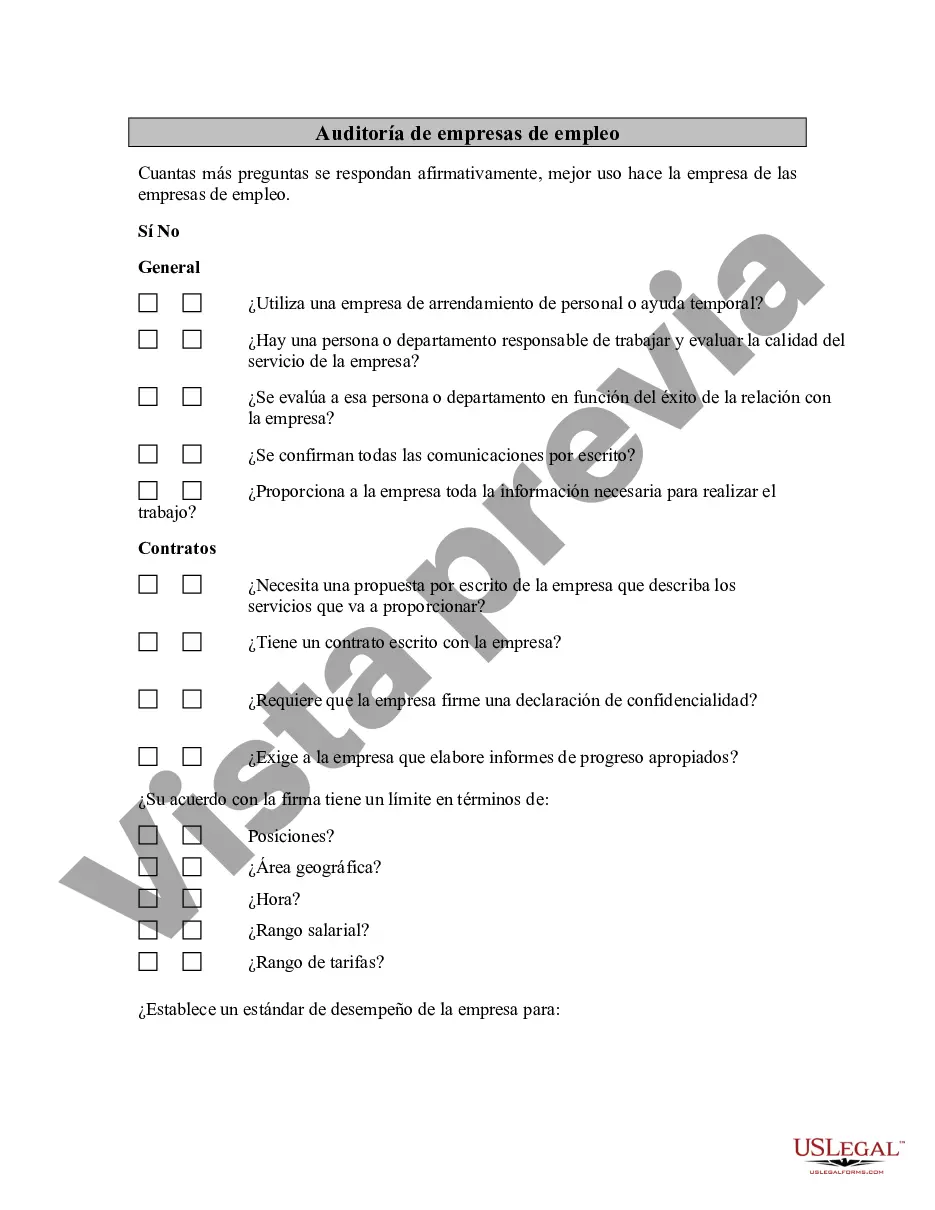

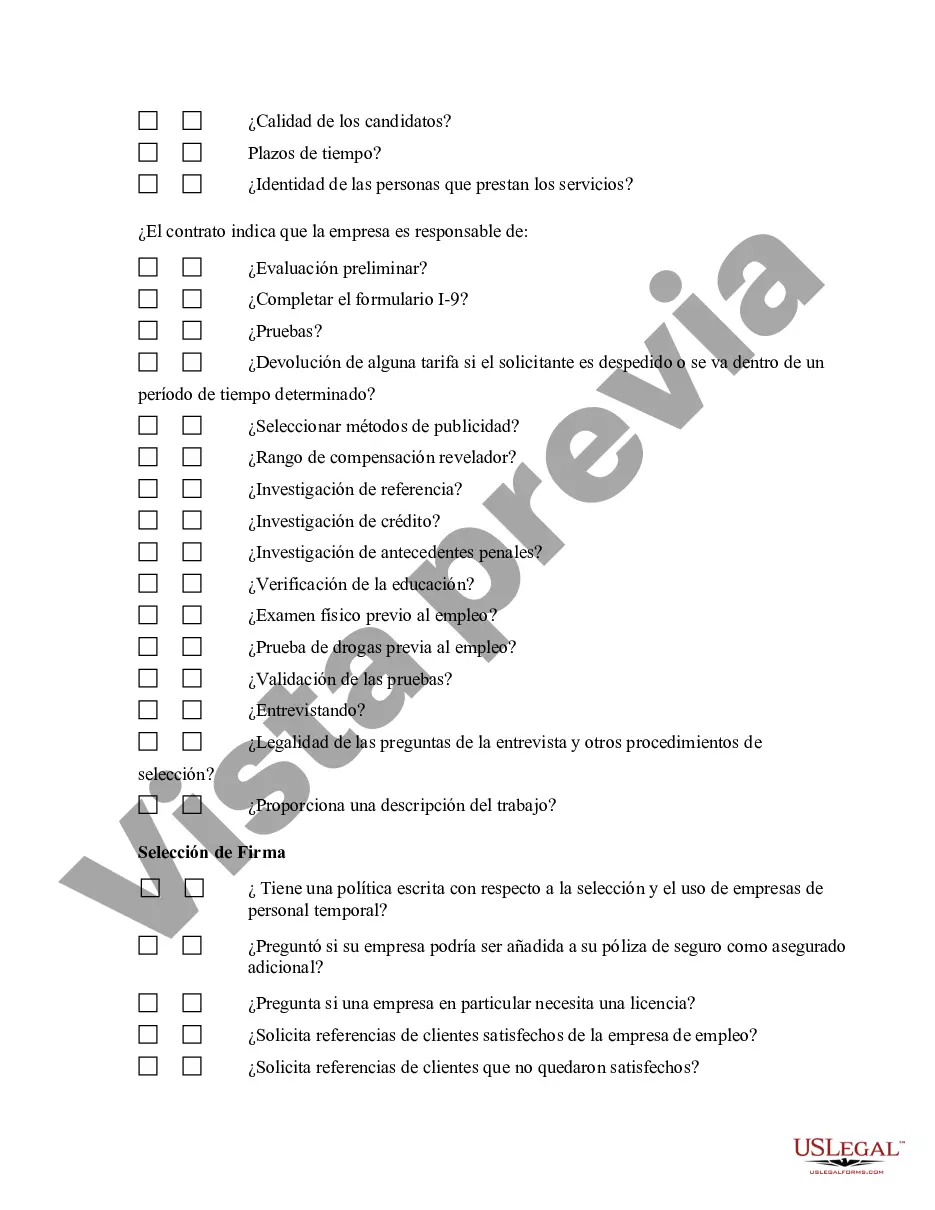

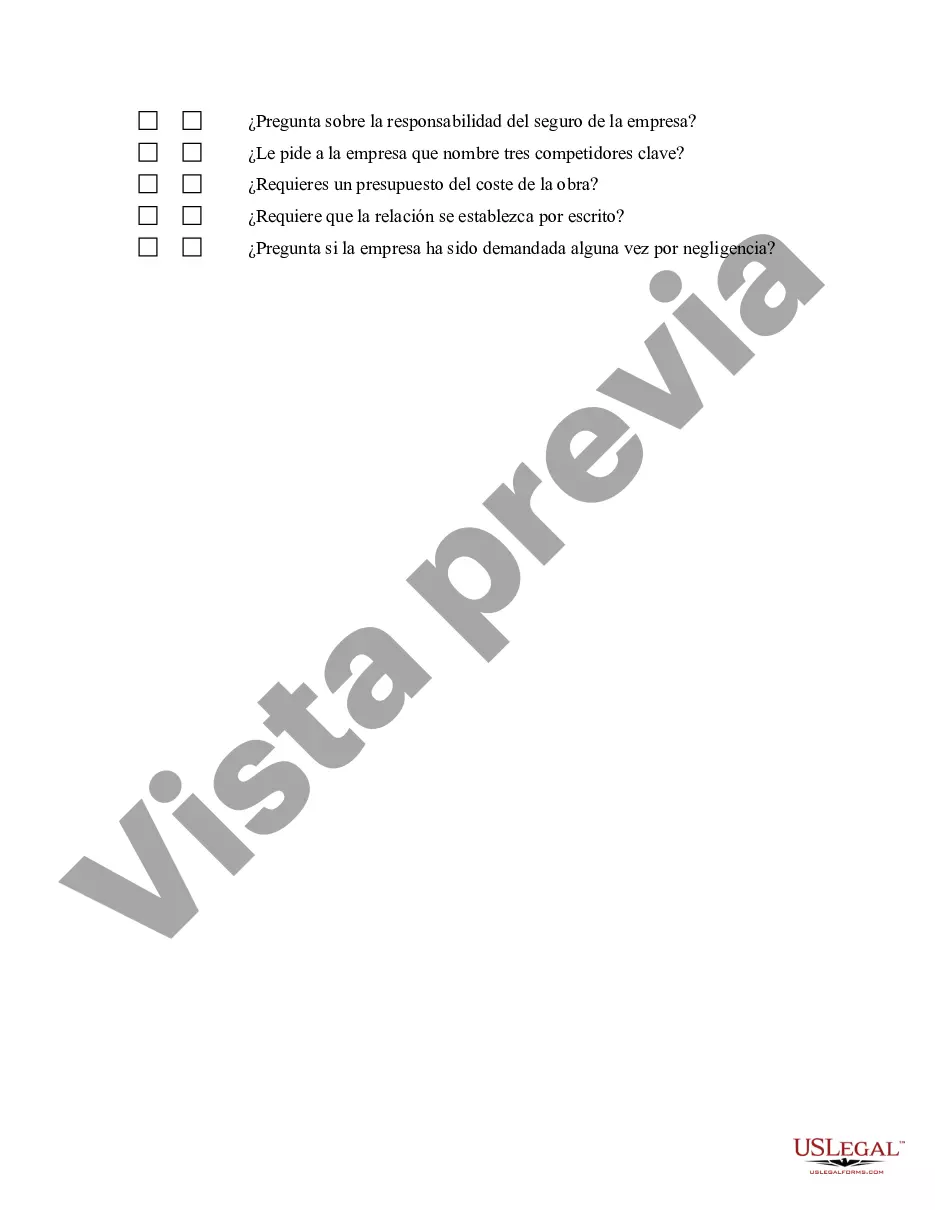

Broward Florida Employment Firm Audit is a comprehensive assessment conducted by professional auditors to evaluate the compliance and performance of employment firms operating in Broward County, Florida. This audit aims to ensure that these firms adhere to the established regulations and standards outlined by local, state, and federal employment laws. By conducting these audits, it helps protect the rights of employees and maintain a fair and equitable work environment. Keywords: — Broward Florida: Refers to the county located in southeastern Florida, known for its diverse businesses, industries, and a significant workforce. — Employment Firm: Encompasses any company or organization involved in the recruitment, hiring, and employment of individuals. — Audit: A systematic examination of records, processes, and procedures, conducted by independent auditors to assess compliance and adherence to specific guidelines or regulations. Types of Broward Florida Employment Firm Audits: 1. Compliance Audit: This type of audit focuses on ensuring that employment firms in Broward County comply with all relevant local, state, and