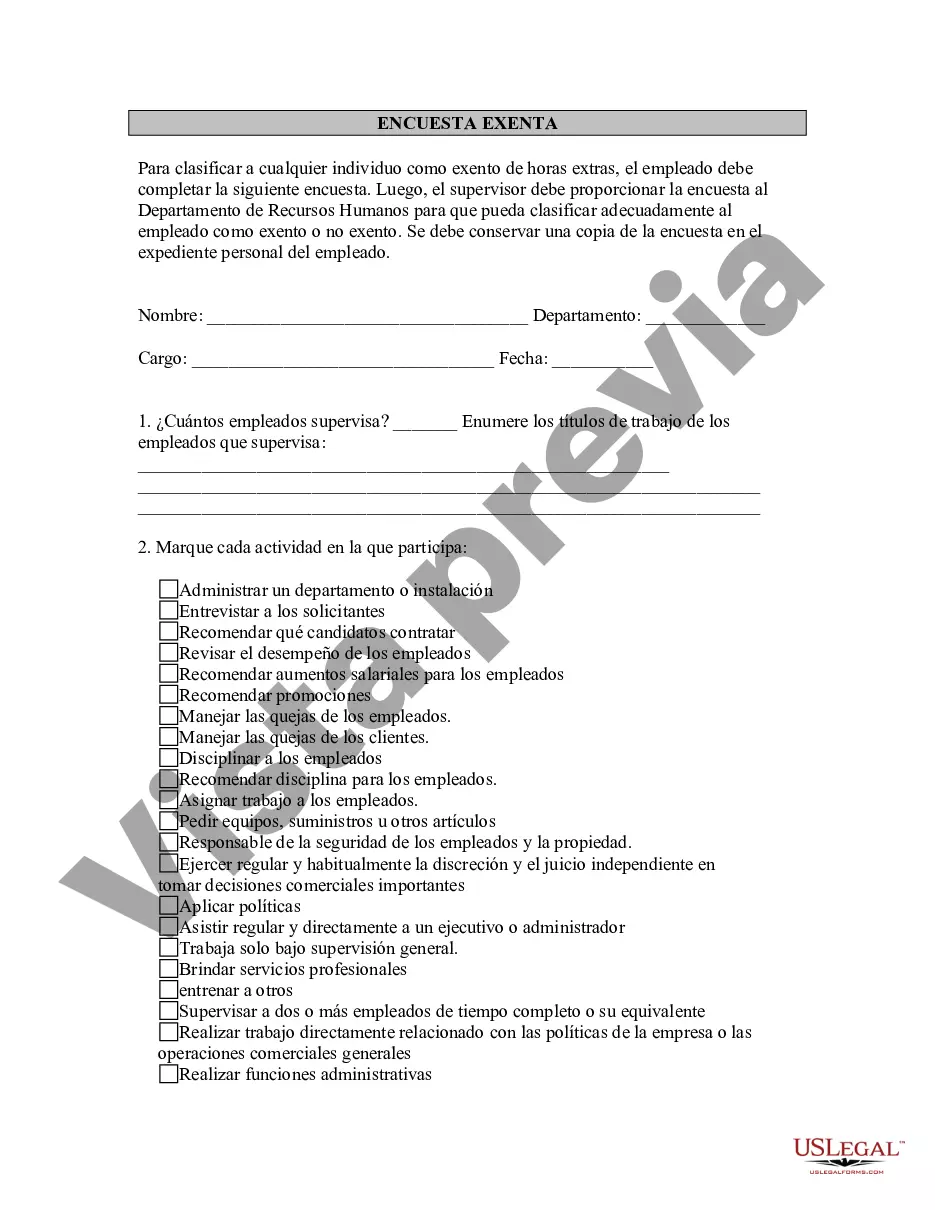

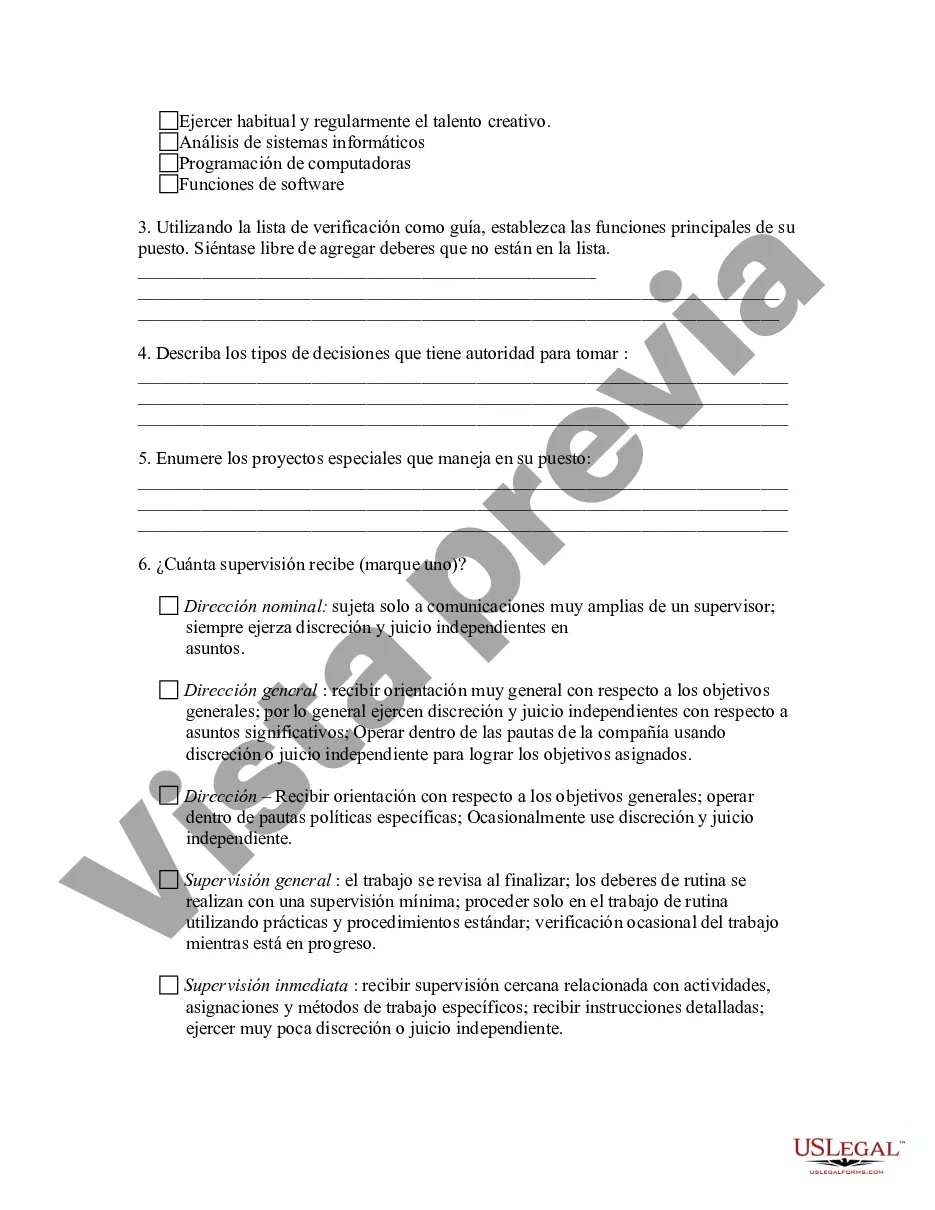

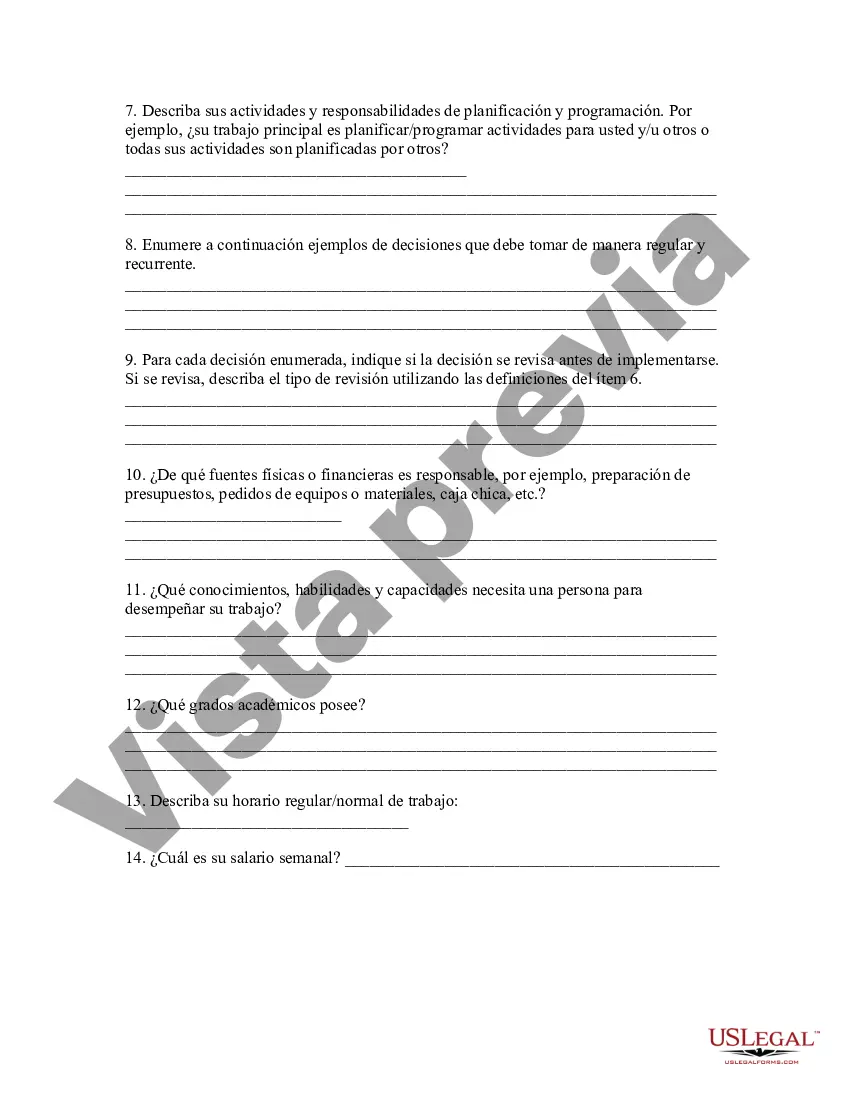

Orange California Exempt Survey is a comprehensive assessment conducted within Orange County, California, to determine various types of tax-exempt properties and their compliance with relevant regulations and statutes. This survey aims to evaluate properties that are exempt from specific taxes, such as properties owned by charitable organizations, religious institutions, and government entities. The Orange California Exempt Survey is crucial for ensuring fair taxation and maintaining accurate records of tax-exempt properties. It encompasses a range of surveys and audits tailored to different types of exempt properties, including: 1. Charitable Organization Exemption Survey: This survey focuses on properties owned by non-profit organizations that meet specific criteria for charitable purposes. It verifies compliance with tax laws and assesses the legitimacy of the claimed exemptions. 