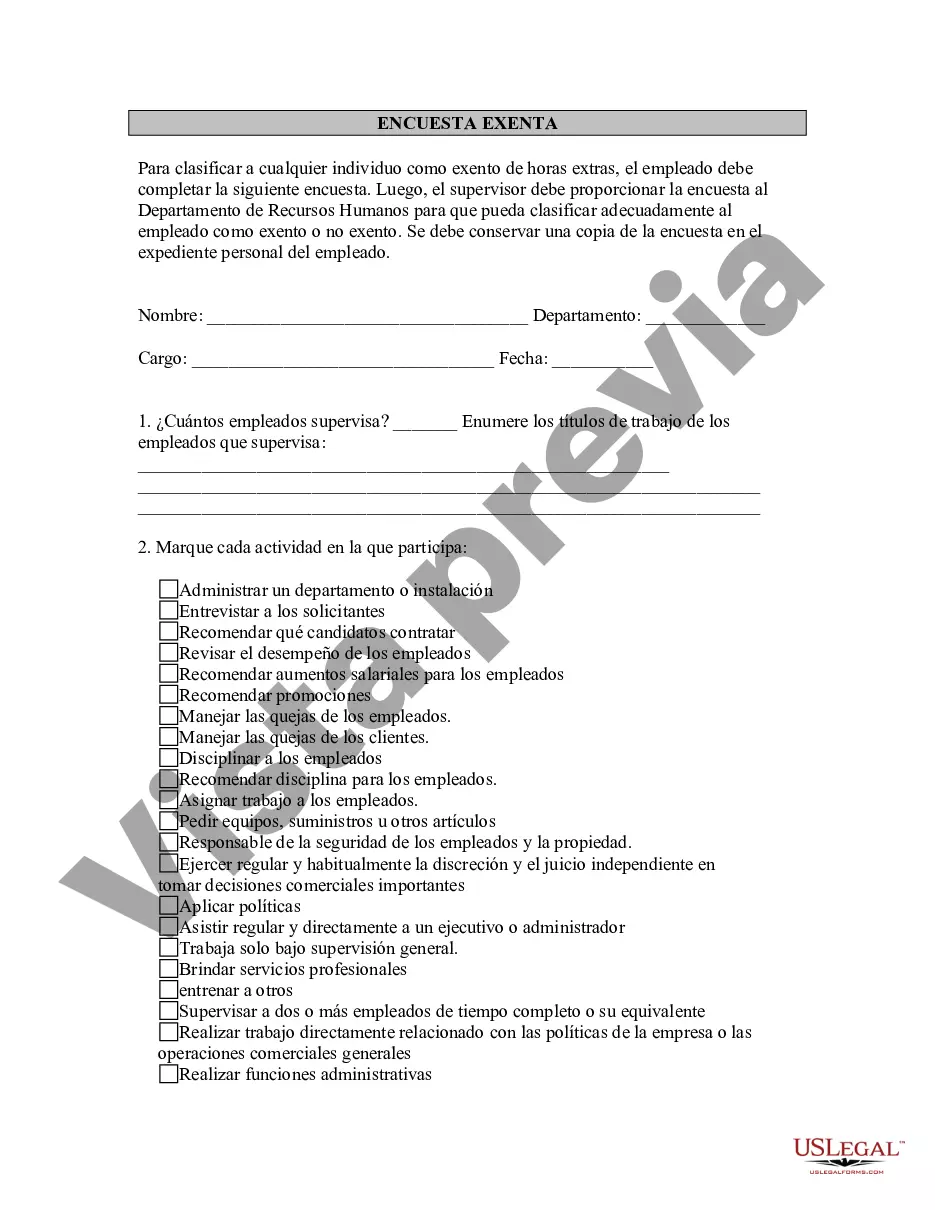

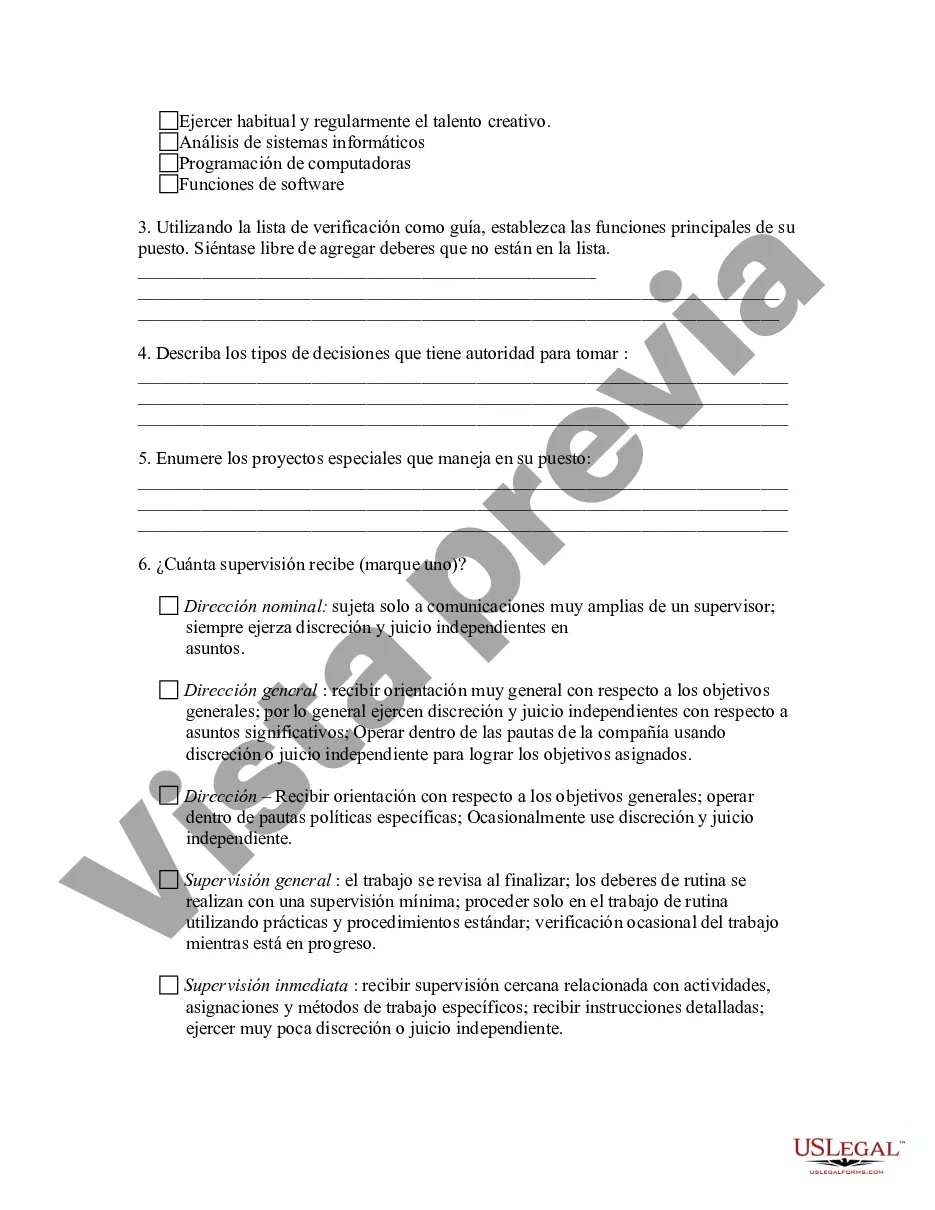

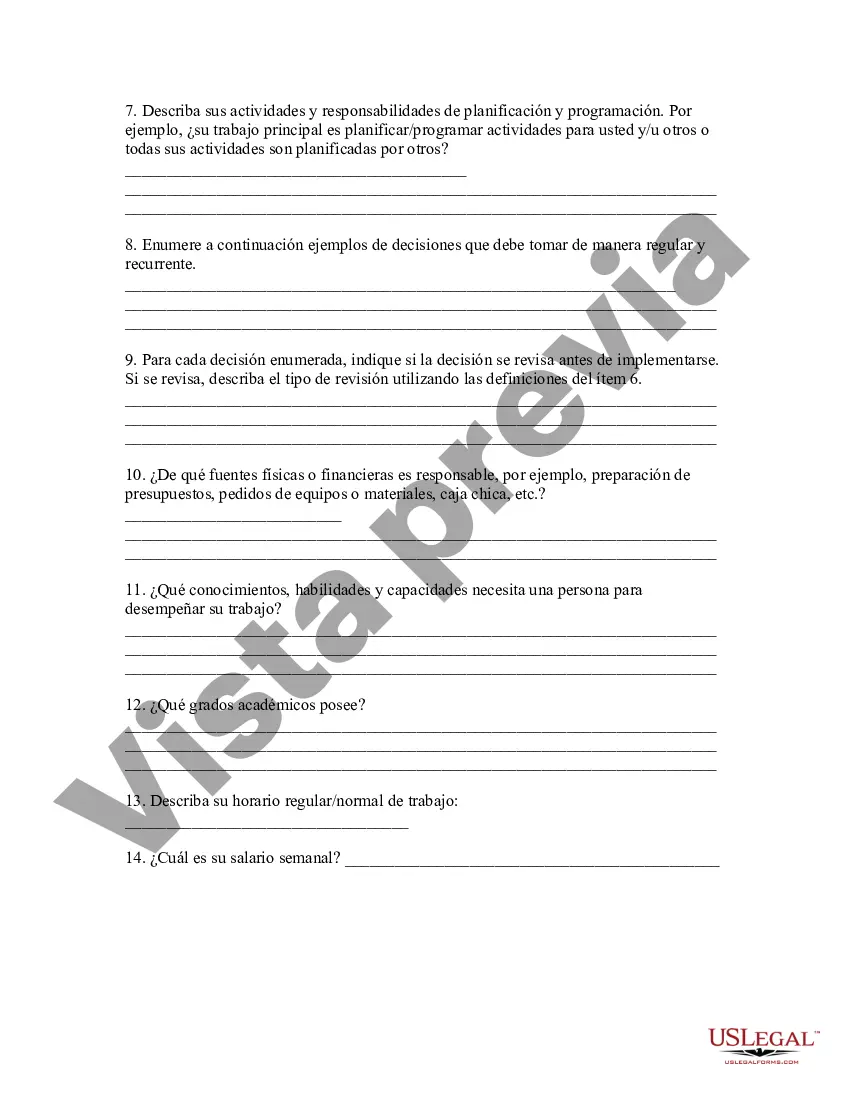

Mecklenburg North Carolina Exempt Survey is a crucial assessment conducted in Mecklenburg County, North Carolina, designed to determine and classify properties that are eligible for tax exemptions. This comprehensive survey plays a vital role in identifying properties that may qualify for exemptions based on certain criteria set by the county. The Mecklenburg North Carolina Exempt Survey is an essential process carried out to ensure equitable taxation and provide accurate information for property assessment purposes. By conducting this survey, the county aims to identify properties that could potentially be exempt from property taxes due to specific reasons, such as their usage, ownership, or community impact. There are different types of Mecklenburg North Carolina Exempt Surveys conducted, each targeting specific categories of properties. These surveys include: 1. Charitable Organization