Title: Travis Texas Resolution of Meeting of LLC Members to Make Specific Loan: A Comprehensive Guide Introduction: In Travis County, Texas, LLC members often convene meetings to discuss important matters pertaining to the operations and financial decisions of the company. One such crucial discussion revolves around authorizing a specific loan for various purposes. This article aims to provide a detailed description of what a Travis Texas Resolution of Meeting of LLC Members to Make Specific Loan entails, along with different types that may arise. I. Understanding the Travis Texas Resolution of Meeting: The Travis Texas Resolution of Meeting of LLC Members to Make Specific Loan is a formal document that outlines the decision-making process for approving a specific loan. This resolution arises when LLC members convene a meeting to vote on whether to authorize or reject a proposed loan transaction. II. Key Components of the Resolution: 1. Meeting Date and Attendance: The resolution specifies the date, time, and location of the LLC meeting. It also lists the names of the LLC members who are present or participate remotely. 2. Purpose of the Loan: The resolution explicitly outlines the purpose of the loan, whether it is for business expansion, working capital, real estate acquisition, equipment purchase, or any other specific financial need. 3. Loan Amount and Terms: The resolution should state the exact loan amount requested, along with specific terms such as interest rate, repayment schedule, and collateral (if applicable). 4. Borrower Responsibilities: It is crucial to mention the responsibilities of the borrower, including adherence to the loan agreement and timely repayment according to the agreed terms. 5. Voting and Approval: The resolution records the voting process, highlighting the number of votes cast in favor, against, or abstaining. It specifies the necessary majority required for approval. III. Types of Travis Texas Resolution of Meeting of LLC Members to Make Specific Loan: 1. General Loan Resolution: This type covers loans related to regular business operations, day-to-day expenses, or routine financing needs. 2. Expansion Loan Resolution: When LLC members decide to pursue significant growth opportunities, they may pass an Expansion Loan Resolution to facilitate financing for expansion, new ventures, or acquisitions. 3. Emergency Loan Resolution: In case of unexpected financial crises or urgent cash requirements, an LLC may pass an Emergency Loan Resolution to address immediate needs, ensuring the company's stability. 4. Project-Specific Loan Resolution: This type involves securing loans for specific projects, such as capital investments, research and development initiatives, or marketing campaigns. Conclusion: Travis Texas Resolution of Meeting of LLC Members to Make Specific Loan serves as a vital tool for LLC member decision-making and approval processes in Travis County, Texas. By understanding the key elements and the various types of resolutions that may arise, LLC members can effectively manage the financial needs and growth opportunities in their business ventures. It is essential to consult legal professionals and follow the necessary protocols when drafting and implementing such resolutions.

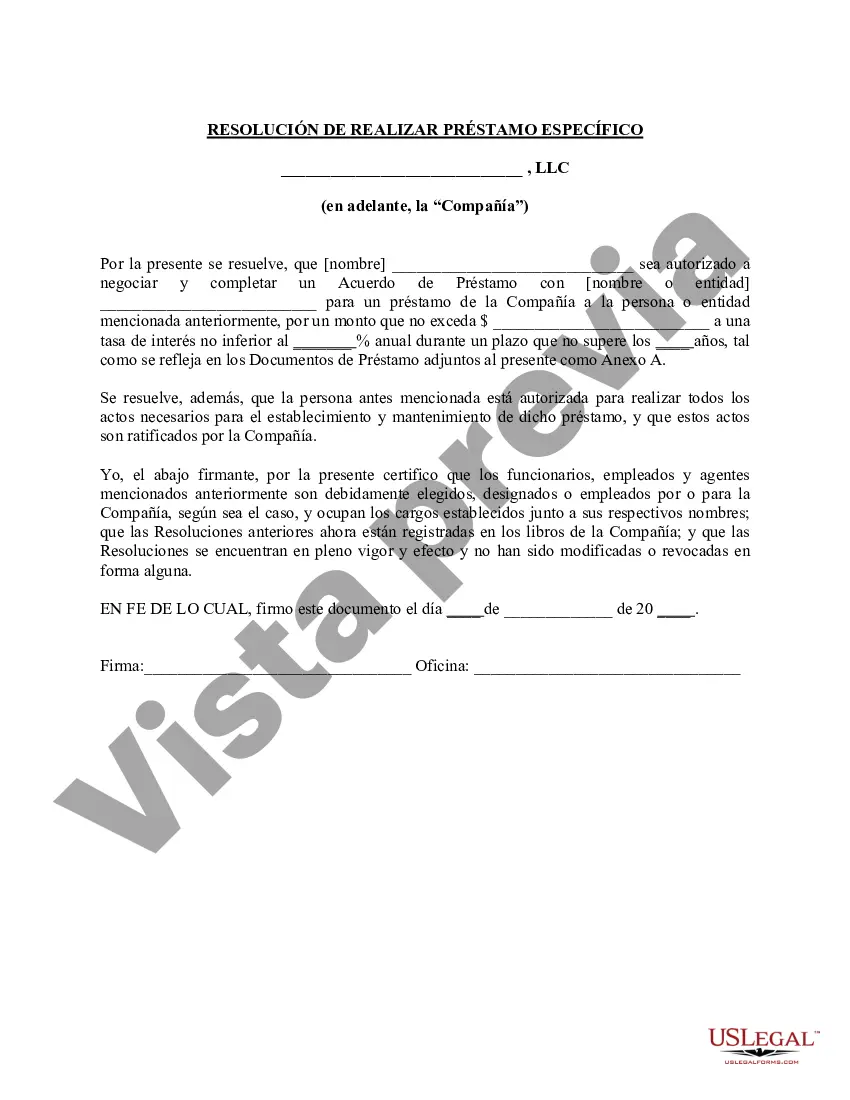

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Resolución de la reunión de los miembros de la LLC para hacer un préstamo específico - Resolution of Meeting of LLC Members to Make Specific Loan

Description

How to fill out Travis Texas Resolución De La Reunión De Los Miembros De La LLC Para Hacer Un Préstamo Específico?

Preparing documents for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Travis Resolution of Meeting of LLC Members to Make Specific Loan without professional assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Travis Resolution of Meeting of LLC Members to Make Specific Loan by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Travis Resolution of Meeting of LLC Members to Make Specific Loan:

- Examine the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!