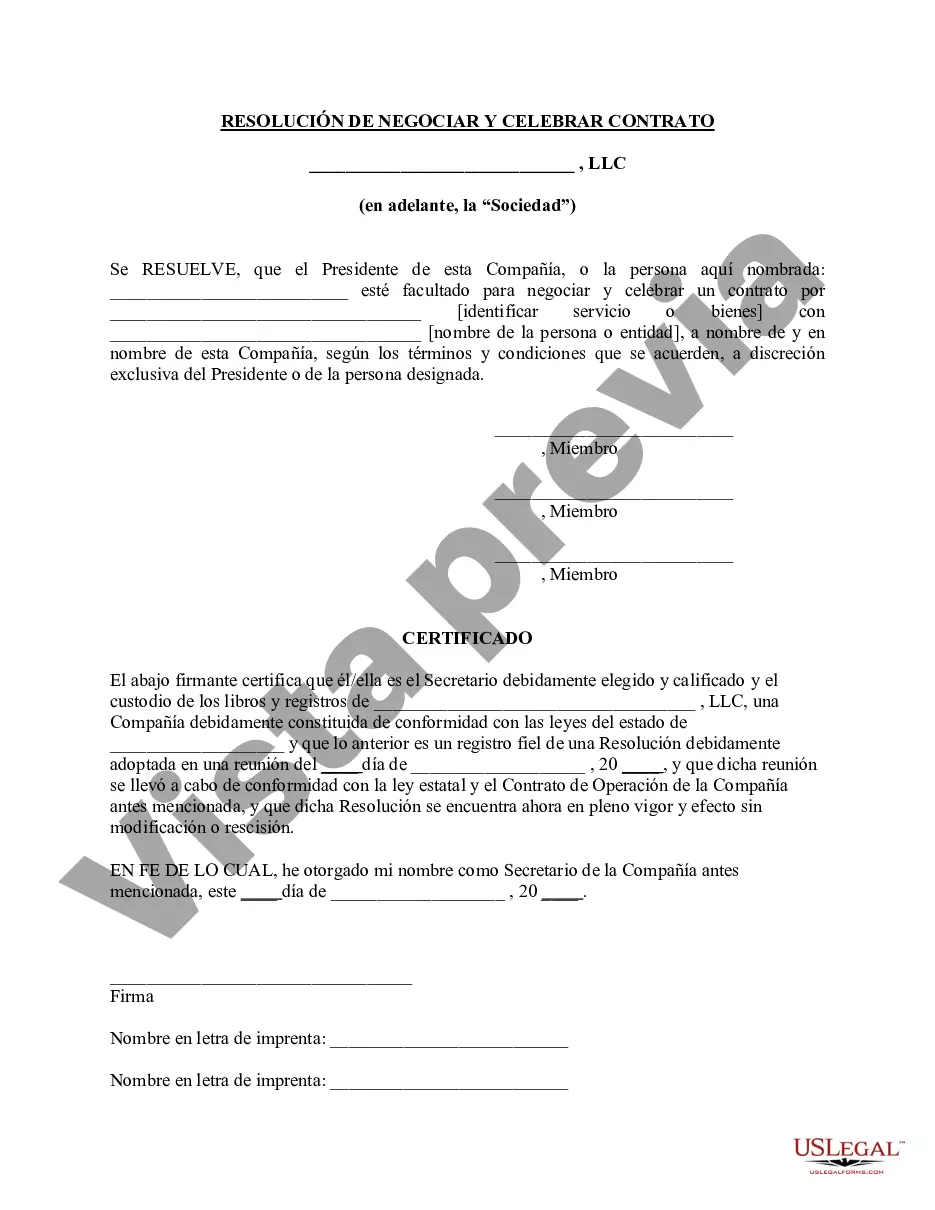

Pima Arizona Resolución de la reunión de los miembros de la LLC para negociar y celebrar el contrato - Resolution of Meeting of LLC Members to Negotiate and Enter Contract

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Pima Arizona Resolución De La Reunión De Los Miembros De La LLC Para Negociar Y Celebrar El Contrato?

Are you looking to quickly create a legally-binding Pima Resolution of Meeting of LLC Members to Negotiate and Enter Contract or probably any other document to manage your own or corporate matters? You can go with two options: hire a professional to write a legal paper for you or create it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you get professionally written legal papers without having to pay sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Pima Resolution of Meeting of LLC Members to Negotiate and Enter Contract and form packages. We offer documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the Pima Resolution of Meeting of LLC Members to Negotiate and Enter Contract is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Pima Resolution of Meeting of LLC Members to Negotiate and Enter Contract template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Una corporacion es una buena opcion para una compania que va a obtener financiamiento de capital de riesgo o quiere establecer un plan de opciones sobre acciones para empleados. Pero una LLC es mas facil de mantener, mas flexible que una corporacion y puede convertirse facilmente en una corporacion.

Probablemente el paso mas critico para disolver exitosamente su LLC es pagar sus impuestos. Usted debe cerrar las cuentas de impuesto de la LLC con el IRS y el estado. Pague cualquier deuda que tenga y cerciorese de financiar correctamente su retencion de nomina, asi como sus impuestos sobre las ventas.

More In File The IRS cannot cancel your EIN. Once an EIN has been assigned to a business entity, it becomes the permanent Federal taxpayer identification number for that entity. Regardless of whether the EIN is ever used to file Federal tax returns, the EIN is never reused or reassigned to another business entity.

Requisitos para abrir una LLC en Estados Unidos Nombre de la compania. Agente registrado. Acuerdo de operacion. Articulos de organizacion. Licencias y permisos comerciales (locales y federales) Formulario de declaracion de informacion. Declaracion de impuestos. EIN (Numero de Identificacion del Empleador)

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

LLC Ingles Comercial abbreviation for Limited Liability Company: a form of company in the US whose owners are not legally responsible for the company's debts if those debts are above a particular amount: State law requires LLCs to produce annual reports.

Al contrario de las LLC, los socios de las C Corps no necesitan realizar declaraciones de impuestos en Estados Unidos. Esto solo es necesario cuando existe distribucion de ganancia para los accionistas. Es por esto que muchos extranjeros optan por una Corporation al momento de crear una empresa en Estados Unidos.

No hay un limite maximo de miembros. La mayoria de los estados tambien permiten las LLC de un miembro unico, las que tienen un solo dueno.

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

Asociacion General (Partnership). Asociacion con Responsabilidad Limitada (Limited Liability Partnership). Sociedad Limitada (Limited Partnership). Corporacion C (C Corporation).