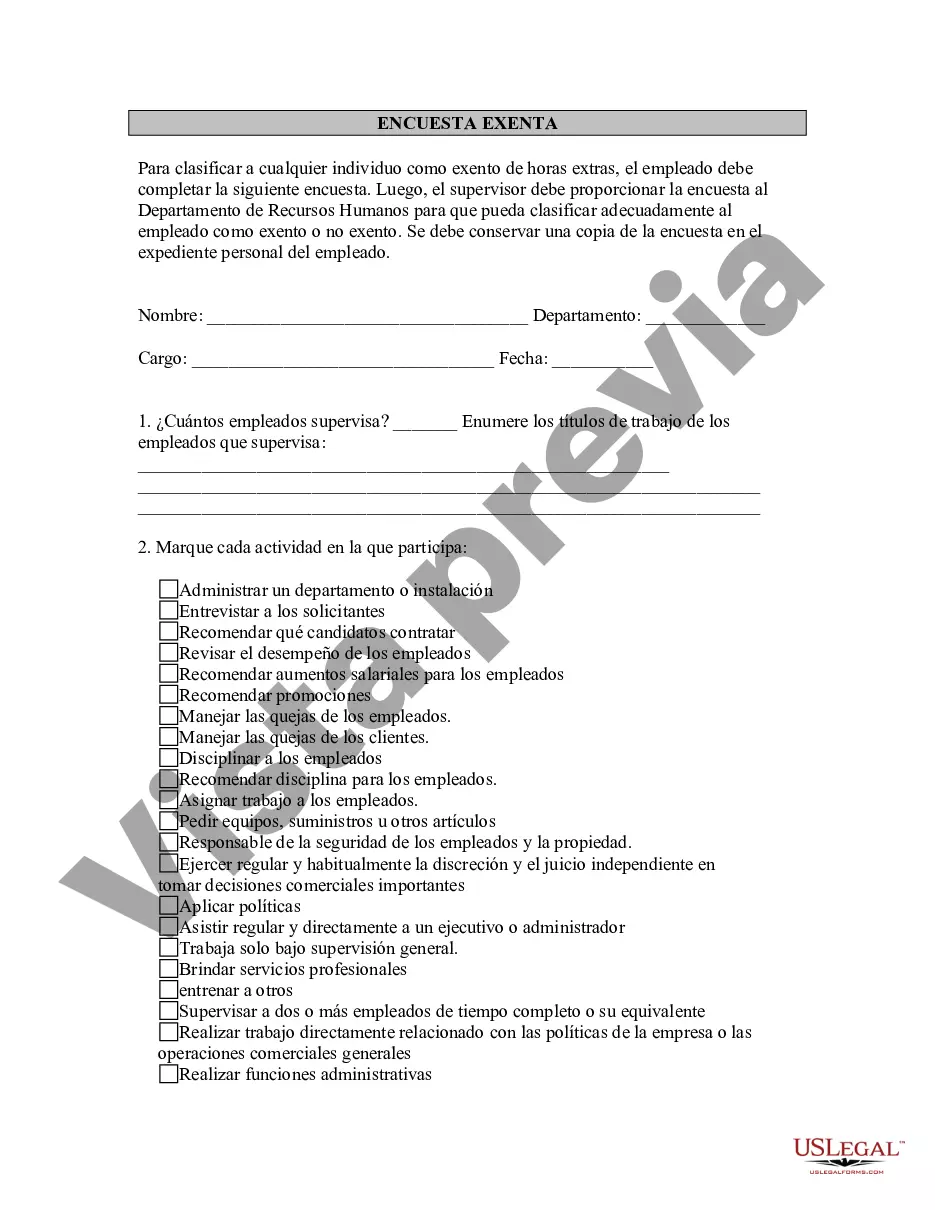

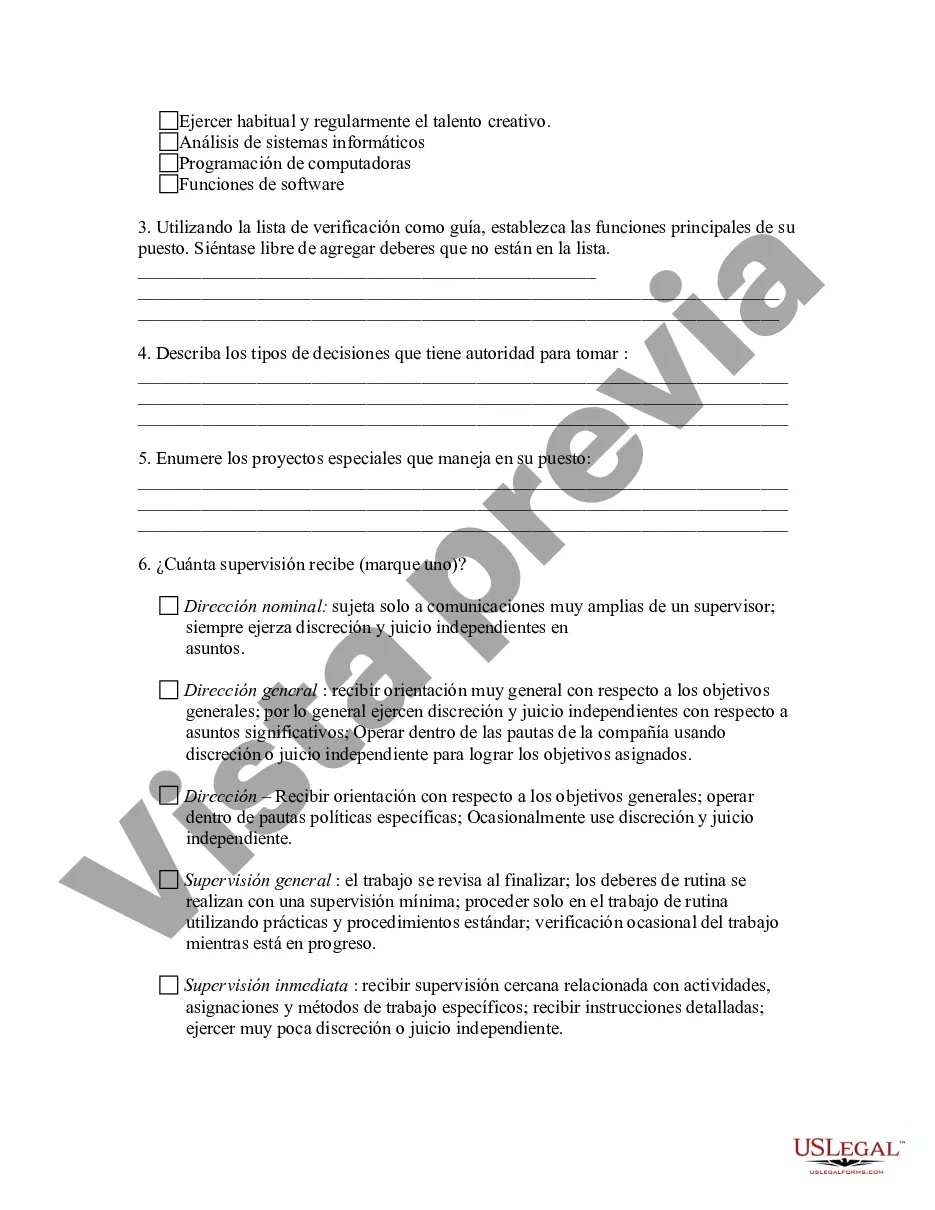

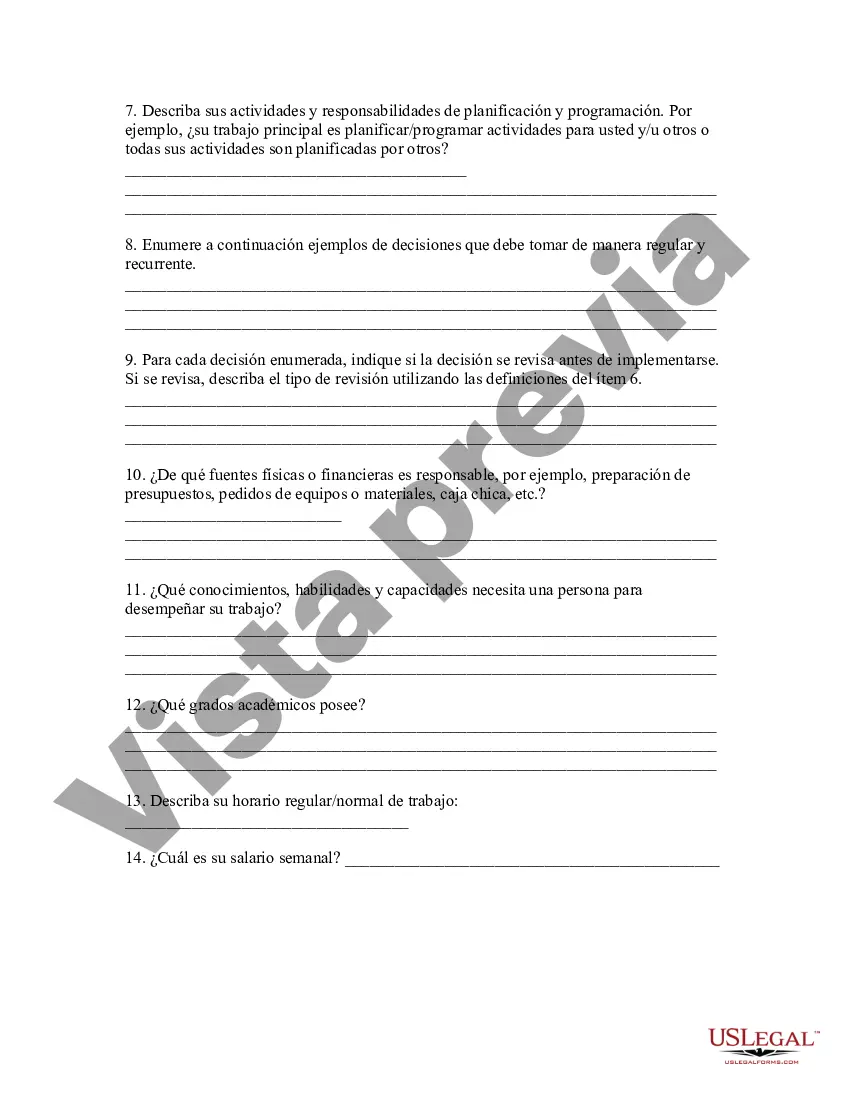

The Wake North Carolina Exempt Survey is a comprehensive assessment conducted by the Wake County government to determine various exemptions applicable to property owners in Wake County, North Carolina. This survey aims to evaluate the eligibility of properties for specific exemptions, which may provide financial relief or reduced tax liability for homeowners or other property owners. The Wake North Carolina Exempt Survey plays a crucial role in identifying exemptions related to property taxes, land use, and special categories within Wake County. By conducting this survey, the government can ensure that property owners receive accurate exemptions that they qualify for, while also maintaining transparency and fairness in the property tax system. There are various types of exemptions covered under the Wake North Carolina Exempt Survey, including: 1. Homestead Exemption: This exemption is applicable