federal regulations. It involves a thorough review of the firm's practices, policies, and procedures to ensure legal compliance in areas such as equal employment opportunity, anti-discrimination laws, payroll and wage regulations, workplace safety, and more. 2. Financial Audit: A financial audit assesses the financial records and practices of employment firms in Broward County. It ensures accuracy and transparency in financial reporting, identifies any potential fraud or misappropriation of funds, and verifies compliance with accounting standards and tax regulations. 3. Internal Control Audit: Internal control audits evaluate the effectiveness and efficiency of employment firms' internal control systems. This includes reviewing internal policies, procedures, and governance practices assessing risk management, safeguarding of assets, and prevention of fraudulent activities. 4. Payroll Audit: This type of audit focuses specifically on a company's payroll processes and ensures compliance with tax laws regarding employee wages, payroll deductions, benefits administration, and employee classification. The auditors ensure accuracy in payroll calculations, tax withholding, and reporting. 5. Employee Benefits Audit: This audit examines the employee benefits programs offered by employment firms in Broward County, ensuring compliance with state and federal regulations such as health insurance, retirement plans, and leave policies. It assesses the fairness, accessibility, and adherence to legal requirements for benefit offerings. 6. Record keeping Audit: Record keeping audits verify the accuracy, completeness, and confidentiality of employment firms' records, including personnel files, time cards, training records, and other relevant documentation. This audit ensures compliance with record keeping requirements mandated by labor and employment laws. In summary, Broward Florida Employment Firm Audit involves thorough inspections, evaluations, and verifications to ascertain compliance with employment laws and regulations. Through various types of audits, employment firms in Broward County can ensure fair and lawful practices, protecting the rights of both employers and employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Auditoría de empresas de empleo - Employment Firm Audit

Description

How to fill out Broward Florida Auditoría De Empresas De Empleo?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Broward Employment Firm Audit, with a platform like US Legal Forms.

