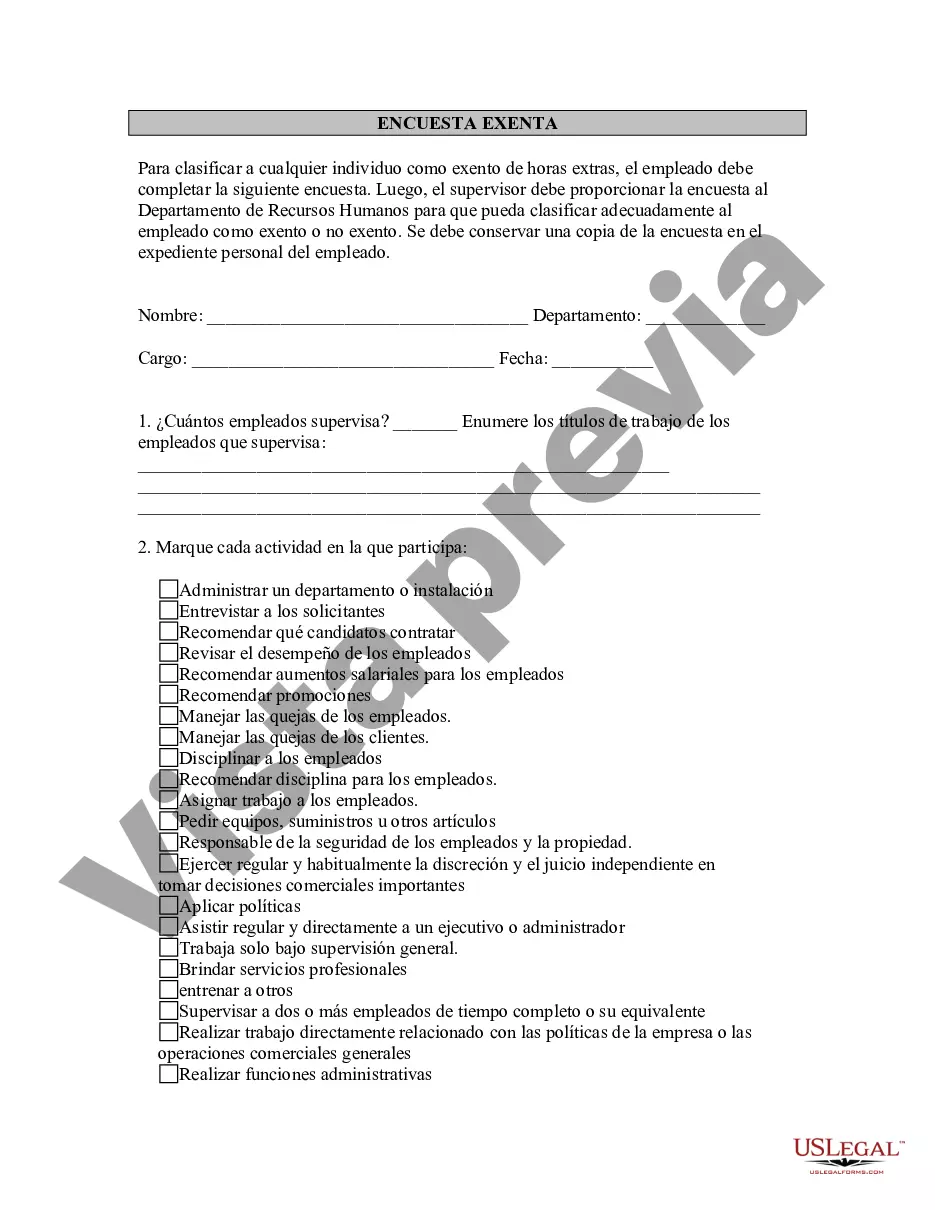

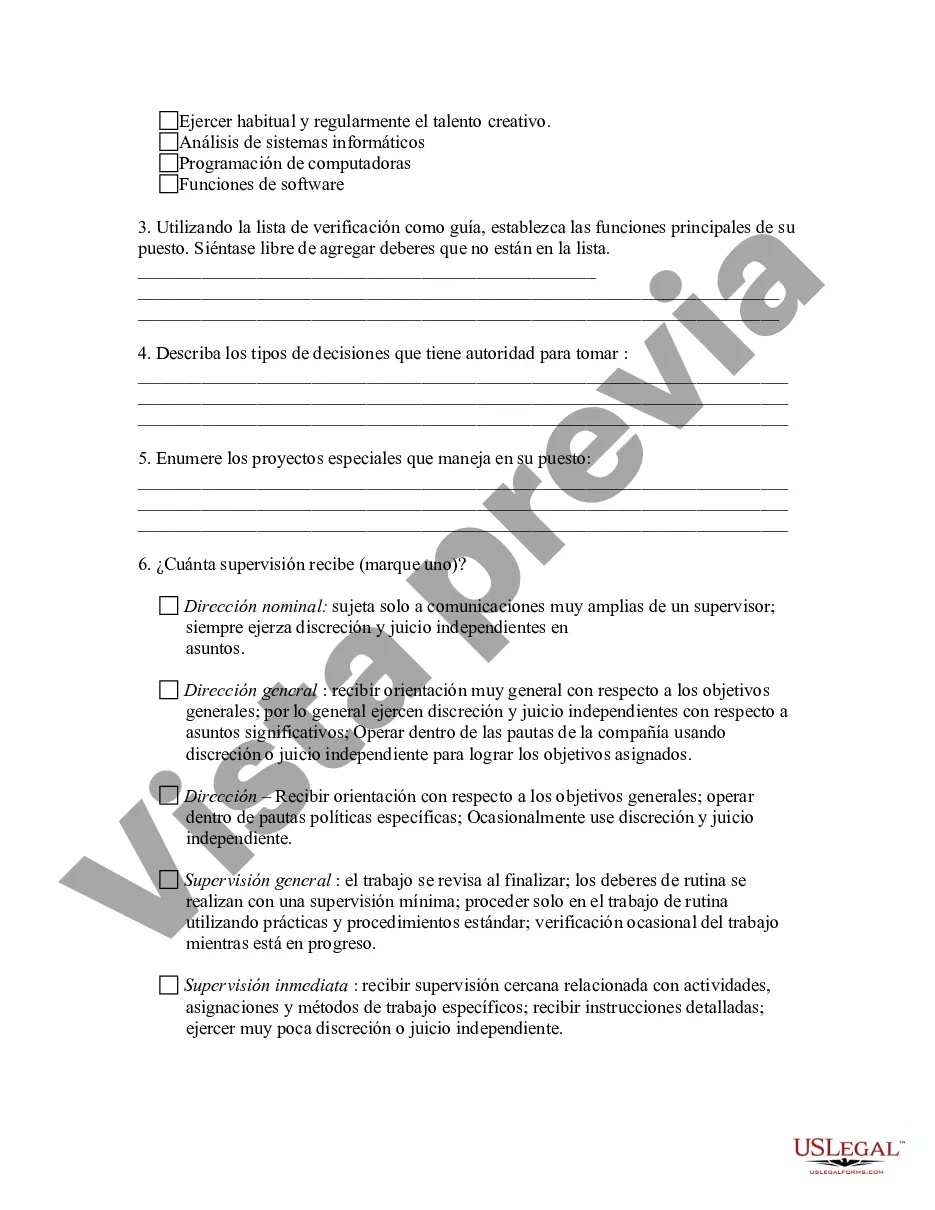

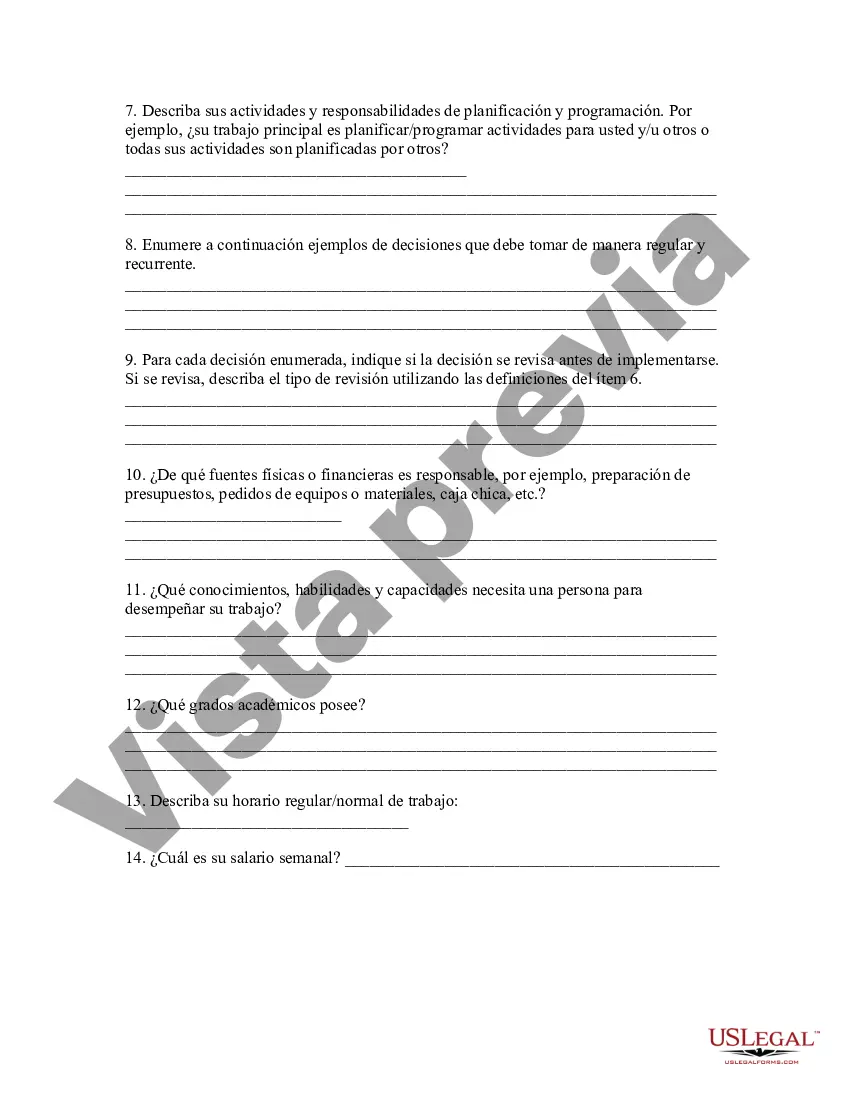

Bronx New York Exempt Survey is a comprehensive assessment conducted within Bronx, New York, to determine which properties qualify for tax exemptions. This survey plays a crucial role in determining if a property is eligible for exemption from property taxes based on specific criteria and qualifications set by the government. The Bronx New York Exempt Survey aims to identify properties that meet certain criteria for exemption, such as nonprofit organizations, religious institutions, and government-owned buildings. The survey process involves gathering extensive information about each property, including its use, ownership, and purpose, to determine its eligibility for tax exemption. There are different types of Bronx New York Exempt Surveys, depending on the specific purpose and nature of the property being assessed. Some commonly conducted surveys include: 1. Nonprofit Exempt Survey: This survey focuses on properties owned or operated by nonprofit