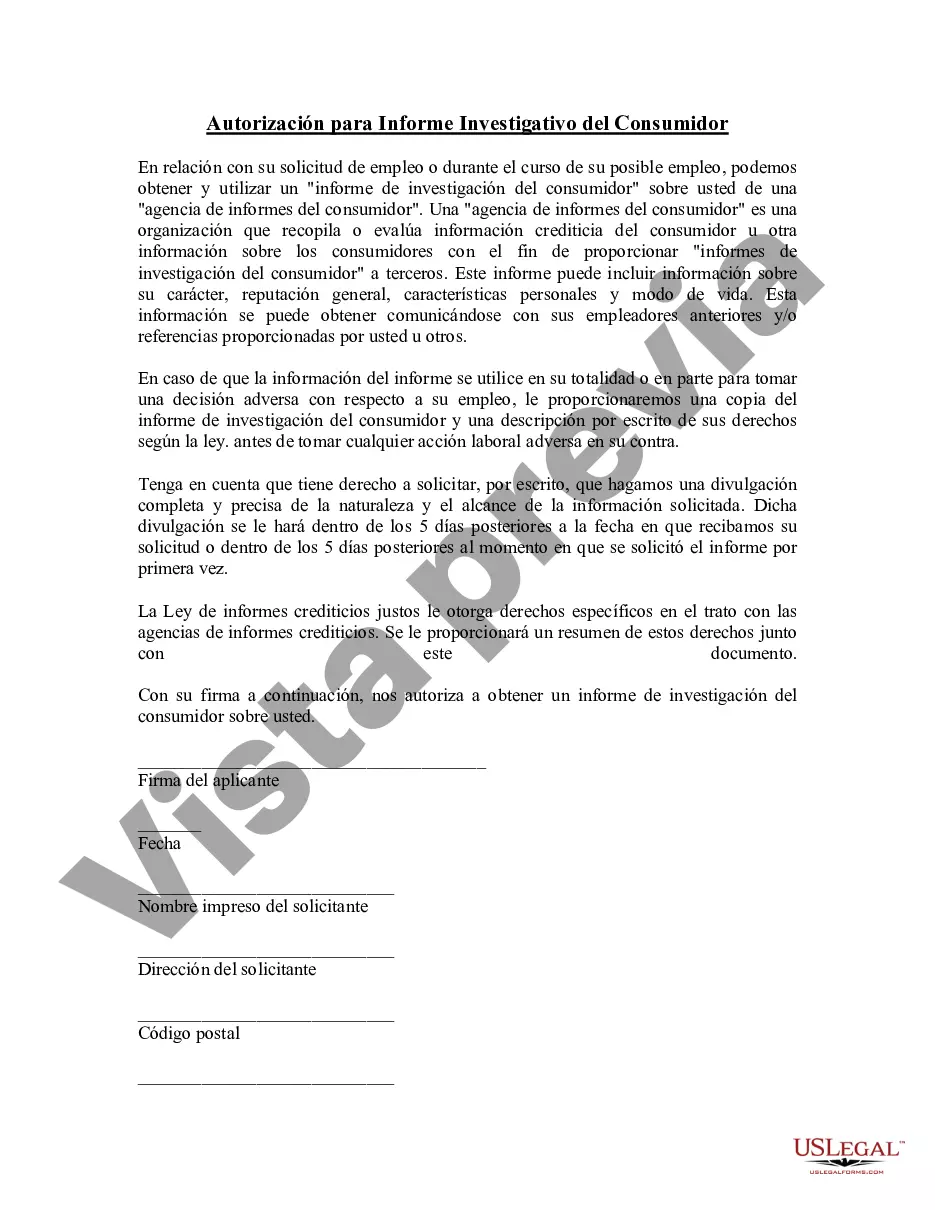

Title: Understanding Santa Clara California Authorization of Consumer Report: A Comprehensive Description Introduction: The Santa Clara California Authorization of Consumer Report is a vital legal document that aims to protect consumer rights and privacy in the city of Santa Clara, California. This detailed description will provide an in-depth understanding of the authorization process, its objectives, and the various types associated with it. Key Concepts: 1. Consumer Report: A consumer report is a detailed document that contains information about an individual's creditworthiness, character, general reputation, personal characteristics, and mode of living. It is prepared by a consumer reporting agency (CRA) and used by businesses and organizations to evaluate an individual's eligibility for certain services or opportunities. 2. Santa Clara California Authorization of Consumer Report: The Santa Clara California Authorization of Consumer Report refers to the specific legal permission granted by an individual (consumer) to a business or organization (consumer reporting agency) to obtain and use their consumer report for a specific purpose. This authorization is mandated by the Fair Credit Reporting Act (FCRA) and ensures transparency and consumer consent in obtaining and utilizing consumer reports. Types of Santa Clara California Authorization of Consumer Report: 1. Employment Authorization: Employers often require consumer reports to assess an applicant's background, character, and suitability for a specific role. This type of authorization allows employers to obtain a consumer report as part of the pre-employment screening process. 2. Tenancy Authorization: Landlords and property management companies may require consumer reports to evaluate prospective tenants' financial stability, rental history, and ability to fulfill lease obligations. A tenancy authorization grants permission to obtain and review a consumer report during the tenant screening process. 3. Credit Application Authorization: Financial institutions and lenders typically request consumer reports when assessing an individual's creditworthiness and eligibility for credit-related applications, such as credit cards, loans, or mortgages. Credit application authorization enables lenders to access and analyze relevant consumer reports before finalizing lending decisions. 4. Insurance Coverage Authorization: Insurance companies often evaluate an individual's risk profile before providing coverage for various types of insurance, such as auto, home, or health insurance. Insurance coverage authorization permits insurers to gather relevant consumer reports to assess risk and determine appropriate coverage terms and premiums. Conclusion: The Santa Clara California Authorization of Consumer Report plays a crucial role in safeguarding consumer privacy rights. By allowing individuals to authorize the access and use of their consumer reports, this authorization ensures transparency, consent, and fair treatment in various fields such as employment, housing, credit, and insurance. Understanding the importance and different types of this authorization can help individuals make informed decisions regarding their personal information and effectively protect their privacy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Autorización de Informe del Consumidor - Authorization of Consumer Report

Description

How to fill out Santa Clara California Autorización De Informe Del Consumidor?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life situation, locating a Santa Clara Authorization of Consumer Report suiting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Santa Clara Authorization of Consumer Report, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Santa Clara Authorization of Consumer Report:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Santa Clara Authorization of Consumer Report.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!