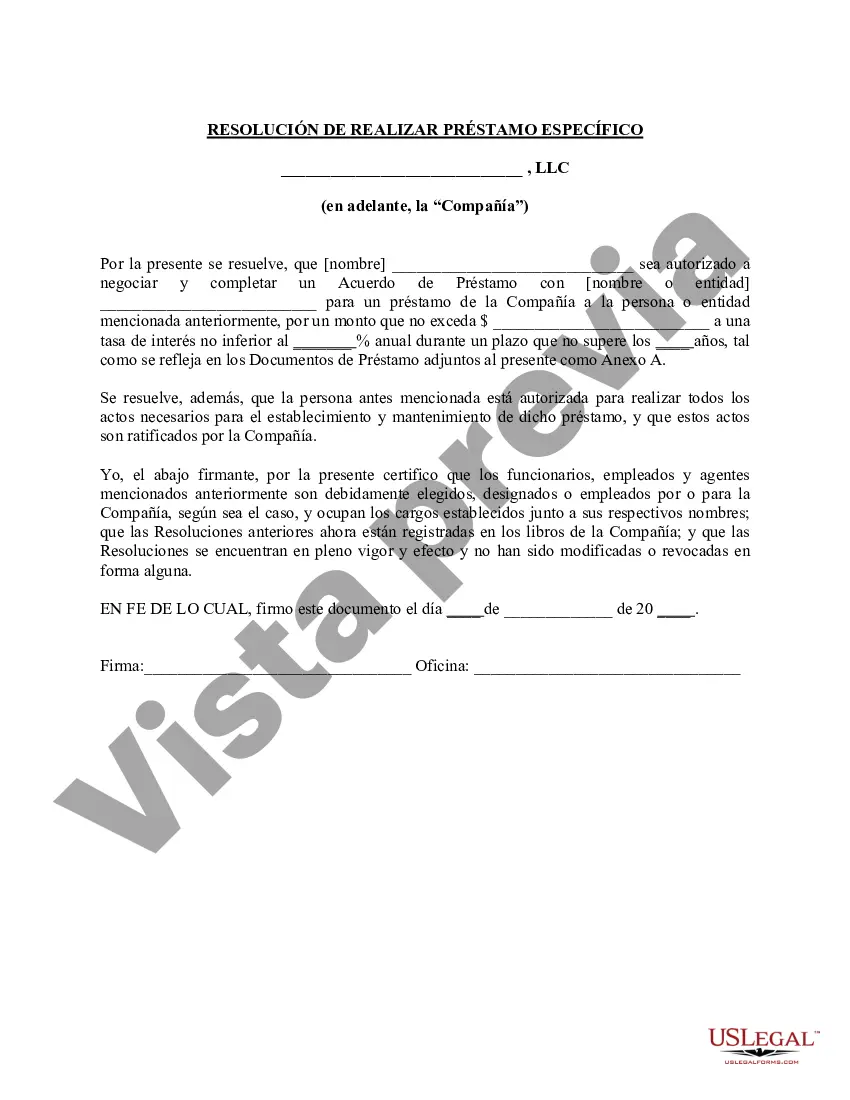

Wayne Michigan Resolución de la reunión de los miembros de la LLC para hacer un préstamo específico - Resolution of Meeting of LLC Members to Make Specific Loan

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Wayne Michigan Resolución De La Reunión De Los Miembros De La LLC Para Hacer Un Préstamo Específico?

Drafting papers for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Wayne Resolution of Meeting of LLC Members to Make Specific Loan without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Wayne Resolution of Meeting of LLC Members to Make Specific Loan on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Wayne Resolution of Meeting of LLC Members to Make Specific Loan:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

A Limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.

For example, Anheuser-Busch, Blockbuster and Westinghouse are all organized as limited liability companies.

An LLC, or limited liability company, is a type of business entity that a company can form by filing paperwork with the state. An LLC can have one owner (known as a "member") or many owners. The words "limited liability" refer to the fact that LLC members cannot be held personally responsible for business debts.

Para que la LLC declare impuestos como una empresa unipersonal, debes presentar el Anexo C. Los propietarios unicos pagan impuestos sobre las ganancias y perdidas comerciales de la empresa. Para declarar impuestos como una LLC/sociedad, presenta el Formulario 1065, Retorno de los ingresos de la sociedad.

Para mantener una LLC en Texas, no necesita pagar una tarifa anual. Sin embargo, se cobran impuestos sobre las ventas y el uso de 6.25%, impuestos estatales de franquicia e impuestos federales.

El principal beneficio de una LLC (Limited Liability Company) es que protege el patrimonio personal de los propietarios al ser de responsabilidad limitada. Esto evita poner en riesgo los activos de los duenos en caso de problemas. Tienen flexibilidad tributaria, pueden evitar la doble imposicion.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business.

Para que la LLC declare impuestos como una empresa unipersonal, debes presentar el Anexo C. Los propietarios unicos pagan impuestos sobre las ganancias y perdidas comerciales de la empresa. Para declarar impuestos como una LLC/sociedad, presenta el Formulario 1065, Retorno de los ingresos de la sociedad.