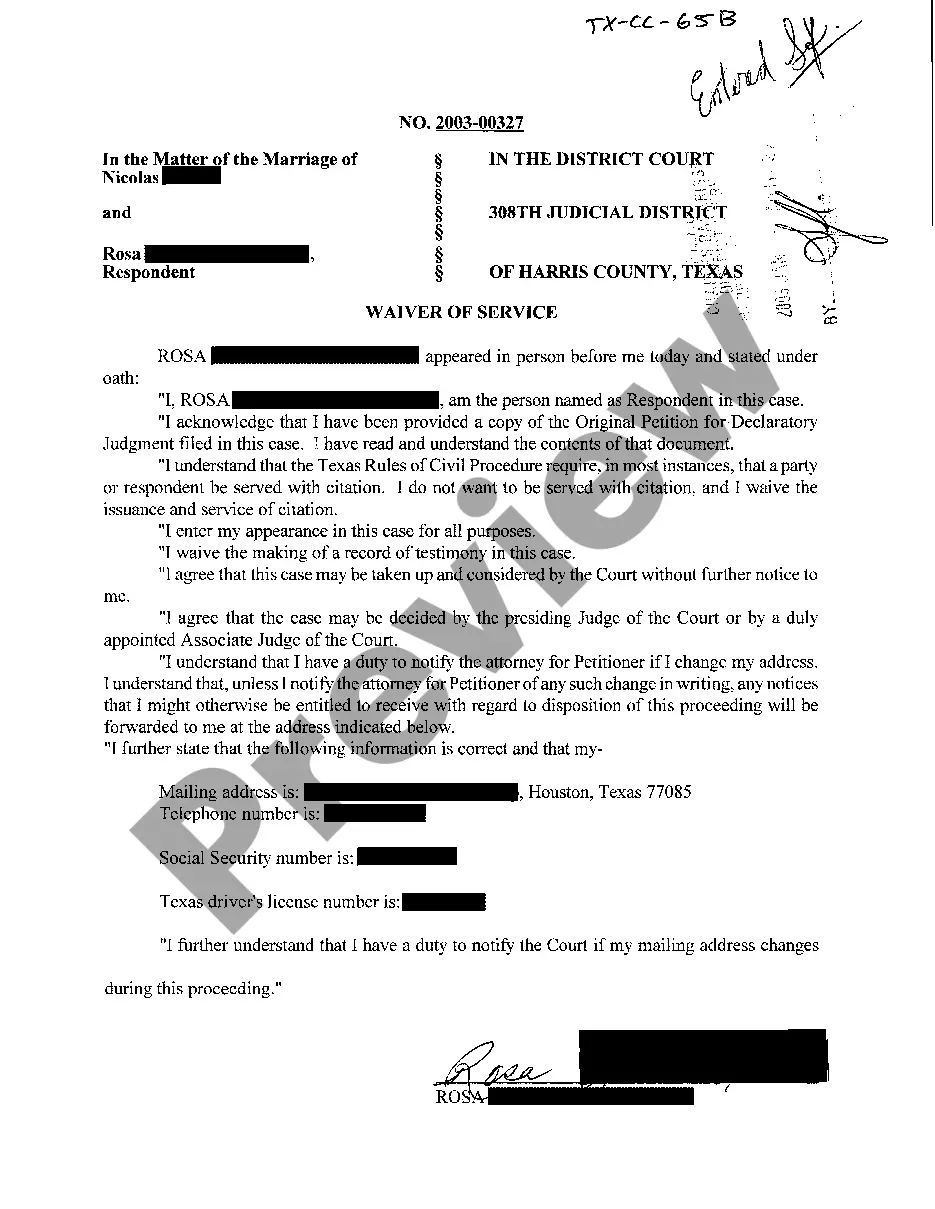

US Legal Forms has over 85,000 templates to choose from in different categories ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any activities related to paperwork execution simple.

Here's how to purchase and download Broward Employment Firm Audit.

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and purchase Broward Employment Firm Audit.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Broward Employment Firm Audit, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to deal with an extremely difficult situation, we advise using the services of a lawyer to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!