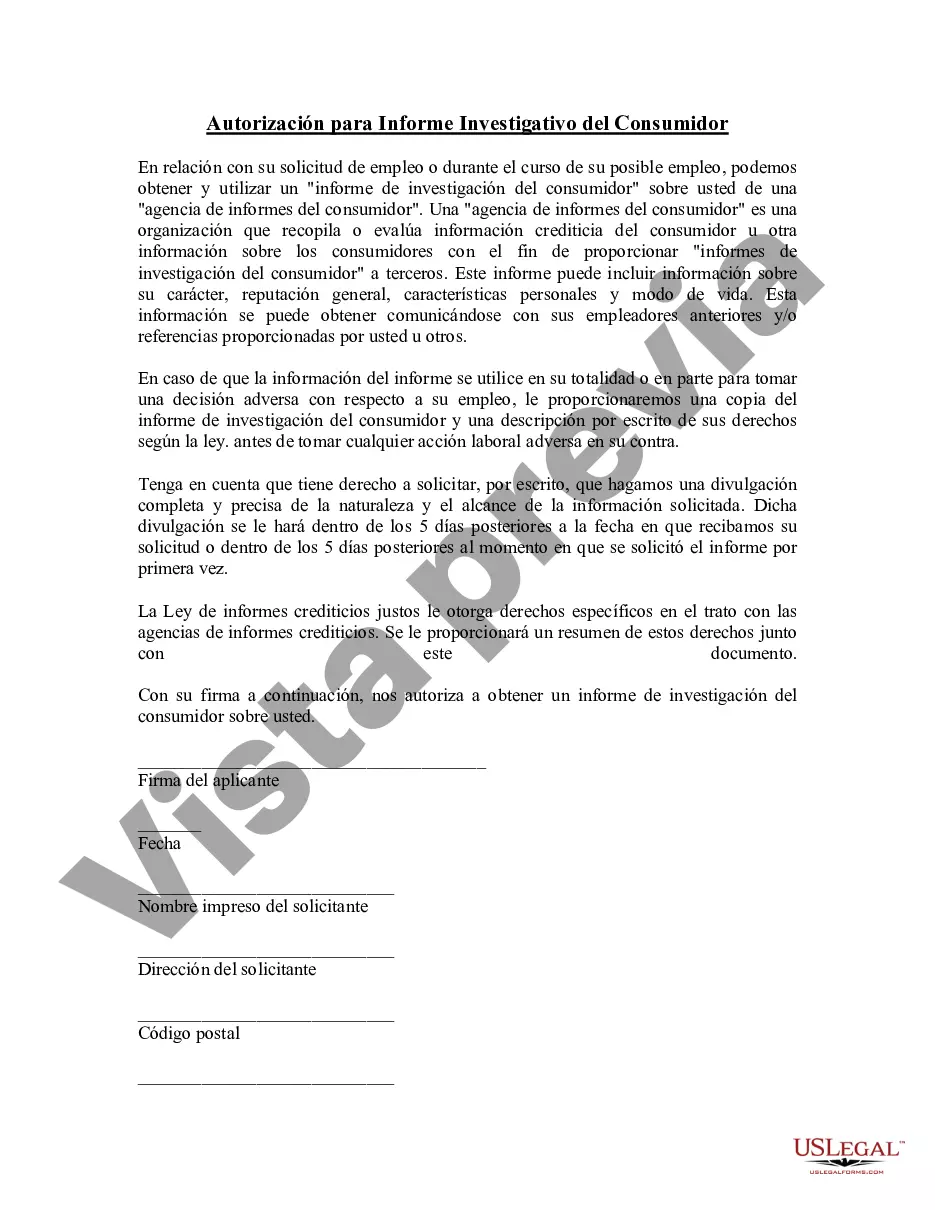

Contra Costa California Authorization of Consumer Report is a legal document that grants permission for an individual or organization to access and obtain a consumer's personal information from third-party sources. It is primarily used for conducting background checks, tenant screenings, employment verifications, and other similar activities in Contra Costa County, California. The Contra Costa California Authorization of Consumer Report ensures compliance with state and federal laws regarding consumer privacy and protection. By signing this document, the consumer acknowledges that their personal information may be collected, processed, and shared for legitimate purposes, such as evaluating their eligibility for employment, housing, credit, or insurance. Keywords: Contra Costa California, authorization of consumer report, personal information, third-party sources, background checks, tenant screenings, employment verifications, consumer privacy, consumer protection, compliance, legitimate purposes, eligibility, housing, credit, insurance. Different types of Contra Costa California Authorization of Consumer Report may include: 1. Employment Screening Authorization: This type of authorization grants employers the right to conduct consumer reports, including background checks, driving records, credit checks, and reference checks, to assess an individual's suitability for employment. 2. Rental Application Authorization: This authorization allows landlords or property management companies to access an applicant's consumer report, which includes credit history, rental history, employment verification, and criminal records, to evaluate their eligibility for housing or rental agreements. 3. Volunteer Background Check Authorization: Non-profit organizations and volunteer-based programs often require this type of authorization to perform consumer reports on prospective volunteers, ensuring the safety of vulnerable populations by screening for criminal records or any other relevant information. 4. Credit Check Authorization: Lenders, financial institutions, and credit card companies use this authorization to obtain consumer reports, including credit scores, payment history, and any outstanding debts, to determine an individual's creditworthiness and make informed lending decisions. 5. Insurance Application Authorization: Insurance companies may require this authorization to access consumer reports for assessing an individual's insurance eligibility, calculating premiums, underwriting policies, and evaluating any potential risks based on their personal information. Remember, it is important to consult legal professionals or review specific county guidelines to ensure accuracy and compliance while using Contra Costa California Authorization of Consumer Report.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Autorización de Informe del Consumidor - Authorization of Consumer Report

Description

How to fill out Contra Costa California Autorización De Informe Del Consumidor?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Contra Costa Authorization of Consumer Report, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the recent version of the Contra Costa Authorization of Consumer Report, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Authorization of Consumer Report:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Contra Costa Authorization of Consumer Report and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!