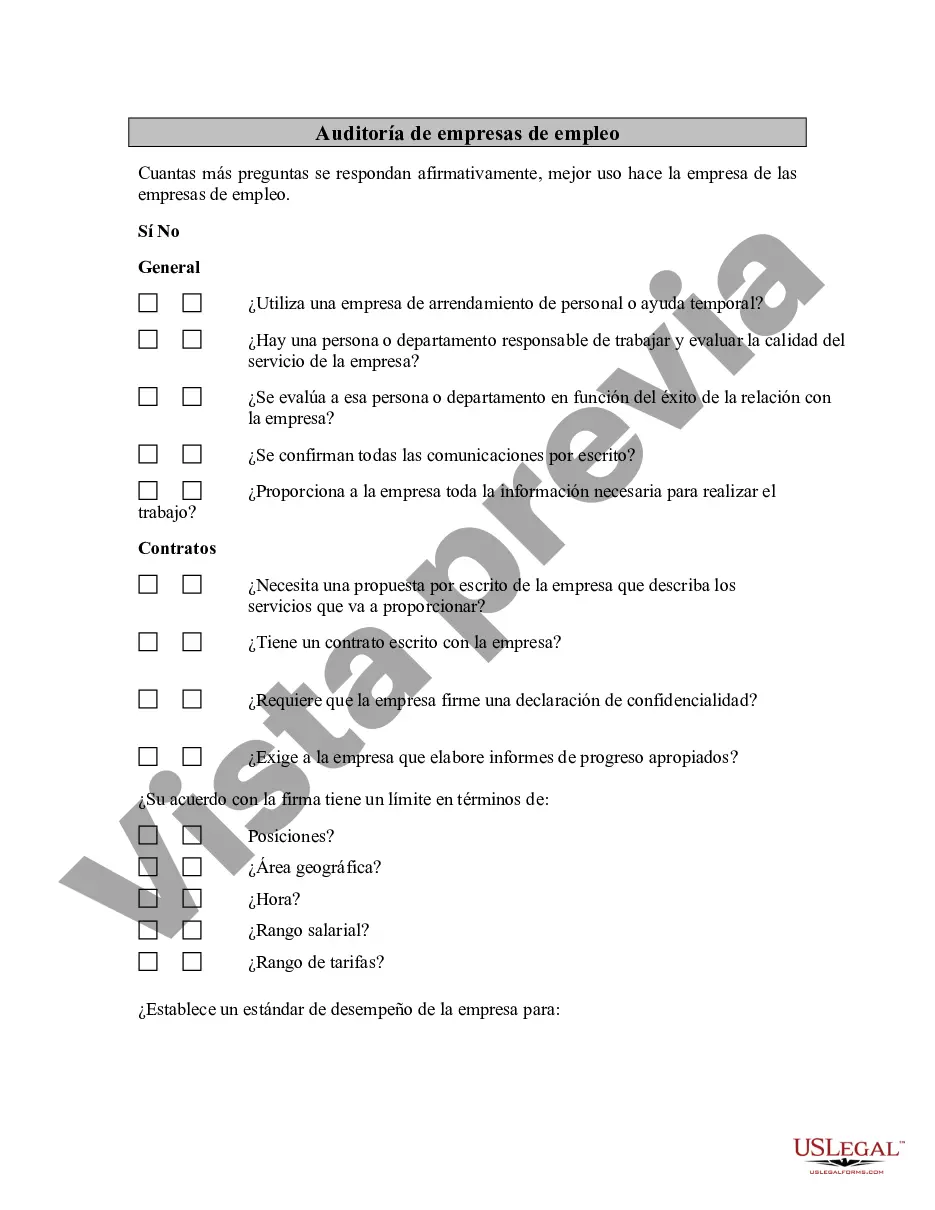

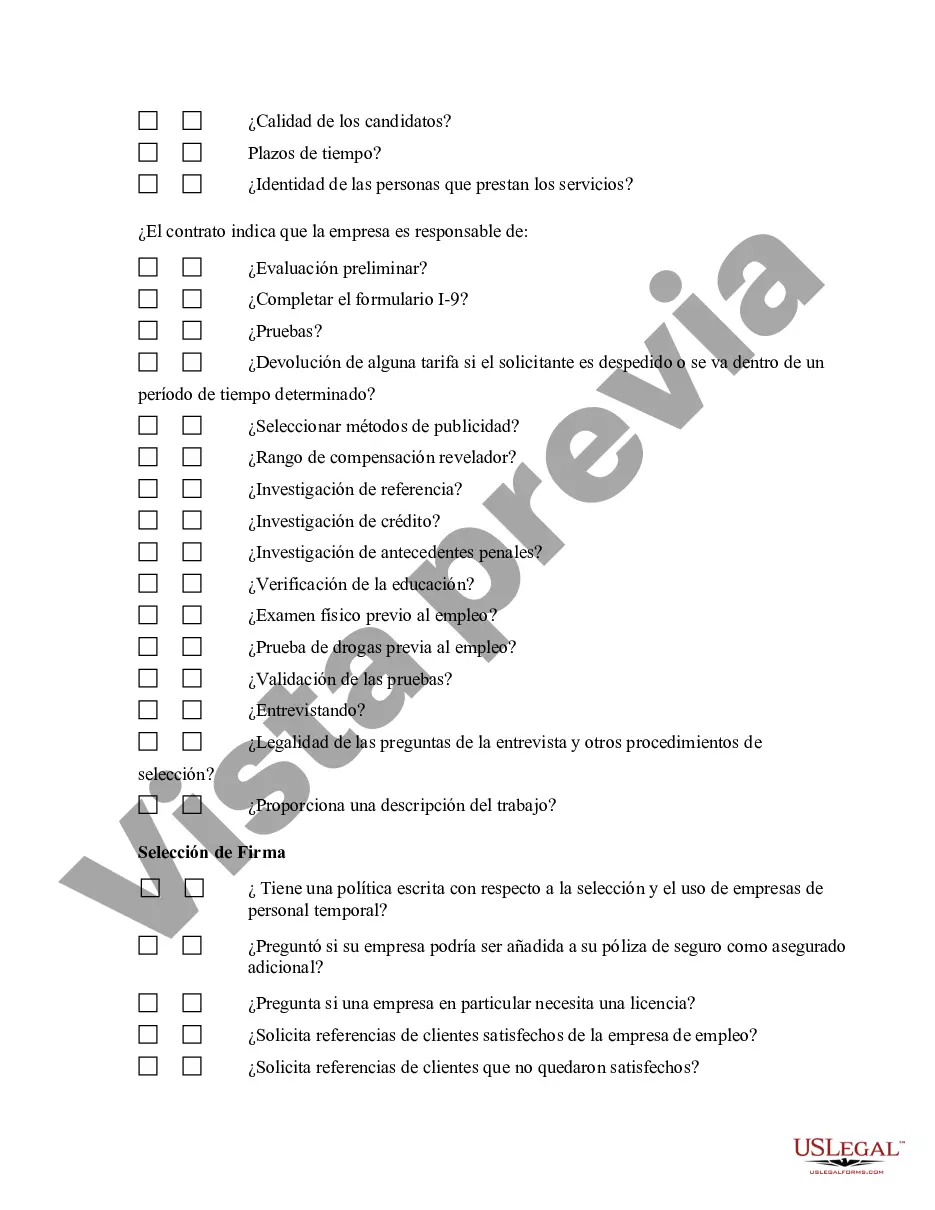

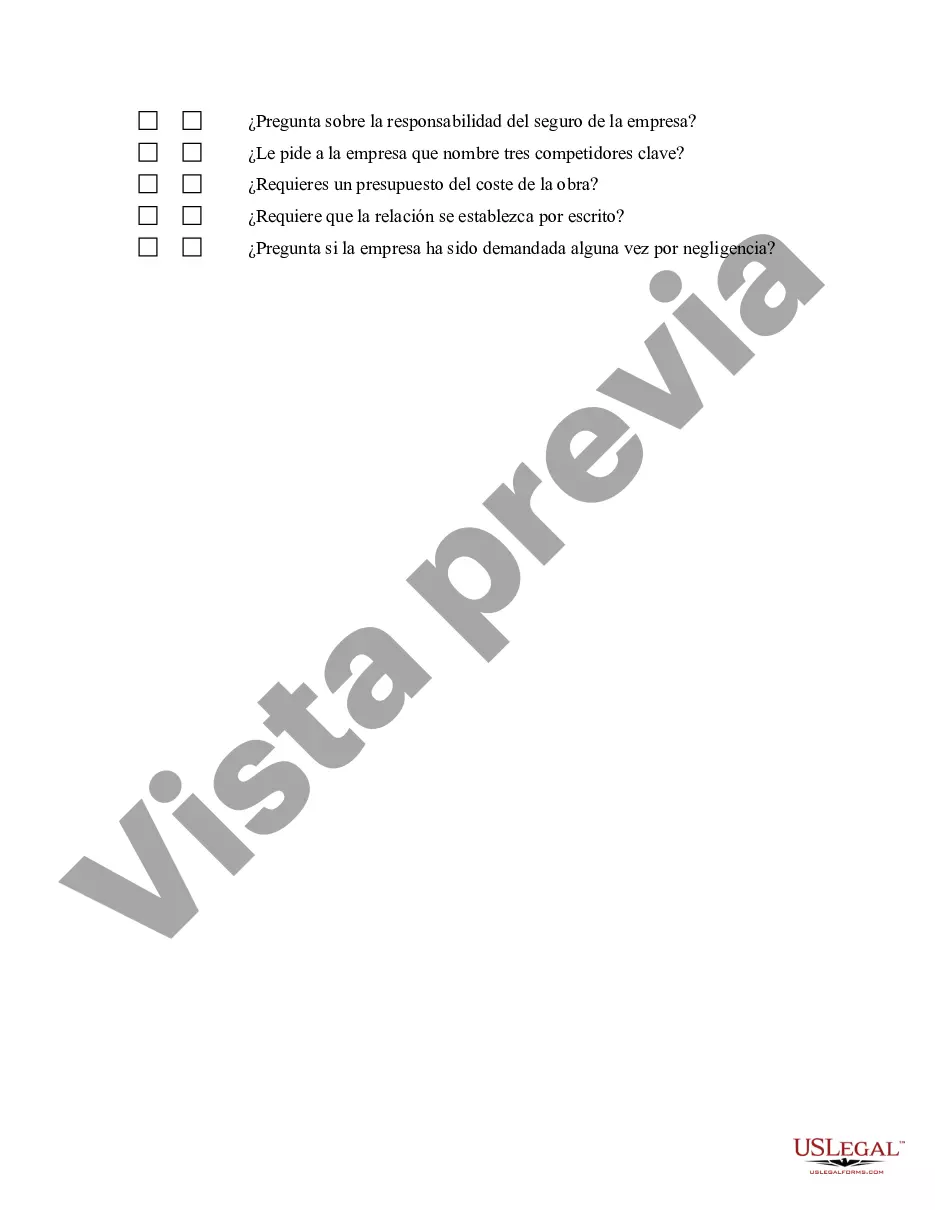

Tarrant Texas Employment Firm Audit refers to the comprehensive evaluation and examination of the operations, practices, and financial records of employment firms in the Tarrant County region of Texas. This audit is conducted by specialized auditing firms to ensure compliance with local, state, and federal laws and regulations that govern employment practices. The Tarrant Texas Employment Firm Audit encompasses