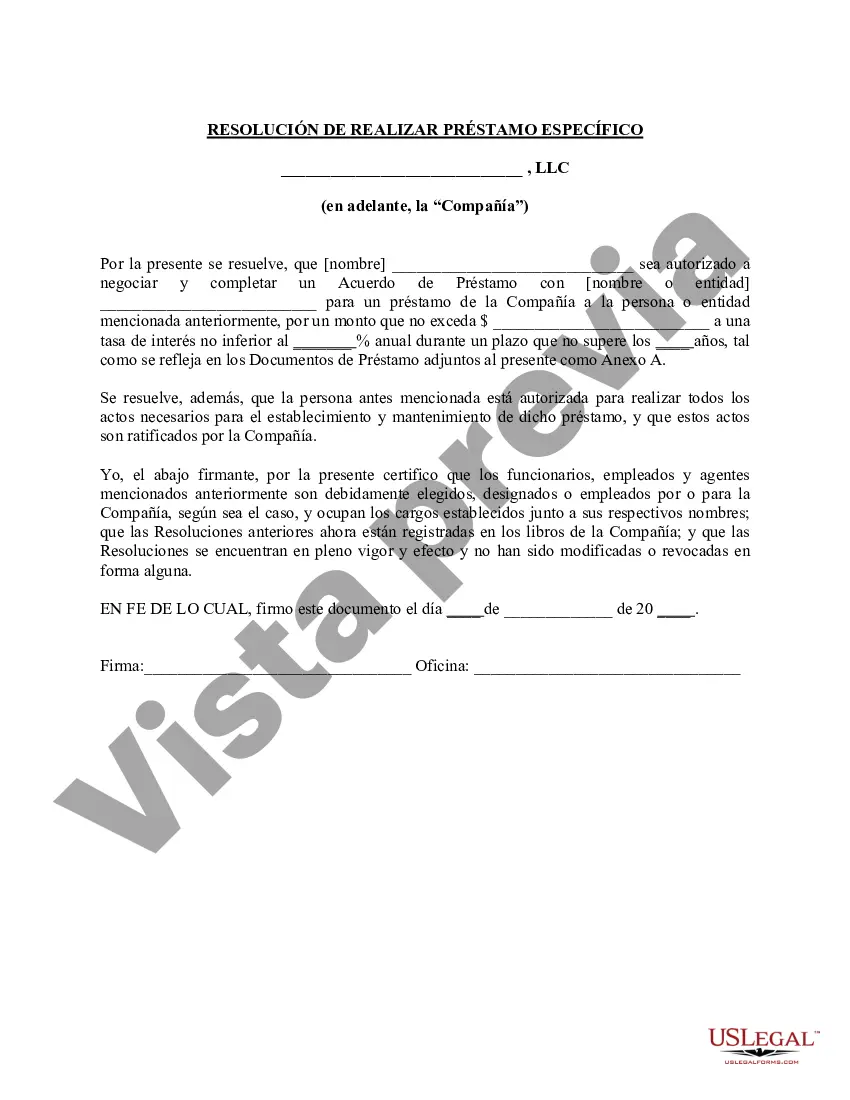

Title: Houston Texas Resolution of Meeting of LLC Members to Make Specific Loan Introduction: In the vibrant city of Houston, Texas, LLC members play a vital role in decision-making processes, including approving loans for their businesses. This article aims to provide a detailed description of what a Houston Texas Resolution of Meeting of LLC Members to Make Specific Loan entails. It will explore the required steps, key elements, and various types of resolutions related to loans in the Houston, Texas area. 1. Understanding the Resolution: A Houston Texas Resolution of Meeting of LLC Members to Make Specific Loan is a formal document that outlines the decision of LLC members to approve a particular loan. This resolution holds significant importance in ensuring transparency and accountability within the LLC's financial operations. 2. Key Elements of the Resolution: a) Identification: The resolution should start by clearly stating the name of the LLC, the loan recipient, and the purpose of the loan. b) Meeting Details: It must mention the date, time, and location of the meeting where the loan resolution was discussed and approved. c) Approval: The resolution needs to include a section highlighting that the loan was approved by a majority vote of the LLC members. d) Loan Terms: Detailed information about the loan, including the amount, interest rate, repayment schedule, and any collateral involved, must be clearly stated. e) Signatures: The resolution should be signed by all participating LLC members, demonstrating their agreement and commitment to the loan decision. 3. Types of Houston Texas Resolution of Meeting of LLC Members to Make Specific Loan: a) Working Capital Loan Resolution: This type of resolution focuses on securing funds to cover day-to-day business expenses, inventory purchases, and payroll obligations. b) Capital Expenditure Loan Resolution: This resolution is related to loans sought to fund long-term investments in assets such as equipment, real estate, or technology upgrades. c) Expansion Loan Resolution: LCS seeking to expand their operations, open new branches, or enter new markets may adopt this resolution to secure financial support. d) Emergency Loan Resolution: In situations of unexpected financial crises, LLC members may need to propose an emergency loan resolution to ensure business continuity. Conclusion: In Houston, Texas, LLC members follow a formal process through a Resolution of Meeting to Make Specific Loan. This document ensures that loan decisions are made collectively, safeguarding the interests of the LLC and maintaining financial transparency. Types of resolutions can vary based on the purpose of the loan, including working capital, capital expenditure, expansion, or emergency loans. By adhering to these resolutions, LCS in Houston, Texas can effectively manage their finances and propel their businesses towards growth and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Resolución de la reunión de los miembros de la LLC para hacer un préstamo específico - Resolution of Meeting of LLC Members to Make Specific Loan

