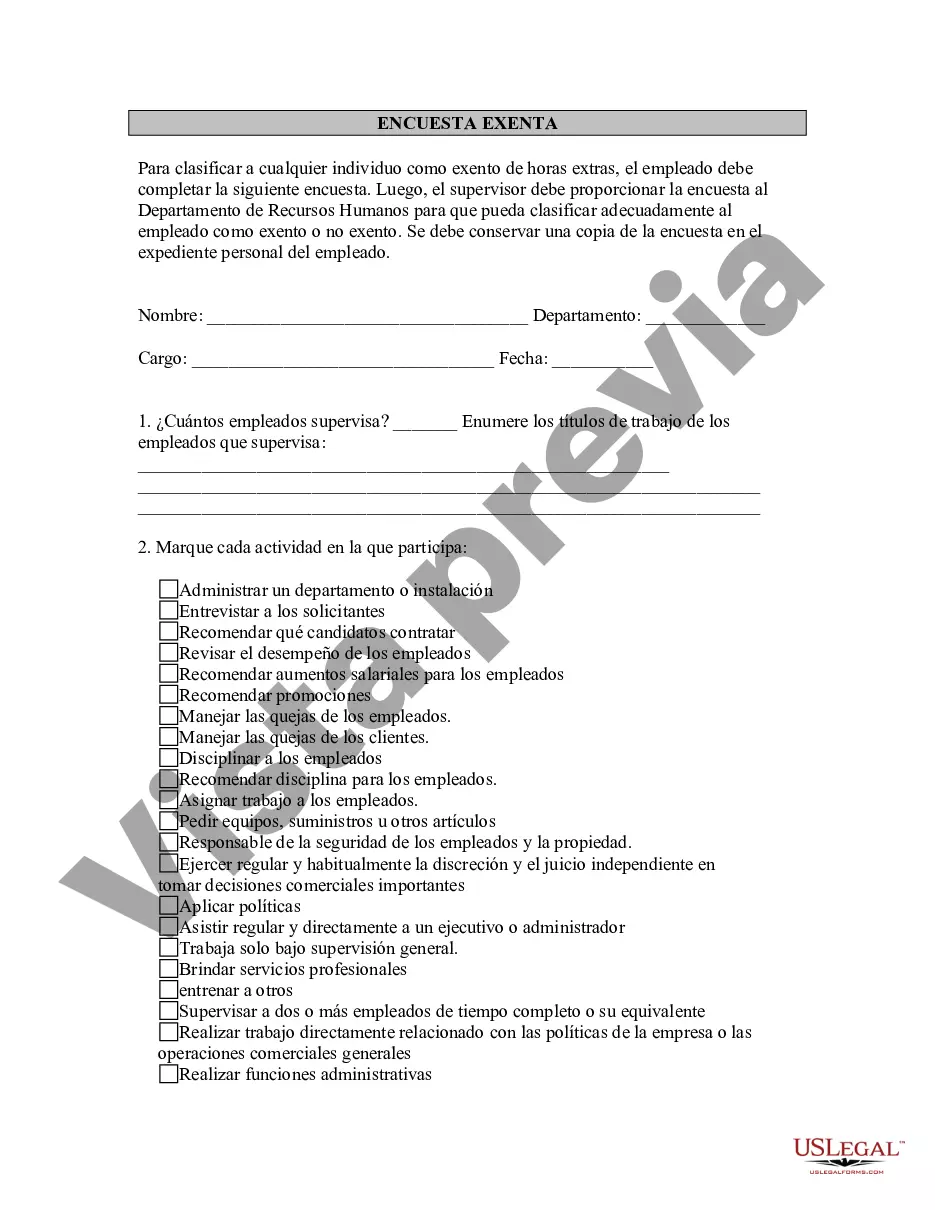

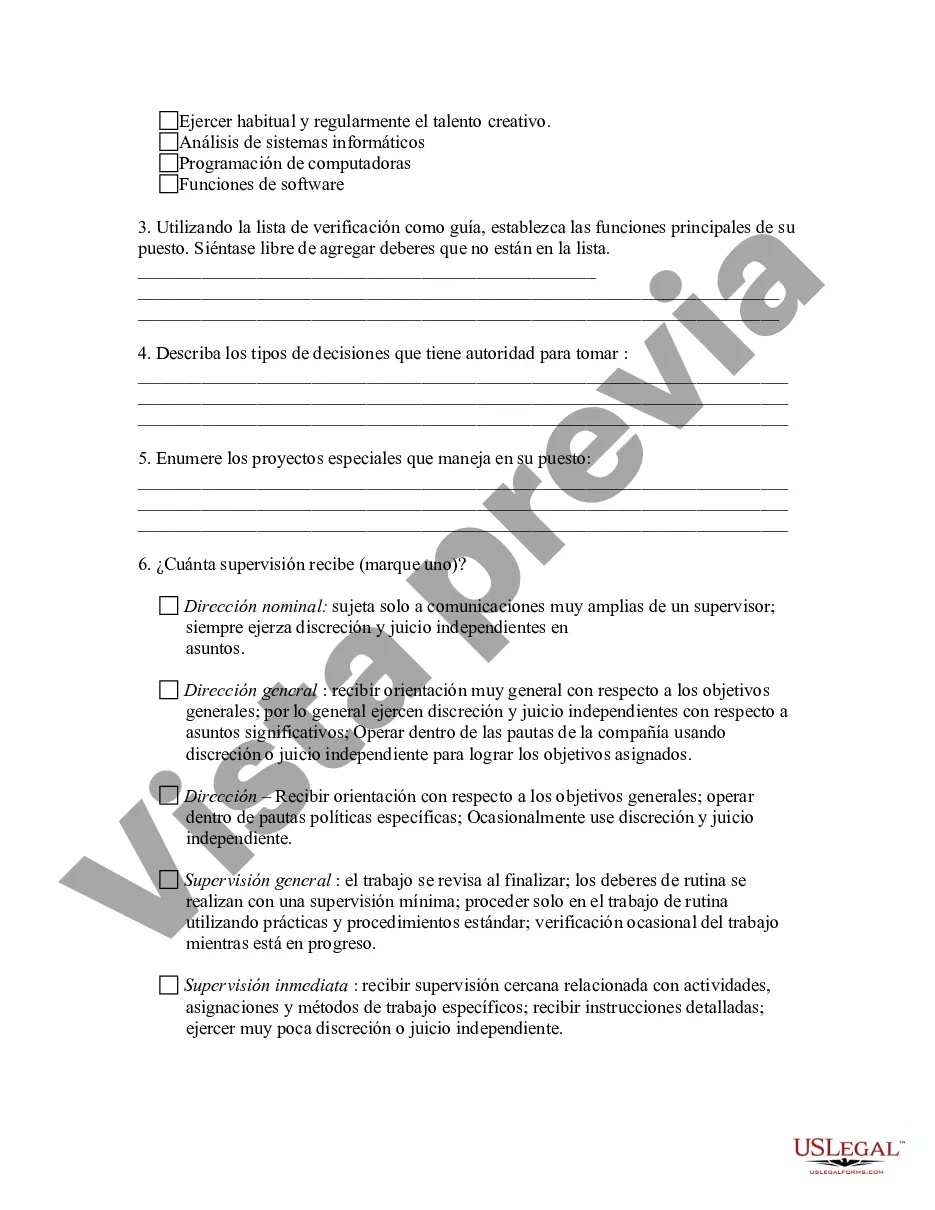

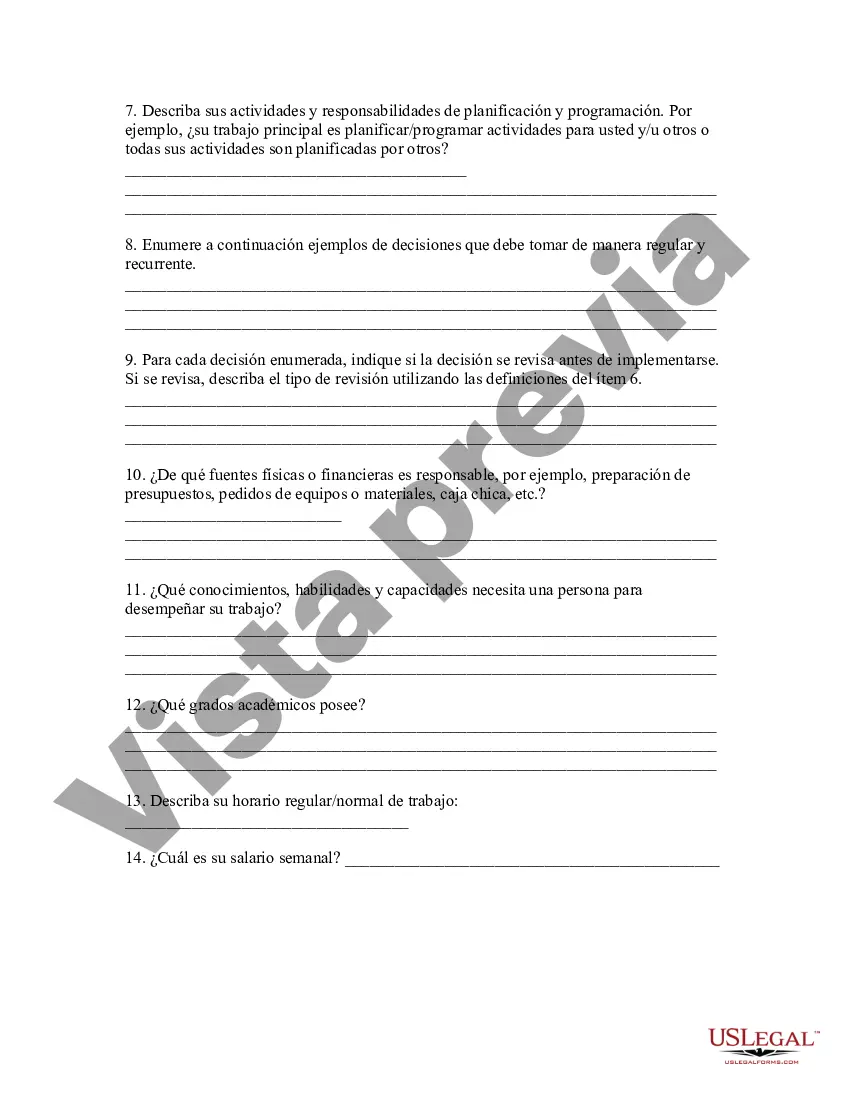

Hennepin Minnesota Exempt Survey is a comprehensive and thorough assessment conducted by the local authorities in Hennepin County, located in the state of Minnesota, United States. This survey aims to determine the eligibility and exemption status of certain entities or individuals within the county, regarding specific laws or regulations. The Hennepin Minnesota Exempt Survey is carried out to ensure compliance with various tax laws, zoning regulations, or exemption criteria established by the county government. The survey assists in identifying entities or individuals that may be exempt from certain taxes, fees, or regulatory requirements based on their qualifications, activities, or organizational status. There are several types of Hennepin Minnesota Exempt Surveys that cater to different areas of focus. Some key types include: 1. Property Tax Exemption Survey: This survey focuses on determining the eligibility of properties or property owners for tax exemption based