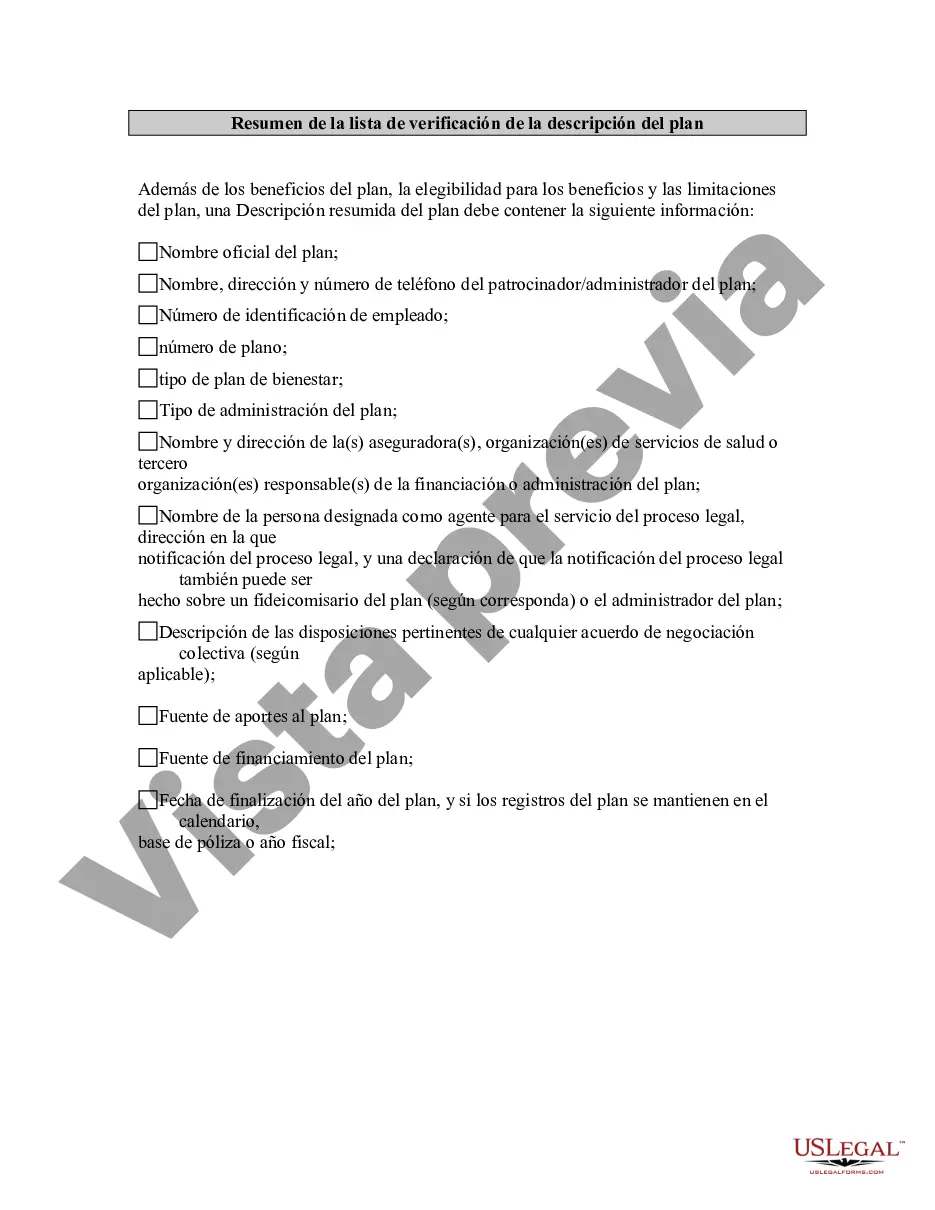

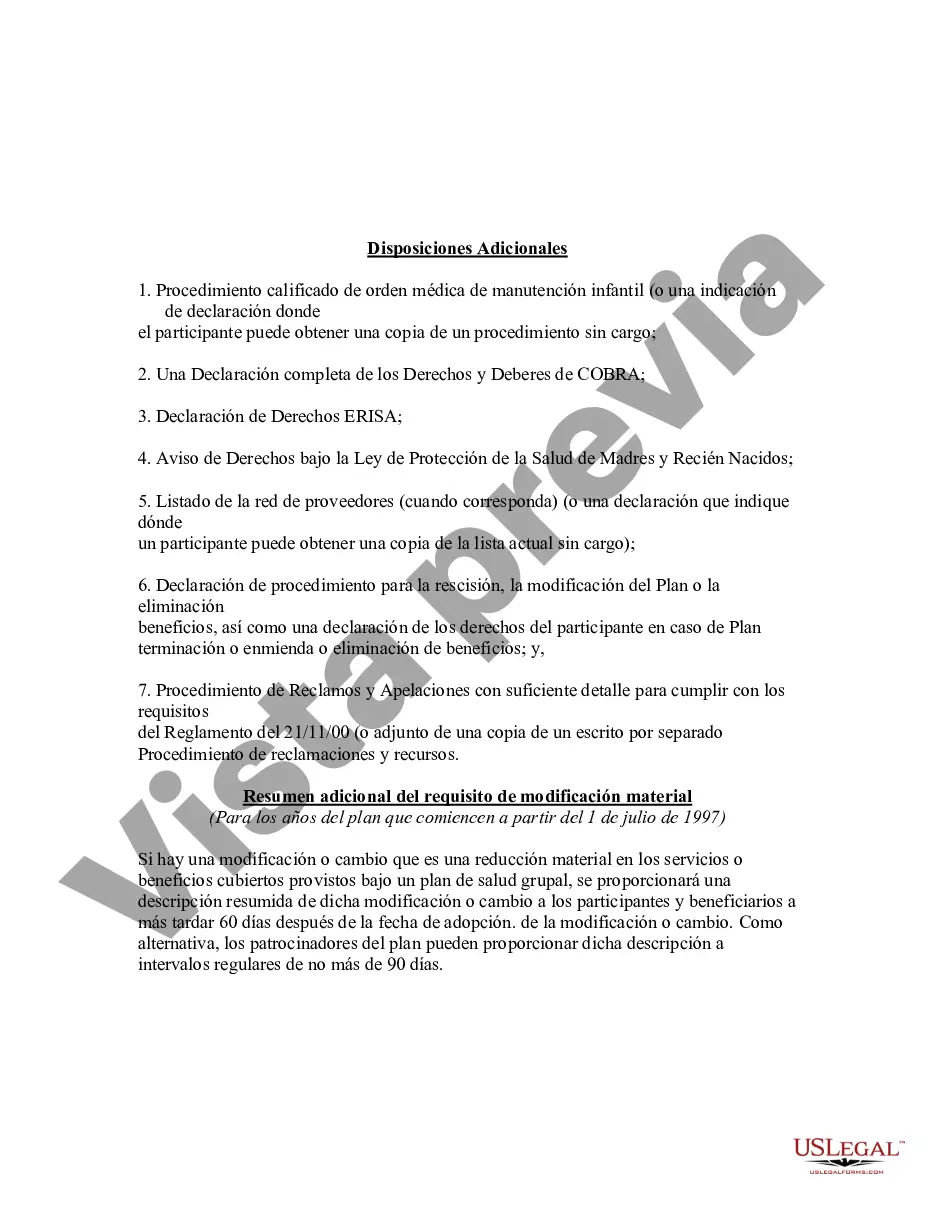

Cuyahoga Ohio Summary Plan Description Checklist is a comprehensive document that outlines the essential details of an employee benefit plan offered by employers in Cuyahoga, Ohio. It serves as a guide for plan participants to understand the plan's key features, benefits, coverage options, and eligibility criteria. The checklist typically includes a set of required information that employers need to include in their Summary Plan Description (SPD) to comply with legal obligations under the Employee Retirement Income Security Act (ERICA). This ensures transparency and provides employees with detailed insights into their benefits, helping them make informed decisions about their coverage. The Cuyahoga Ohio SPD Checklist usually includes the following key elements: 1. Plan Overview: A summary of the employee benefit plan, including a description of the plan sponsor, plan administrator, and plan year. 2. Eligibility: The criteria employees must meet to become eligible for participation in the plan, such as employment status, hours worked, or length of service. 3. Contribution and Funding Information: Details about employer and employee contributions to the plan, including any matching programs or employee contribution options. 4. Vesting: Information on when and how employees become vested in their employer's contribution to their retirement savings. 5. Plan Benefits: A comprehensive breakdown of the different benefits offered by the plan, such as health insurance, retirement savings, life insurance, disability coverage, and any additional perks. 6. Enrollment and Participation: Instructions on how employees can enroll in the plan, any waiting periods, and the process to make changes or updates to coverage. 