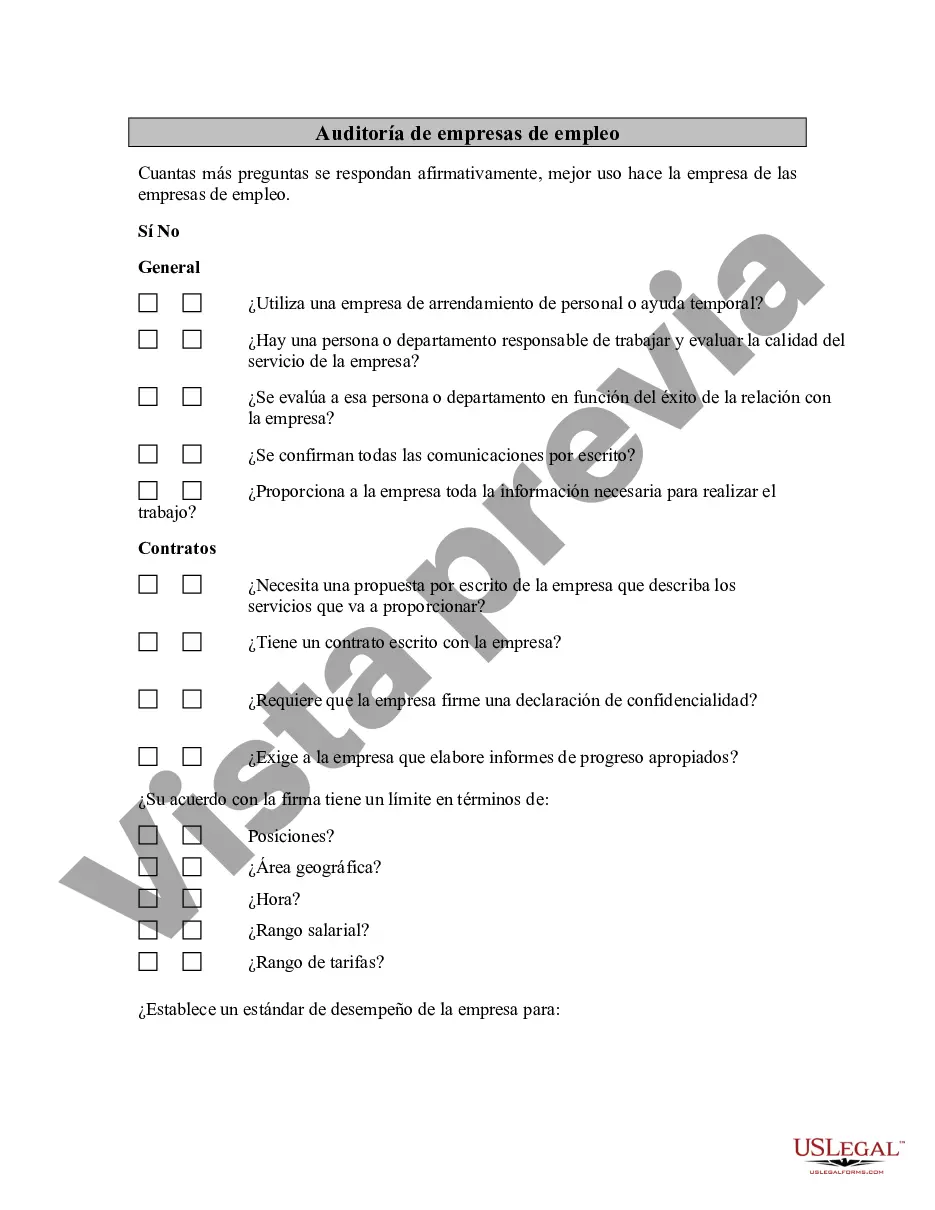

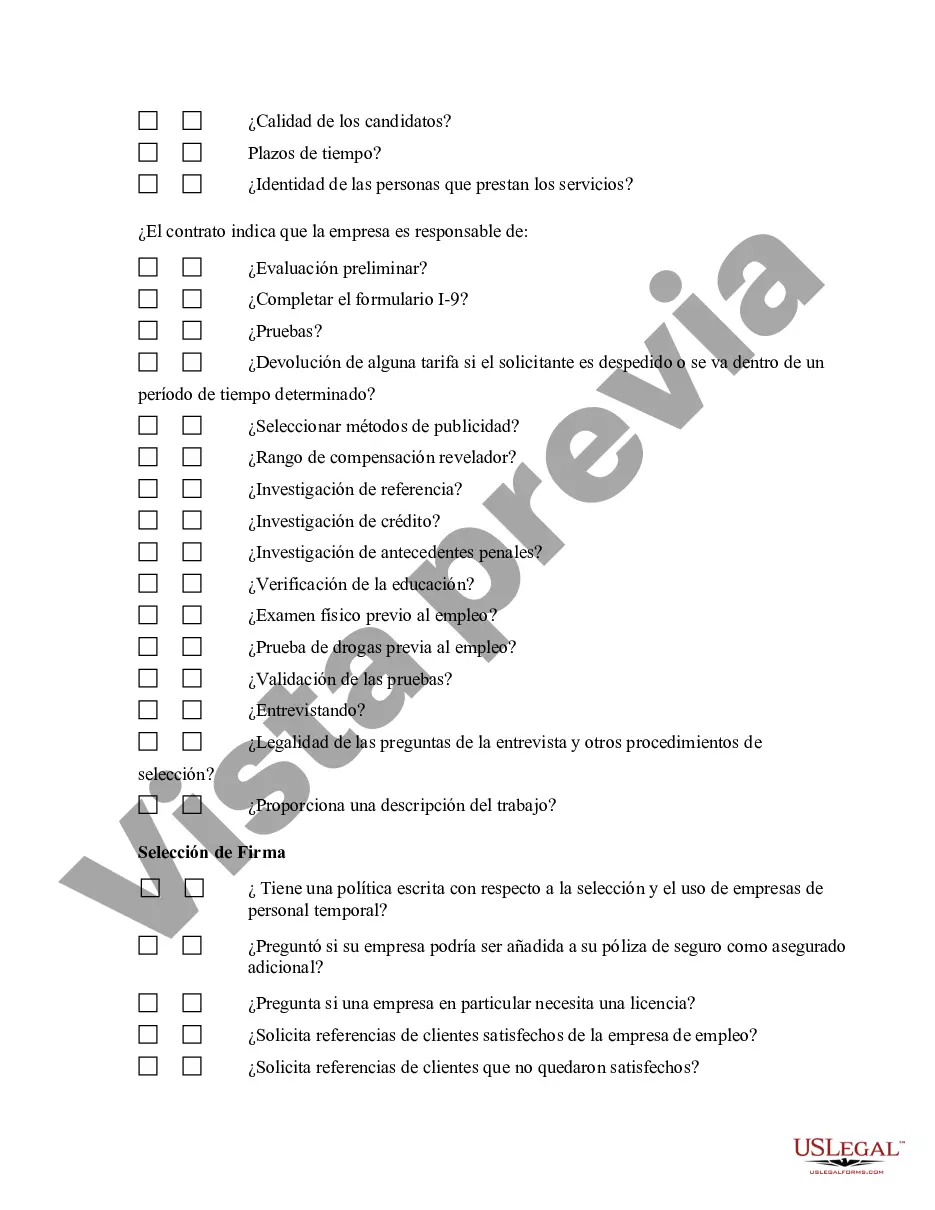

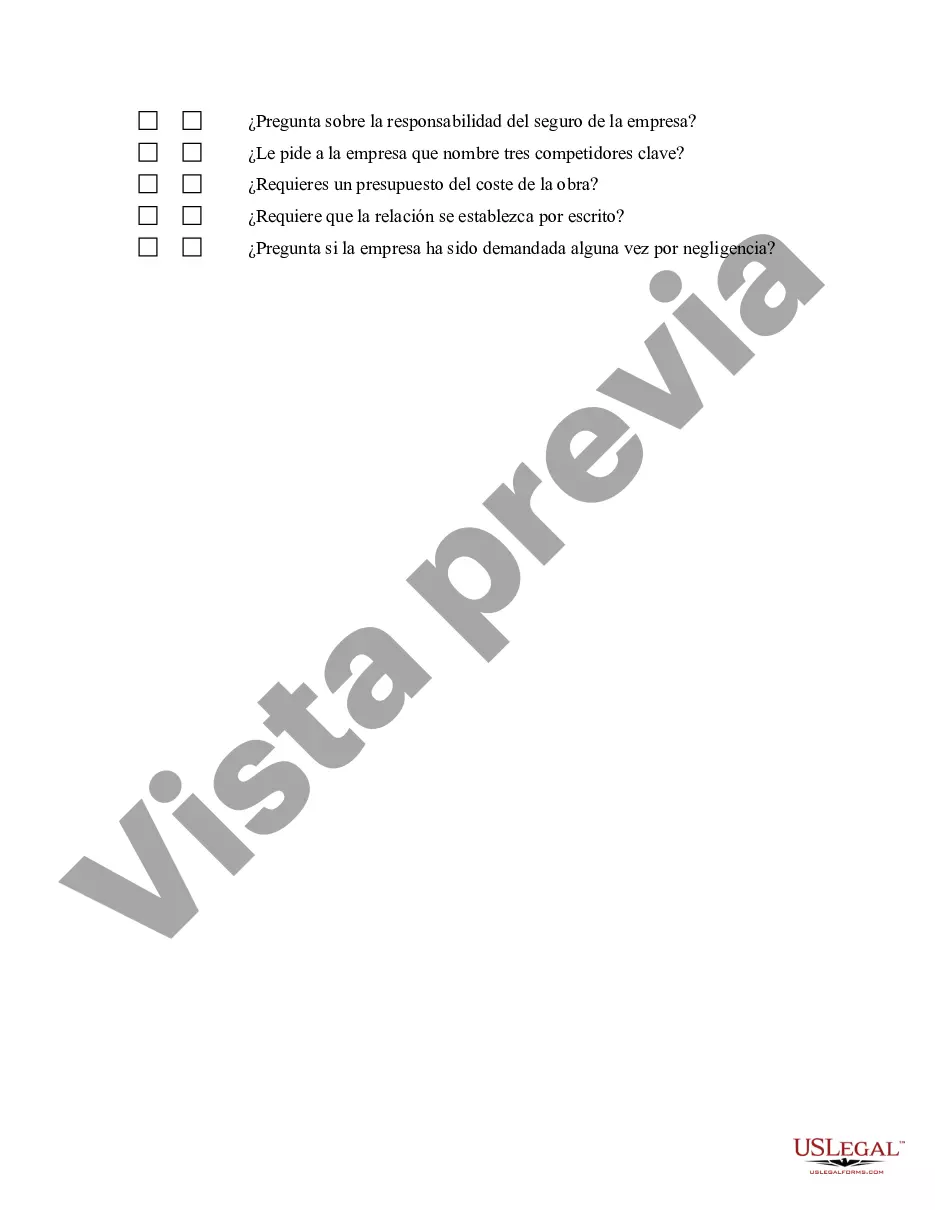

Dallas Texas Employment Firm Audit is a vital process that assesses the overall financial stability, compliance, and efficiency of an employment firm in Dallas, Texas. It involves a detailed evaluation of the firm's financial records, employee compensation, tax compliance, internal controls, and operational procedures. By conducting an audit, Dallas Texas employment firms can ensure that their financial statements are accurate, reliable, and in accordance with the industry's regulations. There are several types of audits that can be performed on employment firms in Dallas, Texas, including: 1. Financial Audit: This audit examines the accuracy of the financial statements, including the firm's balance sheet, income statement, and cash flow statement. It aims to determine if the figures presented reflect the true financial position of the firm. 2. Compliance Audit: This type of