Queens, New York: A Vibrant Borough Filled with Opportunities Introduction: Queens, New York, commonly referred to as the "borough of opportunity," is one of the most diverse and populous areas in New York City. Known for its unique cultural blend, thriving business sectors, and vibrant community, Queens attracts numerous entrepreneurs and investors seeking growth and success. In this article, we will delve into the significance of resolutions during meetings of LLC (Limited Liability Company) members when making specific loans. Additionally, we will explore different types of resolutions that can be formulated to ensure a smooth loan process. 1. Understanding the Importance of Resolutions in LCS: In the realm of LCS, resolutions are essential tools for conducting business affairs and making important decisions. A resolution is a formal statement that represents the majority or unanimous agreement of LLC members during a meeting. When it comes to making specific loans, a resolution solidifies and documents the LLC members' decision, ensuring transparency, legality, and accountability. 2. Overview of Queens New York Resolution of Meeting of LLC Members to Make Specific Loan: A Queens New York Resolution of Meeting of LLC Members to Make Specific Loan is a legal document created by an LLC in Queens, New York, when members decide to provide a specific loan to an individual or entity for various purposes. It is a proactive step taken to enable financial assistance while protecting the interests of the LLC and its members. 3. Different Types of Queens New York Resolution of Meeting of LLC Members to Make Specific Loan: a) Loan to Finance Business Expansion: This resolution is formulated when LLC members decide to extend a specific loan to finance the expansion of their own business operations. Whether opening a new branch, investing in advanced technology, or acquiring additional inventory, this resolution ensures proper documentation and compliance with legal requirements. b) Loan for Real Estate Development: When an LLC aims to invest in real estate development projects, a specific resolution must be made during a meeting to document the decision. This resolution outlines the loan amount, terms, and conditions, protecting both the LLC and the potential borrower. c) Loan for Partner's Personal Needs: In some cases, a resolution may be passed when members agree to extend a specific loan to one of the LLC's partners for personal purposes. The resolution should include loan details, repayment plans, and any necessary collateral to safeguard the LLC's interests. d) Loan for Investments: If the LLC members decide to invest in external opportunities, such as stocks, bonds, or other businesses, a specific resolution of meeting must be enacted to specify loan parameters. This ensures clarity and mitigates any potential conflicts in the future. Conclusion: Queens, New York, is a bustling borough that attracts ambitious entrepreneurs and offers immense business potential. During LLC meetings, resolutions play a crucial role in making specific loans while maintaining transparency, legality, and accountability. Whether it is financing business expansions, facilitating real estate developments, catering to personal needs of partners, or venturing into investments, Queens New York Resolution of Meeting of LLC Members to Make Specific Loan documentations ensure that decisions are properly formalized. By understanding and utilizing these resolutions effectively, LCS in Queens can protect their interests while fostering growth and success.

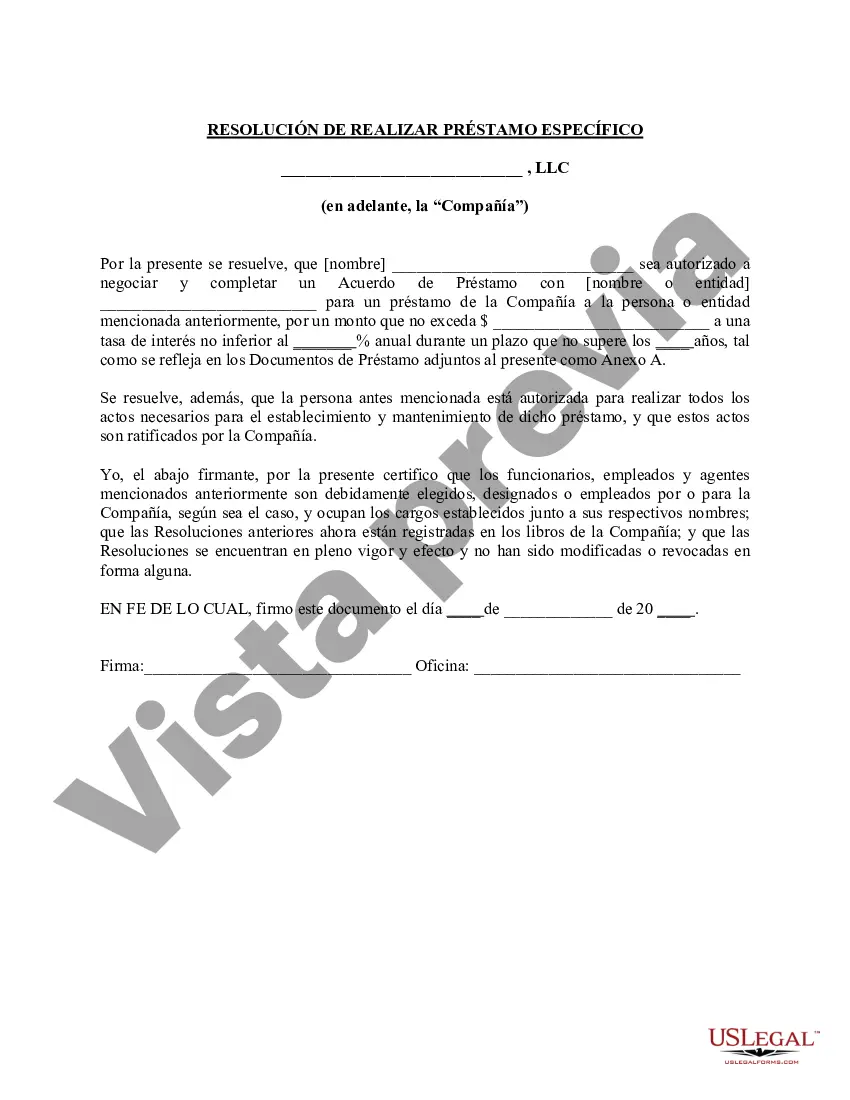

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Resolución de la reunión de los miembros de la LLC para hacer un préstamo específico - Resolution of Meeting of LLC Members to Make Specific Loan

Description

How to fill out Queens New York Resolución De La Reunión De Los Miembros De La LLC Para Hacer Un Préstamo Específico?

Are you looking to quickly create a legally-binding Queens Resolution of Meeting of LLC Members to Make Specific Loan or maybe any other document to manage your own or business matters? You can go with two options: contact a professional to draft a legal document for you or draft it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Queens Resolution of Meeting of LLC Members to Make Specific Loan and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, carefully verify if the Queens Resolution of Meeting of LLC Members to Make Specific Loan is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the search over if the document isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Queens Resolution of Meeting of LLC Members to Make Specific Loan template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the paperwork we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!