7. Benefit Payment and Distribution: Information on how benefits are calculated, when and how they are paid out, and any restrictions or limitations on distributions. 8. Claims and Appeals: Explanation of the procedures and timelines for filing claims and the steps involved in the appeals process if a claim is denied. 9. Plan Amendments and Termination: Details on how the plan can be amended, terminated, or modified, including any potential impact on existing benefits. 10. Contact Information: Contact details for the plan administrator or other relevant personnel who can address employee questions or concerns about the plan. While the basic components of a Cuyahoga Ohio SPD Checklist generally remain the same, the exact requirements may vary depending on the specific type of employee benefit plan. These could include retirement plans like 401(k) plans, pension plans, healthcare plans such as health insurance or flexible spending accounts (FSA's), or other types of fringe benefits offered by employers in Cuyahoga County, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Resumen de la lista de verificación de la descripción del plan - Summary Plan Description Checklist

Description

How to fill out Cuyahoga Ohio Resumen De La Lista De Verificación De La Descripción Del Plan?

Draftwing paperwork, like Cuyahoga Summary Plan Description Checklist, to take care of your legal matters is a tough and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents created for a variety of scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Cuyahoga Summary Plan Description Checklist form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Cuyahoga Summary Plan Description Checklist:

- Ensure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Cuyahoga Summary Plan Description Checklist isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and get the form.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!