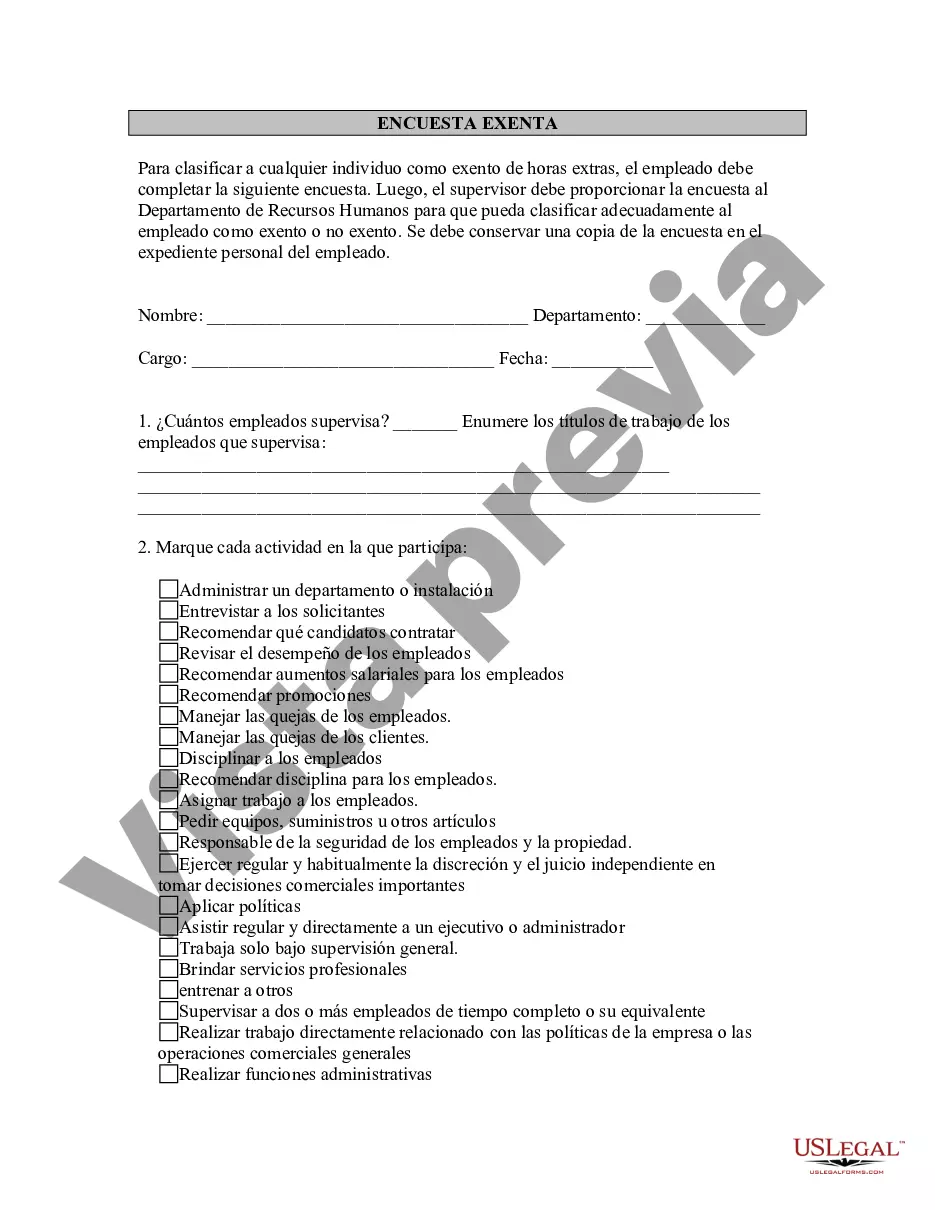

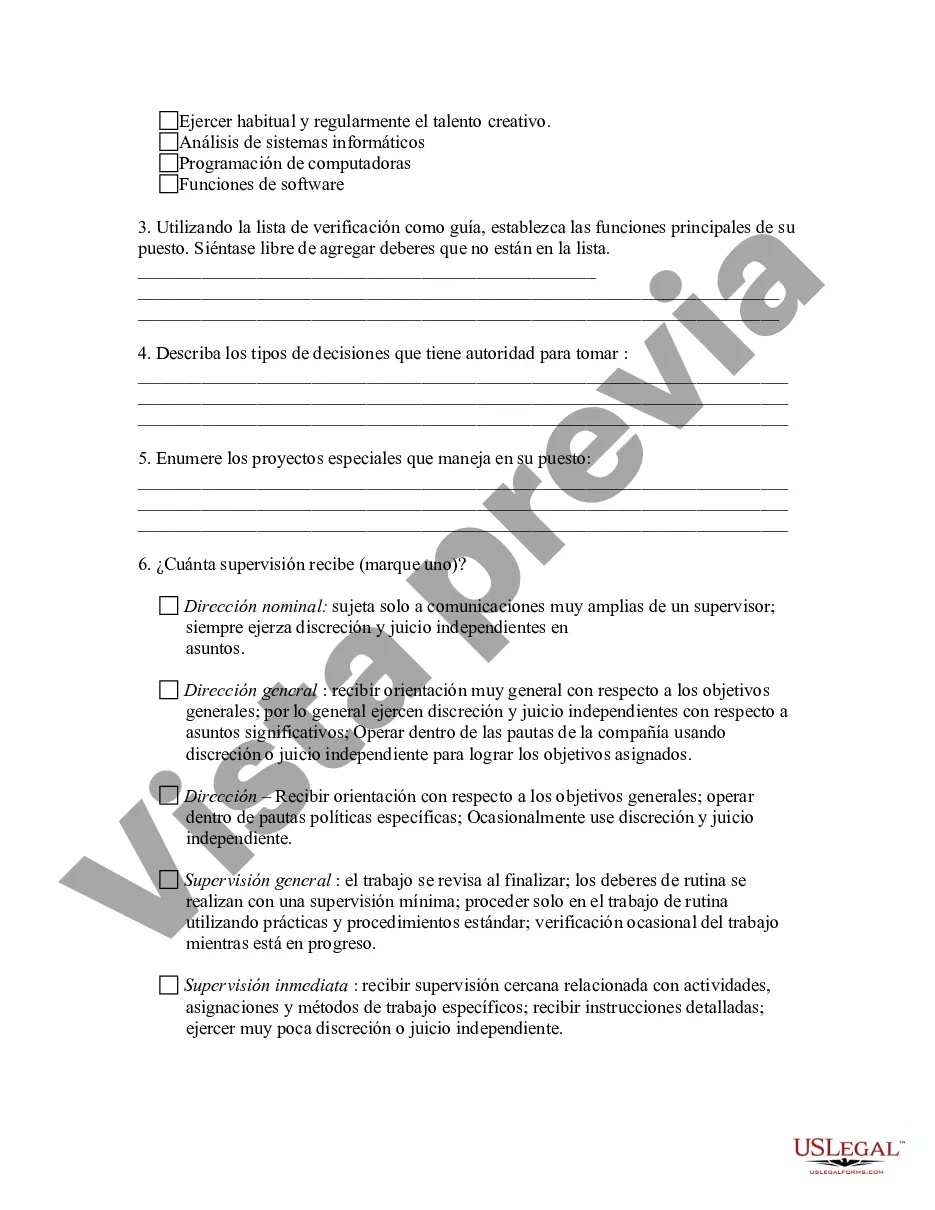

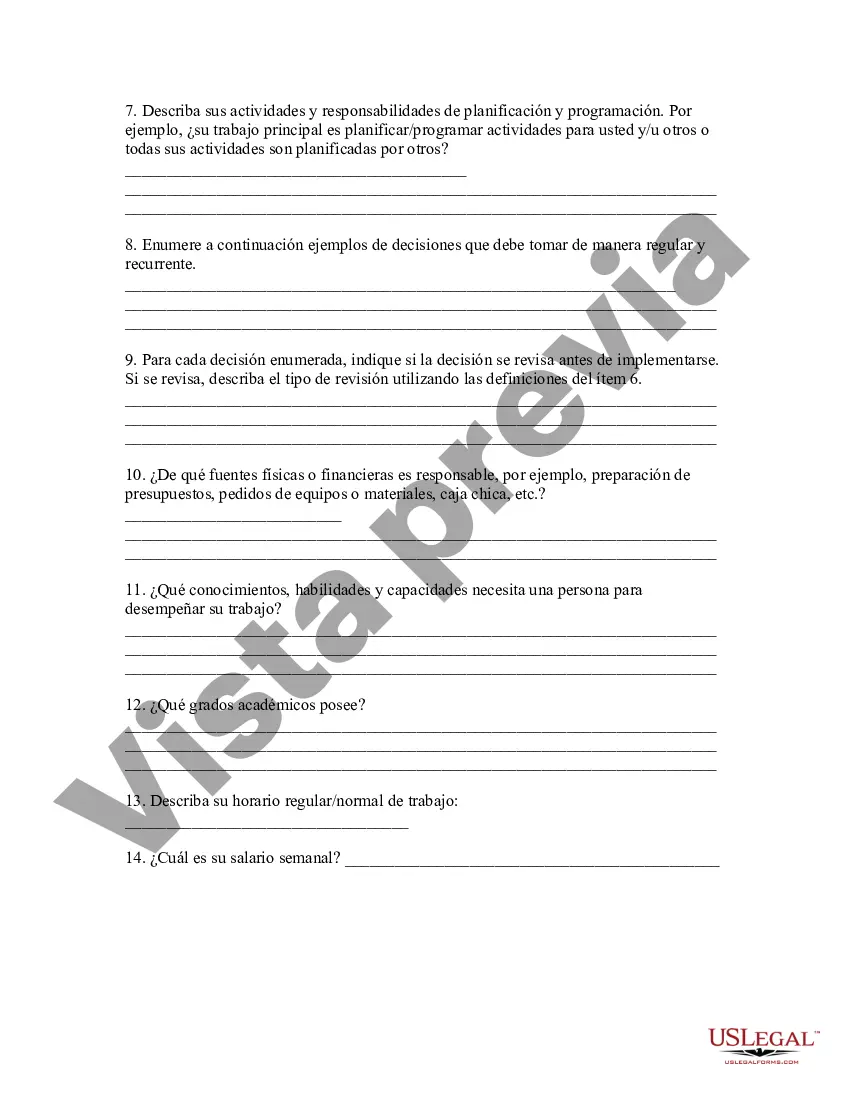

Cook Illinois Exempt Survey is a comprehensive survey conducted in Cook County, Illinois. This survey aims to gather detailed information about exempt properties within the county. Exempt properties are those that are eligible for certain tax exemptions, such as religious institutions, charitable organizations, government-owned properties, and more. The Cook Illinois Exempt Survey is designed to determine the validity of property tax exemptions claimed by different entities and ensure that they meet the criteria set by the county's tax laws. It helps in evaluating the exemption status of a wide range of properties to maintain a fair and accurate tax system. The survey involves a thorough examination of the property records, including ownership details, property descriptions, and the types of exemptions being claimed. Trained assessors review the exemption applications and