Title: Exploring the Oakland Michigan Resolution of Meeting of LLC Members to Borrow Specific Money: Types and Essential Insights Introduction: The Oakland Michigan Resolution of Meeting of LLC Members to Borrow Specific Money serves as a vital tool for Limited Liability Companies (LCS) seeking to obtain funds for their business initiatives. This article aims to provide a comprehensive understanding of this resolution, its importance, and explore different types and scenarios where it is employed. By incorporating relevant keywords, we delve into the intricacies of Oakland Michigan's borrowing resolutions for LCS. Keywords: Oakland Michigan, Resolution of Meeting, LLC Members, Borrow Specific Money, Limited Liability Companies. I. What is an Oakland Michigan Resolution of Meeting of LLC Members to Borrow Specific Money? a) Definition and Purpose of the Resolution b) Legal Implications and Compliance Requirements c) Importance of Obtaining Specific Money for LCS II. Types of Oakland Michigan Resolution of Meeting of LLC Members to Borrow Specific Money a) Traditional Borrowing Resolution: — Process and Requirements involved in obtaining funds through traditional methods — Securing loans from financial institutions, banks, or private lenders — Highlight legal aspects and documentation required for a traditional borrowing resolution b) Internal Financing Resolution: — Exploring alternative methods of acquiring funds within an LLC — Utilizing existing LLC resources or capital for business expansion, projects, or investments — Discussing the internal financing resolution process and guidelines c) Crowdfunding Resolution: — Focus on new-age financing options for LCS — Explanation of crowdfunding platforms and their suitability for borrowing specific money — Discussing legal considerations and documenting crowdfunding resolutions d) Private Equity Resolution: — Introduction to obtaining funds through private equity investments — Highlighting differences between traditional borrowing and private equity investments — Analyzing benefits and challenges associated with private equity resolutions III. Key Considerations for Oakland Michigan Resolution of Meeting of LLC Members to Borrow Specific Money a) Voting Requirements: — Explanation of the voting process required to pass the resolution — Clarification of required majoritsuperer majority for successful passage b) Financial Disclosure and Reporting: — Overview of financial disclosure obligations regarding borrowed funds — Applicable reporting requirements and documentation for regulatory compliance c) Repayment Terms and Interest Rates: — Discussion on terms of repayment, such as duration, installment plans, or lump-sum payment — Highlighting the significance of determining interest rates and their impact d) Risk Assessment and Mitigation: — Exploring potential risks associated with borrowing specific money — Suggestions for risk management and mitigation strategies Conclusion: The Oakland Michigan Resolution of Meeting of LLC Members to Borrow Specific Money plays a fundamental role in helping LCS obtain necessary funds for their growth and operations. By understanding various types of resolutions, their implications, and best practices, LLC members can make informed decisions for their borrowing needs. Adhering to legal requirements, financial disclosures, and considering risk factors, LCS can successfully navigate these resolutions while securing the necessary financing.

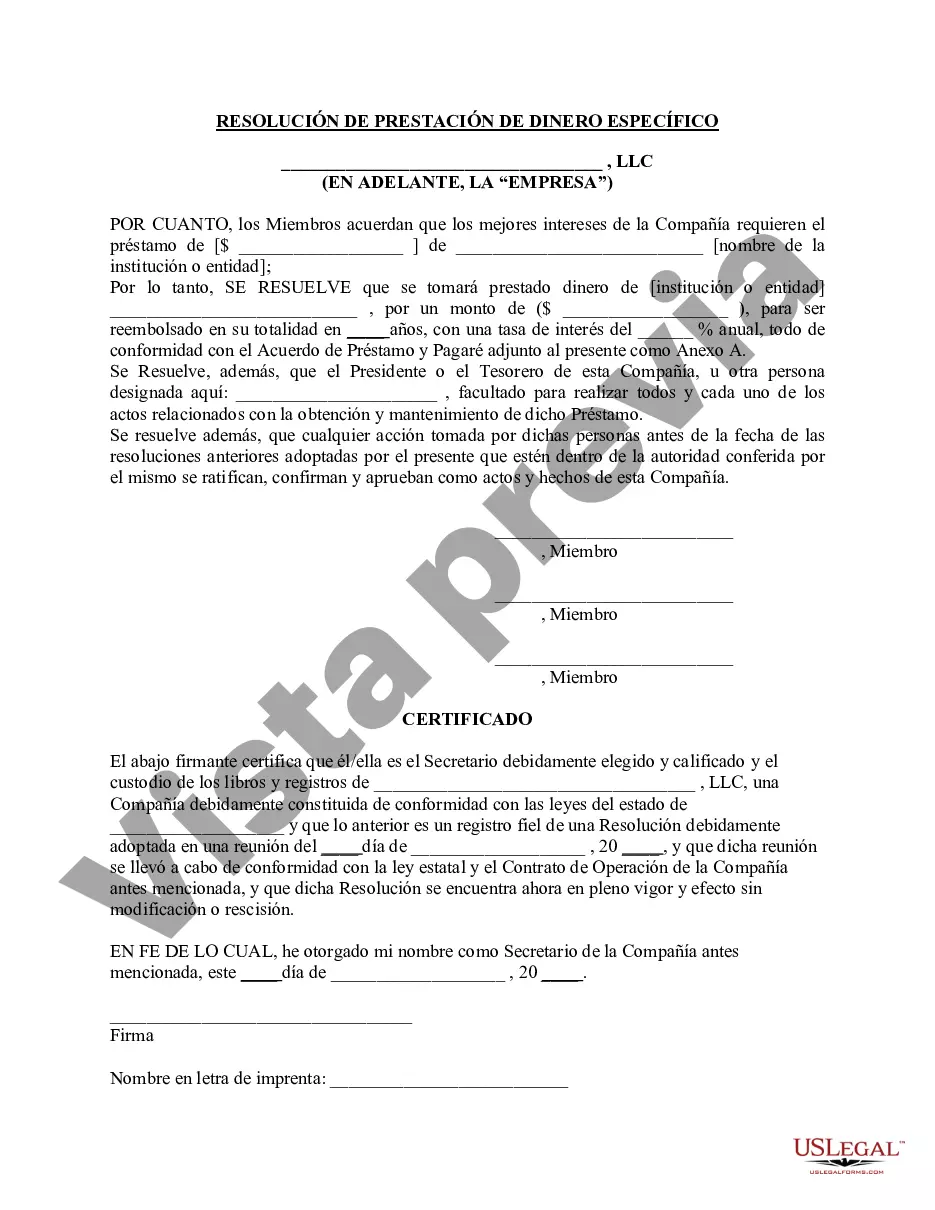

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Resolución de la reunión de miembros de la LLC para pedir prestado dinero específico - Resolution of Meeting of LLC Members to Borrow Specific Money

Description

How to fill out Oakland Michigan Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Dinero Específico?

If you need to get a trustworthy legal paperwork supplier to get the Oakland Resolution of Meeting of LLC Members to Borrow Specific Money, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support make it simple to get and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Oakland Resolution of Meeting of LLC Members to Borrow Specific Money, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Oakland Resolution of Meeting of LLC Members to Borrow Specific Money template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less pricey and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Oakland Resolution of Meeting of LLC Members to Borrow Specific Money - all from the convenience of your home.

Sign up for US Legal Forms now!