various key areas, including personnel records, employee classification, payroll practices, benefits administration, tax compliance, hiring processes, and adherence to employment laws such as wage and hour regulations, anti-discrimination practices, and workplace safety standards. During the audit, the auditing firm closely reviews the documentation and procedures of employment firms to identify any discrepancies, non-compliance, or potential risks. The auditors carefully examine payrolls, tax filings, contracts, employee handbooks, training materials, and internal policies to assess the level of compliance. They also conduct interviews with key personnel, managers, and employees to gather information about the firm's employment practices, policies, and procedures. Tarrant Texas Employment Firm Audit aims to ensure that employment firms are upholding their legal obligations, treating employees fairly, and maintaining ethical business practices. The audit helps identify any irregularities, fraud, or mismanagement within the firm, which can lead to legal consequences, financial penalties, or reputational damage. Different types of Tarrant Texas Employment Firm Audits can include: 1. Compliance Audit: This type of audit focuses on ensuring that employment firms are adhering to local, state, and federal employment laws. It assesses the firm's compliance with laws related to minimum wage, overtime, benefits, equal employment opportunities, workplace safety, and more. 2. Payroll Audit: This audit specifically examines the firm's payroll practices, ensuring accurate calculation and distribution of wages, appropriate tax withholding, compliance with payroll tax regulations, and proper documentation. 3. HR Process Audit: This type of audit reviews the firm's human resources processes, including recruitment, hiring, onboarding, training, performance evaluations, and termination procedures. It assesses the effectiveness and compliance of these processes with relevant laws and regulations. 4. Employee Benefits Audit: This audit focuses on evaluating the firm's employee benefits programs, ensuring compliance with laws pertaining to healthcare benefits, retirement plans, vacation policies, and other employee benefits. 