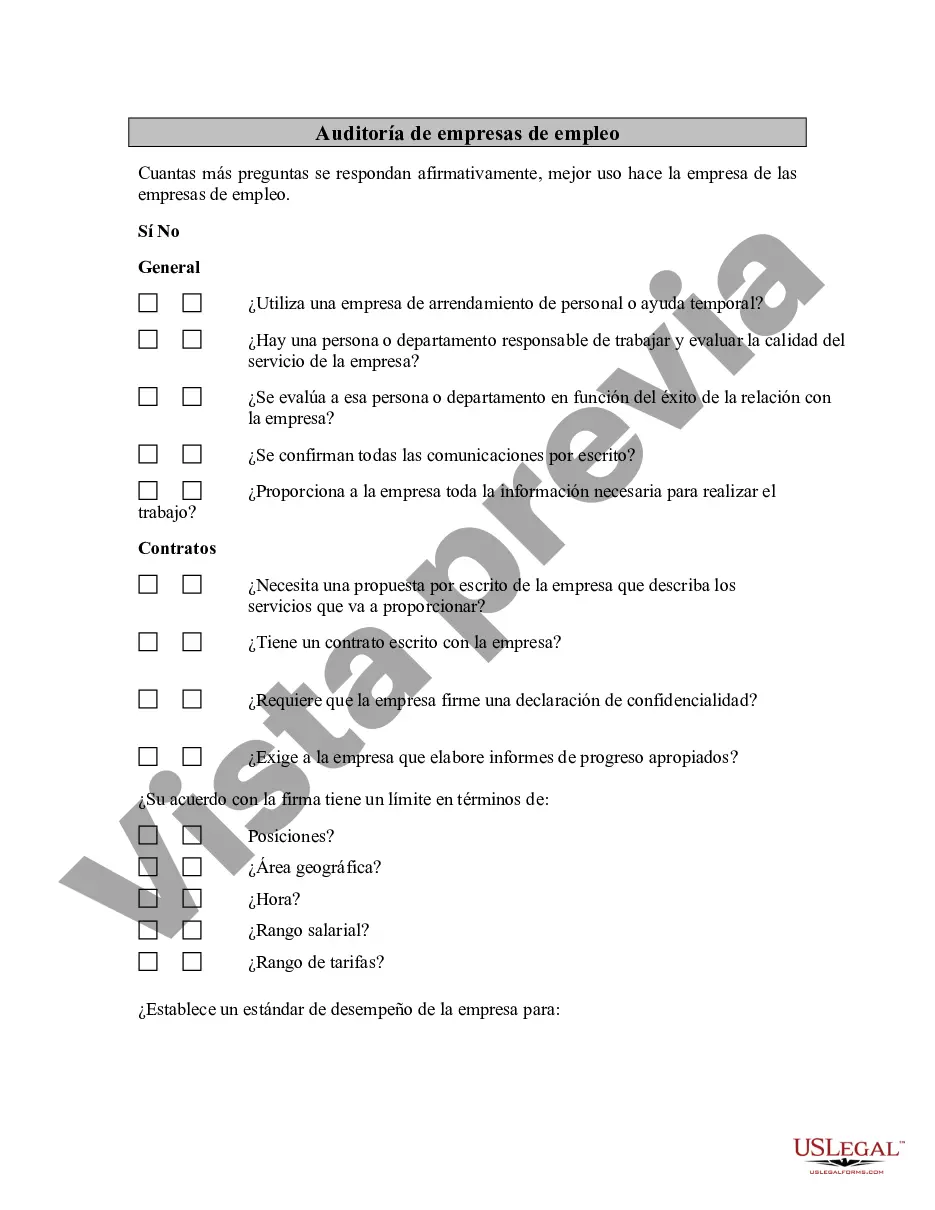

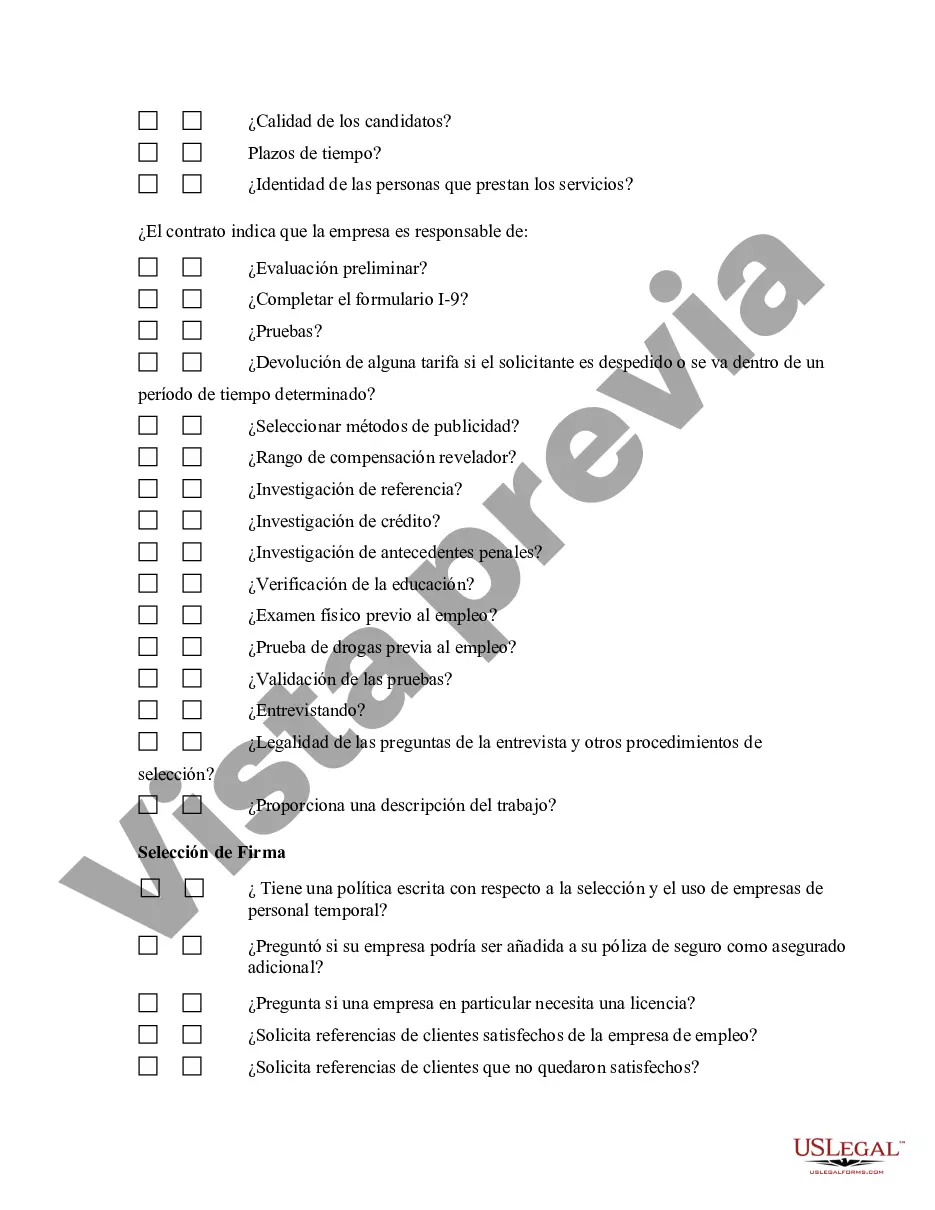

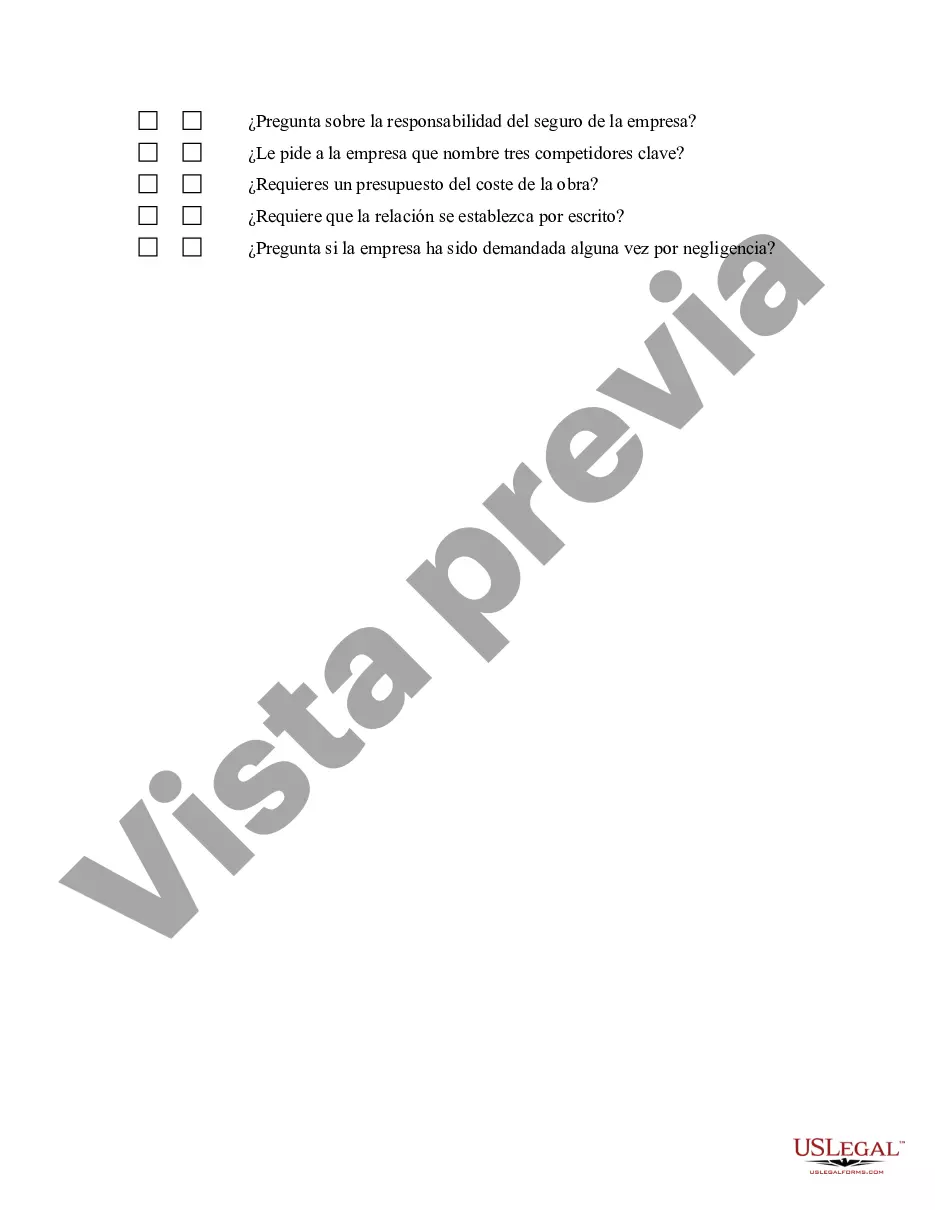

Cook Illinois Employment Firm Audit is a comprehensive evaluation process conducted by financial specialists to examine and assess the internal control systems, financial records, and compliance standards followed by the Cook Illinois Employment Firm. This audit aims to ensure the accuracy, reliability, and legality of the firm's financial statements and operations. The Cook Illinois Employment Firm Audit involves a systematic review of various key areas such as financial statements, payroll, tax compliance, employee benefits, vendor relationships, and internal policies. Employing the usage of advanced auditing techniques and practices, the audit seeks to identify potential risks, errors, fraud, or non-compliance issues within the firm's financial and operational processes. Keywords: Cook Illinois, employment firm, audit, financial specialists, internal control systems, financial records, compliance standards, accuracy, reliability, legality, financial statements, operations, systematic review, payroll, tax compliance, employee benefits, vendor relationships, internal policies, risks, errors, fraud, non-compliance issues, auditing techniques, operational processes. Different types of Cook Illinois Employment Firm Audit can be categorized based on the specific focus or