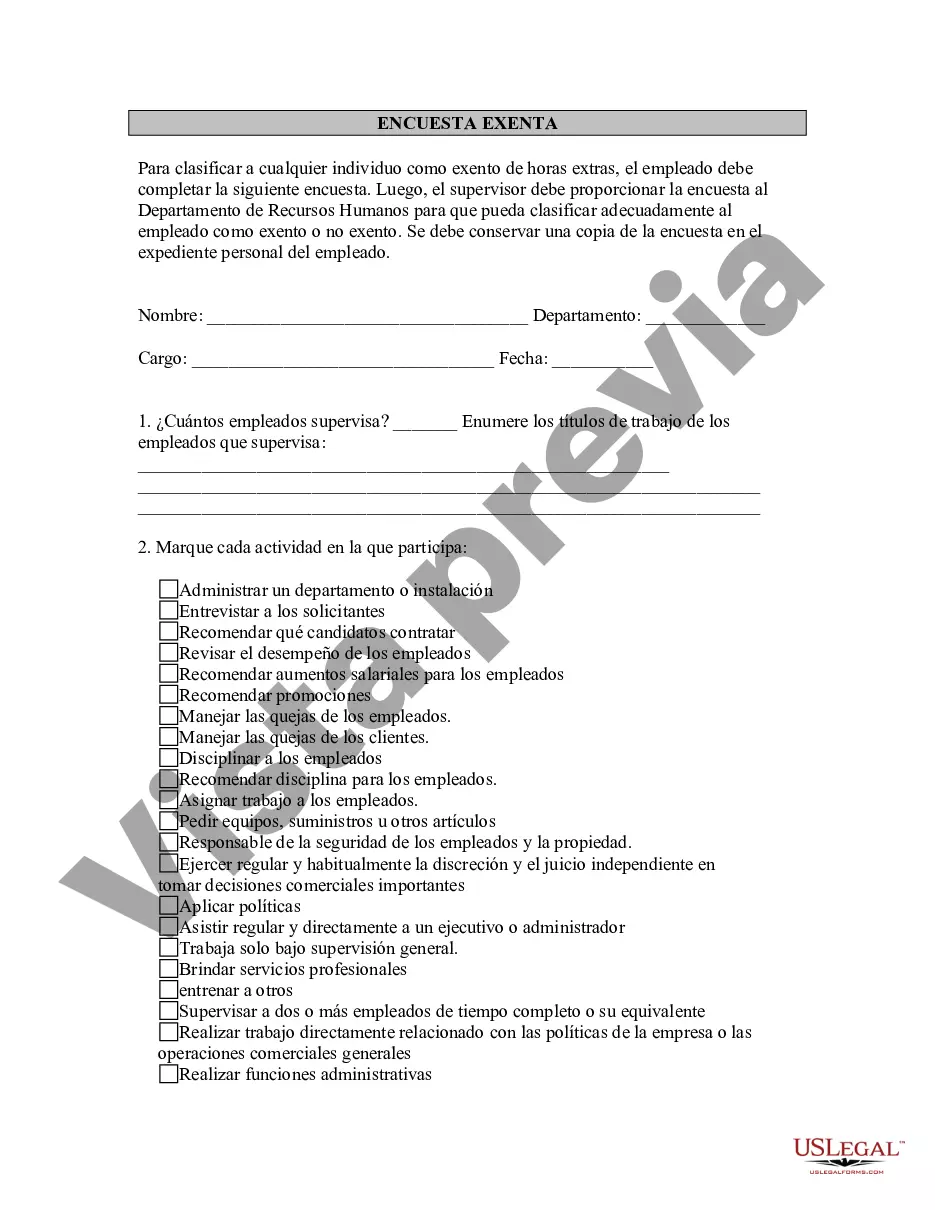

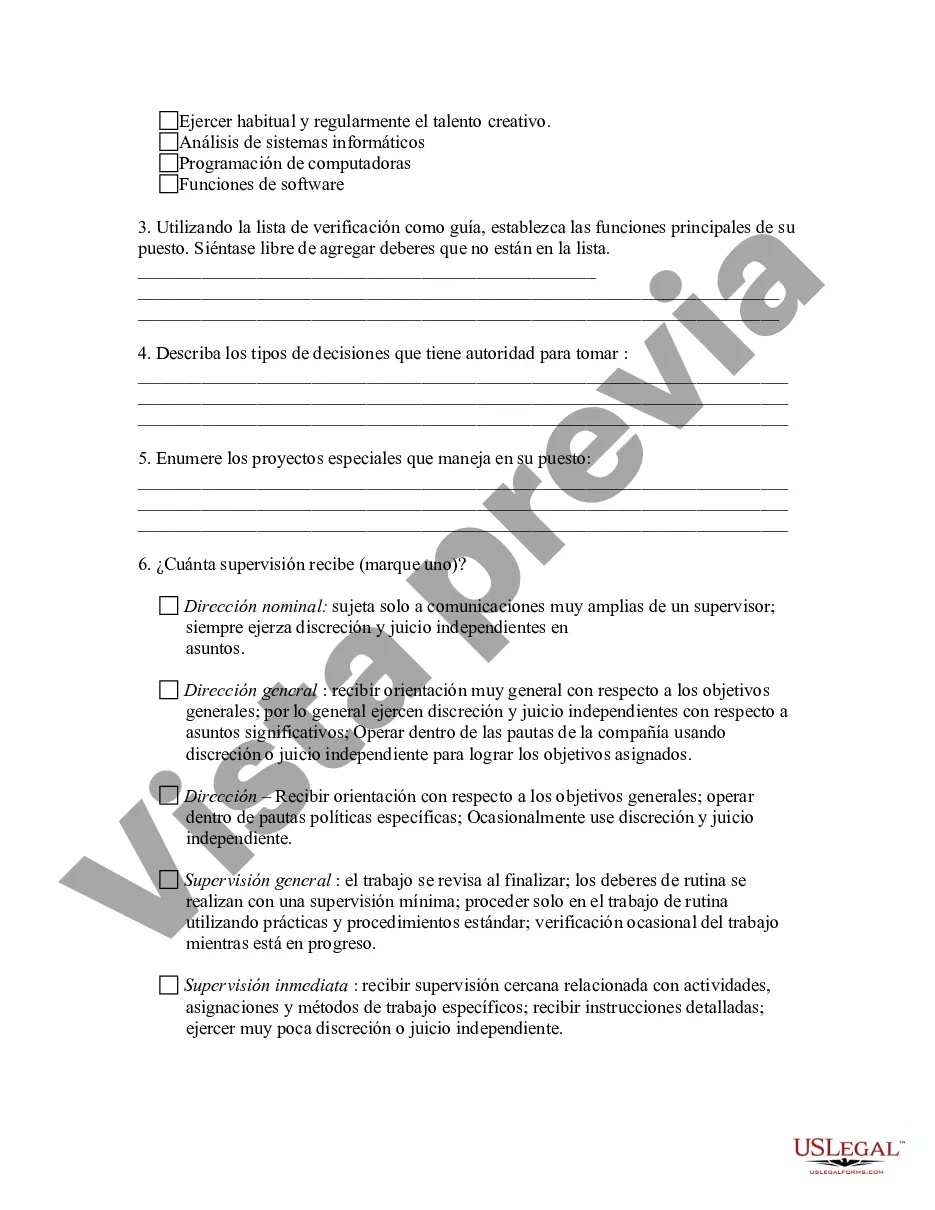

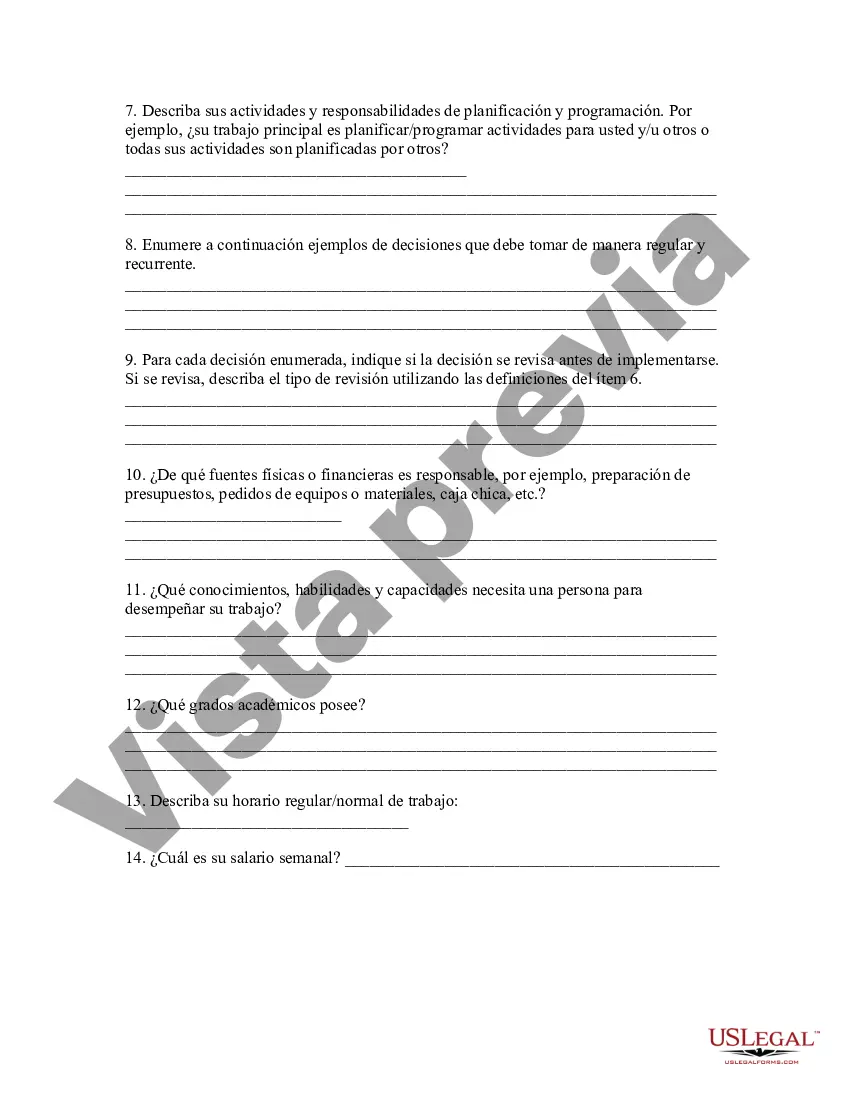

Salt Lake Utah Exempt Survey is a comprehensive assessment conducted within Salt Lake City, Utah, to determine whether specific properties or organizations qualify for tax-exempt status. This survey aims to analyze and collect relevant information from potential beneficiaries to ascertain their eligibility for tax exemptions and provide accurate records for taxation purposes. The Salt Lake Utah Exempt Survey focuses on various types of properties and organizations seeking exemption status. These include religious institutions, nonprofit organizations, charitable foundations, educational institutions, community service organizations, and government entities. Each type undergoes a thorough examination based on specific criteria to ascertain their eligibility. Religious Institutions Survey: This type of survey focuses on churches, temples, mosques, and other places of worship. It analyzes the organization's religious practices, accessibility