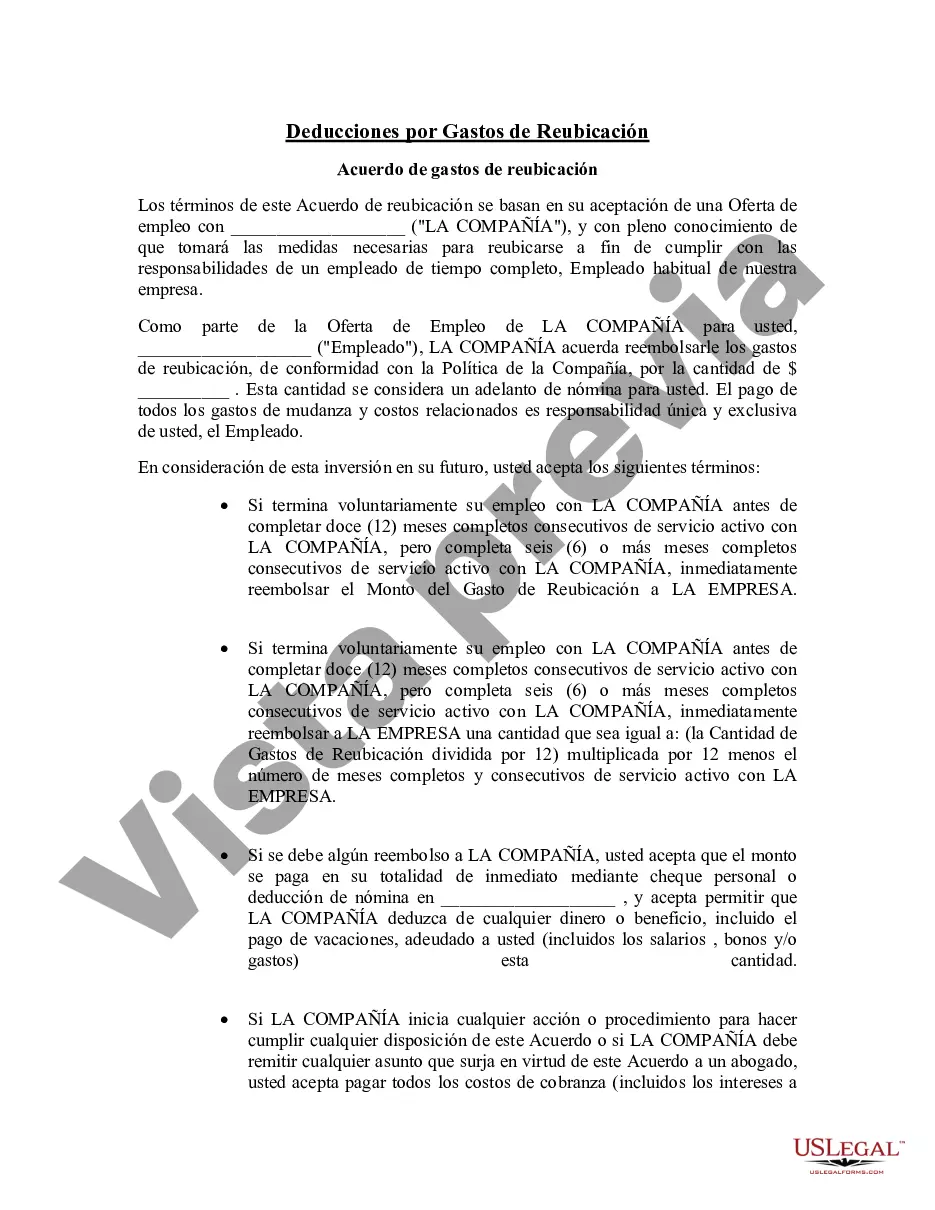

The Harris Texas Relocation Expense Agreement is a legally binding document that outlines the terms and conditions related to the relocation expenses for employees or individuals moving to Harris County, Texas. This agreement is typically entered into between an employer and an employee who is required to move to Harris County for work-related purposes. The agreement covers various aspects of the relocation process and ensures that both parties are aware of their rights and responsibilities. It serves as a roadmap for managing the expenses associated with the relocation and aims to provide clarity and transparency in the process. Some key features included in the Harris Texas Relocation Expense Agreement are: 1. Scope and Purpose: The agreement starts by defining the scope and purpose of the relocation, such as the reasons for the move and the specific job responsibilities for the employee in the new location. 2. Reimbursable Expenses: The agreement outlines the types of expenses that will be reimbursed by the employer. These may include transportation costs, temporary living expenses, moving and storage costs, real estate fees, and other related expenditures. Each item is detailed with specific conditions and limitations. 3. Documentation and Approval: The agreement specifies the required documents and receipts that the employee needs to submit to claim reimbursement for the expenses. It also outlines the process for obtaining pre-approval for certain expenses and the timeframe for submitting reimbursement requests. 4. Payment and Tax Implications: The agreement addresses the method and frequency of payment for the reimbursed expenses. It may also highlight any tax implications or reporting requirements for both the employer and the employee. 5. Repayment Obligations: In some cases, the agreement may include provisions for repayment obligations if the employee voluntarily terminates their employment within a certain timeframe after the relocation. It's worth noting that there may be different types of Harris Texas Relocation Expense Agreements depending on various factors, such as the employee's position, seniority, and the employer's relocation policies. Examples of specific types of agreements could include executive relocation expense agreements, employee relocation expense agreements, or even government-related relocation expense agreements. In conclusion, the Harris Texas Relocation Expense Agreement is a comprehensive legal document that governs the reimbursement of relocation expenses for employees moving to Harris County, Texas. It outlines the terms and conditions, eligible expenses, documentation requirements, and other relevant matters related to the relocation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de gastos de reubicación - Relocation Expense Agreement

Description

How to fill out Harris Texas Acuerdo De Gastos De Reubicación?