to homeowners who use their property as their primary residence. It aims to provide a reduction in property taxes and protect homeowners from rapid increases in their tax bills. 2. Elderly or Disabled Exemption: This exemption specifically caters to elderly individuals or those with disabilities who meet certain qualifications. It offers tax relief to senior citizens or individuals with disabilities on their primary residences. 3. Nonprofit Exemption: Wake County recognizes certain qualifying nonprofit organizations and provides exemptions on property and land owned by these organizations. The exempt status allows nonprofits to focus on their missions and allocate funds to their respective causes rather than property tax obligations. 4. Agricultural Exemption: This exemption is applicable to properties used primarily for farming, agricultural activities, or forestry. It provides reduced taxes on agricultural land, supporting North Carolina's vibrant agricultural industry. 5. Conservation Exemption: This exemption targets land conservation efforts. It encourages owners of environmentally sensitive land to protect and conserve it by offering tax relief in exchange for keeping the land undeveloped. 6. Religious Exemption: Wake County provides an exemption to buildings or properties used exclusively for religious worship or religious educational purposes. This exemption recognizes the importance of religious institutions in the community and supports their contribution to society. The Wake North Carolina Exempt Survey is an essential tool for ensuring the fair distribution of exemptions and determining the accurate tax liabilities for property owners in Wake County. Property owners can participate in the survey to determine their eligibility for various exemptions and streamline their tax obligations accordingly. The survey process involves thorough documentation and assessment to validate exemption claims and ensure compliance with applicable regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Encuesta exenta - Exempt Survey

