Title: Understanding the Oakland, Michigan Resolution of Meeting of Corporation to Make Specific Loan Introduction: In Oakland, Michigan, corporations must adhere to specific guidelines when seeking to secure loans. This article aims to provide a detailed description of the Oakland Michigan Resolution of Meeting of Corporation to Make Specific Loan. We will explore the key elements, legal requirements, and different types of resolutions related to this process. 1. Definition of the Resolution: The Oakland, Michigan Resolution of Meeting of Corporation to Make Specific Loan refers to the official document issued by a corporation's board of directors or shareholders, authorizing the company to pursue a specific loan for a predetermined purpose. This resolution is crucial in ensuring corporate compliance and aligning with statutory requirements. 2. Key Elements of the Resolution: The resolution typically includes several key elements, such as: a) Identification: It should clearly identify the corporation seeking the loan, stating its full legal name, address, and any unique identifiers. b) Purpose: The resolution should state the purpose for which the loan is required, providing a detailed explanation of how the funds will benefit the corporation's operations or expansion plans. c) Loan Amount: The resolution must specify the exact loan amount requested, ensuring accuracy and consistency. d) Loan Terms: This section outlines the anticipated interest rate, repayment period, any associated fees, and any collateral or security agreements tied to the loan. e) Approval: The resolution requires formal approval by a vote of the corporation's board of directors or shareholders. This demonstrates that the decision is made collectively in the best interests of the corporation. 3. Legal Requirements: a) Compliance with State Laws: The Oakland, Michigan Resolution of Meeting of Corporation to Make Specific Loan must comply with all relevant state laws and regulations. It is essential to consult legal counsel or refer to the Michigan Corporations and Securities Bureau for guidance. b) Record Keeping: Corporations should maintain accurate records of the resolution, including meeting minutes, to ensure legal compliance and transparency. c) Filing: Depending on the loan amount, the corporation may need to file additional documentation with the state, such as UCC filings. 4. Types of Oakland, Michigan Resolution of Meeting of Corporation to Make Specific Loan: While the basic structure remains the same, Oakland, Michigan may have variations of this resolution based on specific loan scenarios, such as: a) Short-Term Loan Resolution: Pertains to loans with a shorter repayment period, typically used to cover immediate operational expenses or urgent capital requirements. b) Long-Term Loan Resolution: Relates to loans with longer repayment terms, often utilized for significant investments, expansions, or acquisitions. c) Line of Credit Loan Resolution: Focuses on obtaining a revolving line of credit, giving the corporation access to funds as needed, often used to manage cash flow fluctuations or ongoing projects. Conclusion: Understanding the Oakland, Michigan Resolution of Meeting of Corporation to Make Specific Loan is crucial for corporations seeking financial support. By adhering to the legal requirements and incorporating the key elements, corporations can ensure transparency, compliance, and effective management of their financial needs. It is advisable to consult legal professionals familiar with Michigan corporate laws to navigate the loan resolution process successfully.

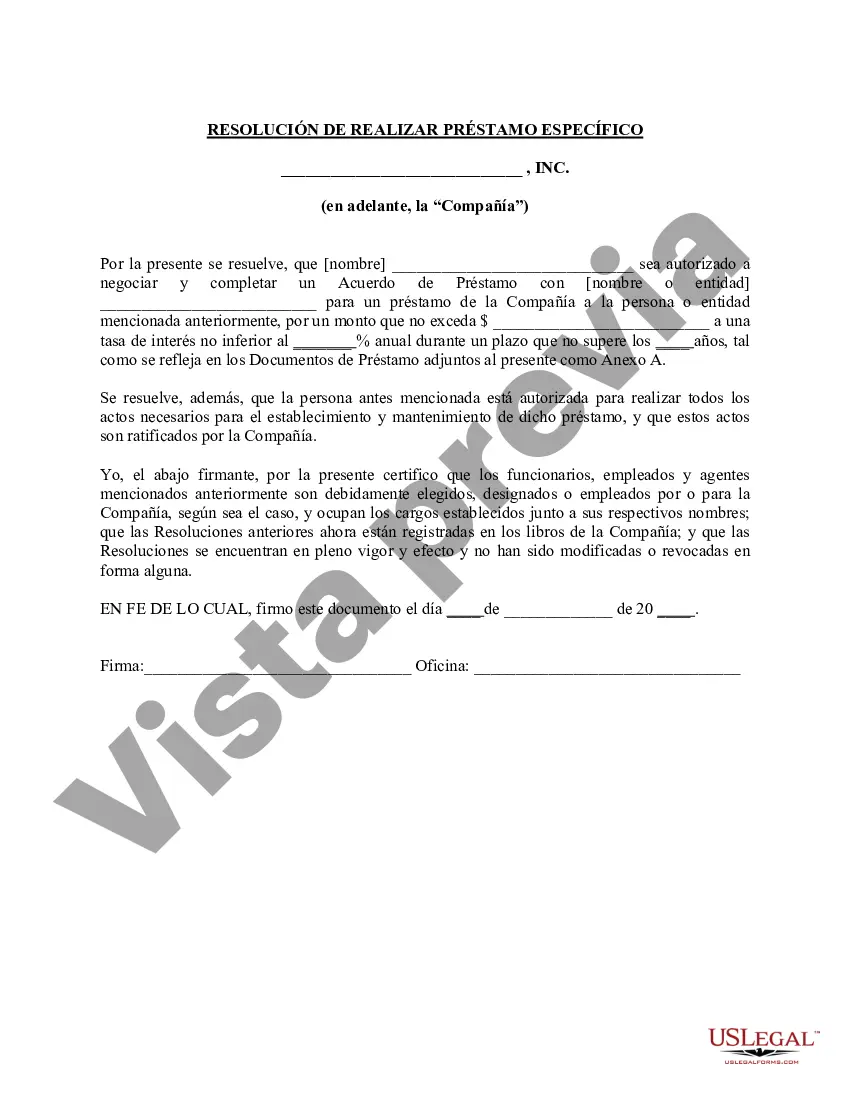

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Resolución de Asamblea de Corporación para Hacer Préstamo Específico - Resolution of Meeting of Corporation to Make Specific Loan

Description

How to fill out Oakland Michigan Resolución De Asamblea De Corporación Para Hacer Préstamo Específico?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including Oakland Resolution of Meeting of Corporation to Make Specific Loan, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks associated with paperwork completion simple.

Here's how to purchase and download Oakland Resolution of Meeting of Corporation to Make Specific Loan.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the related document templates or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Oakland Resolution of Meeting of Corporation to Make Specific Loan.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Oakland Resolution of Meeting of Corporation to Make Specific Loan, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you have to cope with an exceptionally challenging situation, we recommend using the services of an attorney to check your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific documents with ease!