In Franklin, Ohio, the Resolution of Meeting of LLC Members to Borrow Money is a formal procedure undertaken by Limited Liability Company (LLC) members to secure financial resources for various business purposes. When an LLC requires extra funds to invest in new projects, expand its operations, purchase assets, or meet its financial obligations, a resolution is convened to authorize borrowing money. The process of drafting a Resolution of Meeting of LLC Members to Borrow Money involves several key components. The resolution document should clearly outline the purpose of borrowing, the specific amount deemed necessary, and the intended use of the funds. It should also specify the terms and conditions of the borrowing, including interest rates, repayment schedules, and any collateral or personal guarantees required. Keywords: Franklin, Ohio, Resolution of Meeting, LLC Members, Borrow Money, Limited Liability Company, formal procedure, financial resources, business purposes, invest, projects, expand operations, purchase assets, meet financial obligations, authorize borrowing, drafting, purpose, specific amount, intended use, terms and conditions, interest rates, repayment schedules, collateral, personal guarantees. Types of Franklin Ohio Resolution of Meeting of LLC Members to Borrow Money: 1. Short-term borrowing resolution: This type of resolution is used when the LLC requires funds for immediate and short-term needs. It typically involves borrowing a relatively small amount of money for a specific duration, such as bridging gaps in working capital or funding time-sensitive projects. 2. Long-term borrowing resolution: When the LLC requires a substantial amount of funds for long-term investments or strategic initiatives, a long-term borrowing resolution is drafted. This resolution differs from short-term borrowing as it involves borrowing a larger sum for an extended period, often with different repayment terms and a more comprehensive evaluation of the borrowing decision. 3. Emergency borrowing resolution: In situations where unforeseen circumstances create an urgent need for funds, an emergency borrowing resolution is put in place. This type of resolution allows the LLC to quickly secure funds to address unexpected expenses, mitigate risks, or seize time-sensitive opportunities. 4. Secured borrowing resolution: If the LLC intends to obtain funds by pledging assets or collateral, a secured borrowing resolution is developed. This resolution ensures that the assets being pledged are properly identified and outlines the necessary steps to protect both the LLC and the lender's interests. 5. Unsecured borrowing resolution: Unlike secured borrowing, an unsecured borrowing resolution does not involve the pledge of specific assets. Instead, it relies solely on the creditworthiness and financial standing of the LLC. This type of resolution is generally used for smaller loan amounts or when collateral is not available or desirable. Keywords: Short-term borrowing, long-term borrowing, emergency borrowing, secured borrowing, unsecured borrowing, immediate needs, short-term needs, long-term investments, strategic initiatives, unforeseen circumstances, urgent need for funds, emergency expenses, mitigate risks, time-sensitive opportunities, pledge assets, collateral, creditworthiness, financial standing, loan amounts.

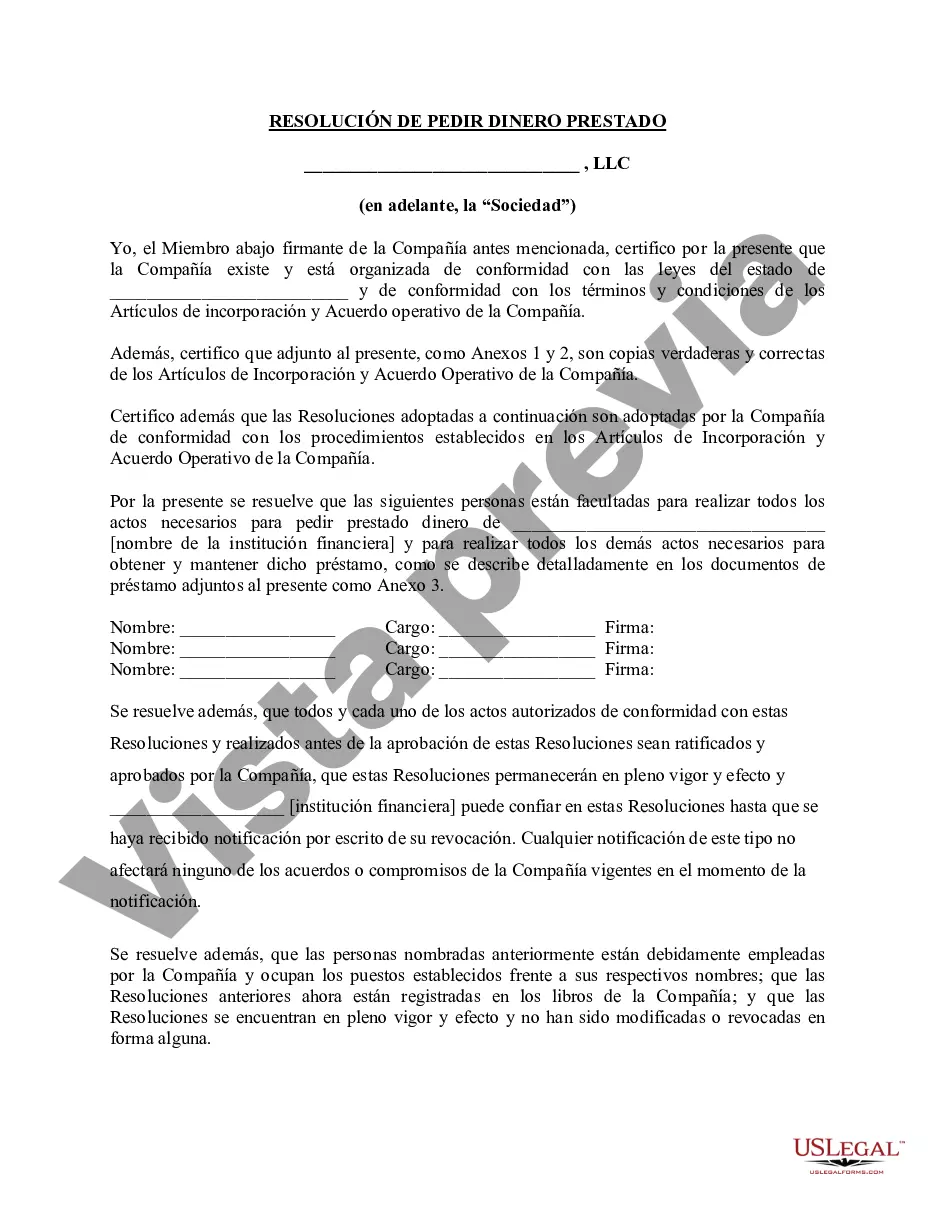

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pedir Forms - Resolution of Meeting of LLC Members to Borrow Money

Description

How to fill out Franklin Ohio Resolución De La Reunión De Miembros De La LLC Para Pedir Dinero Prestado?

Draftwing documents, like Franklin Resolution of Meeting of LLC Members to Borrow Money, to take care of your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for different cases and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Franklin Resolution of Meeting of LLC Members to Borrow Money template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Franklin Resolution of Meeting of LLC Members to Borrow Money:

- Ensure that your template is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Franklin Resolution of Meeting of LLC Members to Borrow Money isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and download the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!