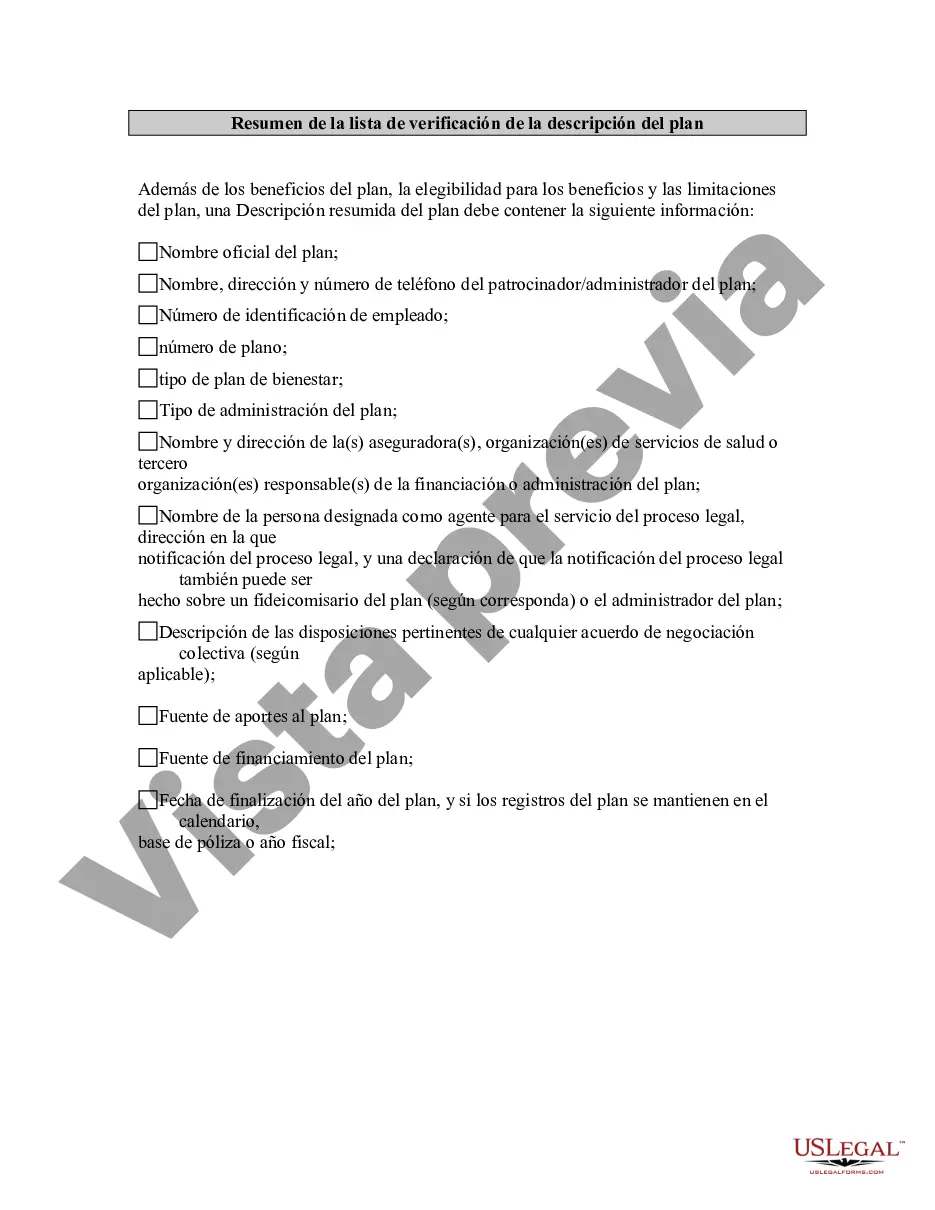

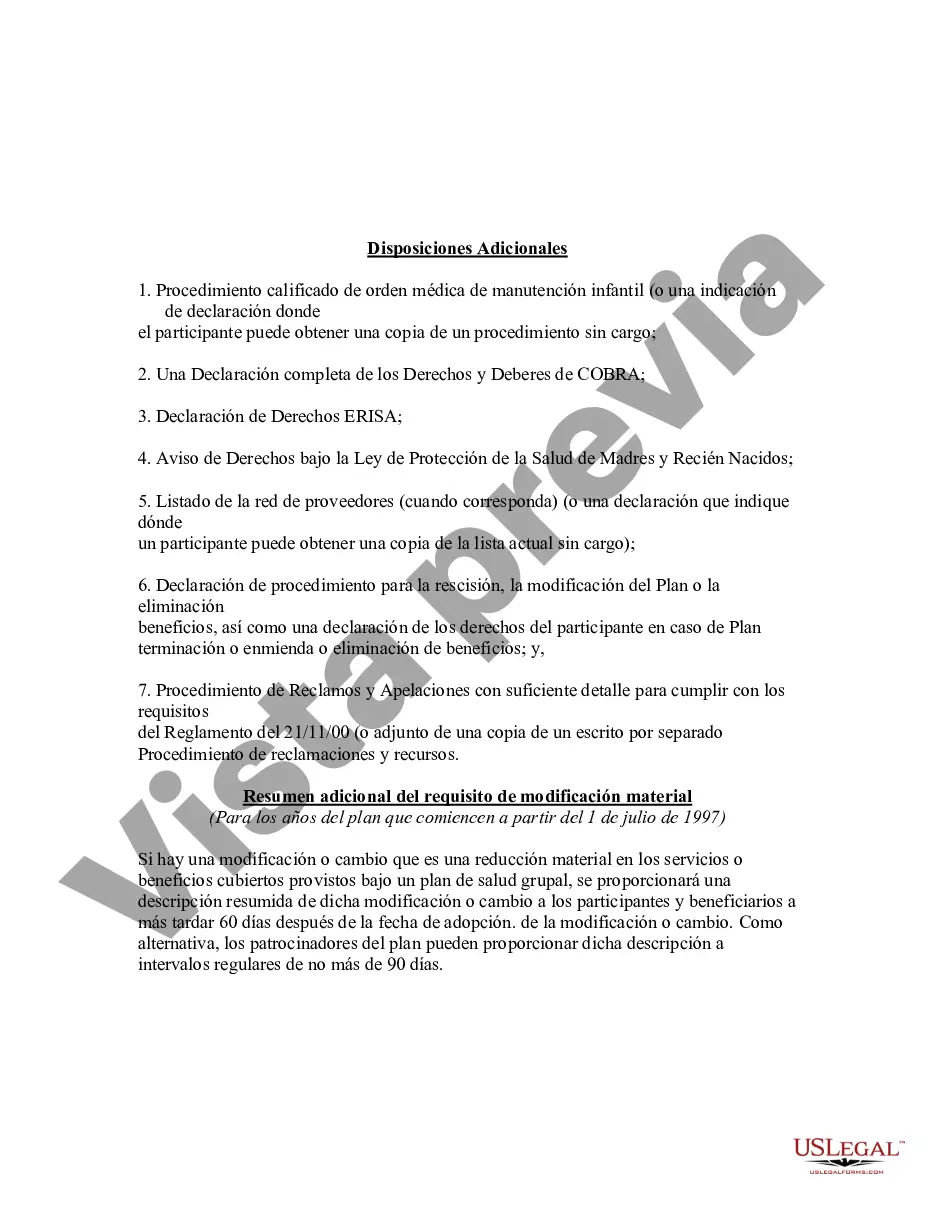

Clark Nevada Summary Plan Description Checklist is a comprehensive tool designed to ensure that the summary plan description (SPD) of employee benefit plans complies with all the necessary regulations and provides the required information to plan participants. This checklist serves as a guideline to help employers and plan administrators create an effective and informative SPD that enables employees to understand their rights, benefits, and obligations under the plan. The Clark Nevada Summary Plan Description Checklist includes an extensive range of important components that should be incorporated in an SPD. It covers areas such as plan eligibility criteria, enrollment procedures, benefit calculations, vesting schedules, distribution options, and the claims and appeals process. By following this checklist, employers and plan administrators can be confident that they have covered all the essential information required in the SPD. Different types of Clark Nevada Summary Plan Description Checklists may exist depending on the specific employee benefit plan at hand. For example, there might be separate checklists for retirement plans, health insurance plans, disability plans, and other types of employee benefits. Each checklist would focus on the unique requirements and regulations related to that particular plan type. The checklist typically begins with an overview of the plan, detailing its purpose, the entities involved, and the governing laws and regulations. It would then proceed to outline the eligibility criteria, including information on who is eligible to participate in the plan and the conditions that must be met. Next, the checklist would cover the plan's benefits, such as the types of benefits offered, how they are calculated, any limitations or exclusions, and the conditions under which benefits are payable. This section may also include information about beneficiaries, survivor benefits, and any applicable legal protections. The checklist would also prompt the inclusion of information related to employee contributions, employer contributions, and any matching or profit-sharing arrangements. It would specify the calculation methods for determining contribution amounts and the vesting schedules for employer-provided benefits. Other important elements covered in the Clark Nevada Summary Plan Description Checklist may include details on the plan's funding mechanisms, exercise of rights, claims and appeals procedures, and how the plan is amended or terminated. It may also require the inclusion of required legal notices, contact information for plan administrators, and the availability of plan documents for review. In summary, the Clark Nevada Summary Plan Description Checklist is a valuable tool for employers and plan administrators to ensure compliance with applicable regulations and to provide clear and comprehensive information to plan participants. It helps outline the necessary components of an SPD and ensures that employees have a thorough understanding of their benefits and rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Resumen de la lista de verificación de la descripción del plan - Summary Plan Description Checklist

Description

How to fill out Clark Nevada Resumen De La Lista De Verificación De La Descripción Del Plan?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Clark Summary Plan Description Checklist, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Clark Summary Plan Description Checklist from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Clark Summary Plan Description Checklist:

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!