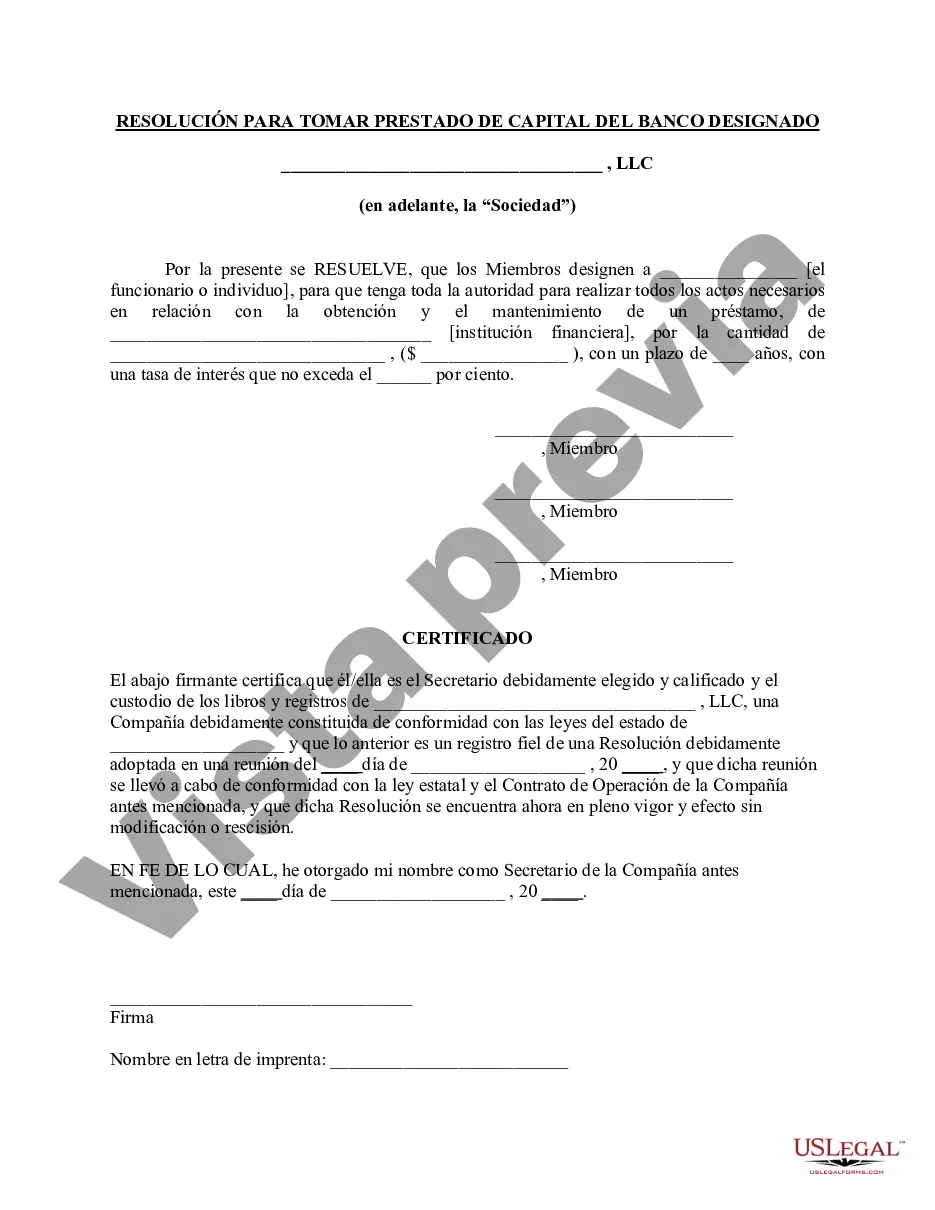

King Washington Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is a formal document outlining the decision of an LLC (Limited Liability Company) to borrow funds from a designated bank. This resolution is crucial as it provides clarity and legal validity to the capital borrowing process. It ensures that all LLC members are in agreement and have approved the borrowing of the specified funds. The resolution starts by stating the LLC's name, such as "King Washington LLC," followed by the date and location of the meeting where the resolution was enacted. It lists the LLC members present and their voting rights. The resolution highlights the purpose of the meeting, which is to discuss and decide on borrowing capital from a designated bank. It outlines the specific reasons for seeking the funds, like expansion, acquisitions, inventory management, or working capital needs. The resolution emphasizes the importance of this decision in achieving the LLC's goals and objectives. Keywords: King Washington LLC, resolution, meeting, LLC members, borrow capital, designated bank, formal document, LLC members' agreement, legal validity, LLC's name, date, location, present members, voting rights, meeting purpose, borrowing capital, expansion, acquisitions, inventory management, working capital needs, goals, objectives. Different types of King Washington Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank may include: 1. First-time capital borrowing resolution: This type of resolution is passed when an LLC decides to borrow capital from a designated bank for the first time. It sets the precedent for future borrowing activities. 2. Additional capital borrowing resolution: In case the LLC has previously borrowed capital but requires additional funds, this resolution specifies the additional borrowing amount and its purpose. 3. Amended capital borrowing resolution: If there is a need to modify the terms and conditions of an existing capital borrowing resolution, an amended resolution is passed to reflect the changes. 4. Emergency capital borrowing resolution: In urgent situations where immediate capital is required due to unforeseen circumstances or business emergencies, an LLC may pass an emergency resolution to borrow funds from a designated bank. 5. Debt refinancing resolution: This type of resolution is enacted when an LLC wants to refinance its existing debt by borrowing from a designated bank. It allows the LLC to consolidate its debt or obtain better terms and interest rates. Remember, the specific types of resolutions may vary based on the LLC's specific requirements and the nature of its business operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out King Washington Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

Do you need to quickly create a legally-binding King Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank or probably any other form to handle your own or corporate affairs? You can select one of the two options: hire a professional to draft a legal paper for you or create it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant form templates, including King Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, carefully verify if the King Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the King Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Moreover, the documents we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!