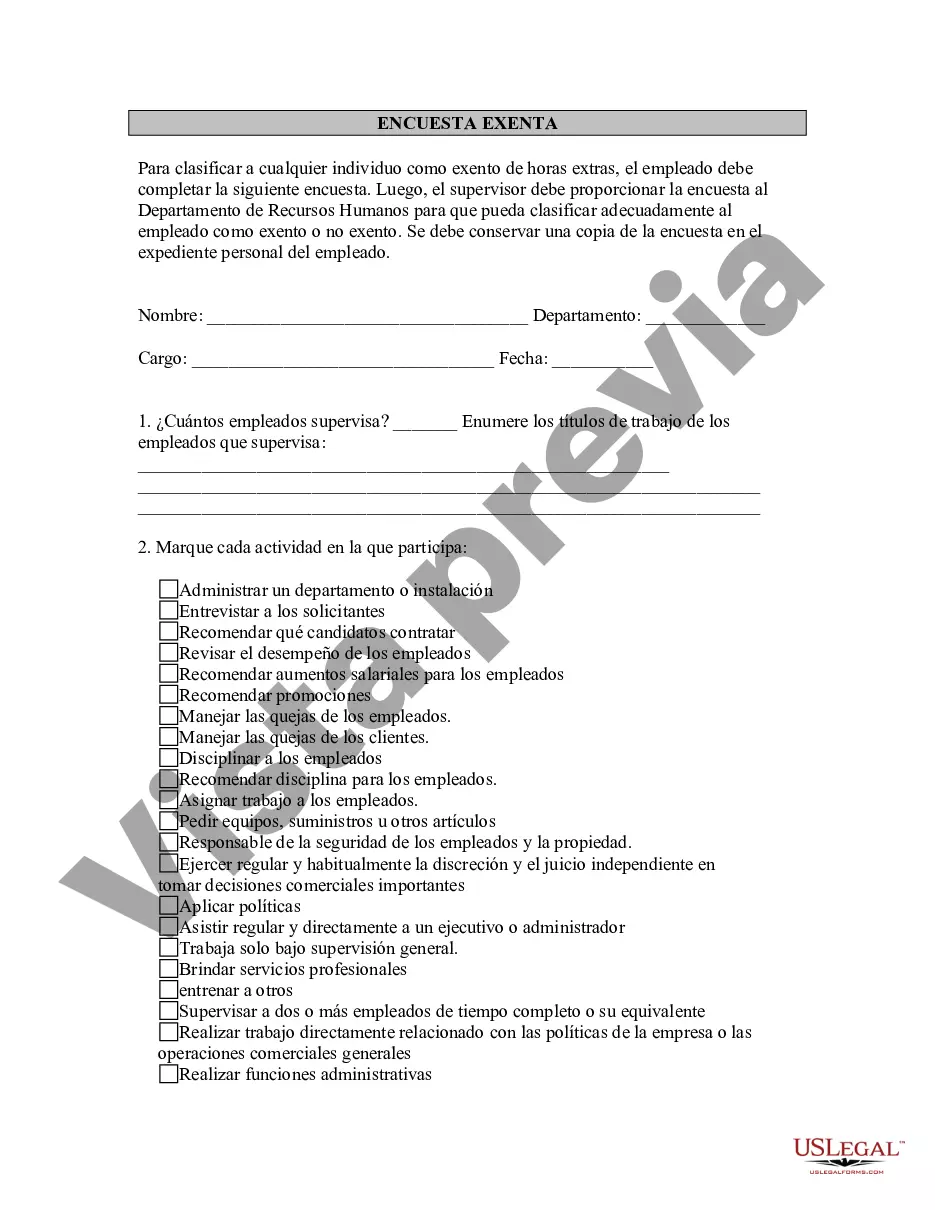

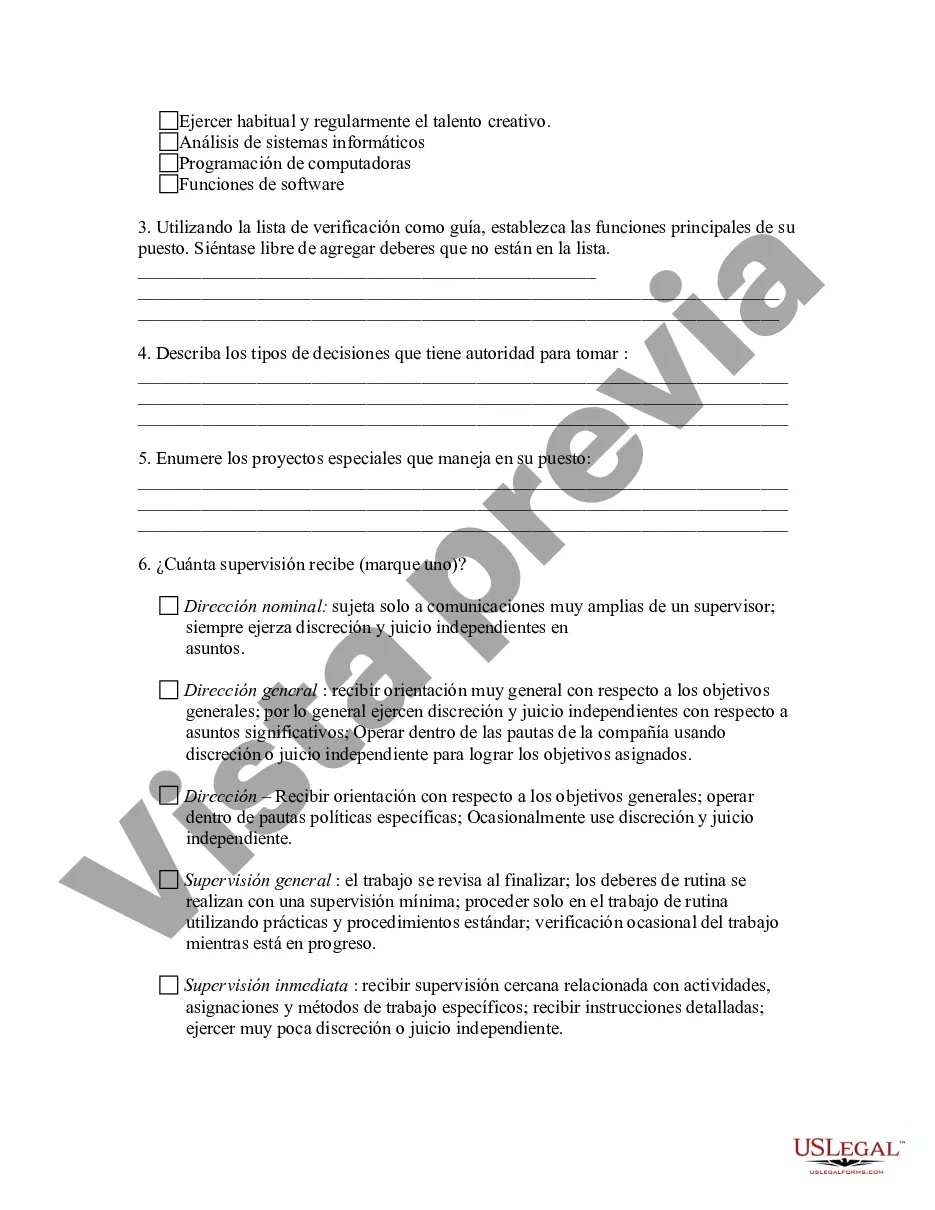

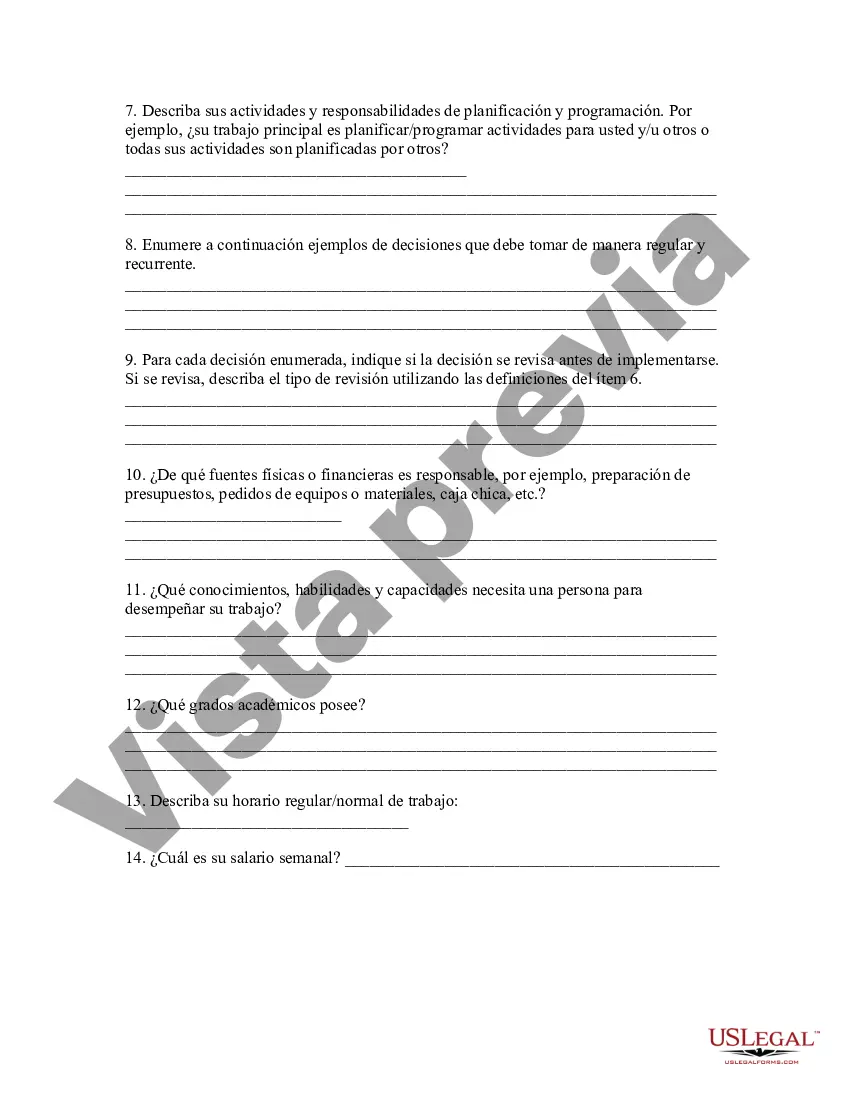

Queens, New York Exempt Survey is a comprehensive assessment process implemented by local authorities to determine property tax exemptions for eligible properties in Queens County, New York City. This detailed survey aims to identify properties that meet specific criteria for exemption eligibility, ensuring fair taxation and supporting various community initiatives. The Queens New York Exempt Survey encompasses several types of exemptions that property owners may apply for, depending on the intended usage and ownership status. Here are some key exemption types: 1. Homeowners Exemption: This exemption is available to homeowners residing in their primary residences. It provides a significant reduction in property taxes by exempting a portion of the property's assessed value from taxation. 