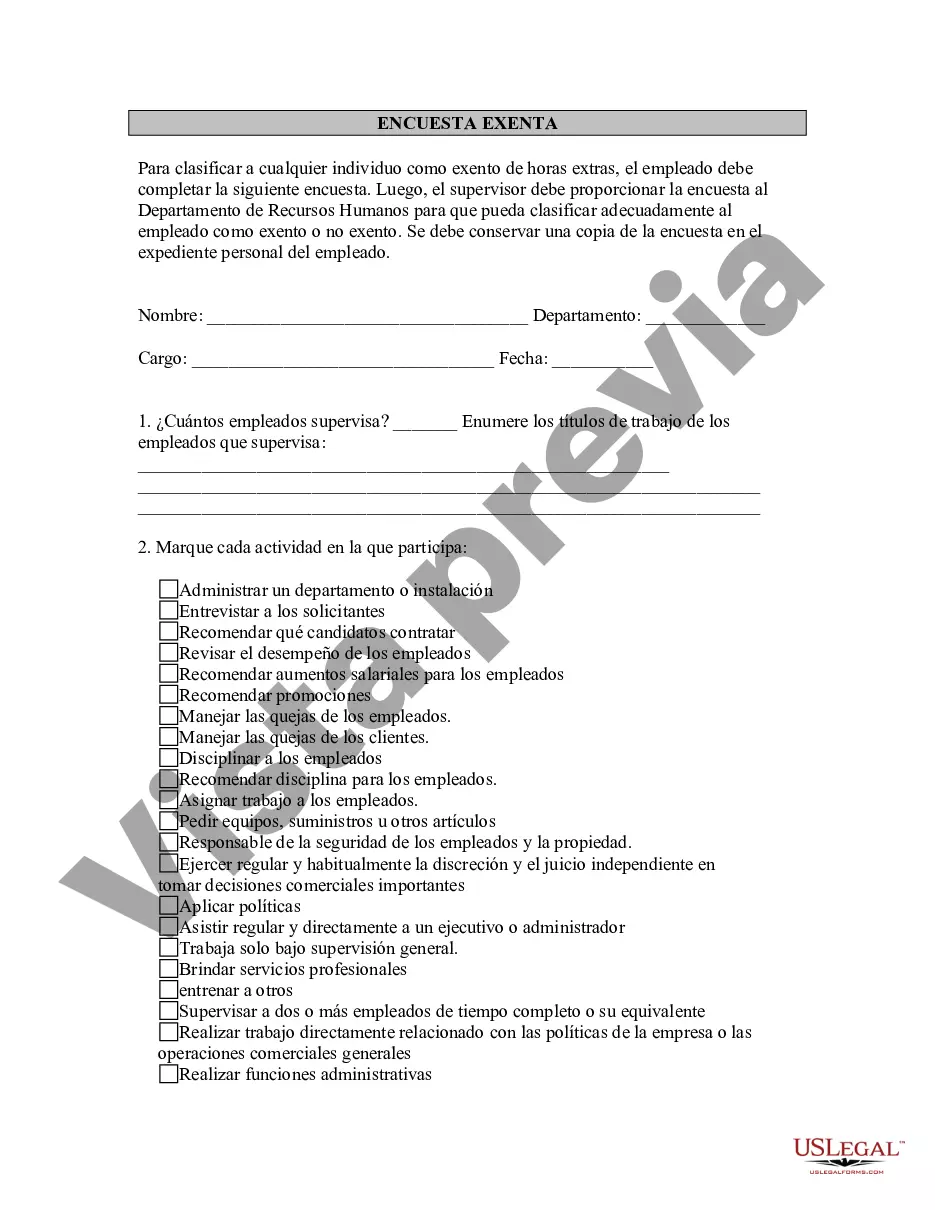

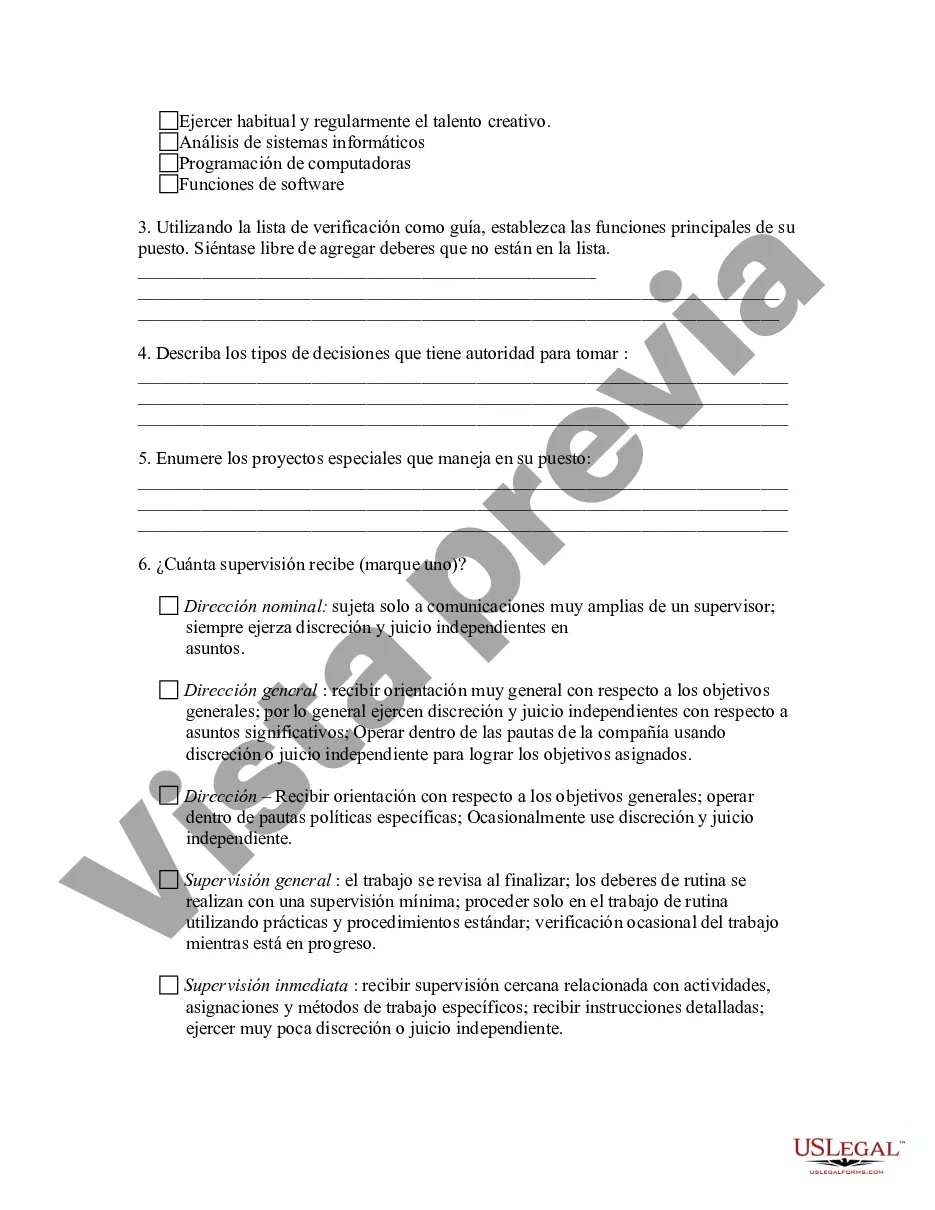

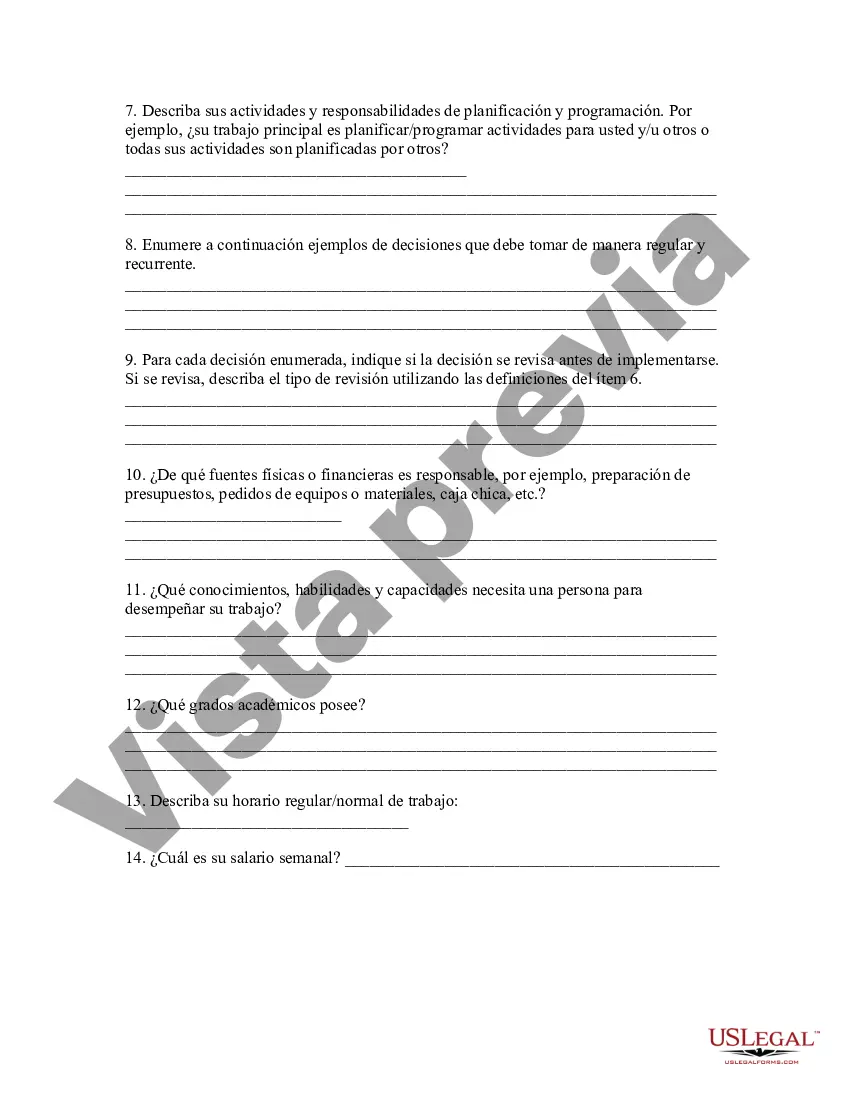

Fairfax Virginia Exempt Survey is a comprehensive assessment conducted in Fairfax, Virginia, to determine the eligibility of properties or individuals for tax exemptions. This survey aims to evaluate various factors and qualifications that may exempt certain properties or individuals from paying certain taxes in Fairfax, Virginia. The Fairfax Virginia Exempt Survey comprises multiple types, specifically tailored to different categories of exemptions: 1. Property Exemption Survey: This survey concentrates on determining properties that may qualify for exemptions based on their usage, such as religious properties, nonprofit organizations, agricultural lands, or properties owned by certain government entities. It assesses the property's purpose, ownership, and usage to grant applicable tax exemptions. 2. Personal Exemption Survey: This type of survey focuses on individuals who may be eligible for tax exemptions due to specific circumstances, such as veterans, disabled persons, or elderly residents. It verifies the credentials and documents of individuals to evaluate their eligibility for various tax exemption programs. 