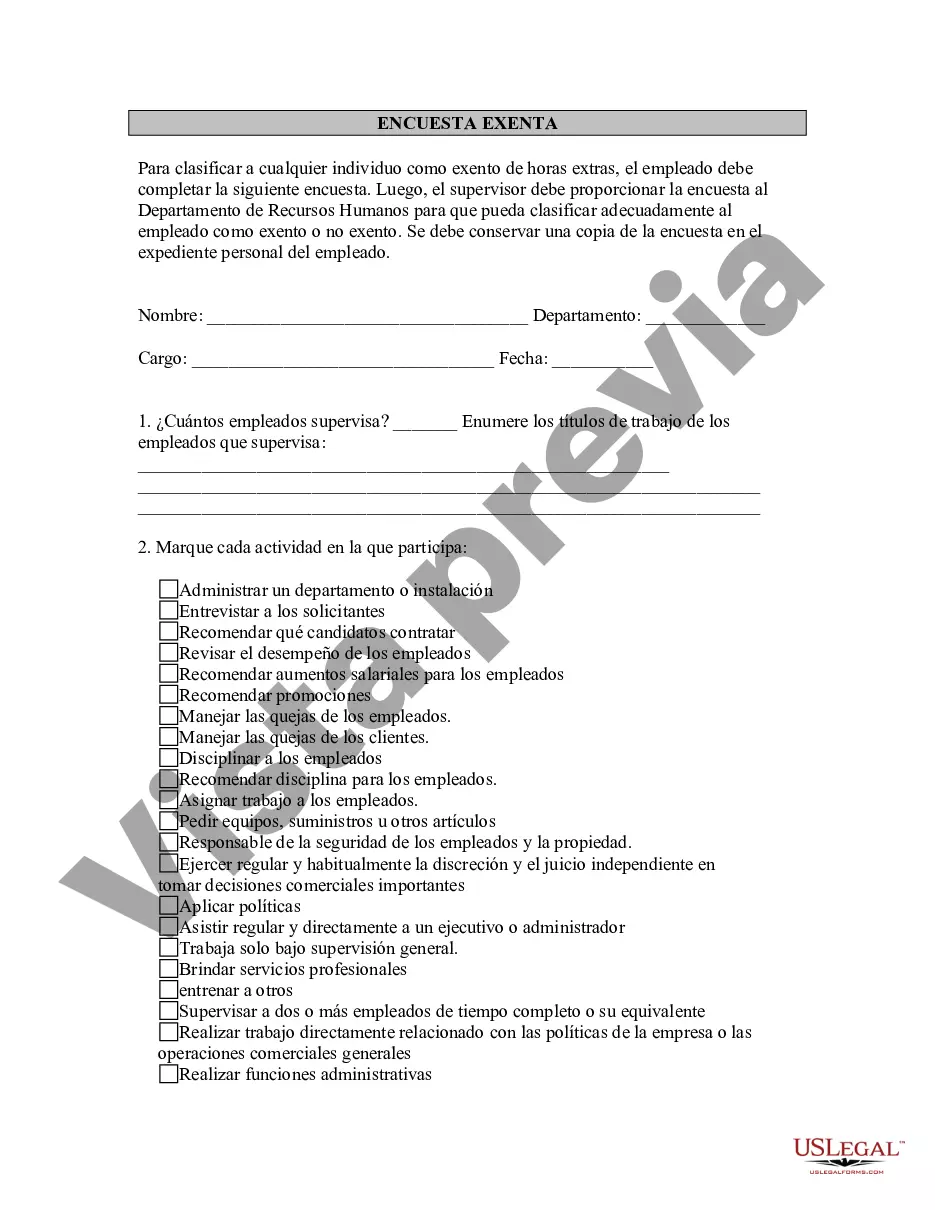

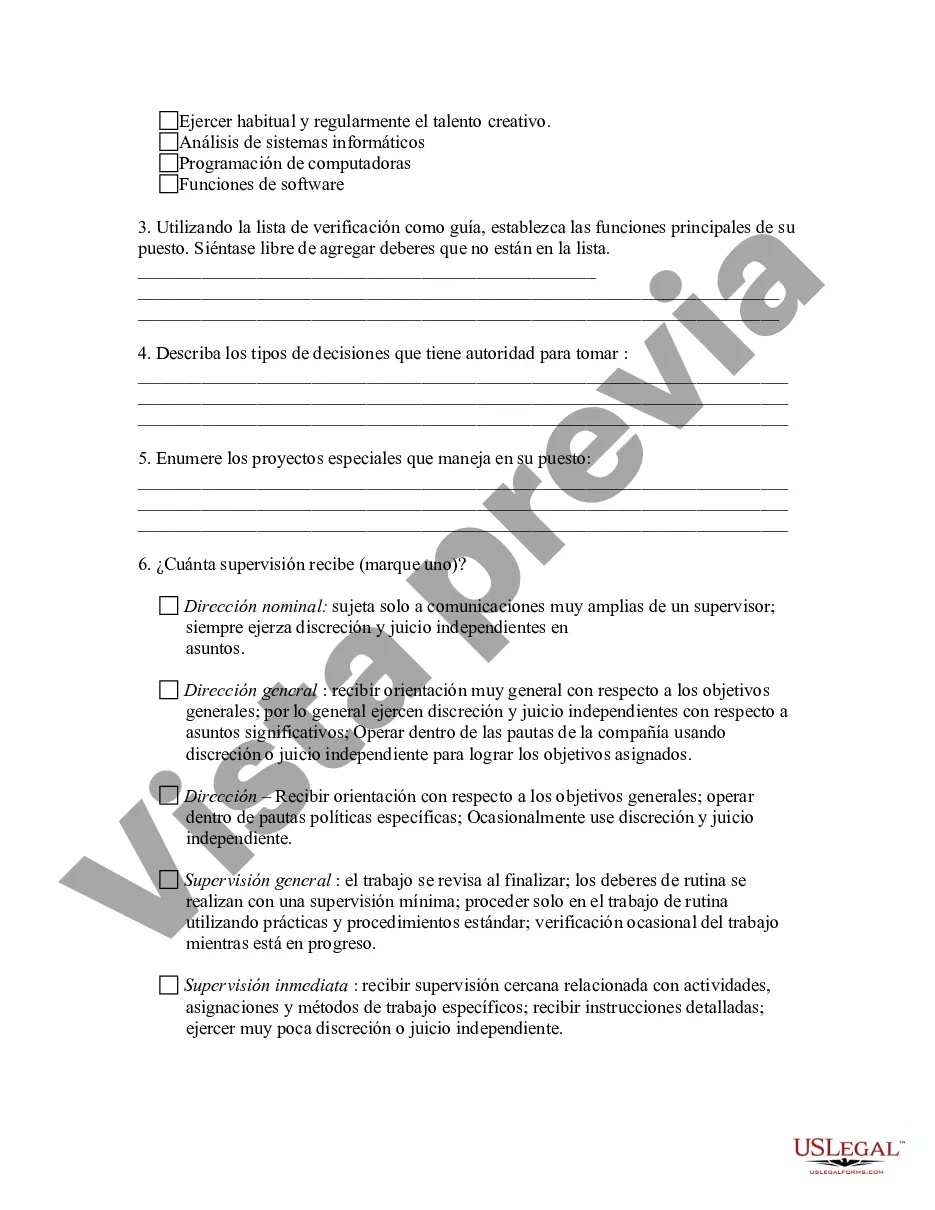

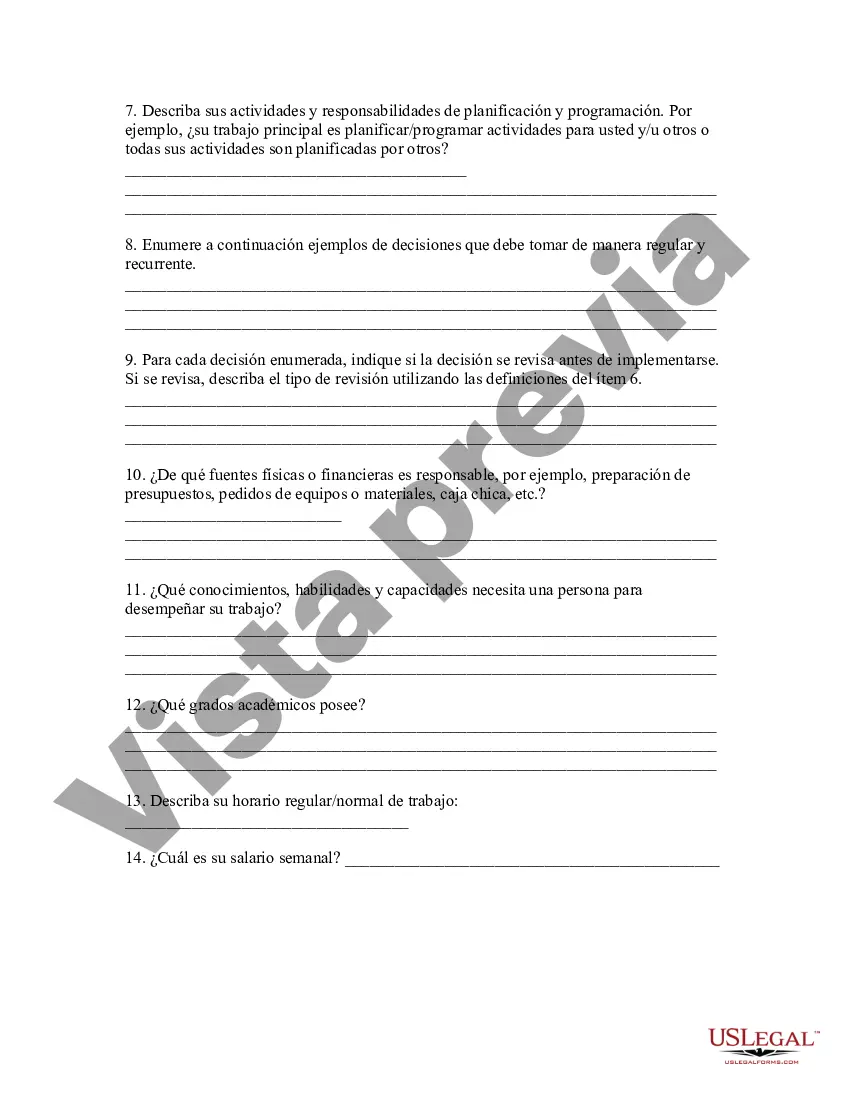

Oakland Michigan Exempt Survey is a comprehensive data collection process conducted in Oakland County, Michigan. This survey aims to gather critical information related to exemptions within the county, which primarily revolve around property taxes and certain privileges granted by law. The Oakland Michigan Exempt Survey involves the examination of various exemptions that can be claimed by residents or organizations residing within the county. The survey specifically focuses on exploring exemptions related to property tax, including exemptions for senior citizens, veterans, disabled individuals, religious organizations, and non-profit entities. The primary purpose of this survey is to identify those individuals or entities that qualify for these exemptions, ensuring they receive the appropriate benefits and privileges entitled to them under the law. By conducting this survey, the county aims to ensure fairness, accuracy, and transparency in the administration of property taxes and the distribution of exemptions in Oakland County. Types of exemptions covered in the Oakland Michigan Exempt Survey include: 1. Senior Citizen Exemptions: This category includes exemptions specifically designed for elderly residents who meet certain age and income criteria. These exemptions provide relief from property tax burdens, helping seniors maintain their homes and financial stability. 