Description

How to fill out Wake North Carolina Encuesta Exenta?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Wake Exempt Survey meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Apart from the Wake Exempt Survey, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Wake Exempt Survey:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Wake Exempt Survey.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Los cuestionarios usualmente contienen hasta 10 preguntas. Las pruebas tienen mas preguntas que los cuestionarios. Esto es porque se evaluara mas acerca de tu curso. Mientras un cuestionario puede evaluar las primeras 3 paginas de tu libro, una prueba puede contener un nivel mas alto de conocimiento.

Como hacer una encuesta de satisfaccion: la importancia de la estructura Introduccion con argumentos para captar la atencion de nuestro interlocutor. Preguntas sobre nuestros competidores. Cuestiones abiertas sobre nuestros productos o servicios. Preguntas de importancia cerradas.

Ejemplos de preguntas abiertas: ¿En que mes del ano sueles irte de vacaciones? ¿Por que elegiste esa carrera para estudiar en la Universidad? ¿Desde cuando es que no vas a la peluqueria? ¿A donde te gustaria ir a celebrar?

Pueden hacer una por dia, especialmente en la primera semana de clases. ¿ Que te hace sentir bienvenido? ¿ Como te gusta que te saluden? ¿ Que fortalezas traes a la sala de clase y a la escuela? Hasta ahora, ¿ que es lo que mas te gusta de la escuela?¿ En que momentos te sientes competente y con que frecuencia? ¿¿¿

El cuestionario es un instrumento utilizado para obtener informacion con fines de investigacion o evaluacion, sin embargo, su uso tradicional en la escuela esta ampliamente ligado a la recuperacion memoristica de la informacion y, por lo general, a la asignacion de calificaciones, a pesar de ser un instrumento con

Extra: Mas Ideas ¿Que quieres obtener de esta clase? ¿Cuales son las mayores lecciones que te ha aportado tu educacion hasta ahora? ¿Como puedes aplicar este conocimiento al nuevo ano academico? ¿Que 3 cosas puedes hacer para mejora tu aprendizaje este ano? ¿Que habilidades te gustaria adquirir con esta asignatura?

1. Tecnicas de preguntas abiertas Buscar evidencia: Que te hace pensar que2026 ? Explicar: ¿Cuales son algunas de las causas que llevan2026 ? Relacionar conceptos, ideas y opiniones: Como eso se compara con2026 ? Predecir: ¿Que haras despues? Describir: ¿Que observaste2026 ?

Objetivo de una encuesta Evaluar periodicamente los resultados de un programa en ejecucion. Saber la opinion del publico acerca de un tema en especifico. Investigar previamente de las caracteristicas de la poblacion para hacer las preguntas correctas.

El cuestionario es un instrumento utilizado para recoger de manera organizada la informacion que permitira dar cuenta de las variables de interes en cierto estudio, investigacion, sondeo o encuesta.

Cosas que observar: ¿Que aspecto tienen las aulas, los maestros reflejan entusiasmo y los estudiantes parecen alegres?¿Que te parecen los maestros?¿Que te parece el director?¿Como se portan los estudiantes al moverse de clase a clase o al jugar afuera? ¿Como mantienen las instalaciones?