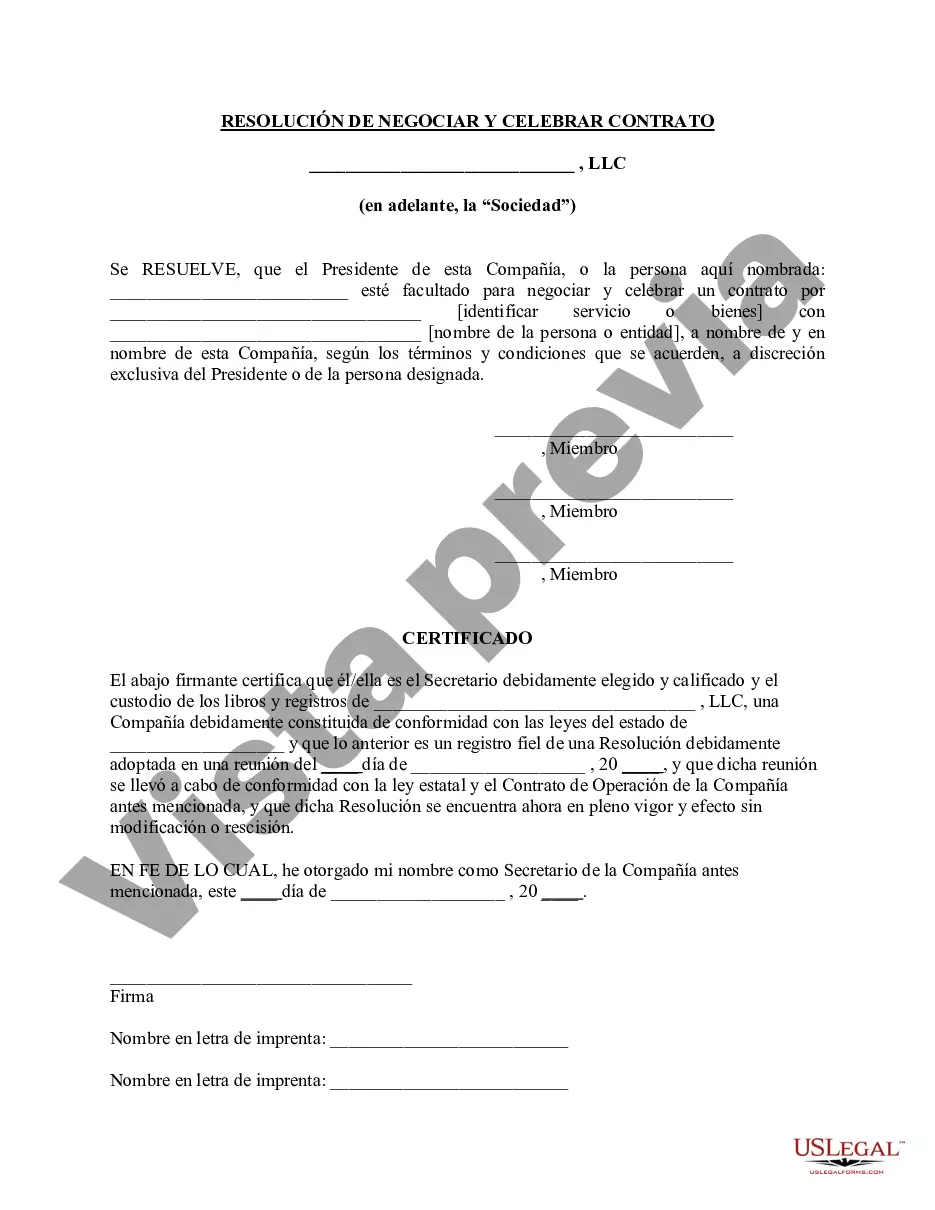

King Washington Resolución de la reunión de los miembros de la LLC para negociar y celebrar el contrato - Resolution of Meeting of LLC Members to Negotiate and Enter Contract

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out King Washington Resolución De La Reunión De Los Miembros De La LLC Para Negociar Y Celebrar El Contrato?

Creating documents, like King Resolution of Meeting of LLC Members to Negotiate and Enter Contract, to take care of your legal affairs is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for a variety of cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the King Resolution of Meeting of LLC Members to Negotiate and Enter Contract template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting King Resolution of Meeting of LLC Members to Negotiate and Enter Contract:

- Ensure that your document is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the King Resolution of Meeting of LLC Members to Negotiate and Enter Contract isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and download the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

El primer paso para disolver una LLC es tomar una decision formal y oficial de hacerlo. Inicie una reunion con los miembros de su LLC y vote por la disolucion de la compania. Usted debe ser consciente de que cada estado tiene diferentes requisitos de voto.

Para las LLC de un solo miembro que actuan como entidades excluidas, los propietarios deben presentar el formulario 1040 si ganan mas de $400 (USD) del trabajo por cuenta propia. Como propietario, completaras tu declaracion de impuestos personal normalmente, pero con el Anexo C adjunto.

For example, Anheuser-Busch, Blockbuster and Westinghouse are all organized as limited liability companies.

¿Y cuanto voy a tener que pagar? ImpuestoRangoA pagar10%$0 a $9,95010% de la base imponible12%$9,951 a $40,525$995 mas el 12% del excedente por encima de $9,95022%$40,526 a $86,375$4,664 mas el 22% del excedente por encima de $40,52524%$86,376 a $164,925$14,751 mas el 24% del excedente por encima de $86,3754 more rows

A Limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial.

Para mantener una LLC en Texas, no necesita pagar una tarifa anual. Sin embargo, se cobran impuestos sobre las ventas y el uso de 6.25%, impuestos estatales de franquicia e impuestos federales.

Impuesto empresarial estatal El impuesto sobre la renta de corporaciones en Florida es generalmente a una tasa de 5.5% de ingresos imponibles federales.