Miami-Dade Florida Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is a legal document that outlines the decision-making process within a Limited Liability Company (LLC) in Miami-Dade County, Florida, regarding borrowing funds from a designated bank. This resolution reflects the LLC members' agreement to borrow capital from a bank and specifies the terms, conditions, and purpose of the loan. In Miami-Dade County, Florida, there are various types of resolutions of LLC members to borrow capital from a designated bank, which can be classified based on the specific purpose or nature of the loan. Some common types include: 1. Working Capital Loan Resolution: This resolution is formulated when an LLC requires financing for daily operational expenses, such as payroll, inventory, or marketing. It outlines the loan amount needed, the designated bank, the interest rate, the repayment schedule, and any collateral or personal guarantees offered by the LLC members. 2. Capital Investment Loan Resolution: If an LLC intends to make a significant investment in expanding its business, acquiring assets, or venturing into new markets, a capital investment loan resolution is drafted. This resolution outlines the purpose of the loan, the projected return on investment, the specific terms and conditions, and any associated risks or contingencies. 3. Real Estate Acquisition Loan Resolution: When an LLC aims to acquire property for business purposes, such as office space, warehousing facilities, or commercial real estate, a real estate acquisition loan resolution is formulated. It includes details about the property to be acquired, the loan amount required, the repayment structure, any mortgage or lien considerations, and the LLC members' contribution or personal guarantees. 4. Equipment Financing Loan Resolution: If an LLC needs to purchase or lease machinery, vehicles, or equipment to conduct its operations, an equipment financing loan resolution is prepared. This resolution specifies the type of equipment, the loan amount, the repayment terms, the interest rate, and any warranties or conditions related to the financed equipment. 5. Debt Consolidation Loan Resolution: Sometimes, an LLC may accumulate various debts or high-interest loans, leading to financial strain. In such cases, a debt consolidation loan resolution is drafted to consolidate multiple debts into one loan with better terms and interest rates. It outlines the total debt to be consolidated, the loan amount needed, the designated bank, and the repayment schedule. When drafting any Miami-Dade Florida Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank, it is crucial to consult legal professionals and ensure compliance with applicable state laws, LLC operating agreements, and the requirements of the designated bank.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

State:

Multi-State

County:

Miami-Dade

Control #:

US-230LLC

Format:

Word

Instant download

Description

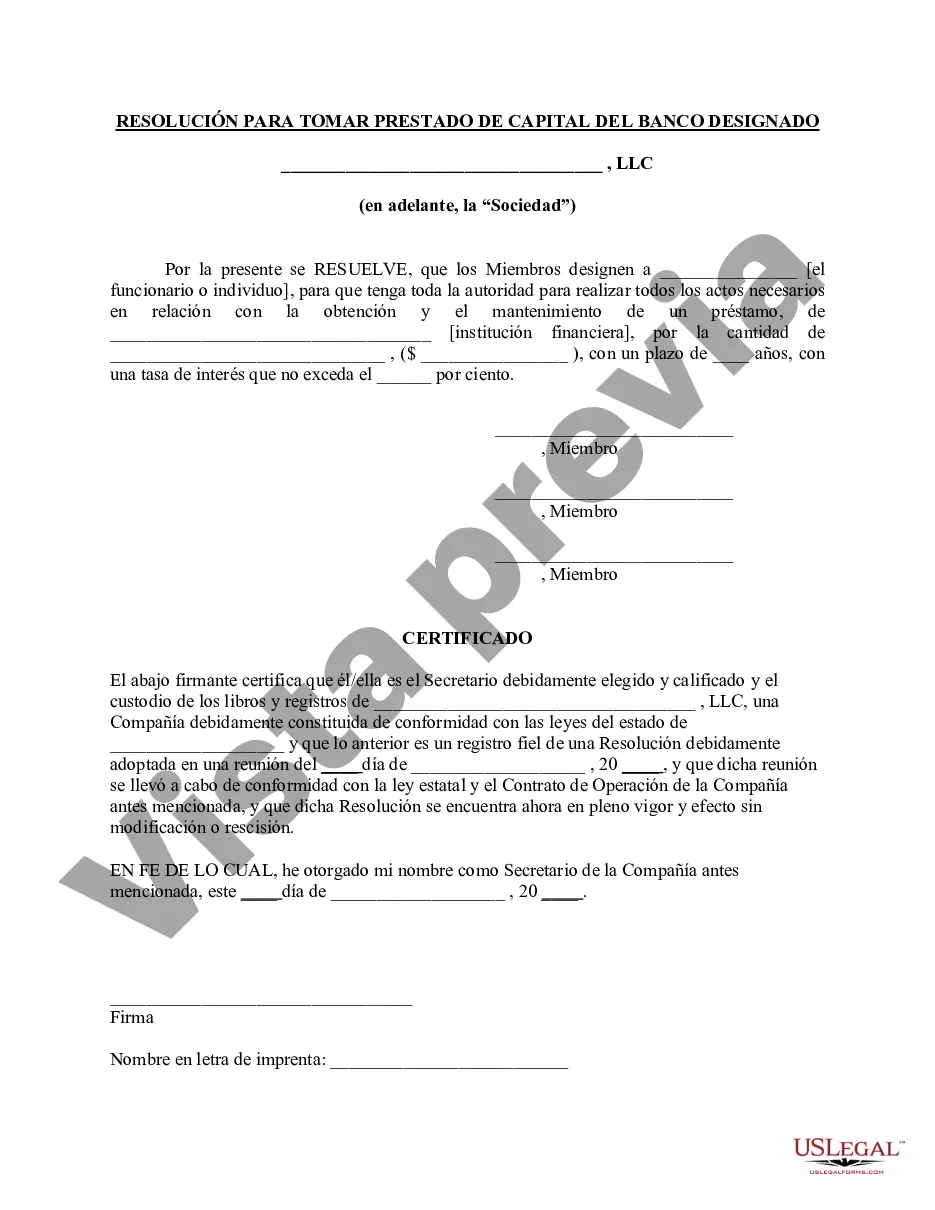

This form is a resolution of meeting of LLC Members to borrow capital from a designated bank.

Miami-Dade Florida Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is a legal document that outlines the decision-making process within a Limited Liability Company (LLC) in Miami-Dade County, Florida, regarding borrowing funds from a designated bank. This resolution reflects the LLC members' agreement to borrow capital from a bank and specifies the terms, conditions, and purpose of the loan. In Miami-Dade County, Florida, there are various types of resolutions of LLC members to borrow capital from a designated bank, which can be classified based on the specific purpose or nature of the loan. Some common types include: 1. Working Capital Loan Resolution: This resolution is formulated when an LLC requires financing for daily operational expenses, such as payroll, inventory, or marketing. It outlines the loan amount needed, the designated bank, the interest rate, the repayment schedule, and any collateral or personal guarantees offered by the LLC members. 2. Capital Investment Loan Resolution: If an LLC intends to make a significant investment in expanding its business, acquiring assets, or venturing into new markets, a capital investment loan resolution is drafted. This resolution outlines the purpose of the loan, the projected return on investment, the specific terms and conditions, and any associated risks or contingencies. 3. Real Estate Acquisition Loan Resolution: When an LLC aims to acquire property for business purposes, such as office space, warehousing facilities, or commercial real estate, a real estate acquisition loan resolution is formulated. It includes details about the property to be acquired, the loan amount required, the repayment structure, any mortgage or lien considerations, and the LLC members' contribution or personal guarantees. 4. Equipment Financing Loan Resolution: If an LLC needs to purchase or lease machinery, vehicles, or equipment to conduct its operations, an equipment financing loan resolution is prepared. This resolution specifies the type of equipment, the loan amount, the repayment terms, the interest rate, and any warranties or conditions related to the financed equipment. 5. Debt Consolidation Loan Resolution: Sometimes, an LLC may accumulate various debts or high-interest loans, leading to financial strain. In such cases, a debt consolidation loan resolution is drafted to consolidate multiple debts into one loan with better terms and interest rates. It outlines the total debt to be consolidated, the loan amount needed, the designated bank, and the repayment schedule. When drafting any Miami-Dade Florida Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank, it is crucial to consult legal professionals and ensure compliance with applicable state laws, LLC operating agreements, and the requirements of the designated bank.

Free preview