Exempt Survey: This survey focuses on properties owned and operated by charitable organizations such as non-profit institutions, hospitals, schools, or religious entities that may qualify for tax exemptions under specific laws. 2. Agricultural Exempt Survey: This survey specifically identifies properties primarily used for agriculture-related activities, such as farming, ranching, forestry, or livestock breeding. It aims to determine if these properties meet the qualifications for agricultural exemptions. 3. Disabled Veterans Exempt Survey: This survey is aimed at identifying properties owned by disabled veterans that may be eligible for tax exemptions based on their service-connected disabilities as outlined by state statutes. 4. Historic Property Exempt Survey: This survey is conducted to identify properties designated as historic by the county or state that may qualify for tax exemptions. These properties are typically preserved for their historical, architectural, or cultural significance. 5. Conservation Land Exempt Survey: This survey targets properties dedicated to some form of conservation, such as wildlife habitats, green spaces, or natural reserves. It aims to determine if these areas meet the requirements for tax exemptions under conservation laws. In summary, Mecklenburg North Carolina Exempt Survey is a comprehensive assessment conducted to identify properties within the county that may qualify for tax exemptions under various categories, including charitable organizations, agricultural use, disabled veteran ownership, historic significance, and conservation purposes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Encuesta exenta - Exempt Survey

Description

How to fill out Mecklenburg North Carolina Encuesta Exenta?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Mecklenburg Exempt Survey, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Exempt Survey from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Mecklenburg Exempt Survey:

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!