Title: Tarrant Texas Authorization of Consumer Report: A Comprehensive Guide Description: If you're in Tarrant, Texas, and seeking services that require a consumer report, it's crucial to understand the Tarrant Texas Authorization of Consumer Report process. This comprehensive guide provides detailed information on what it entails, the importance of authorization, and key terms associated with it. Keywords: Tarrant Texas, Authorization of Consumer Report, consumer report, Tarrant Texas Authorization, consumer report process 1. What is Tarrant Texas Authorization of Consumer Report? The Tarrant Texas Authorization of Consumer Report is a legal document that grants permission to entities, such as employers or landlords, to procure and evaluate individuals' credit histories, criminal records, employment history, and other relevant information. This authorization ensures compliance with the Fair Credit Reporting Act (FCRA) regulations. 2. Importance of Tarrant Texas Authorization of Consumer Report: The Tarrant Texas Authorization of Consumer Report is vital for both the requesting entity and the individual being evaluated. By gaining consent, employers and landlords can make informed decisions based on accurate and reliable information, improving the selection process while mitigating potential risks. For individuals, this authorization ensures fair treatment and transparency during the evaluation process. 3. Different Types of Tarrant Texas Authorization of Consumer Report: While there might not be specific types of Tarrant Texas Authorization of Consumer Reports, the document generally covers a wide range of assessments, including: a. Employment Background Checks: Employers often request consumer reports to assess a candidate's qualifications, work history, criminal records, and creditworthiness during the hiring process. b. Tenant Screening: Landlords utilize consumer reports to evaluate prospective tenants' credit, rental history, criminal background, and eviction records to make informed leasing decisions. c. Mortgage and Loan Applications: Lenders obtain consumer reports to assess an individual's creditworthiness before granting a mortgage or loan approval. d. Insurance Underwriting: Insurance companies may request consumer reports to determine an individual's risk profile and assess their eligibility for specific insurance policies. e. Volunteer Screening: Organizations and non-profits may require consumer reports to ensure the safety of their beneficiaries by evaluating the criminal records and qualifications of potential volunteers. In conclusion, the Tarrant Texas Authorization of Consumer Report is a fundamental process that plays a significant role in various aspects of life, such as employment, housing, and finance. Understanding its purpose, importance, and different scenarios will enable both entities and individuals to navigate the evaluation process smoothly, ensuring compliance with relevant regulations.

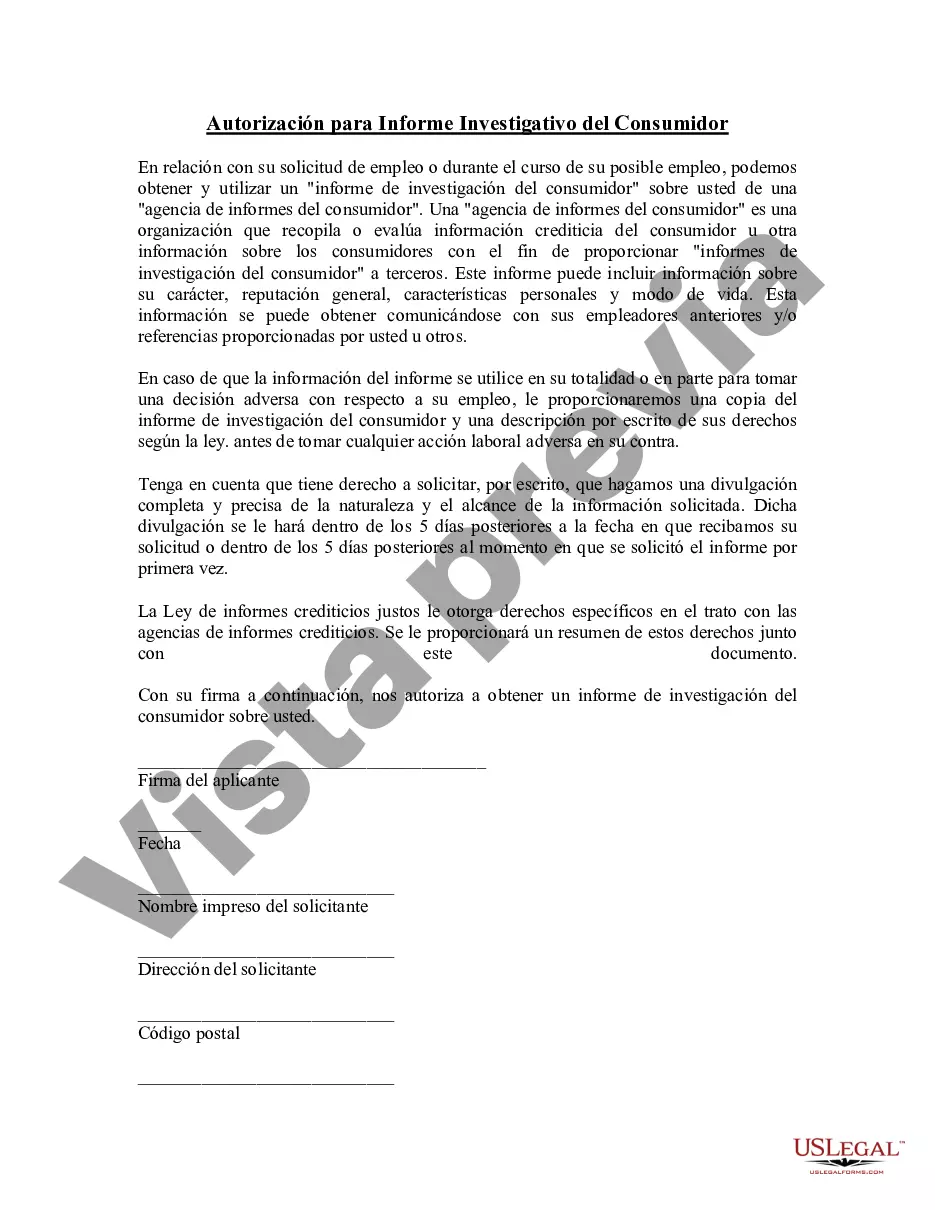

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Autorización de Informe del Consumidor - Authorization of Consumer Report

Description

How to fill out Tarrant Texas Autorización De Informe Del Consumidor?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Tarrant Authorization of Consumer Report.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Tarrant Authorization of Consumer Report will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Tarrant Authorization of Consumer Report:

- Make sure you have opened the correct page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Tarrant Authorization of Consumer Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!