2. Religious Institution Exemption Survey: This survey is specifically designed for properties owned by religious organizations, including churches, mosques, synagogues, temples, and other places of worship. It evaluates whether these properties meet the requisite criteria for tax exemption as defined by local laws. 3. Government Entity Exemption Survey: This survey scrutinizes properties owned by government institutions at various levels, including federal, state, county, and municipal entities. It assesses the eligibility of these properties for tax exemption and ensures compliance with regulations governing public buildings and land use. The Orange California Exempt Survey employs a comprehensive approach to collect relevant data for each property type. Surveyors conduct field visits, examine property records, and verify the stated exemptions against established guidelines. Assessors often collaborate with property owners or representatives to gather accurate information and resolve any inconsistencies. By conducting the Orange California Exempt Survey, the county authorities can maintain a fair tax system, avoid potential tax evasion, and ensure that tax-exempt properties are being used appropriately for their intended purposes. It also promotes transparency and confidence in the taxation process, benefiting both the government and the public.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Encuesta exenta - Exempt Survey

Description

How to fill out Orange California Encuesta Exenta?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Orange Exempt Survey, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any activities associated with document completion simple.

Here's how to locate and download Orange Exempt Survey.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar forms or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy Orange Exempt Survey.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Orange Exempt Survey, log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you have to deal with an exceptionally challenging case, we advise getting an attorney to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!