Title: Houston Texas Resolution of Meeting of LLC Members to Loan Money: A Comprehensive Guide Introduction: In the bustling city of Houston, Texas, limited liability companies (LCS) often find themselves in need of financial support to fuel growth, seize opportunities, or overcome temporary setbacks. This article explores the significance of resolutions of meetings for LLC members to loan money, providing valuable insights, and exploring different variations depending on the specific circumstances. Key Keywords: — HoustoTextxa— - Resolution of Meeting - LLC Members — Loan Money I. Understanding the Houston Texas Resolution of Meeting of LLC Members to Loan Money A. Definition: 1. A Resolution of Meeting: A formal decision made by LLC members during a meeting. 2. LLC Members: Individuals holding membership interests in a limited liability company. 3. Loan Money: Funds provided to an LLC by its members to support financial requirements. B. Purpose and Importance: 1. Financial Support: Loaning money helps LCS meet various financial needs, such as expansion, inventory purchase, or debt settlement. 2. Decision-Making: Resolutions ensure transparency and accountability in the loan process, safeguarding the interests of both members and the LLC. 3. Legal Protection: Proper documentation protects against potential disputes or misunderstandings between members. II. Types of Houston Texas Resolution of Meeting of LLC Members to Loan Money A. General Loan Resolution: 1. Standard Resolution: A common resolution approving loan money to the LLC. 2. Loan Amount and Terms: Clearly define the loan amount, repayment terms, interest rates, and any collateral requirements. 3. Voting Process: The resolution may introduce a voting process to reach a unanimous decision or require a specified majority vote. B. Emergency Loan Resolution: 1. Defined Circumstances: For unexpected financial emergencies or temporary cash-flow shortages. 2. Expedited Approval: Streamlined decision-making process due to urgency. 3. Temporary Nature: Emergency loans are typically intended for specific purposes and need to be repaid promptly. C. Loan Conversion or Modification Resolution: 1. Change in Loan Structure: Conversion of loans to equity or modifying loan terms. 2. Members' Consent: Unanimous approval or a defined majority is usually necessary. 3. Legal Compliance: Ensure adherence to state regulations, LLC operating agreement, and tax implications. D. Interim Loan Resolution: 1. Bridge Financing: Funding provided to an LLC until it can obtain a long-term loan or secure funds from other sources. 2. Clear Repayment Strategy: Specify the repayment timeline and any applicable interest rates. 3. Member Agreement: Unanimous consent may be required to avoid future disagreements. Conclusion: Houston, Texas, plays host to numerous LCS seeking financial assistance through resolutions of meetings to loan money. By understanding the different types of loan resolutions available, LLC members can make informed decisions while supporting the growth and financial stability of their respective organizations. Proper documentation and compliance ensure efficient and secure lending processes within the legal framework, fostering trust among members and safeguarding the LLC's future.

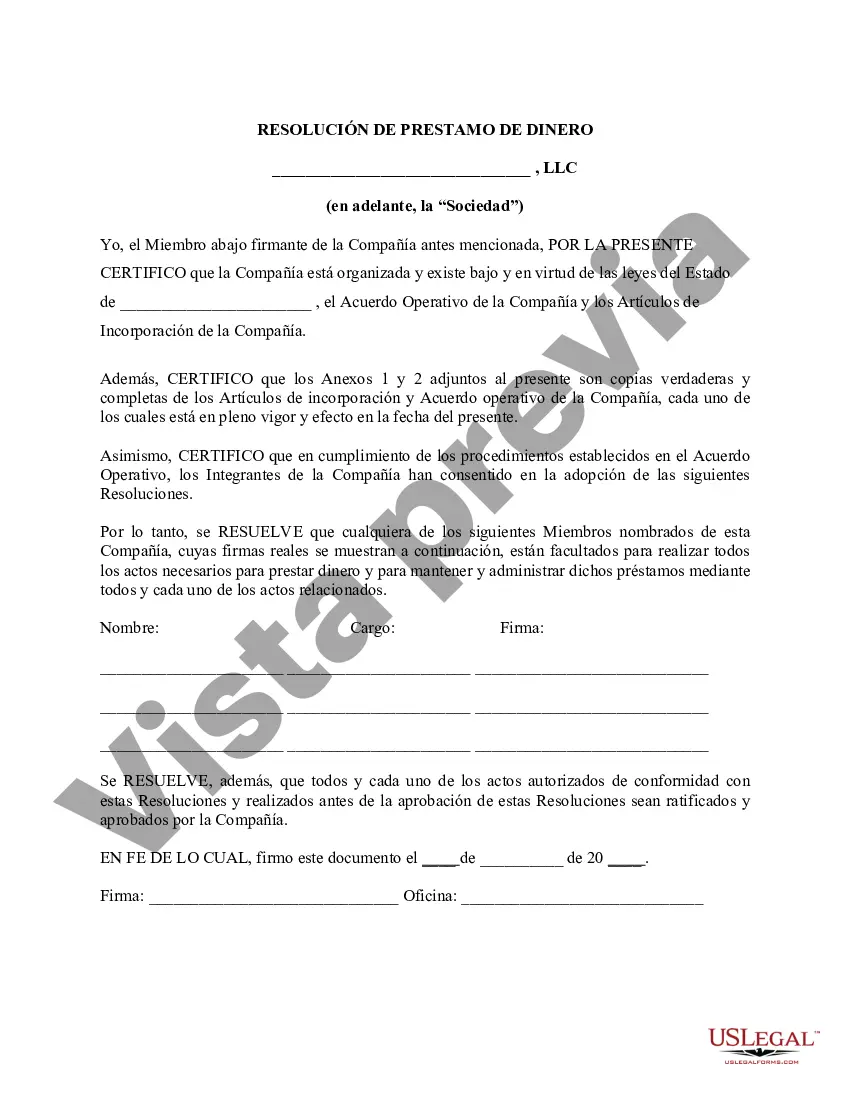

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Resolución de la reunión de los miembros de la LLC para prestar dinero - Resolution of Meeting of LLC Members to Loan Money

Description

How to fill out Houston Texas Resolución De La Reunión De Los Miembros De La LLC Para Prestar Dinero?

Drafting documents for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Houston Resolution of Meeting of LLC Members to Loan Money without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Houston Resolution of Meeting of LLC Members to Loan Money by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Houston Resolution of Meeting of LLC Members to Loan Money:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!