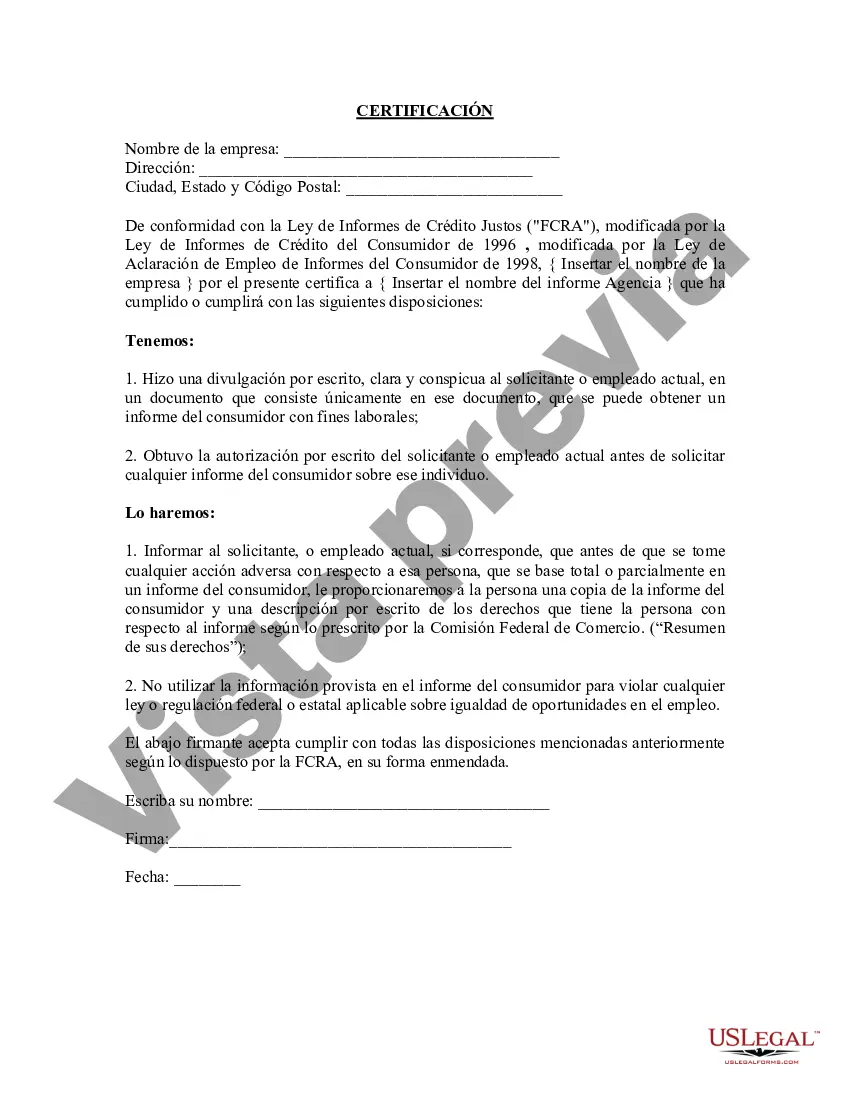

Fulton Georgia FCRA Certification Letter to Consumer Reporting Agency serves as an official document that certifies the compliance of a consumer reporting agency (CRA) with the Fair Credit Reporting Act (FCRA) guidelines in Fulton County, Georgia. This letter is crucial for Crash to demonstrate their adherence to the FCRA regulations and ensure fair and accurate consumer reporting practices. The Fulton Georgia FCRA Certification Letter to Consumer Reporting Agency contains detailed information concerning the CRA's compliance with FCRA requirements. It substantiates that the agency performs all its operations within legal boundaries and ensures the protection of consumers' rights when it comes to credit reporting. This certification letter is commonly issued by the relevant regulatory authorities or governing bodies responsible for overseeing Crash in Fulton County, Georgia, such as the Fulton County Consumer Affairs Office. The content of a Fulton Georgia FCRA Certification Letter typically includes the following key elements: 1. Agency Information: The letter includes the full legal name, address, and contact details of the certified CRA. It may also include the unique identification number or license of the agency, signifying its authorized status. 2. FCRA Compliance Statement: Clear and concise details are provided, stating that the agency fully complies with all FCRA provisions, regulations, and amendments. This demonstrates the agency's commitment to following the industry's best practices for consumer credit reporting. 3. Data Protection and Security Measures: The letter highlights the measures implemented by the CRA to ensure the privacy, accuracy, and security of consumer information. It may include details about encryption protocols, secure storage systems, access controls, and employee training on data protection. 4. Dispute Resolution Procedures: This section outlines the CRA's procedures for addressing consumer disputes, emphasizing timely investigations, and accurate resolution of any reported inaccuracies or discrepancies on credit reports. It may mention the process of conducting reinvestigations, including interacting with data furnishes and consumers alike. 5. Consumer Rights Awareness: The letter may also include educational information for consumers, highlighting their rights under the FCRA, such as the right to access their credit reports, dispute erroneous information, and protect their privacy. Different types of Fulton Georgia FCRA Certification Letters may include variations based on the specific regulatory body issuing the certification. For example: — Fulton County Consumer Affairs Office FCRA Certification Letter: Issued by the authorized department responsible for consumer protection in Fulton County, this letter certifies the CRA's compliance with both federal and local FCRA ordinances. — Georgia Secretary of State FCRA Certification Letter: Provided by the Georgia Secretary of State's office, this certification letter validates the CRA's adherence to FCRA guidelines and demonstrates its compliance with state-specific regulations. In conclusion, the Fulton Georgia FCRA Certification Letter to Consumer Reporting Agency represents an essential tool to maintain consumer trust and demonstrate regulatory compliance within the credit reporting industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Carta de certificación de la FCRA a la agencia de informes del consumidor - FCRA Certification Letter to Consumer Reporting Agency

Description

How to fill out Fulton Georgia Carta De Certificación De La FCRA A La Agencia De Informes Del Consumidor?

If you need to find a reliable legal document supplier to find the Fulton FCRA Certification Letter to Consumer Reporting Agency, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it simple to locate and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply select to search or browse Fulton FCRA Certification Letter to Consumer Reporting Agency, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Fulton FCRA Certification Letter to Consumer Reporting Agency template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate agreement, or complete the Fulton FCRA Certification Letter to Consumer Reporting Agency - all from the convenience of your sofa.

Join US Legal Forms now!