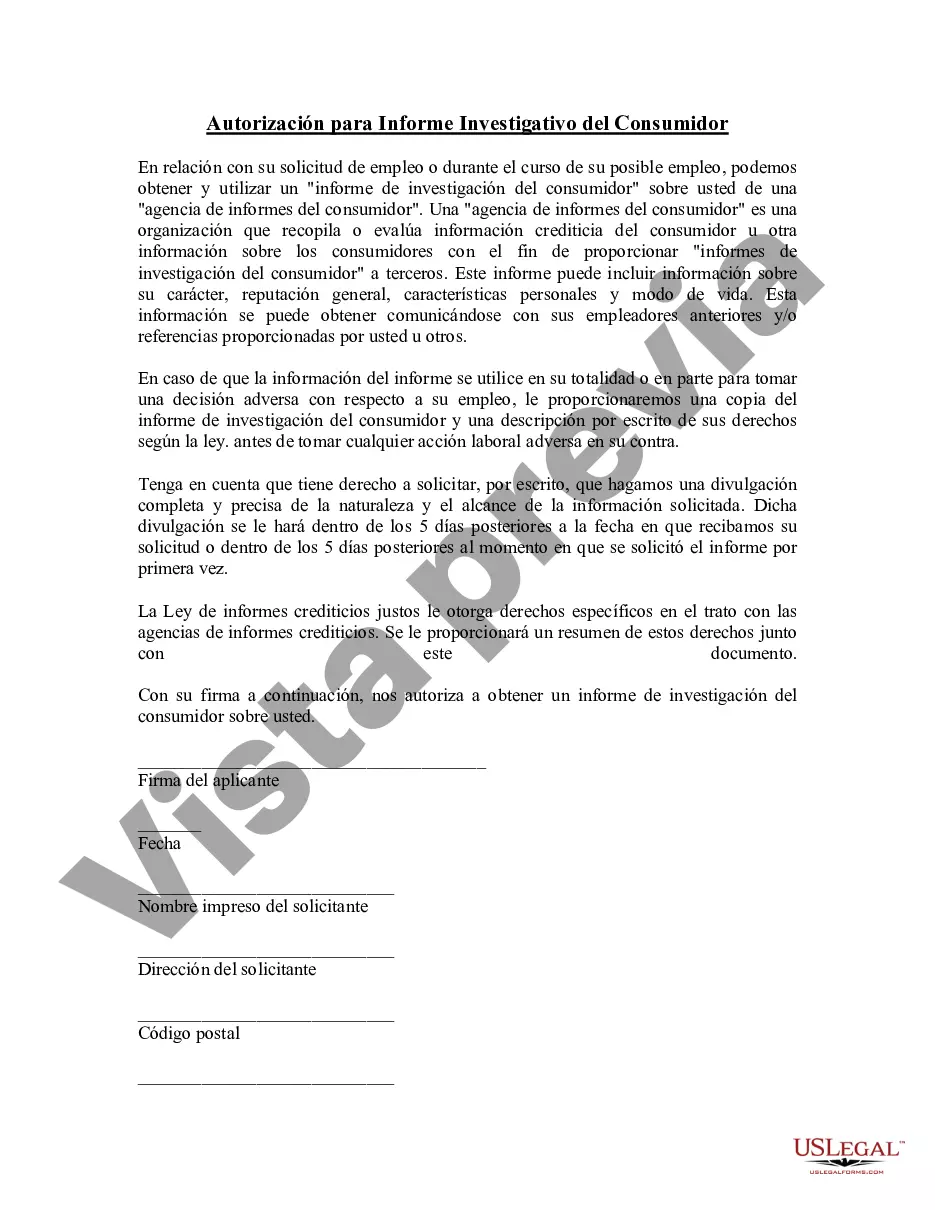

The Harris Texas Authorization of Consumer Report is a legal document that enables businesses, organizations, and individuals to obtain consumer information for various purposes. This report is crucial for evaluating an individual's creditworthiness, rental applications, background checks, employment screening, and other related activities. Obtaining a Harris Texas Authorization of Consumer Report requires the written consent of the consumer as it involves accessing personal and sensitive information. The authorization grants the requester permission to gather data from credit bureaus, financial institutions, employment references, educational institutions, and other relevant sources. In Harris Texas, there are different types of consumer reports that require specific authorizations based on their intended use: 1. Credit Reports: Credit reports provide a comprehensive overview of an individual's credit history, including repayment patterns, outstanding debts, loans, credit limits, and bankruptcies. This type of report is essential for financial institutions, lenders, landlords, and other entities to assess an individual's creditworthiness and make informed decisions. 2. Background Checks: Background checks involve accessing public records and databases to verify an individual's criminal history, employment history, education qualifications, and more. Employers often require these reports to ensure the safety, security, and integrity of their workplace environment. 3. Tenant Screening Reports: Landlords and property management companies use tenant screening reports assessing the suitability of potential tenants. These reports provide information on an individual's rental history, eviction records, creditworthiness, and other relevant factors. 4. Employment Screening Reports: Employers commonly request consumer reports during the hiring process to gain insights into an applicant's background. These reports may include employment history, education verification, professional licenses, and any legal or financial records that could impact their suitability for the position. 5. Insurance Underwriting Reports: Insurance companies may require consumer reports to determine insurance rates and coverage eligibility. These reports evaluate an individual's credit history, claims history, and other factors that could affect their insurability. The Harris Texas Authorization of Consumer Report is essential to protect the privacy and rights of individuals while allowing authorized entities to access relevant information for lawful purposes. It ensures that personal information is collected and used responsibly, fostering trust between consumers and the organizations requesting these reports.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Autorización de Informe del Consumidor - Authorization of Consumer Report

Description

How to fill out Harris Texas Autorización De Informe Del Consumidor?

If you need to get a trustworthy legal document provider to get the Harris Authorization of Consumer Report, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support team make it simple to locate and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Harris Authorization of Consumer Report, either by a keyword or by the state/county the form is created for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Harris Authorization of Consumer Report template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Harris Authorization of Consumer Report - all from the convenience of your sofa.

Sign up for US Legal Forms now!