5. Contract Compliance Audit: This type of audit examines the firm's compliance with contractual agreements, including client contracts, vendor agreements, and employee contracts. It ensures that the firm is meeting its contractual obligations and following appropriate procedures. 6. Internal Controls Audit: This audit assesses the firm's internal controls and risk management processes to identify any weaknesses or potential risks. It aims to improve the overall governance and operational efficiency of the employment firm. In conclusion, Tarrant Texas Employment Firm Audit is a vital process that evaluates the compliance and practices of employment firms in Tarrant County, Texas. With various types of audits, it ensures that employment firms follow legal obligations, maintain fairness, and uphold ethical standards in their daily operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Auditoría de empresas de empleo - Employment Firm Audit

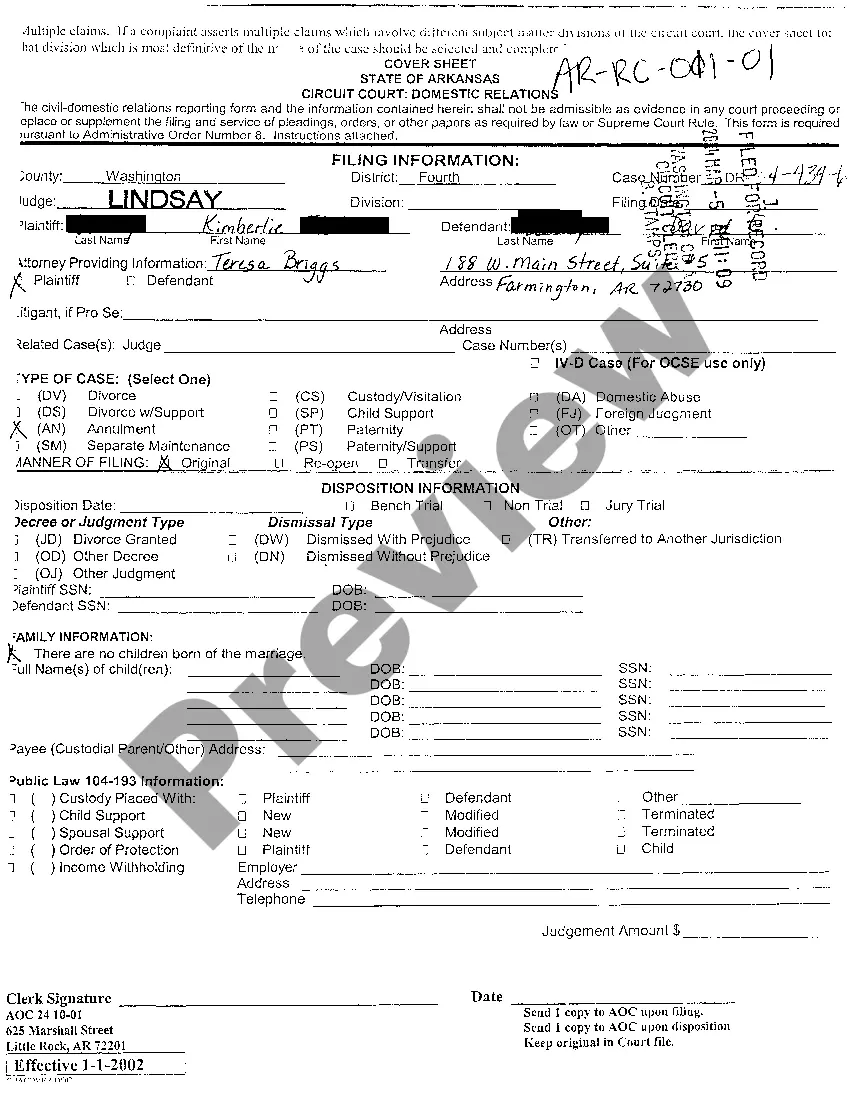

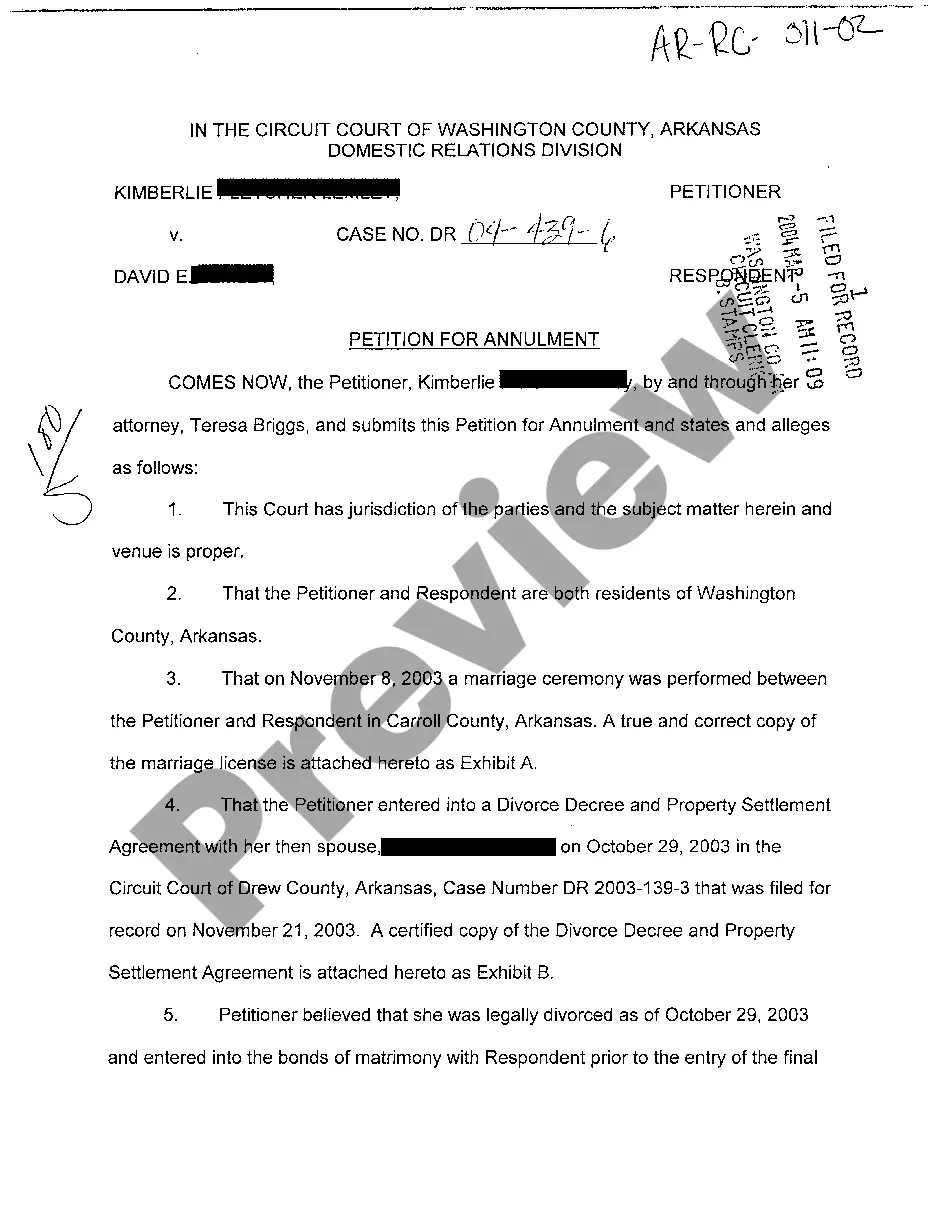

