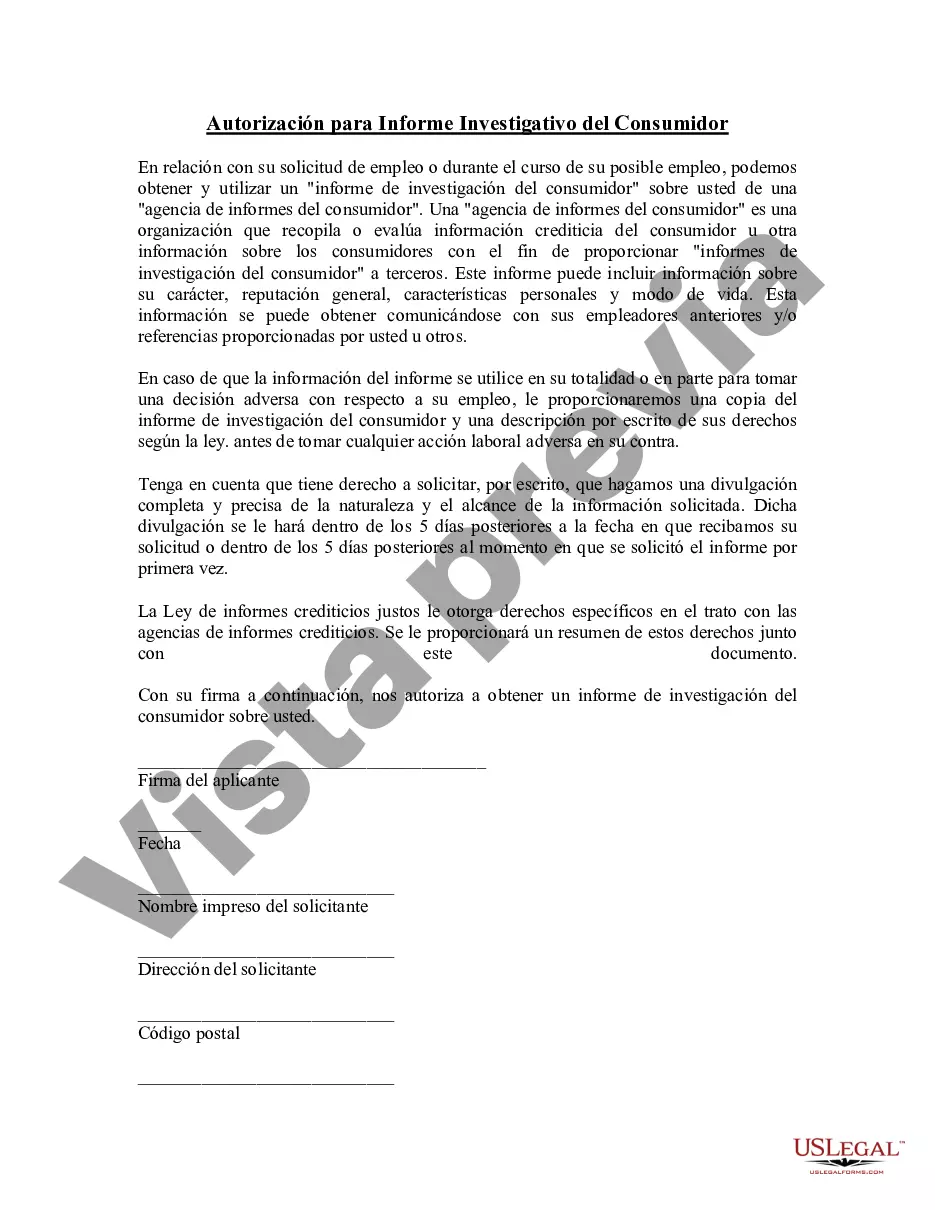

Travis Texas Authorization of Consumer Report is a legal document that grants permission to businesses, organizations, or individuals to obtain and review a consumer's background information for various purposes. It ensures compliance with the Fair Credit Reporting Act (FCRA) and protects the consumer's rights as well. The Travis Texas Authorization of Consumer Report is a crucial step in the hiring process, enabling employers to gather comprehensive information about potential employees. It allows them to assess an applicant's credit history, criminal records, employment history, education verification, and other relevant factors. By obtaining this consent, employers can make more informed decisions regarding employment, promotion, or other business-related purposes. In Travis Texas, the authorization of consumer reports may differ depending on the specific purpose or industry requirements. Here are some notable types: 1. Employment Background Check Authorization: This authorization is commonly used by employers to conduct pre-employment screenings. It allows them to obtain a consumer report, which helps determine a candidate's suitability for a particular position. Employers may consider factors such as credit score, criminal records, drug testing results, and previous employment verification. 2. Tenant Screening Authorization: Landlords or property management companies often use this type of authorization to evaluate prospective tenants. By conducting a consumer report, landlords can assess an applicant's rental history, creditworthiness, eviction records, and criminal background. This information assists them in making informed decisions about potential renters. 3. Financial Institution Authorization: Financial institutions, such as banks or credit unions, may require this authorization to verify a client's creditworthiness before granting loans, credit cards, or other financial services. It enables them to assess a person's financial stability, repayment history, outstanding liabilities, and credit habits. 4. Insurance Application Authorization: Insurance companies may require applicants to grant authorization for consumer reports to assess their risk factor, claims history, credit score, and other relevant information. This ensures accurate risk assessment and appropriate premium calculations. 5. Professional License Background Check Authorization: Regulatory agencies, professional boards, or licensing bodies often require individuals seeking professional licenses (such as attorneys, doctors, nurses, or real estate agents) to authorize consumer reports. This authorization helps establish an applicant's qualifications, ethical conduct, disciplinary actions, or any criminal history that might impact their suitability for a licensed profession. It is imperative for both businesses and consumers to understand the importance of the Travis Texas Authorization of Consumer Report. This consent ensures transparency, protects personal information, and guarantees compliance with the FCRA guidelines, promoting fair and unbiased decisions when accessing consumer background information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Autorización de Informe del Consumidor - Authorization of Consumer Report

Description

How to fill out Travis Texas Autorización De Informe Del Consumidor?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, locating a Travis Authorization of Consumer Report suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Apart from the Travis Authorization of Consumer Report, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Travis Authorization of Consumer Report:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Travis Authorization of Consumer Report.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!