2. Veteran Exemptions: This category encompasses exemptions granted to veterans, including disabled veterans, who have served in military service. These exemptions focus on providing financial relief to veterans and recognizing their sacrifices. 3. Disabled Individual Exemptions: This category covers exemptions for individuals with disabilities who meet specific criteria. These exemptions aim to alleviate the financial strain on disabled individuals, granting them relief from property tax obligations. 4. Religious Organization Exemptions: This category pertains to exemptions granted to religious organizations and institutions that meet certain guidelines and criteria. These exemptions recognize the contributions of religious organizations to the community and honor the freedom of religion. 5. Non-Profit Entity Exemptions: This category includes exemptions for qualified non-profit organizations, such as charitable organizations, educational institutions, and cultural entities. These exemptions support the vital work carried out by non-profit organizations and encourage their positive impact on the community. The Oakland Michigan Exempt Survey plays a crucial role in ensuring that these exemptions are fairly awarded and properly administered. By conducting a thorough and detailed survey, the county can accurately identify individuals and organizations eligible for exemptions, avoiding any potential misuse or abuse of the system. Overall, the Oakland Michigan Exempt Survey is a comprehensive data collection process that aims to identify and validate various exemptions within the county. It supports the goal of fair and accurate property tax administration while acknowledging and providing necessary benefits to eligible individuals and organizations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Encuesta exenta - Exempt Survey

Description

How to fill out Oakland Michigan Encuesta Exenta?

Do you need to quickly create a legally-binding Oakland Exempt Survey or probably any other form to handle your own or corporate matters? You can go with two options: hire a legal advisor to write a valid document for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant form templates, including Oakland Exempt Survey and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, double-check if the Oakland Exempt Survey is tailored to your state's or county's laws.

- If the form has a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Oakland Exempt Survey template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the templates we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!