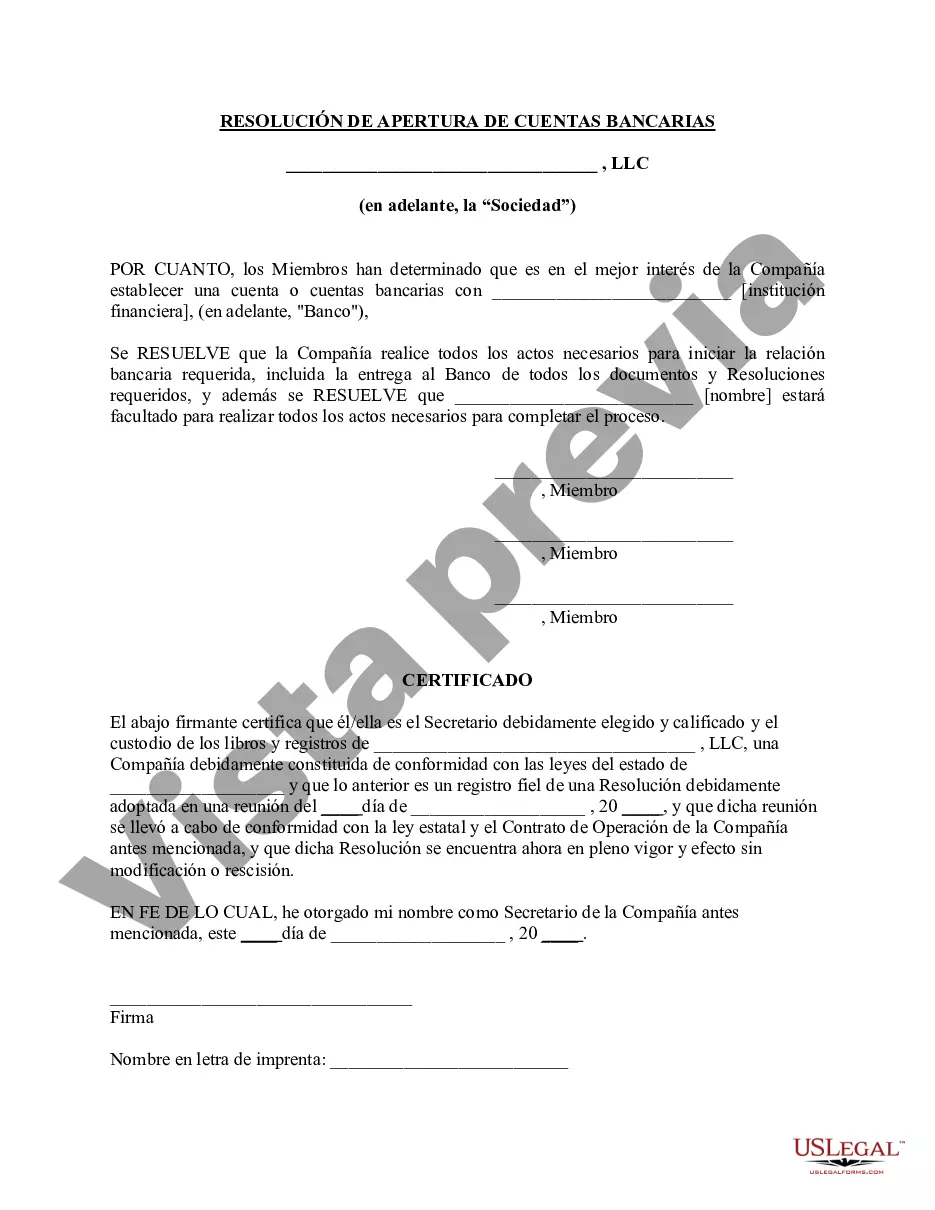

Los Angeles California Resolution of Meeting of LLC Members to Open Bank Accounts is a formal document that outlines the decisions made during a meeting of LLC members regarding the opening of bank accounts for the company. This resolution is an essential step in the financial management of an LLC, as it authorizes the members to take necessary actions and provides instructions to proceed with opening the accounts. The resolution begins with a heading that includes the LLC's name, a reference to it being a California-based LLC in Los Angeles, and the specific purpose of the resolution, which is to open bank accounts. This ensures clarity and specificity right from the start. The document then proceeds with the details of the meeting, including the date, time, and location where the meeting was held. It should mention all members present or participating, reinforcing the legitimacy of the resolution. It is crucial to accurately list all members present to ensure compliance with the LLC's operating agreement or bylaws. Next, the resolution outlines the specific decisions made during the meeting. This section can include: 1. Authorization of LLC Representatives: This part clarifies who is allowed to open the bank accounts on behalf of the LLC. It may specify certain members or designated representatives who have the authority to act as signatories or authorized representatives. 2. Bank Selection: This section outlines the criteria used to select the bank(s) where the LLC intends to open its accounts. It may include factors such as the bank's reputation, proximity to the LLC's main office, fee structures, and any other pertinent details affecting the decision. 3. Account Types: If there are different types of accounts the LLC wishes to open, such as checking, savings, or investment accounts, the resolution should clearly name and describe each account type, along with its purpose and intended use. For example, a checking account may be designated for day-to-day operations, while a savings account may be for long-term funds or specific goals. 4. Deposit Amount and Signatories: This part specifies the initial deposit amount required for each account type and designates the individuals who will have authorization to sign checks, make withdrawals, and handle banking transactions on behalf of the LLC. It is important to list full legal names and titles to avoid any confusion regarding authority. Lastly, the resolution should be signed by all LLC members, indicating their agreement and approval of the decisions made during the meeting. Copies of the signed resolution should be kept on file, as it may be required by the bank when opening the accounts or making future transactions. Overall, the Los Angeles California Resolution of Meeting of LLC Members to Open Bank Accounts is a critical document that ensures transparency, accountability, and compliance within an LLC when dealing with financial matters. It sets the foundation for efficient banking operations and serves as a record of the LLC members' resolutions regarding the accounts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Resolución de la reunión de miembros de la LLC para abrir cuentas bancarias - Resolution of Meeting of LLC Members to Open Bank Accounts

Description

How to fill out Los Angeles California Resolución De La Reunión De Miembros De La LLC Para Abrir Cuentas Bancarias?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Los Angeles Resolution of Meeting of LLC Members to Open Bank Accounts, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any activities related to paperwork execution simple.

Here's how to purchase and download Los Angeles Resolution of Meeting of LLC Members to Open Bank Accounts.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the similar document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Los Angeles Resolution of Meeting of LLC Members to Open Bank Accounts.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Los Angeles Resolution of Meeting of LLC Members to Open Bank Accounts, log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you need to deal with an exceptionally complicated situation, we advise using the services of an attorney to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!