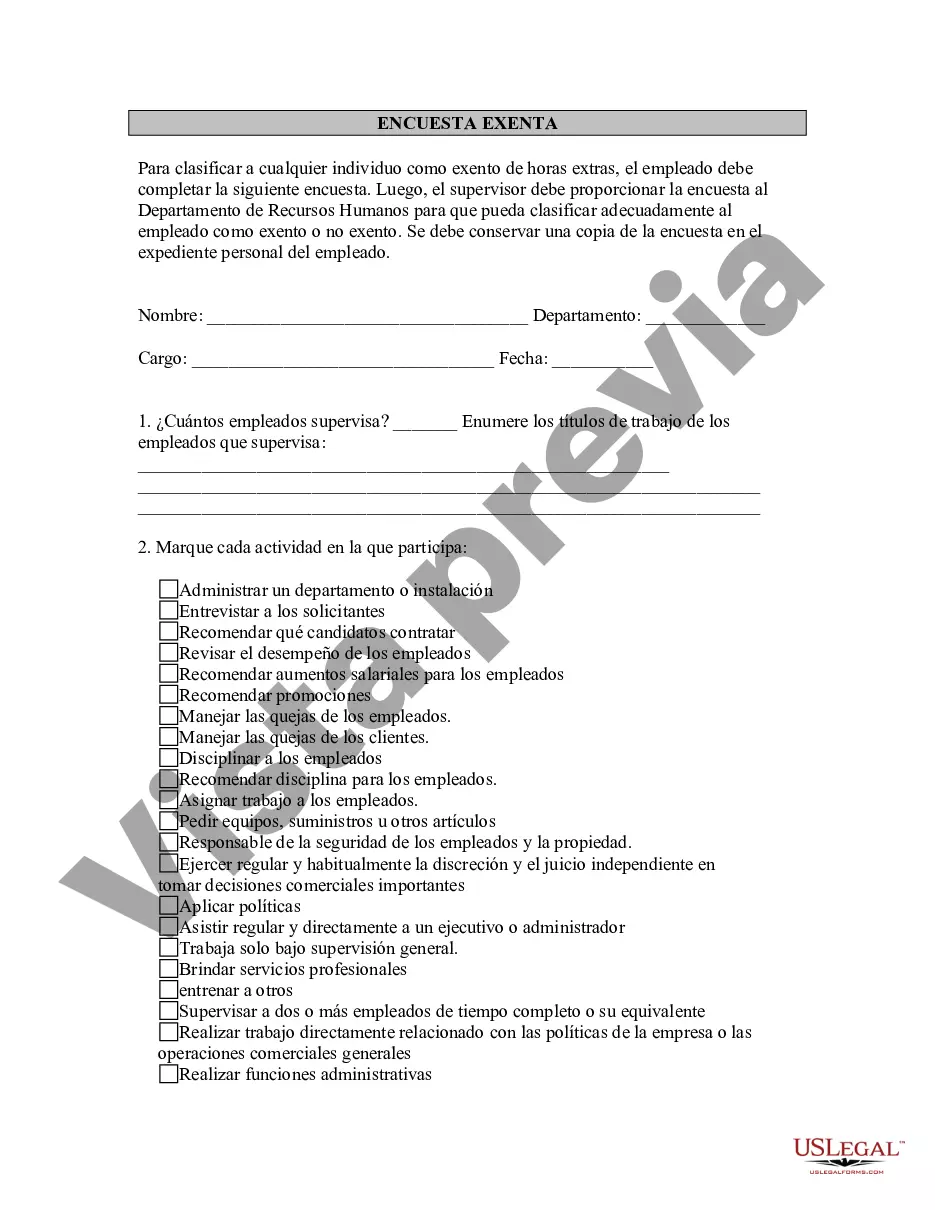

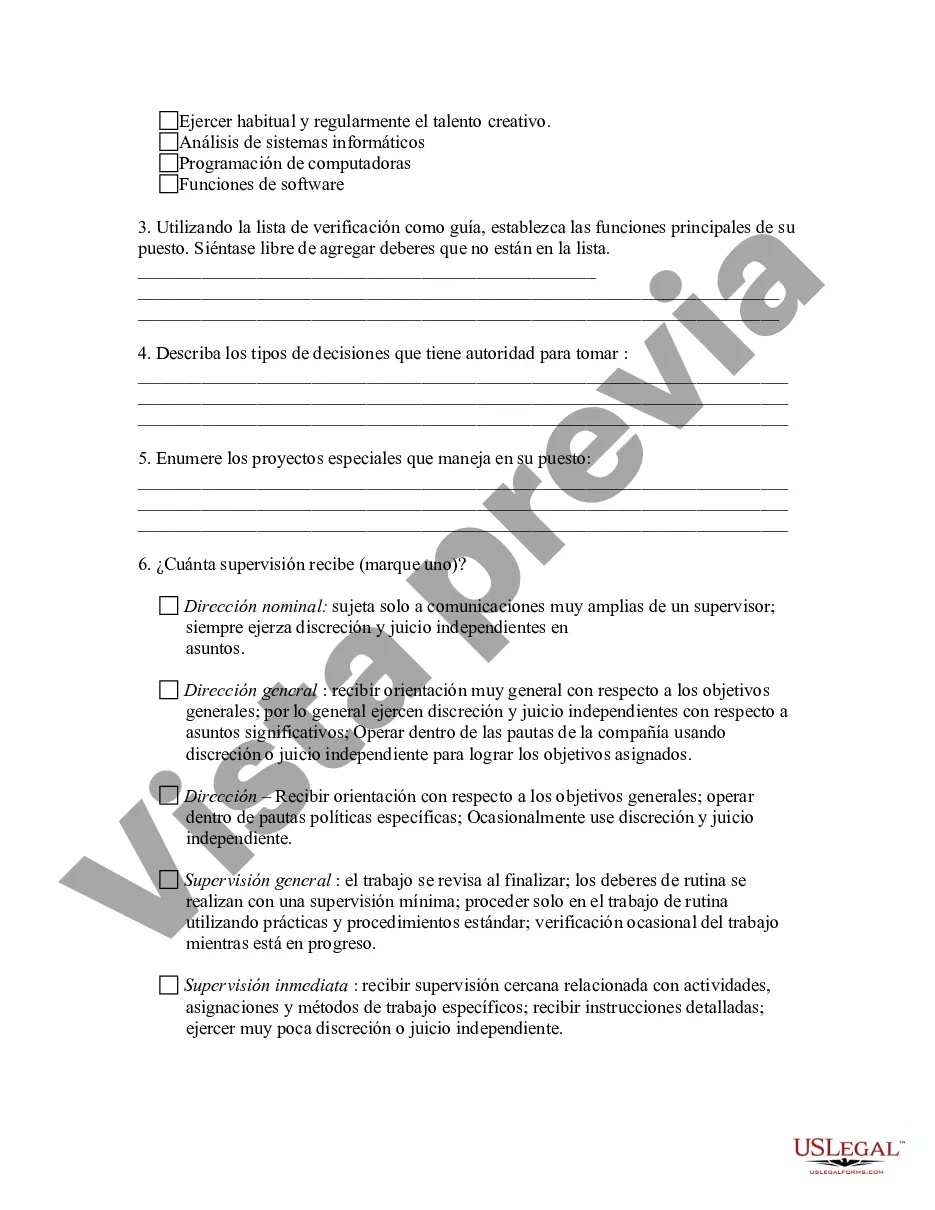

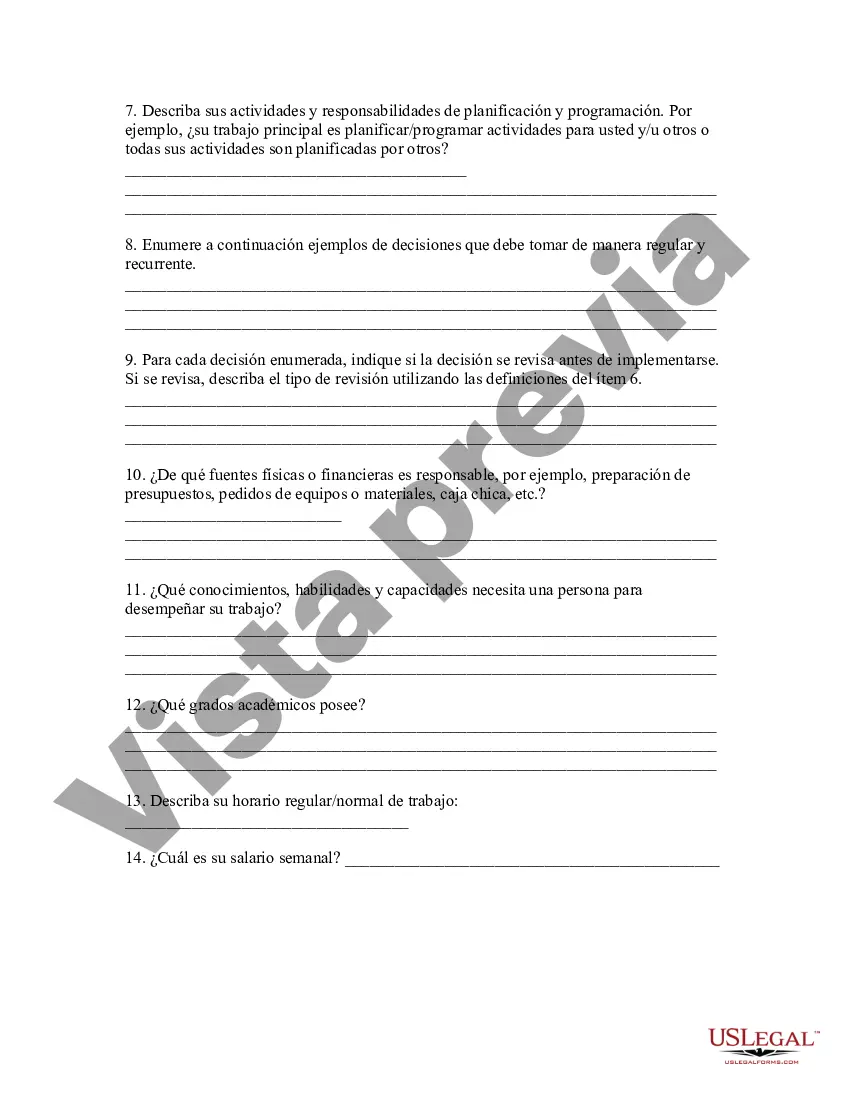

Maricopa Arizona Exempt Survey is a comprehensive assessment tool that is specifically designed to determine the exemption status of properties in Maricopa, Arizona. This survey is crucial in determining the property tax liability for various types of properties within the region. By conducting this survey, the local authorities can accurately assess whether a property qualifies for any exemptions or abatement. The Maricopa Arizona Exempt Survey takes into consideration various factors and criteria to determine eligibility for exemptions. These factors can include property usage, ownership type, or specific incentives provided by the local government. The survey may also examine the property's adherence to certain regulations or criteria set forth by the municipal governing bodies. There are different types of Maricopa Arizona Exempt Surveys, each catering to specific property types and exemptions: 1. Residential Property Exempt Survey: This survey specifically focuses on properties designated for residential use, such as single-family homes, duplexes, townhouses, or condominiums. It assesses if these properties meet the criteria for exemptions related to owner occupancy, age, or disability. 