organizations, such as charities, religious institutions, educational institutions, and community service organizations. The purpose is to identify properties eligible for tax exemptions based on their nonprofit status and public service activities. 2. Religious Exempt Survey: This survey specifically examines properties owned by religious institutions, such as churches, mosques, synagogues, and temples, to determine their eligibility for tax exemptions. Religious organizations may qualify for exemption if they meet certain criteria and demonstrate their use for religious worship and community activities. 3. Government-Owned Exempt Survey: This survey targets properties owned by government entities, such as federal, state, or local government buildings, schools, libraries, and public parks. These properties may be exempt from property taxes based on their public service role and government ownership. 4. Charitable Exempt Survey: This survey focuses on properties owned by charitable organizations that provide support and services to the community. Such organizations may include foundations, trusts, and other philanthropic entities that dedicate their resources to public welfare. In summary, the Bronx New York Exempt Survey is a detailed assessment conducted to determine if properties in Bronx, New York, qualify for tax exemptions based on certain criteria. This survey includes various types, such as Nonprofit Exempt Survey, Religious Exempt Survey, Government-Owned Exempt Survey, and Charitable Exempt Survey, which are conducted based on the specific nature and purpose of the properties being assessed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.W 908t Form - Exempt Survey

Description

How to fill out Bronx New York Encuesta Exenta?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Bronx Exempt Survey, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Consequently, if you need the recent version of the Bronx Exempt Survey, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Bronx Exempt Survey:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Bronx Exempt Survey and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!