3. Business Exemption Survey: The business exemption survey is conducted to assess if certain commercial enterprises or industries qualify for exemptions based on specific criteria set by the Fairfax, Virginia government. It examines factors like business size, industry type, employment practices, or environmental practices to determine eligibility for tax exemptions. 4. Education Exemption Survey: This survey aims to identify educational institutions, including schools, colleges, and universities, that may qualify for tax exemptions based on their nonprofit status or public service role in the community. It examines the institution's accreditation, nonprofit certification, and its contribution towards education and community-related programs. 5. Historical Exemption Survey: In this survey, historical properties or heritage sites are evaluated to determine whether they meet the criteria for tax exemptions. Historical preservation and restoration initiatives play a significant role in this survey, and properties must showcase their historical value, architectural significance, or cultural importance to justify tax exemption eligibility. It is essential to participate in the Fairfax Virginia Exempt Survey if you believe your property, business, or personal circumstances meet the eligibility criteria for tax exemptions. The survey provides a detailed assessment of each case, ensuring fair and accurate determinations while maintaining compliance with Fairfax, Virginia's tax laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Encuesta exenta - Exempt Survey

Description

How to fill out Fairfax Virginia Encuesta Exenta?

If you need to find a reliable legal form provider to find the Fairfax Exempt Survey, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it simple to find and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Fairfax Exempt Survey, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Fairfax Exempt Survey template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Fairfax Exempt Survey - all from the convenience of your sofa.

Join US Legal Forms now!