2. Commercial Property Exempt Survey: This survey concentrates on properties used for commercial purposes, including office buildings, retail stores, shopping centers, or industrial facilities. It determines if these properties qualify for exemptions such as enterprise zones, economic development incentives, or historic preservation. 3. Agricultural Property Exempt Survey: This survey is tailored specifically for properties engaged in agricultural activities, such as farms, ranches, or nurseries. It verifies if the property meets the criteria for agricultural exemptions, which could include agricultural use valuation or agricultural machinery and equipment exemptions. 4. Nonprofit Organization Property Exempt Survey: This survey is designed for properties owned and operated by nonprofit organizations, including charitable organizations, religious institutions, educational facilities, or healthcare providers. It evaluates if these properties meet the requirements for property tax exemptions granted to nonprofit entities. The Maricopa Arizona Exempt Survey plays a vital role in accurately assessing the exemption status of different properties within the region. It ensures fairness in property tax assessments and helps the local government allocate resources efficiently. By conducting these surveys periodically, Maricopa can maintain an up-to-date and accurate record of exempt properties, supporting effective taxation and budget planning processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Encuesta exenta - Exempt Survey

Description

How to fill out Maricopa Arizona Encuesta Exenta?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Maricopa Exempt Survey, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any activities related to document execution simple.

Here's how to find and download Maricopa Exempt Survey.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Maricopa Exempt Survey.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Maricopa Exempt Survey, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you have to deal with an extremely difficult case, we advise getting an attorney to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific documents effortlessly!