Description

How to fill out Houston Texas Resolución De La Reunión De Los Miembros De La LLC Para Hacer Un Préstamo Específico?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Houston Resolution of Meeting of LLC Members to Make Specific Loan, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed materials and tutorials on the website to make any tasks associated with document execution straightforward.

Here's how to locate and download Houston Resolution of Meeting of LLC Members to Make Specific Loan.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the related document templates or start the search over to locate the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Houston Resolution of Meeting of LLC Members to Make Specific Loan.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Houston Resolution of Meeting of LLC Members to Make Specific Loan, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you have to cope with an extremely challenging case, we advise getting a lawyer to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and get your state-specific documents with ease!

Form popularity

FAQ

Beneficio: Una LLC puede ser utilizada para ayudar a reducir el valor de los activos en poder de un individuo debido a la aplicacion de descuentos por falta de control y falta de comerciabilidad y pasar riqueza adicional a las generaciones futuras.

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

¿Y cuanto voy a tener que pagar? ImpuestoRangoA pagar10%$0 a $9,95010% de la base imponible12%$9,951 a $40,525$995 mas el 12% del excedente por encima de $9,95022%$40,526 a $86,375$4,664 mas el 22% del excedente por encima de $40,52524%$86,376 a $164,925$14,751 mas el 24% del excedente por encima de $86,3754 more rows

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

Un miembro de una corporacion S de Florida tiene que pagar el impuesto federal sobre el trabajo por cuenta propia solo sobre su salario; cualquier otra ganancia que obtenga a traves de la LLC no esta sujeta al impuesto sobre el trabajo por cuenta propia 15.3%.

No hay un limite maximo de miembros. La mayoria de los estados tambien permiten las LLC de un miembro unico, las que tienen un solo dueno.

El principal beneficio de una LLC (Limited Liability Company) es que protege el patrimonio personal de los propietarios al ser de responsabilidad limitada. Esto evita poner en riesgo los activos de los duenos en caso de problemas. Tienen flexibilidad tributaria, pueden evitar la doble imposicion.

Para mantener una LLC en Texas, no necesita pagar una tarifa anual. Sin embargo, se cobran impuestos sobre las ventas y el uso de 6.25%, impuestos estatales de franquicia e impuestos federales.