Title: Understanding Franklin Ohio Resolution of Meeting of Corporation to Make Specific Loan Introduction: In Franklin, Ohio, corporations often convene meetings to discuss important decisions regarding their financial operations. One such critical aspect is the resolution of meetings to make a specific loan. This article provides detailed insight into what a Franklin Ohio Resolution of Meeting of Corporation to Make Specific Loan entails, its significance, and possible variations that may exist. Understanding the Resolution of Meeting of Corporation to Make Specific Loan: A resolution of a meeting of a corporation refers to an official decision or action taken by its members during a convened meeting. In Franklin, Ohio, such resolutions are commonly used to authorize the process of obtaining a specific loan for corporate purposes. This resolution is essential as it ensures transparency, legality, and accountability in corporate financial transactions. Key Elements and Procedure: 1. Purpose of the Loan: The resolution must clearly state the purpose for which the loan is being sought. It should outline the specific financial needs of the corporation, whether it's for expansion, investment, research, or any other valid reason. 2. Loan Amount: The resolution should specify the precise amount of the loan required by the corporation. This amount is determined after considering factors such as projected expenses, repayment capability, and lender requirements. 3. Loan Terms and Conditions: The resolution should also detail the expected terms and conditions associated with the loan. This typically includes interest rates, repayment period, collateral requirements, and any other relevant provisions. 4. Approval and Authorization: The resolution needs to be voted upon and approved by a majority of the corporation's members present at the meeting. The approved resolution then serves as legal authorization for the corporation to proceed with the loan application process. Possible Types or Variations: 1. Short-Term vs. Long-Term Loan Resolutions: Depending on the financial needs and goals of the corporation, resolutions may differ based on the loan duration. Short-term loan resolutions are common for urgent financial requirements or bridging gaps, while long-term loan resolutions are formulated for more extensive projects or capital investments. 2. External vs. Internal Lending Resolutions: Another variation can occur based on the source of the loan. Whether the corporation seeks lending from external financial institutions, such as banks or credit unions, or internal sources like shareholders or affiliated entities, the resolution may include specific clauses and considerations. Conclusion: A Franklin Ohio Resolution of Meeting of Corporation to Make Specific Loan plays a crucial role in ensuring proper financial management within corporations. By outlining the purpose, loan amount, terms, and securing approval, corporations can structure their loan transactions in a transparent and compliant manner. Understanding the significance of such resolutions aids corporations in achieving their financial objectives effectively and legally.

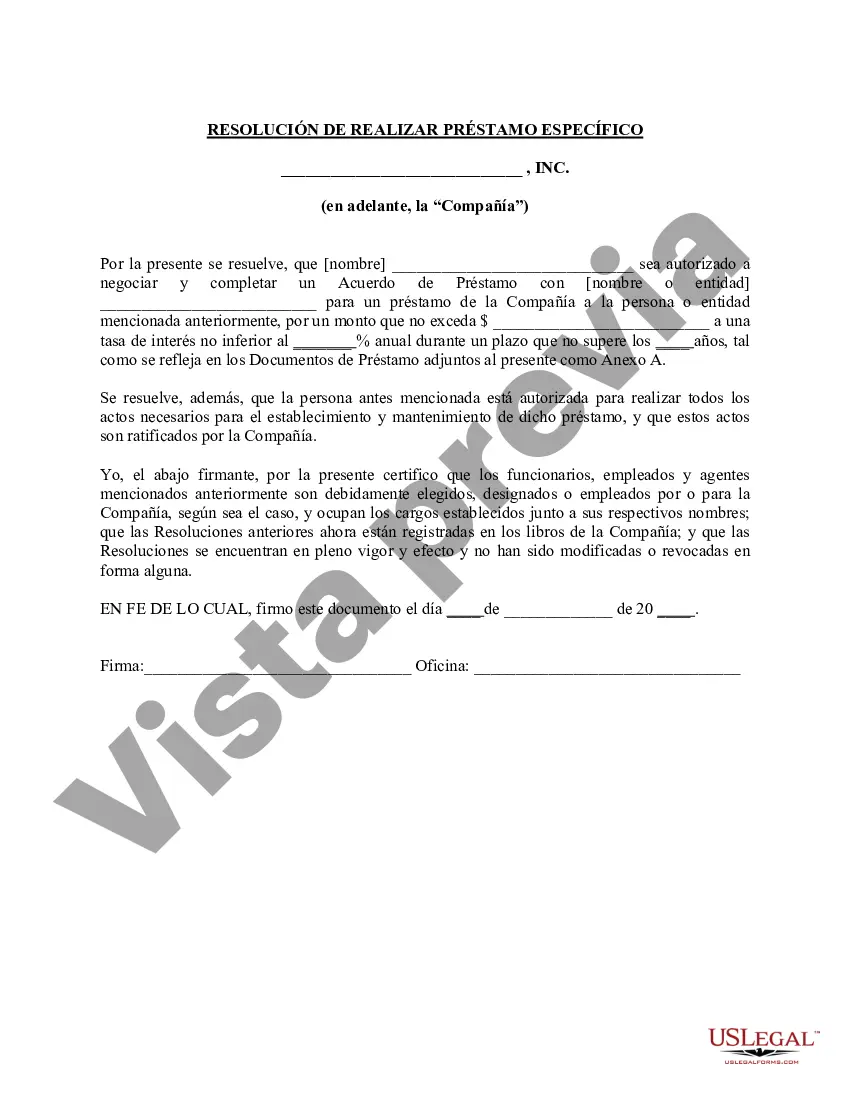

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Resolución de Asamblea de Corporación para Hacer Préstamo Específico - Resolution of Meeting of Corporation to Make Specific Loan

Description

How to fill out Franklin Ohio Resolución De Asamblea De Corporación Para Hacer Préstamo Específico?

If you need to find a trustworthy legal paperwork provider to find the Franklin Resolution of Meeting of Corporation to Make Specific Loan, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it easy to locate and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Franklin Resolution of Meeting of Corporation to Make Specific Loan, either by a keyword or by the state/county the document is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Franklin Resolution of Meeting of Corporation to Make Specific Loan template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less expensive and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate contract, or complete the Franklin Resolution of Meeting of Corporation to Make Specific Loan - all from the comfort of your sofa.

Join US Legal Forms now!