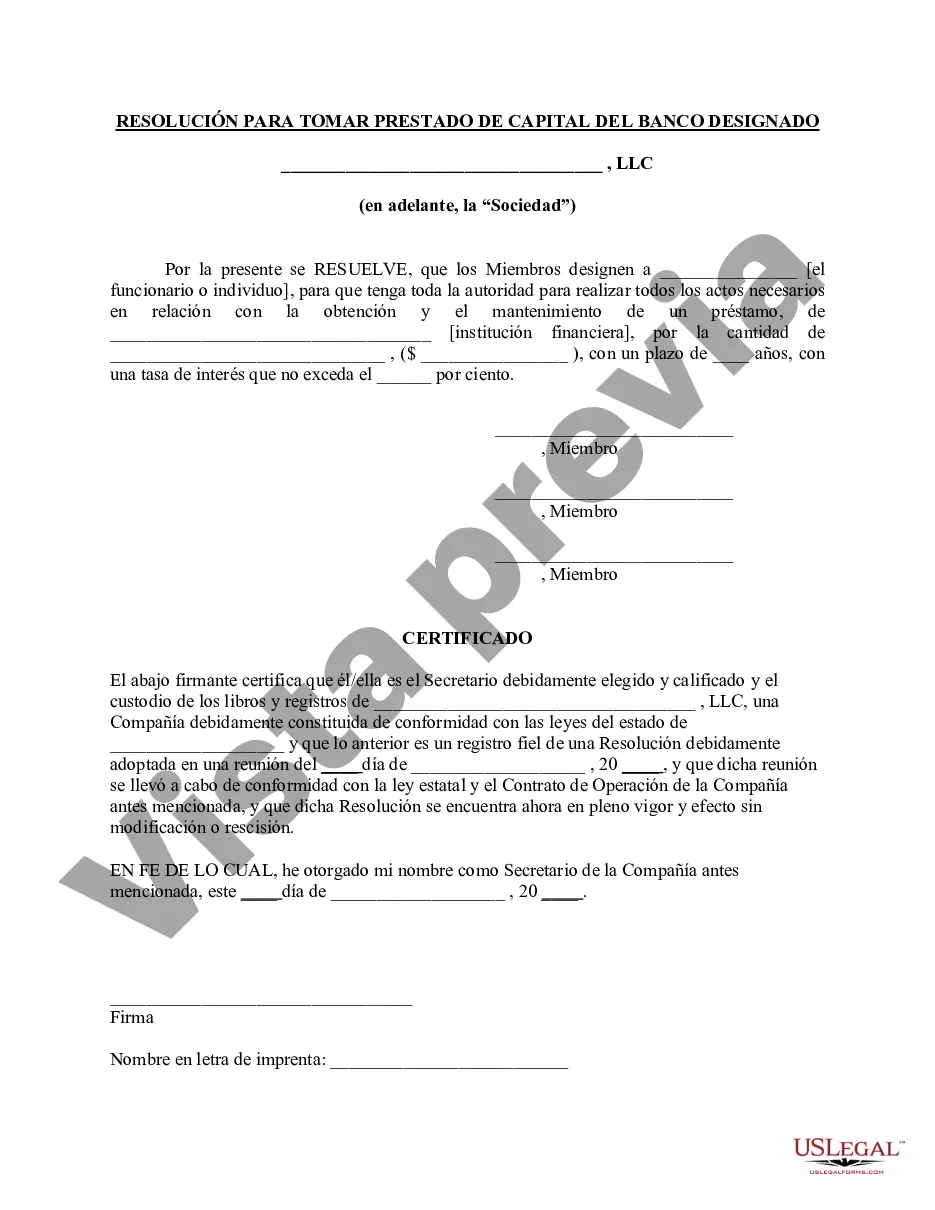

Title: Understanding the Sacramento California Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Keywords: Sacramento California, Resolution of Meeting, LLC Members, Borrow Capital, Designated Bank Introduction: In Sacramento, California, certain procedures and legal requirements need to be followed when an LLC seeks to borrow capital from a designated bank. This article will provide a detailed description of the Sacramento California Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank, highlighting its significance and different types. 1. Sacramento California Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Explained The Resolution of Meeting is a formal document that outlines the LLC's decision to borrow capital from a designated bank. It serves as a legally binding agreement between the LLC members and the bank, ensuring proper execution of the borrowing process. 2. Importance of the Resolution of Meeting The Resolution of Meeting holds significant importance due to the following reasons: a) Legitimacy: It establishes the LLC's intent to borrow capital, giving it a solid legal ground. b) Liability: It defines the extent of liability of each LLC member involved in the borrowing process. c) Borrowing Limit: It establishes the maximum amount of capital the LLC can borrow from the designated bank. d) Decision-Making: It ensures collective decision-making by all LLC members involved in the borrowing process. 3. Types of Sacramento California Resolution of Meeting The following are some different types found under the Sacramento California Resolution of Meeting of LLC Members to Borrow Capital: a) Single Borrower Resolution: A resolution where a single designated member is authorized to borrow capital on behalf of the LLC. b) Joint Borrower Resolution: A resolution where multiple designated members are authorized to borrow capital in collaboration with each other. c) Limit-Based Resolution: A resolution with defined limits on the amount of capital that can be borrowed by the LLC. d) Term-Based Resolution: A resolution specifying the duration for which the borrowing authority is granted to the LLC members. 4. Required Components of the Resolution of Meeting The Resolution of Meeting typically includes the following components: a) LLC Information: Clearly states the name, address, and purpose of the LLC. b) Purpose of Resolution: Clearly outlines the purpose of the resolution, specifically mentioning the intended capital borrowings. c) Borrowing Limit: Clearly states the maximum capital borrowing limit agreed upon by the LLC members. d) Authorization: Identifies the designated LLC members authorized to borrow capital from the designated bank. e) Signatures: Requires the signatures of all LLC members as a sign of agreement and commitment to the resolution. Conclusion: The Sacramento California Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank plays a vital role in establishing the borrowing process within the legal framework. By understanding its significance and different types, LLC members can ensure proper execution of their borrowing plans and protect the interests of all involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Sacramento California Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Sacramento Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Aside from the Sacramento Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Sacramento Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Sacramento Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!