audit focuses on assessing whether the employment firm is complying with the relevant laws, regulations, and industry standards. It ensures that the firm is adhering to laws regarding employee compensation, tax obligations, and health and safety regulations. 3. Internal Audit: An internal audit is conducted by the employment firm's own internal audit department or an external auditing firm. It reviews the firm's internal controls, risk management processes, and governance practices detecting any potential weaknesses or deficiencies. 4. Operational Audit: This audit evaluates the efficiency and effectiveness of the firm's operations, such as recruitment processes, employee onboarding, performance management, and HR policies. It aims to identify areas for improvement and ensure that the firm is operating optimally. 5. Tax Audit: A tax audit focuses on verifying the accuracy of the employment firm's tax returns and ensuring compliance with tax laws. It examines various tax-related documents, deductions, credits, and exemptions claimed by the firm. In conducting a Dallas Texas Employment Firm Audit, auditors utilize various keywords to ensure the accuracy and relevance of their findings. These keywords include financial statements, internal controls, risk management, compliance, taxes, regulations, operational efficiency, accuracy, reliability, industry standards, employee compensation, governance, and auditing procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Auditoría de empresas de empleo - Employment Firm Audit

Description

How to fill out Dallas Texas Auditoría De Empresas De Empleo?

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Dallas Employment Firm Audit, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the current version of the Dallas Employment Firm Audit, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Dallas Employment Firm Audit:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Dallas Employment Firm Audit and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!