Title: Understanding the Wake, North Carolina Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank Introduction: The process of resolving to borrow capital from a designated bank is an important step for LLC members in Wake, North Carolina. This resolution, outlining the terms and conditions for borrowing funds, ensures that all parties involved understand and agree to the borrowing arrangements. In this article, we will delve into the essential components of the Wake, North Carolina Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank, discussing its types, requirements, and key aspects. 1. Wake, North Carolina Resolution of Meeting of LLC Members: The Wake, North Carolina Resolution of Meeting of LLC Members serves as a legally binding document that outlines the LLC's intention to borrow capital from a designated bank. This resolution is drafted during an LLC meeting where members discuss and decide upon the borrowing terms, conditions, and purpose. 2. Types of Wake, North Carolina Resolution of Meeting of LLC Members: a. General Borrowing Resolution: This type addresses general borrowing needs, allowing the LLC to secure a specific amount of capital from a designated bank for various legitimate business purposes. b. Special Borrowing Resolution: This type of resolution focuses on specific borrowing requirements, such as acquiring new assets, expanding operations, or undertaking strategic investments. It provides detailed information regarding the purpose, amount, and utilization of borrowed capital. 3. Key Elements of a Wake, North Carolina Resolution of Meeting of LLC Members: a. Purpose of Borrowing: Clearly state the rationale behind the borrowing, whether it is for expansion, acquiring assets, fulfilling specific contracts, or other business-related activities. b. Borrowing Amount: Specify the exact amount of capital to be borrowed from the designated bank. Ensure that this amount is based on careful analysis and estimation of the LLC's current and future financial requirements. c. Interest Rate and Repayment Terms: Outline the agreed-upon interest rate and repayment schedule, including the frequency and duration of payments. Clearly define any penalty clauses or late payment fees. d. Security or Collateral: If applicable, detail the collateral or security offered by the LLC to the designated bank. This could include property, assets, or personal guarantees from members. e. Accountability and Decision-Making: Clearly state the authority responsible for managing the borrowed funds, such as an LLC manager or a specific committee. Define the decision-making process for utilizing the capital in compliance with the borrowing terms. Conclusion: The Wake, North Carolina Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a vital legal document that forms the basis for borrowing funds. By comprehensively addressing the purpose, amount, terms, security, and decision-making process in this resolution, LLC members can establish a clear borrowing framework that safeguards their interests and supports their business objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pedir Forms - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

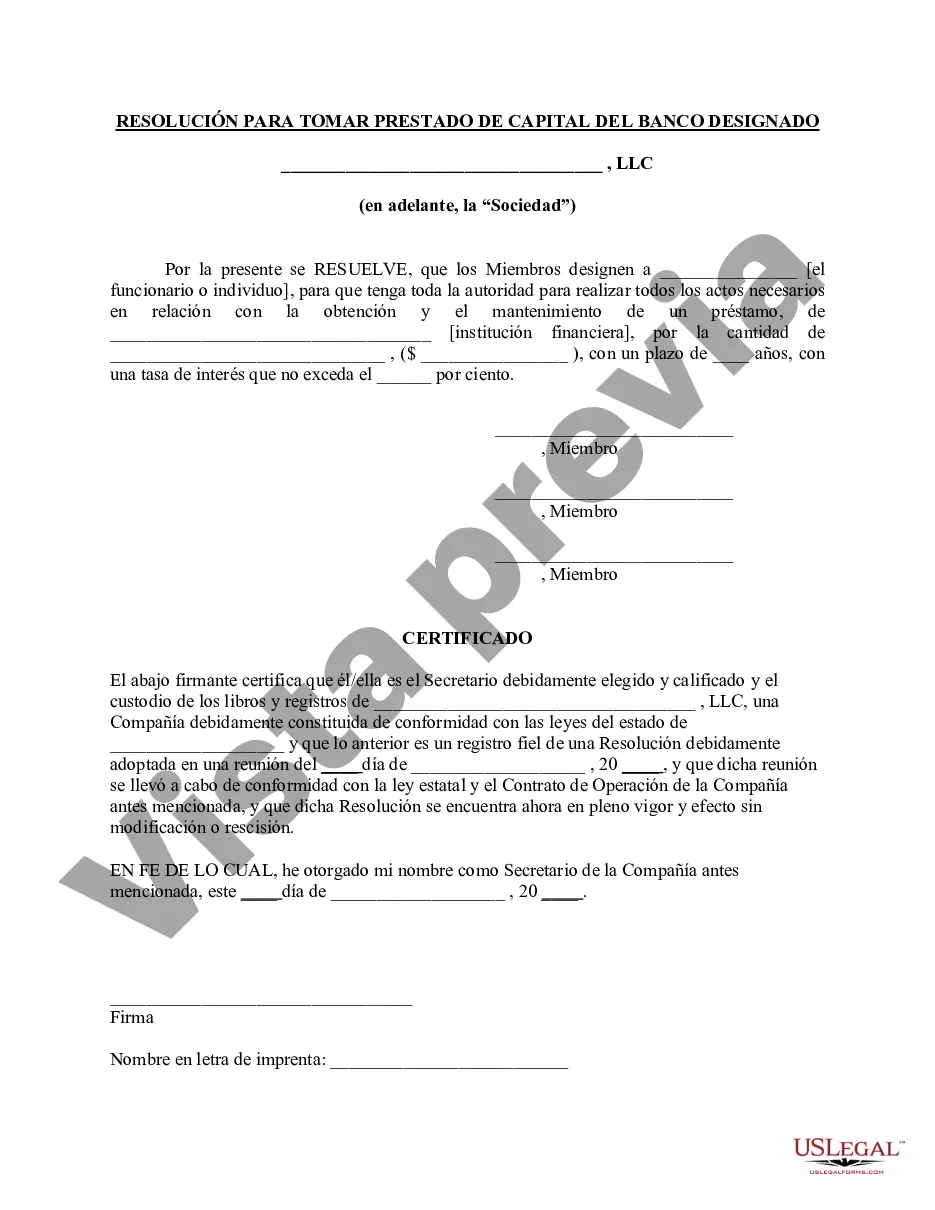

Description

How to fill out Wake North Carolina Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Wake Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the Wake Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Wake Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Wake Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!