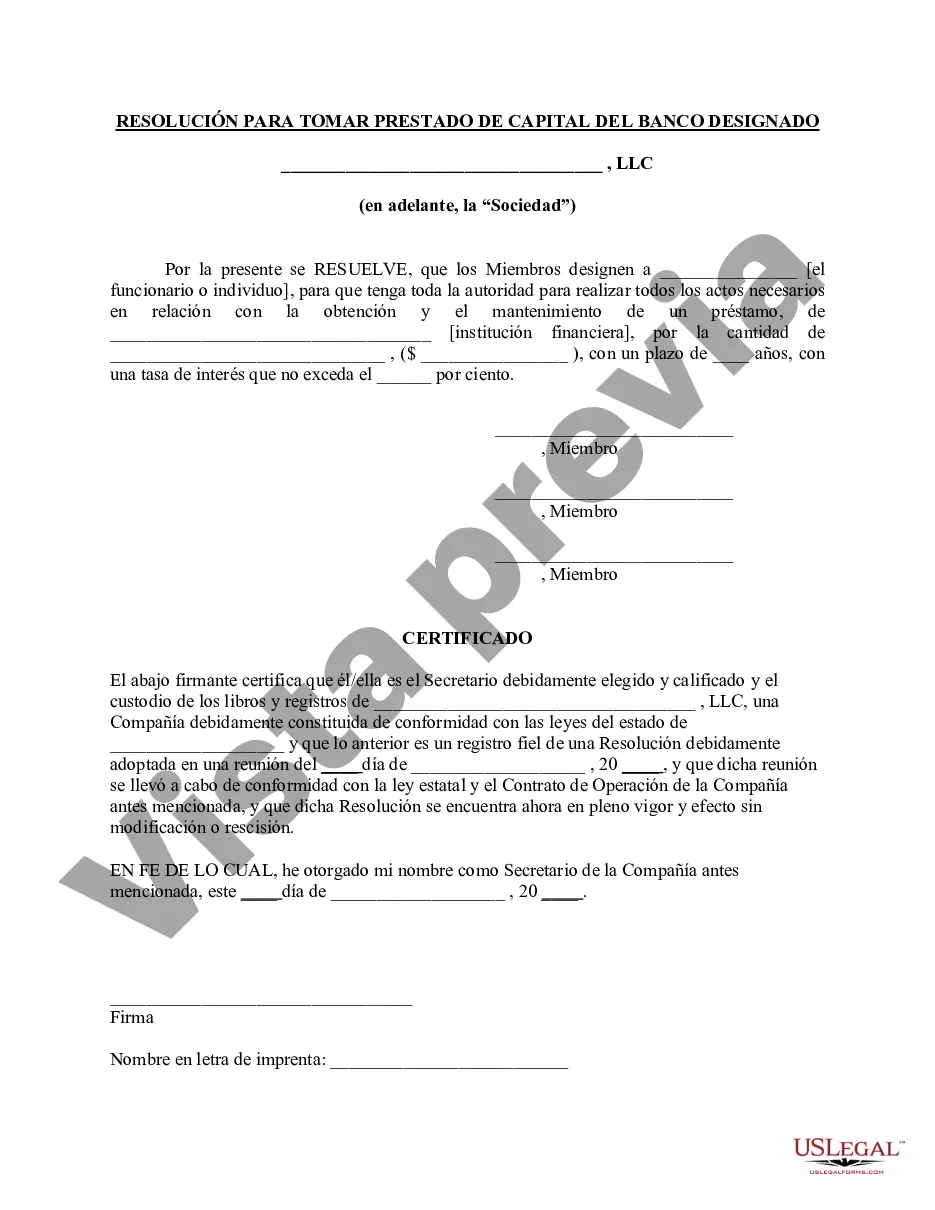

San Antonio, Texas Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: A Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank in San Antonio, Texas is a formal document that outlines the decision-making process and approval of members of a limited liability company (LLC) to obtain financial capital from a particular bank in the city of San Antonio, Texas. This resolution is essential for an LLC when seeking financial resources to fund the company's operations, expansion plans, or investments. It demonstrates the LLC members' agreement and commitment to obtaining a loan from a specific bank. This resolution is typically framed and presented in a business meeting or through written consent, adhering to the provisions established in the LLC's operating agreement and relevant state laws. To create an effective San Antonio, Texas Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank, it is crucial to include relevant information such as: 1. The Title: Clearly state that this document is a resolution of a meeting convened by the LLC members to discuss and authorize the borrowing of capital from a designated bank. 2. Introduction of the LLC: Include the official company name, identification number, and the address of the LLC's principal place of business in San Antonio, Texas. 3. Meeting Details: Specify the date, time, and location of the meeting. If the resolution is passed through written consent, indicate the date when consent was obtained and acknowledge that all members participated and agreed to the borrowing of capital. 4. Purpose of the Loan: Outline the purpose for which the loan is being obtained, whether it is for working capital, expansion, equipment acquisition, or any other specific reason. Clearly express the necessity and benefits of accessing the designated bank's financing. 5. Designated Bank: Identify the name, address, and contact details of the designated bank in San Antonio, Texas, from which the LLC intends to borrow capital. Specify the loan amount and the applicable interest rate, if already determined. 6. Authorization: State that the LLC members, by a majority vote, authorized the borrowing of capital from the designated bank. Indicate the approval is in line with the LLC's operating agreement and any relevant legal requirements. 7. Signatures: Provide space for all LLC members to sign and date the resolution. If applicable, include the LLC's official seal or notary acknowledgment. Types of San Antonio, Texas Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: 1. Long-Term Loan Resolution: This type of resolution is adopted by LLC members when the borrowing of capital is intended for long-term purposes such as acquiring assets, expanding business operations, or making significant investments. 2. Short-Term Loan Resolution: This resolution is used when the LLC requires temporary funding to manage cash flow fluctuations, settle immediate expenses, or address short-term financial obligations. 3. Emergency Loan Resolution: In urgent situations where unforeseen circumstances or opportunities arise, LLC members may pass an emergency loan resolution to obtain immediate capital from a designated bank in San Antonio, Texas. 4. Expansion Loan Resolution: In case the LLC plans to expand its business operations, enter new markets, or launch new products or services, members may adopt this resolution specifically to borrow capital for expansion purposes. To ensure compliance and validity, it is advised to consult with legal professionals or business advisors experienced in LLC law and regulations in San Antonio, Texas, when drafting and executing such resolutions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out San Antonio Texas Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

If you need to get a trustworthy legal form supplier to find the San Antonio Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it simple to locate and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to search or browse San Antonio Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the San Antonio Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate contract, or complete the San Antonio Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank - all from the comfort of your sofa.

Join US Legal Forms now!