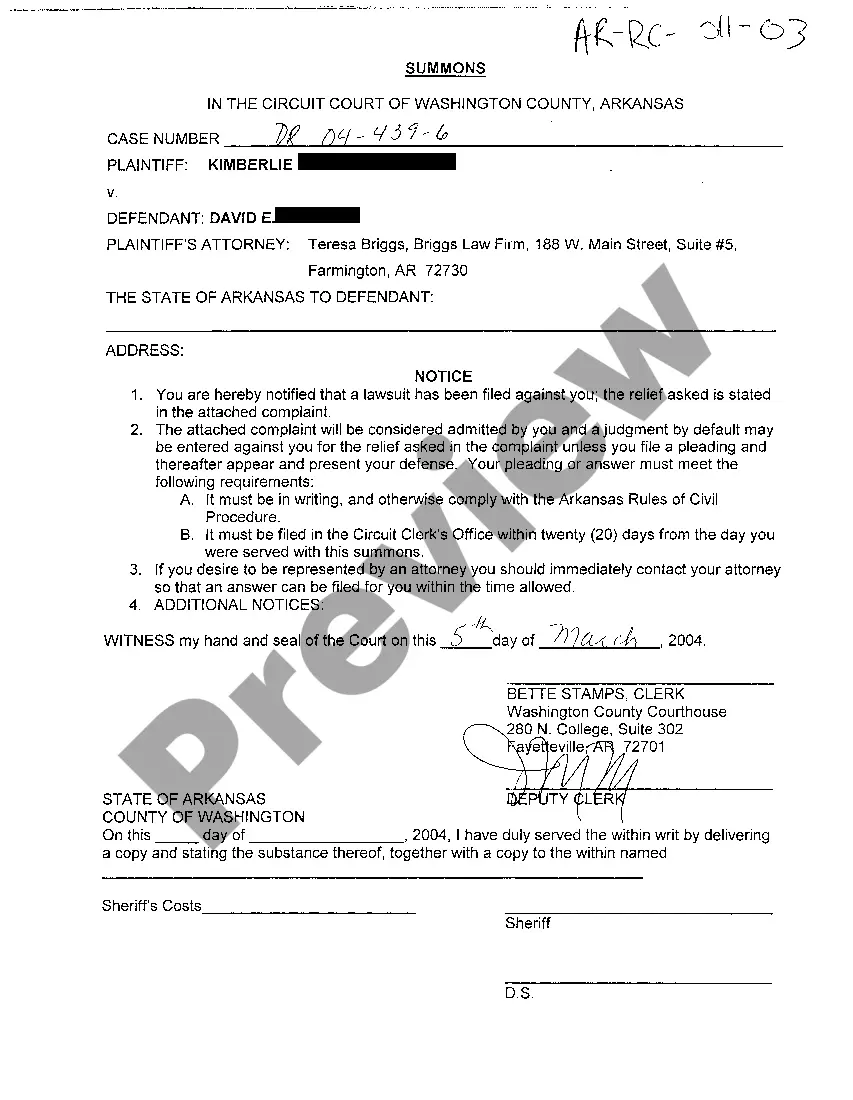

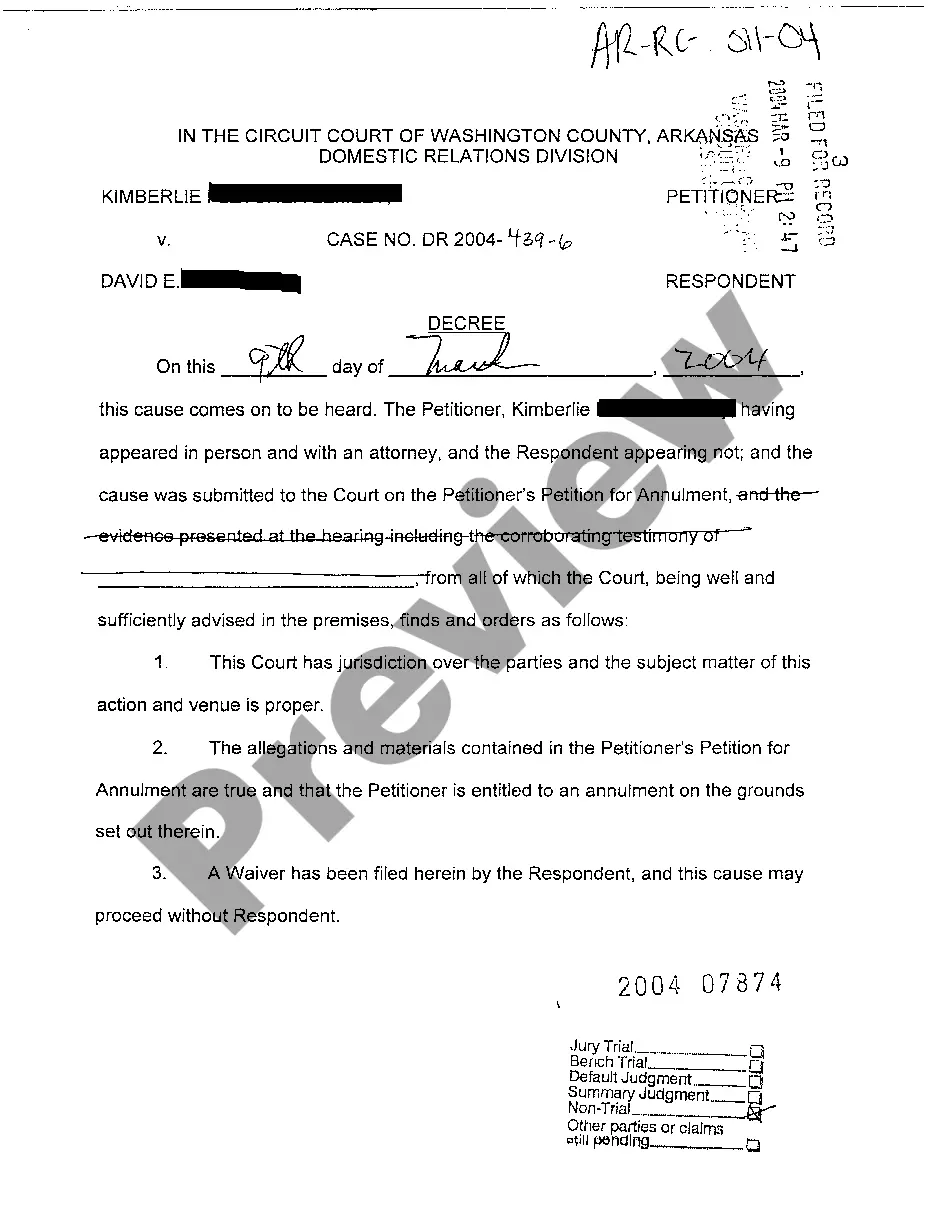

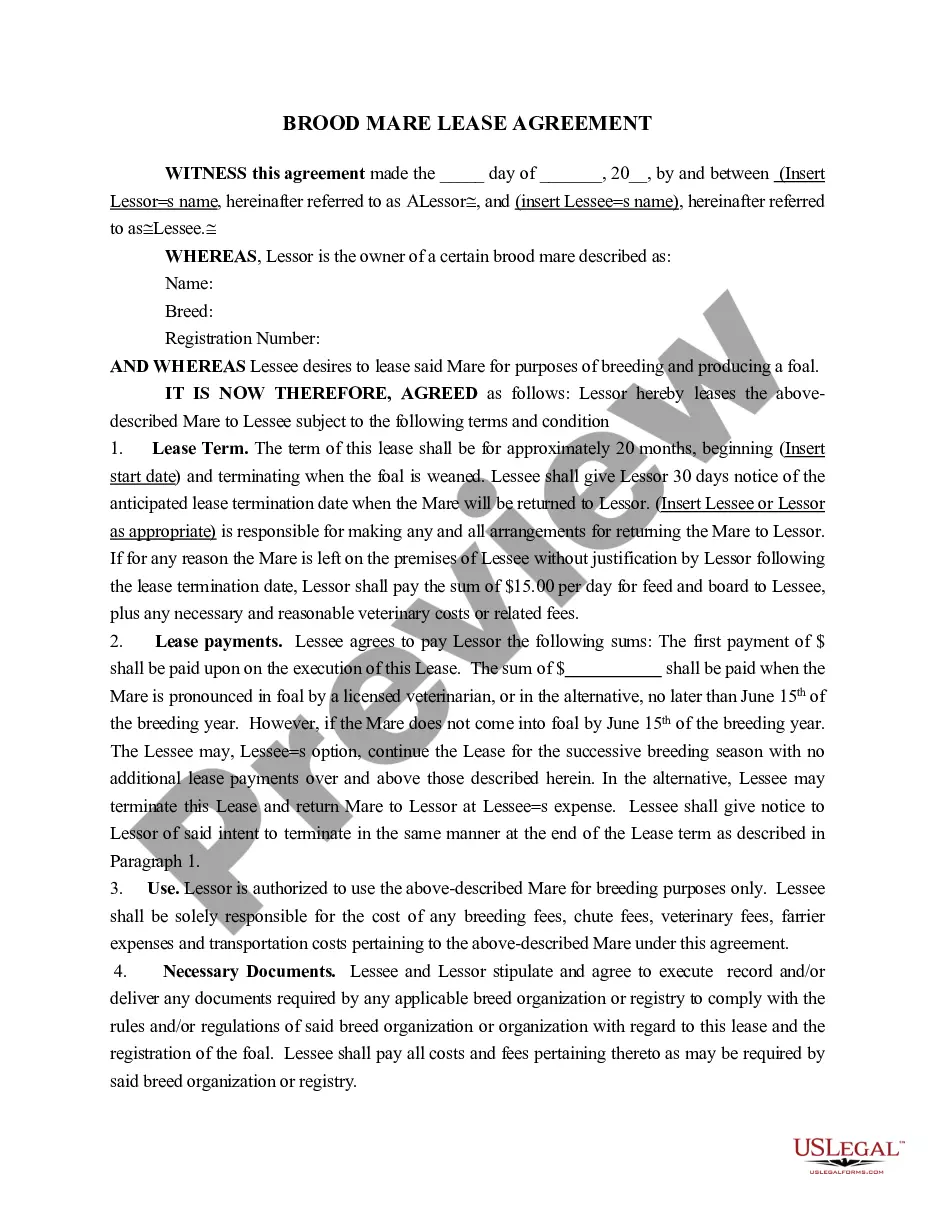

Description

How to fill out Tarrant Texas Auditoría De Empresas De Empleo?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Tarrant Employment Firm Audit without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Tarrant Employment Firm Audit by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Tarrant Employment Firm Audit:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a few clicks!