Title: Understanding Oakland Michigan Resolution of Meeting of LLC Members to Loan Money Introduction: In Oakland, Michigan, LCS engage in resolutions of meetings to facilitate the loaning of money. This article aims to provide an in-depth description of what Oakland Michigan Resolution of Meeting of LLC Members to Loan Money entails, including its purpose, key components, and types. 1. Purpose of the Resolution: The Resolution of Meeting of LLC Members to Loan Money in Oakland, Michigan serves as a formal agreement within the LLC, outlining the terms and conditions for loaning funds. This resolution ensures transparency, legality, and accountability in any financial transactions undertaken by the LLC. 2. Key Components of the Resolution: a) Identification of Members: The resolution should specify the LLC members involved in the loan agreement, including their names, ownership percentages, and any special roles or titles. b) Loan Details: The resolution outlines the specific amount of money to be loaned, the purpose of the loan, interest rates (if applicable), repayment terms, and any collateral or guarantees involved. c) Approval Process: The resolution must detail the voting procedure conducted during the meeting where members decide whether to approve or reject the loan transaction. It should specify the minimum number of votes or percentage required to pass the resolution. d) Record-Keeping: LCS must maintain accurate records of all resolutions passed within the organization. This includes documenting the date, time, place of the meeting, and names of attendees, alongside the signed resolution document. 3. Types of Oakland Michigan Resolution of Meeting of LLC Members to Loan Money: a) Single Loan Resolution: This type of resolution pertains to a one-time loan transaction conducted by the LLC. It includes the specific details of the loan mentioned above, encompassing amounts, terms, and conditions discussed and agreed upon during the meeting. b) Line of Credit Resolution: If an LLC wishes to establish a line of credit for ongoing financial needs, a Line of Credit Resolution is required. This resolution allows the LLC to borrow funds up to a predetermined credit limit, under specified conditions such as interest rates and repayment schedules. c) Special Loan Resolution: In certain situations, an LLC might need to obtain a loan under unique circumstances, such as an urgent financial requirement or investment opportunity. A Special Loan Resolution caters to these unique loan scenarios, outlining the distinct terms and conditions associated with such loans. Conclusion: Oakland Michigan Resolution of Meeting of LLC Members to Loan Money plays a vital role in ensuring proper financial decisions and adherence to regulations within LCS. The resolution brings transparency and clarity to loan transactions, minimizing potential conflicts among members while protecting the interests of all parties involved. The different types of resolutions, including Single Loan, Line of Credit, and Special Loan, provide flexibility in addressing specific loan needs that may arise within the LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Resolución de la reunión de los miembros de la LLC para prestar dinero - Resolution of Meeting of LLC Members to Loan Money

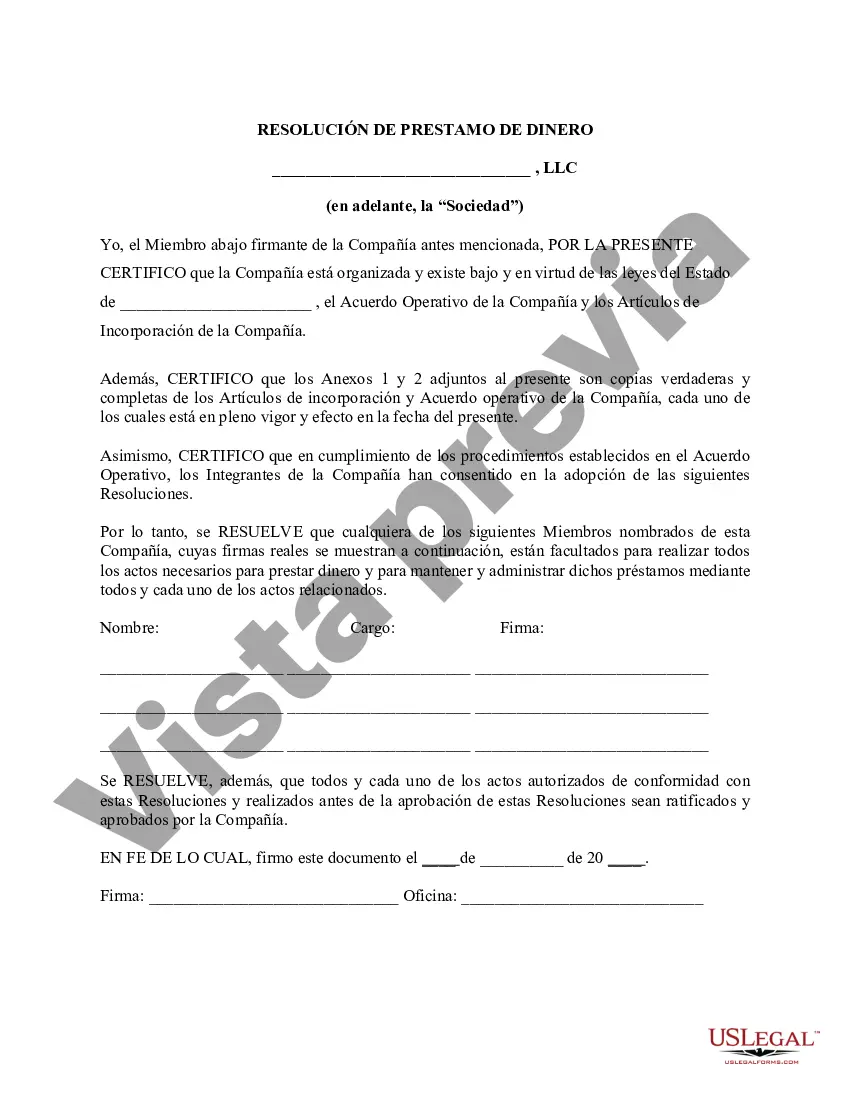

Description

How to fill out Oakland Michigan Resolución De La Reunión De Los Miembros De La LLC Para Prestar Dinero?

If you need to get a reliable legal document provider to find the Oakland Resolution of Meeting of LLC Members to Loan Money, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to locate and complete different papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Oakland Resolution of Meeting of LLC Members to Loan Money, either by a keyword or by the state/county the form is intended for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Oakland Resolution of Meeting of LLC Members to Loan Money template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less pricey and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or complete the Oakland Resolution of Meeting of LLC Members to Loan Money - all from the comfort of your home.

Sign up for US Legal Forms now!