Nassau New York Stop Annuity Request refers to the option available to individuals residing in Nassau County, New York, to halt or terminate an annuity payment. An annuity is a financial product offered by insurance companies or financial institutions that provides a stream of income over a designated period. When individuals in Nassau New York wish to stop or cancel their annuity payments, they can submit a request known as a "Nassau New York Stop Annuity Request". This process involves contacting the relevant insurance company or financial institution that issued the annuity and following their specific procedures for discontinuing or modifying the annuity contract. The reasons for submitting a Nassau New York Stop Annuity Request can vary from person to person. Some common situations where individuals might seek to stop annuity payments include: 1. Financial Hardship: Individuals may be experiencing financial difficulties that require them to discontinue annuity payments to meet immediate financial obligations. 2. Change in Financial Goals: The annuity might no longer align with the person's long-term financial objectives or retirement plans, prompting them to terminate the contract. 3. Better Investment Opportunities: Individuals may have identified alternative investment options that offer higher returns or better suit their financial needs, leading them to seek discontinuation of the annuity. 4. Death of the Annuitant: In the unfortunate event of the annuitant's passing, beneficiaries can request a Stop Annuity Request in order to settle the contract and receive the remaining annuity value. It is important to note that different types of annuities may have specific rules and conditions for stopping or canceling annuity payments. Some common types of annuities in Nassau New York include: 1. Fixed Annuities: These annuities offer a guaranteed income stream for a predetermined period and may have specific guidelines for stopping payment. 2. Variable Annuities: With variable annuities, the income stream is tied to investments in various assets, making the cancellation process subject to the terms and conditions set by the insurance company. 3. Immediate Annuities: Immediate annuities typically start providing income immediately upon purchase. Cancelling or stopping payments for immediate annuities might involve different procedures compared to other types of annuities. Individuals considering submitting a Nassau New York Stop Annuity Request should carefully review their annuity contract and understand the implications of terminating the annuity. Seeking guidance from financial advisors or insurance professionals is recommended to ensure a well-informed decision.

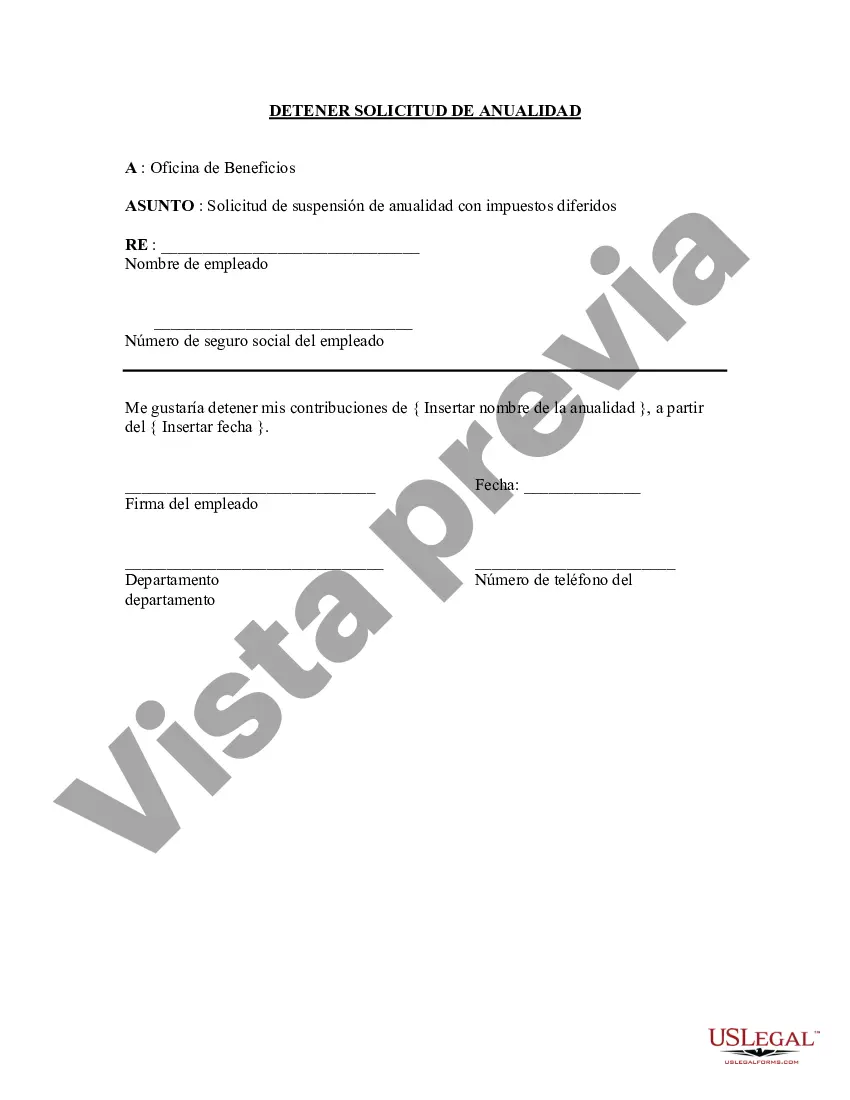

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Detener solicitud de anualidad - Stop Annuity Request

Description

How to fill out Nassau New York Detener Solicitud De Anualidad?

Preparing documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Nassau Stop Annuity Request without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Nassau Stop Annuity Request by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Nassau Stop Annuity Request:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!