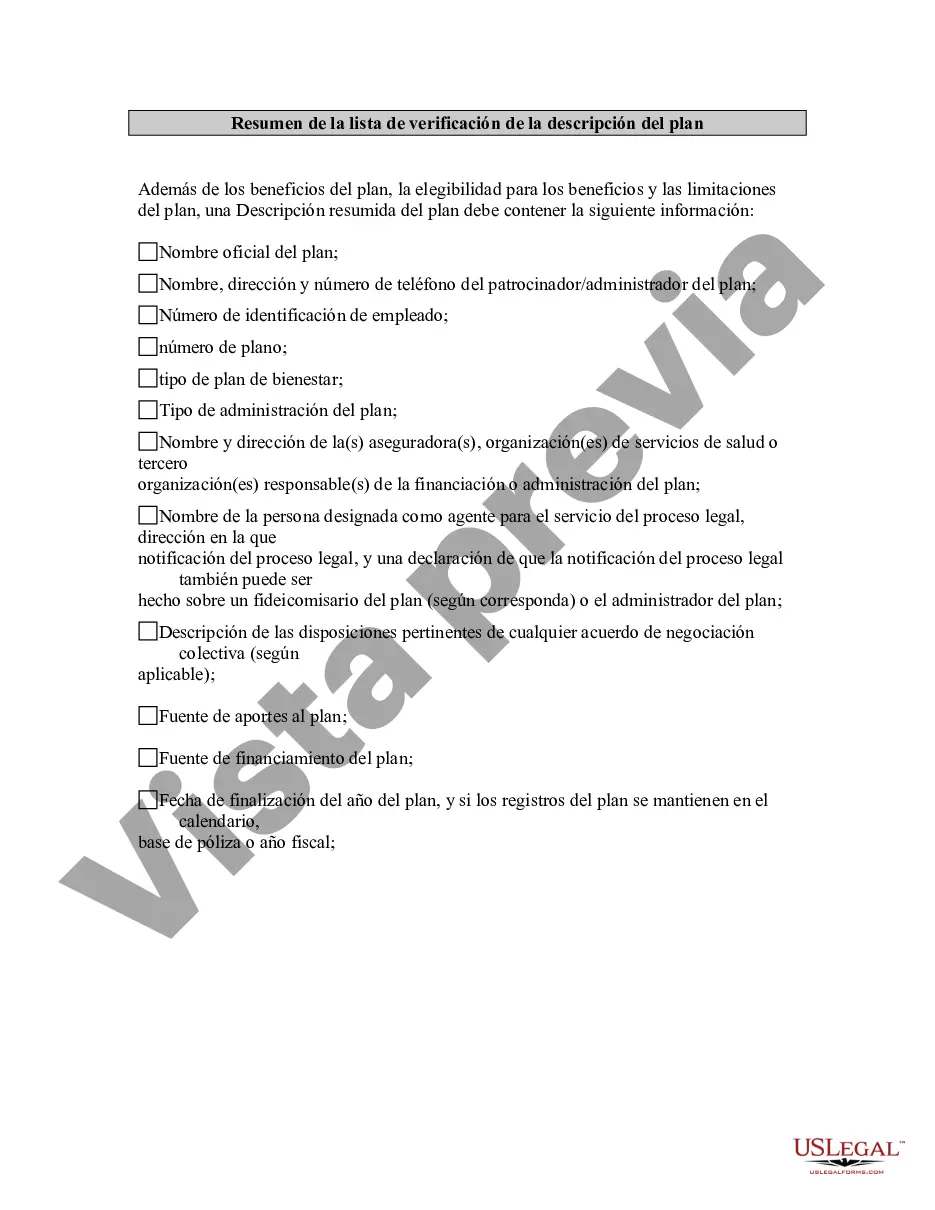

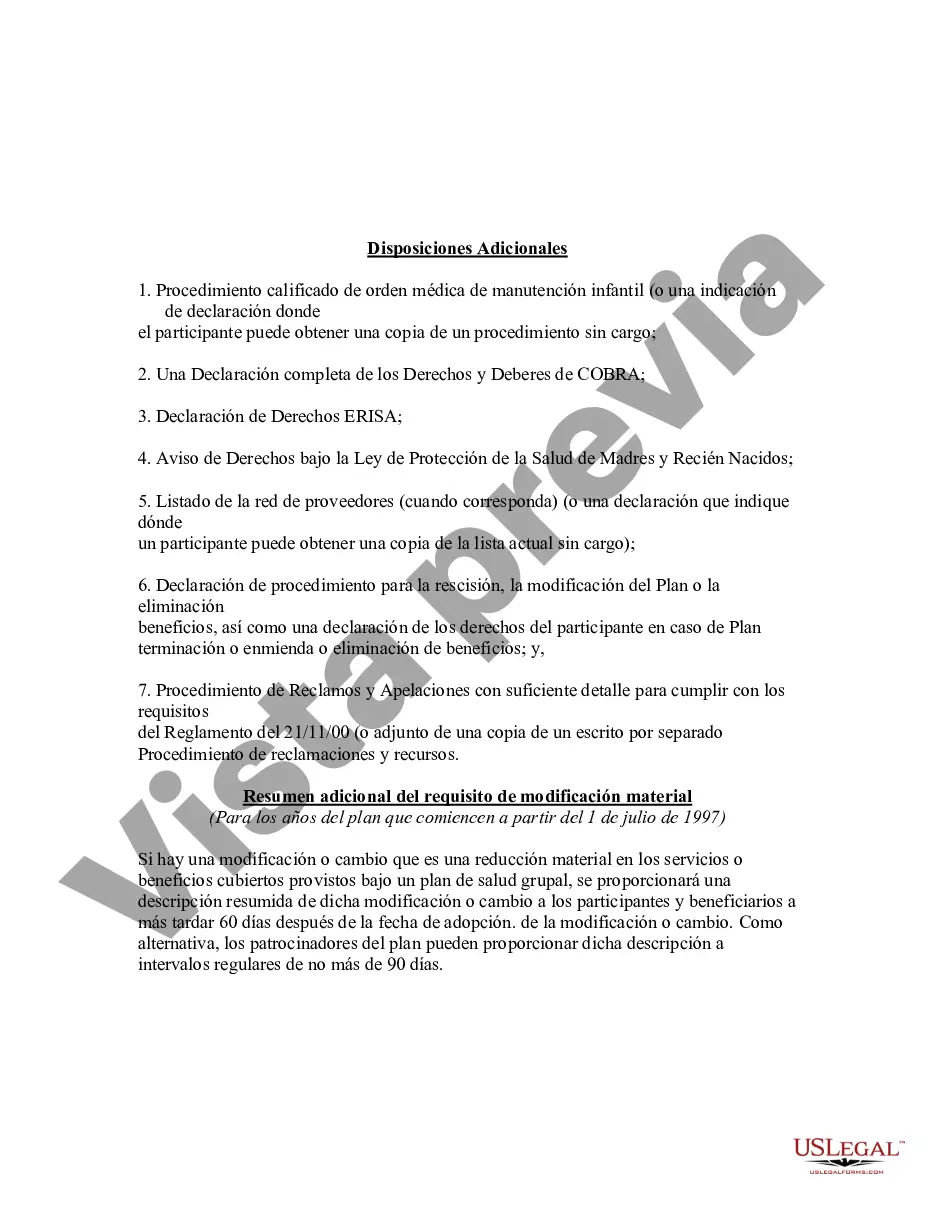

Los Angeles California Summary Plan Description Checklist is a comprehensive document that outlines the key elements and provisions of various employee benefit plans offered by employers in Los Angeles, California. This checklist serves as a guideline for employers to ensure that they have addressed all necessary components in their Summary Plan Description (SPD), which is a legally required document providing employees with information about their benefits. The Los Angeles California Summary Plan Description Checklist includes the following key areas: 1. Plan Summary: This section provides an overview of the employee benefit plan, including the type of plan, eligibility criteria, and participation guidelines. 2. Plan Administration: It outlines the responsibilities and duties of the plan administrator, including record-keeping, disclosures, and compliance with state and federal regulations. 3. Plan Benefits: This section highlights the specific benefits offered under the plan, such as health insurance, retirement plans, life insurance, disability coverage, and any other ancillary benefits provided by the employer. 4. Employee Contributions and Costs: It details the cost-sharing structure between the employer and employees, including information on premiums, deductibles, co-payments, and any cost-sharing arrangements. 5. Enrollment and Eligibility: This part explains the enrollment process, including deadlines, qualifying events, and eligibility requirements, such as waiting periods or probationary periods for new employees. 6. Claims and Appeal Procedures: It outlines the steps employees need to follow when filing claims for benefits and the subsequent appeal process in case of denial or disagreements. 7. Termination and Continuation of Benefits: This section provides information on how benefits end upon termination, including details about eligible continuation coverage under COBRA (Consolidated Omnibus Budget Reconciliation Act) and other applicable state laws. 8. Plan Amendments and Modifications: It addresses the procedures and notification requirements for making changes to the plan, ensuring compliance with ERICA (Employee Retirement Income Security Act) regulations. Different