on criteria established by the Hennepin County tax assessor's office. It may involve evaluating properties owned by nonprofit organizations, religious institutions, or other qualifying entities. 2. Zoning Exemption Survey: This type of survey examines the compliance of properties with zoning regulations and determines their eligibility for exemptions or modifications. It helps identify properties that may be exempt from certain zoning restrictions due to their use, historical significance, or specific circumstances. 3. Business Exemption Survey: This survey targets businesses operating within Hennepin County to assess their eligibility for specific exemptions, such as sales tax exemptions for nonprofit organizations, special industry-specific tax breaks, or regulatory exemptions for certain types of businesses. 4. Nonprofit Organization Exemption Survey: This survey focuses on assessing the eligibility of nonprofit organizations for exemption from property taxes, sales taxes, or other applicable taxes or fees. It verifies their nonprofit status, operational activities, and compliance with state and local laws. 5. Personal Exemption Survey: This type of survey considers individual circumstances to determine eligibility for personal exemptions, such as property tax exemptions for primary residences, senior citizen exemptions, or exemptions for disabled individuals. The Hennepin Minnesota Exempt Survey plays a crucial role in maintaining fair and accurate taxation, promoting compliance with zoning regulations, and identifying eligible exemptions for individuals and organizations within Hennepin County. It ensures transparency and equitable treatment by verifying eligibility based on specific criteria and relevant laws while upholding the principles of good governance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Encuesta exenta - Exempt Survey

Description

How to fill out Hennepin Minnesota Encuesta Exenta?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Hennepin Exempt Survey is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Hennepin Exempt Survey. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Exempt Survey in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!