verify the compliance with tax codes and regulations. They also physically inspect the listed properties to confirm their use and eligibility for exemption. Different types of Cook Illinois Exempt Surveys include: 1. Residential Exempt Survey: Focuses on properties used for residential purposes such as primary homes, apartments, and condos that claim exemptions due to their usage or occupancy. 2. Religious Institutions Exempt Survey: Specifically caters to properties used for religious purposes such as churches, mosques, temples, and synagogues which are owned by religious organizations or dioceses. 3. Charitable Organizations Exempt Survey: Concentrates on properties owned by nonprofit organizations or charitable entities that meet specific criteria to qualify for property tax exemptions. 4. Government-Owned Properties Exempt Survey: Addresses properties owned by federal, state, or local governments which are typically exempt from property taxes due to their public use or government ownership. 5. Educational Institutions Exempt Survey: Targets properties used by schools, universities, colleges, and other educational establishments that meet the requirements for tax exemption based on their educational nature. The Cook Illinois Exempt Survey plays a crucial role in maintaining tax fairness and accuracy by ensuring that tax exemptions are appropriately granted only to eligible entities. The data collected through these surveys contributes to the equitable distribution of the tax burden and aids in the overall assessment process for properties in Cook County, Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Encuesta exenta - Exempt Survey

Description

How to fill out Cook Illinois Encuesta Exenta?

Whether you intend to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Cook Exempt Survey is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Cook Exempt Survey. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Exempt Survey in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!