types of Los Angeles California Summary Plan Description Checklists may exist depending on the specific industry or type of benefit plan offered by employers. For instance: 1. Health Insurance Summary Plan Description Checklist: This variant specifically focuses on the healthcare benefits provided by employers, including details on medical, dental, vision, and prescription drug coverage. 2. Retirement Plan Summary Plan Description Checklist: This type concentrates on employer-sponsored retirement plans, such as defined contribution plans (e.g., 401(k)) or defined benefit plans, outlining contribution limits, vesting schedules, and distribution options. 3. Flexible Spending Account Summary Plan Description Checklist: This variant highlights the specifics of a flexible spending account (FSA) plan, including rules and regulations related to reimbursement of eligible expenses through pre-tax contributions. In conclusion, the Los Angeles California Summary Plan Description Checklist assists employers in ensuring they have included all the necessary elements in their employee benefit plans' Summary Plan Descriptions, covering areas such as plan summary, administration, benefits, employee contributions, eligibility, claims procedures, benefit termination, and plan amendments. Various types of checklists may be available depending on the nature of the benefit plan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Resumen de la lista de verificación de la descripción del plan - Summary Plan Description Checklist

Description

How to fill out Los Angeles California Resumen De La Lista De Verificación De La Descripción Del Plan?

Creating forms, like Los Angeles Summary Plan Description Checklist, to manage your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for different scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Los Angeles Summary Plan Description Checklist template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before downloading Los Angeles Summary Plan Description Checklist:

- Ensure that your document is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Los Angeles Summary Plan Description Checklist isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our website and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!