bank. 1. Purpose of the Resolution: The purpose of the Hennepin Minnesota Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is to outline the intent of the LLC to borrow funds from a specific bank. This resolution serves as an official authorization by the members, allowing the LLC to enter into a loan agreement and ensuring that the borrowed capital can be utilized for the intended purposes. Keywords: purpose, resolution, LLC members, borrow funds, loan agreement, intended purposes. 2. Types of Hennepin Minnesota Resolution of Meeting of LLC Members to Borrow Capital: a) Resolution to Borrow Capital for Business Expansion: When an LLC plans to expand its operations or enter new markets, additional capital is often required. This type of resolution is formulated during a members' meeting to authorize borrowing from a designated bank specifically for business expansion purposes. Keywords: business expansion, authorized borrowing, designated bank. b) Resolution to Borrow Capital for Capital-Intensive Projects: LCS often undertake projects with high capital requirements, such as acquiring new assets, implementing new technologies, or constructing facilities. This resolution focuses on obtaining capital from a designated bank to fund these capital-intensive projects as approved by the members during a meeting. Keywords: capital-intensive projects, designated bank, funding, capital requirements. c) Resolution to Borrow Capital for Working Capital Needs: To address immediate cash flow gaps, meet day-to-day operational expenses, or withstand market fluctuations, an LLC may pass a resolution during a members' meeting to borrow capital from a designated bank specifically for fulfilling its working capital needs. Keywords: working capital needs, cash flow gaps, operational expenses, designated bank. Conclusion: The Hennepin Minnesota Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a crucial step in the LLC's financial decision-making process. By passing this resolution during a formal meeting, members authorize the borrowing of capital from a designated bank for various purposes such as business expansion, capital-intensive projects, or fulfilling working capital requirements. It ensures that proper consent is obtained from all members and facilitates access to the necessary funds to achieve the LLC's objectives. Keywords: Hennepin Minnesota, resolution, LLC members, borrow capital, designated bank, financial decision-making, business expansion, capital-intensive projects, working capital requirements.

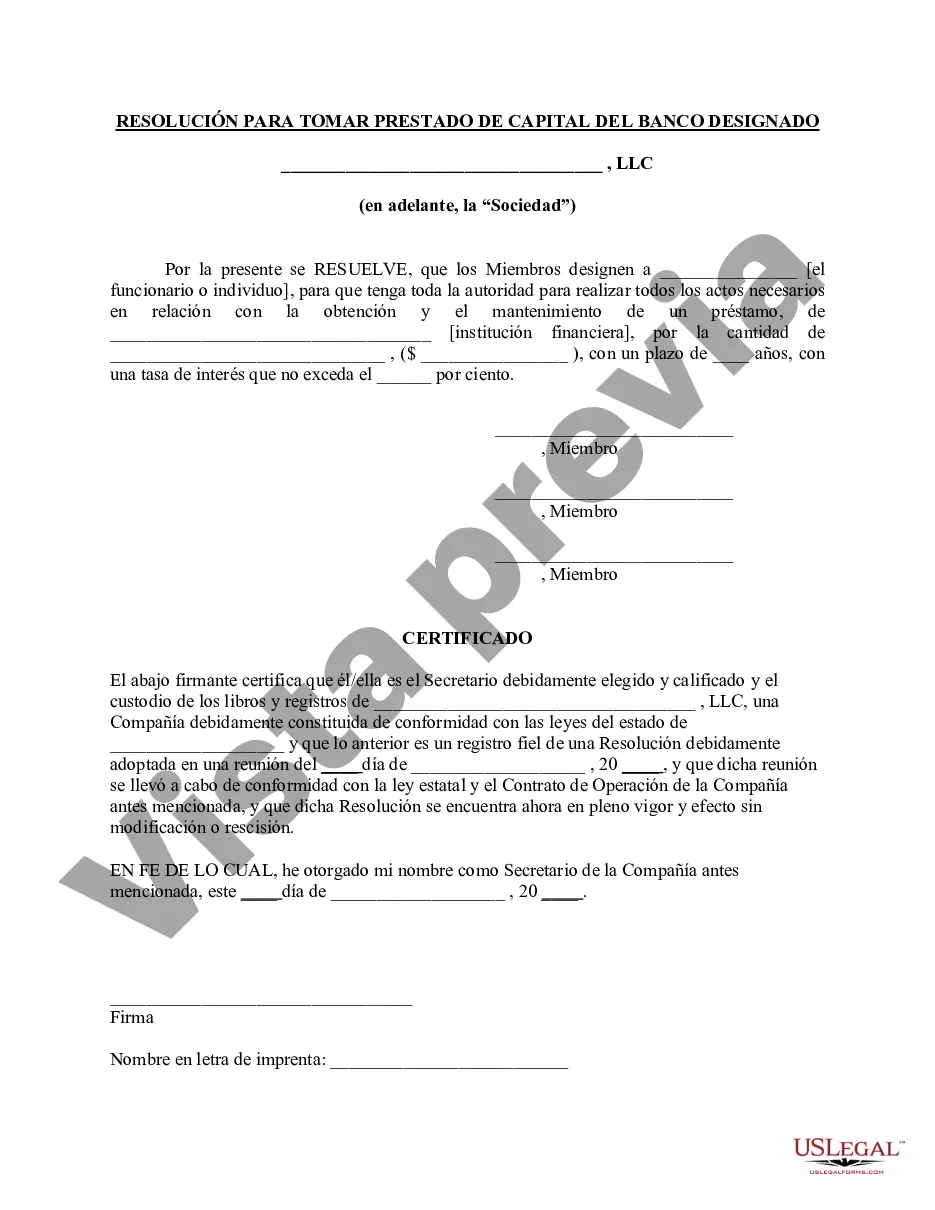

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Hennepin Minnesota Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

Do you need to quickly draft a legally-binding Hennepin Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank or probably any other document to handle your personal or corporate matters? You can select one of the two options: contact a legal advisor to draft a valid paper for you or draft it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Hennepin Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra hassles.

- To start with, double-check if the Hennepin Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process again if the document isn’t what you were seeking by using the search bar in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Hennepin Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!