2. Senior Citizen Exemption: This exemption is specifically designed for elderly residents (aged 65 and older) who meet certain income requirements. It offers additional tax relief to eligible seniors, acknowledging their limited financial resources. 3. Disabled Homeowners Exemption: This exemption targets homeowners with disabilities who meet specific criteria. It grants a partial exemption from property taxes to ease the burden on disabled individuals/families. 4. Veterans Exemption: This exemption recognizes the contributions and sacrifices made by veterans in serving their country. Eligible veterans receive a reduction in their property assessments, thereby lowering their tax obligations. 5. Nonprofit Organization Exemption: Nonprofit organizations that qualify under federal and state regulations may apply for this exemption. It exempts qualifying properties used for religious, charitable, educational, or other approved purposes from property taxes. When conducting the Queens New York Exempt Survey, authorized assessors carefully review applications and supporting documentation submitted by property owners seeking exemptions. They consider factors such as property type, ownership status, occupancy, income requirements, and any special criteria outlined in the exemption programs. It's important for property owners in Queens, New York, to familiarize themselves with the different types of exemptions available and review eligibility requirements before applying. The survey acts as a fundamental tool to ensure fair and consistent evaluation of properties, determine exemption status, and calculate accurate property tax obligations in Queens County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Encuesta exenta - Exempt Survey

Description

How to fill out Queens New York Encuesta Exenta?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Queens Exempt Survey is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to get the Queens Exempt Survey. Adhere to the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Queens Exempt Survey in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!