scope of the audit. These types include: 1. Financial Statement Audit: This type of audit primarily examines the accuracy, completeness, and fairness of the financial statements prepared by the Cook Illinois Employment Firm. The audit ensures compliance with accounting standards, identifies any material misstatements, and provides assurance to stakeholders regarding the reliability of financial information. 2. Compliance Audit: Compliance audits focus on assessing the firm's adherence to applicable laws, regulations, contractual agreements, and internal policies. This type of audit ensures that the Cook Illinois Employment Firm operates within legal boundaries and meets regulatory compliance requirements. 3. Internal Control Audit: Internal control audits evaluate the effectiveness of the firm's internal control mechanisms and procedures. By examining the design and implementation of internal controls, auditors identify weaknesses or gaps that could lead to fraud, errors, or misappropriation of assets, and provide recommendations for improvement. 4. Employment Practices Audit: This type of audit investigates the firm's employment practices, including hiring, onboarding, performance evaluation, compensation, and termination procedures. The audit examines whether these practices comply with labor laws, equal opportunity regulations, and internal HR policies. 5. Payroll Audit: Payroll audits focus on reviewing the accuracy and completeness of the Cook Illinois Employment Firm's payroll records and procedures. Auditors verify that employee wages, deductions, benefits, and tax withholding are properly calculated and comply with legal requirements. Keywords: Financial Statement Audit, Compliance Audit, Internal Control Audit, Employment Practices Audit, Payroll Audit, accuracy, completeness, fairness, accounting standards, material misstatements, assurance, compliance, legal boundaries, regulatory compliance requirements, internal control mechanisms, procedures, weaknesses, fraud, errors, misappropriation, assets, improvement recommendations, hiring, onboarding, performance evaluation, compensation, termination procedures, labor laws, equal opportunity regulations, HR policies, payroll records, wages, deductions, benefits, tax withholding.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Auditoría de empresas de empleo - Employment Firm Audit

Description

How to fill out Cook Illinois Auditoría De Empresas De Empleo?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Cook Employment Firm Audit.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Cook Employment Firm Audit will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Cook Employment Firm Audit:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Cook Employment Firm Audit on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!