Cook Illinois Collections Coordinator Checklist is a comprehensive tool used by collections coordinators at Cook Illinois to ensure the smooth and efficient management of their collection processes. This checklist serves as a guide for collections coordinators to keep track of various tasks and responsibilities involved in the collection procedures. By using this checklist, collections coordinators can adhere to the necessary guidelines and procedures, ensuring the timely recovery of outstanding payments and minimizing financial losses for the company. The checklist includes a series of tasks that need to be completed by collections coordinators on a regular basis. Some key tasks identified in the Cook Illinois Collections Coordinator Checklist are as follows: 1. Reviewing outstanding accounts: Collections coordinators are required to review the accounts that are past due and identify the customers who need to be contacted for payment. 2. Initiating collection efforts: Once the delinquent accounts have been identified, collections coordinators must initiate collection efforts by sending appropriate notices, emails, or making phone calls to remind customers about their overdue payments. 3. Communicating with customers: Collections coordinators are responsible for maintaining regular communication with customers regarding their outstanding balances, payment options, and resolving any disputes or concerns they may have. 4. Updating account information: It is crucial for collections coordinators to update the account information of customers, such as contact details, payment arrangements, and any modifications made during the collection process. 5. Documenting collection activities: Collections coordinators must keep detailed records of all collection activities, including dates, times, and outcomes of each contact made with customers. This documentation is important for future reference and legal purposes. 6. Negotiating payment plans: In some cases, collections coordinators may need to negotiate payment plans with customers who are unable to pay the full balance immediately. They need to assess the customers' financial situations and propose suitable repayment options. 7. Coordinating with internal departments: Collections coordinators often need to liaise with other departments within Cook Illinois, such as accounting or legal, to gather additional information or seek guidance on handling specific collection issues. 8. Monitoring progress: It is essential for collections coordinators to monitor the progress of collection efforts, track the accounts that have been resolved, and identify any accounts that require further action. Different types or variations of the Cook Illinois Collections Coordinator Checklist may exist depending on specific requirements or changes in collection procedures. Some additional checklist variations might include sections related to legal actions, credit reporting, escalation processes, or specific industry regulations related to debt collection. Overall, the Cook Illinois Collections Coordinator Checklist is a valuable tool that helps collections coordinators efficiently manage the collection process, improve cash flow, and uphold positive customer relationships.

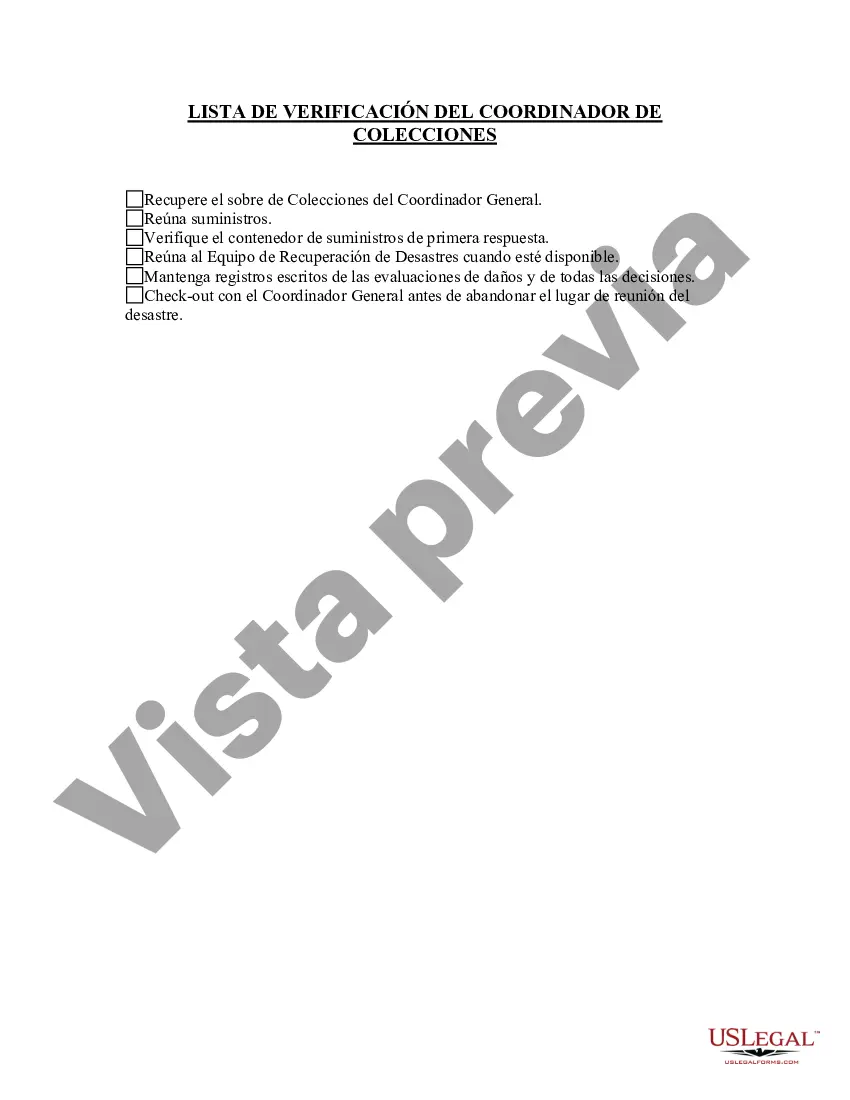

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Lista de verificación del coordinador de colecciones - Collections Coordinator Checklist

Description

How to fill out Cook Illinois Lista De Verificación Del Coordinador De Colecciones?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cook Collections Coordinator Checklist, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the current version of the Cook Collections Coordinator Checklist, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Collections Coordinator Checklist:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Cook Collections Coordinator Checklist and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!