to the public, community outreach programs, and financial transparency. Nonprofit Organizations Survey: Nonprofits, such as NGOs, advocacy groups, and charitable organizations, are assessed to determine their operations, mission, impact on the community, sources of funding, and adherence to legal requirements for tax-exempt status. Charitable Foundations Survey: This survey concentrates on foundations that provide grants and support charitable initiatives. It evaluates their philanthropic activities, financial management, grant allocation, and compliance with taxation regulations. Educational Institutions Survey: Schools, colleges, universities, and educational programs seeking tax exemptions undergo this survey. It examines their curriculum, student enrollment, educational goals, tuition structure, financial aid programs, and community involvement. Community Service Organizations Survey: Organizations involved in community development, health, social services, or environmental initiatives are evaluated using this survey. Their services, outreach efforts, community partnerships, impact assessments, and financial transparency are analyzed. Government Entities Survey: This specific survey focuses on different government entities seeking tax-exempt status, such as municipal organizations, public libraries, or public schools. It examines their governance structure, public services provided, accountability measures, and financial records. In summary, the Salt Lake Utah Exempt Survey encompasses various distinct surveys tailored to assess different types of properties and organizations seeking tax exemption in Salt Lake City, Utah.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Encuesta exenta - Exempt Survey

Description

How to fill out Salt Lake Utah Encuesta Exenta?

Drafting paperwork for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Salt Lake Exempt Survey without expert help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Salt Lake Exempt Survey on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Salt Lake Exempt Survey:

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!