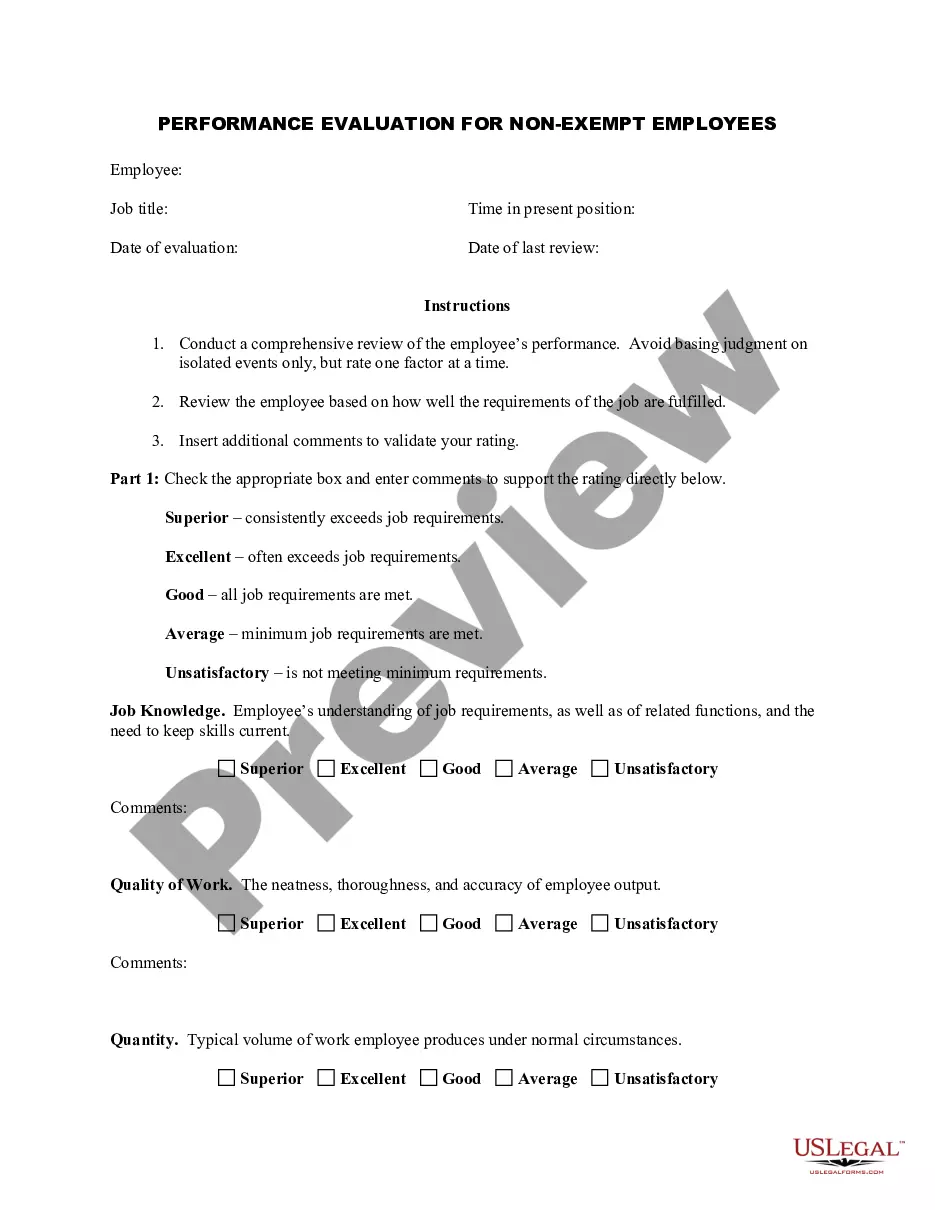

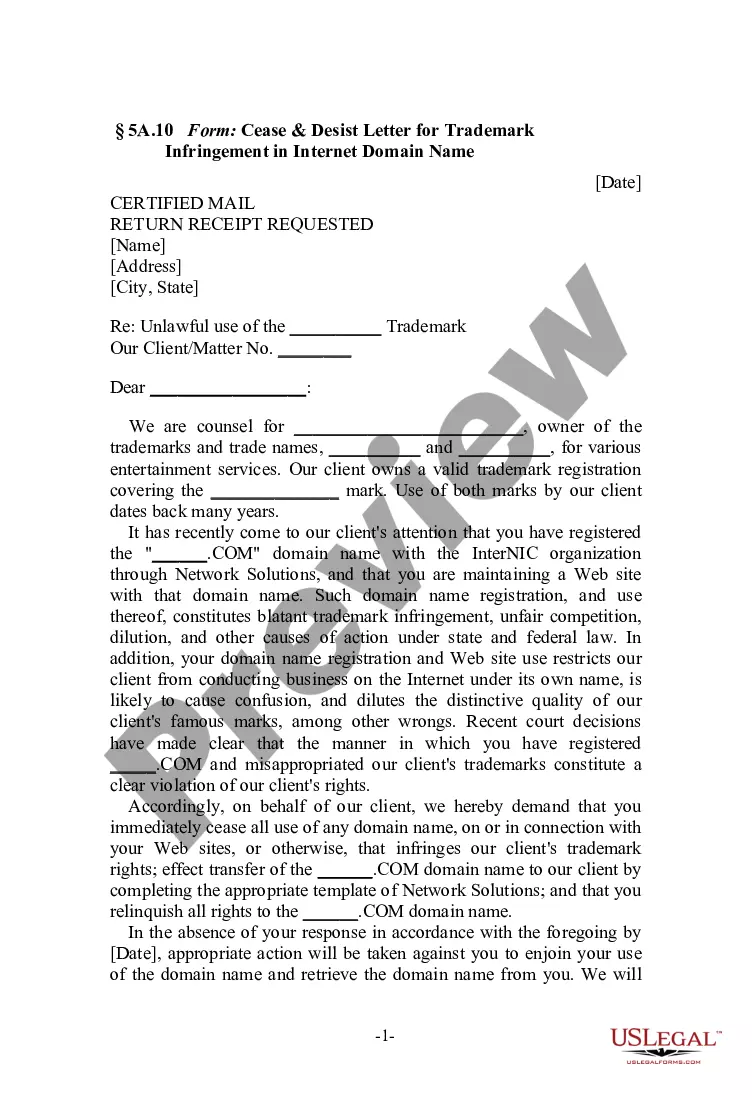

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Harris Relocation Expense Agreement, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any activities related to paperwork execution simple.

Here's how to purchase and download Harris Relocation Expense Agreement.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related forms or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Harris Relocation Expense Agreement.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Harris Relocation Expense Agreement, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you need to cope with an extremely complicated case, we recommend using the services of an attorney to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!