Title: Fulton Georgia Collections Coordinator Checklist: A Comprehensive Guide for Efficient Debt Recovery Introduction: The Fulton Georgia Collections Coordinator Checklist is a well-structured and systematic guide designed for collections coordinators in Fulton, Georgia, focused on streamlining debt recovery processes. This article offers an in-depth description of various essential checklists, methods, and tools employed by collections coordinators to recover outstanding debts effectively. 1. Preliminary Assessment Checklist: — This checklist includes gathering debtor information such as name, contact details, and address. — Verification of debtor's identity through documentation. — Analyzing the debt details, including outstanding balance, due dates, and payment history. — Assessing the legality and validity of the debt in accordance with federal and state laws. 2. Communication Checklist: — Drafting and sending initial collection letters to debtors, stating the amount due and requesting prompt payment. — Making follow-up phone calls for debtors who have not responded to initial letters. — Establishing effective communication channels with debtors to negotiate repayment plans. — Ensuring compliance with the Fair Debt Collection Practices Act during all communication. 3. Documentation and Records Checklist: — Maintaining accurate records of all communication with debtors, including dates, times, and outcomes. — Creating and updating debtor files with essential details, payments, and correspondence. — Organizing and securely storing all documents related to debt collection for future reference. 4. Payment Agreement Checklist: — Preparing formal payment agreements, outlining terms, repayment plans, and consequences for non-payment. — Verifying debtor's willingness and ability to fulfill the agreed-upon repayment plan. — Discussing alternative payment options to ensure debtor compliance and increase chances of recovery. 5. Legal Procedures Checklist: — Initiating legal actions when all other attempts have failed to result in debt recovery. — Collaborating with attorneys and filing necessary legal documents. — Attending court proceedings and representing the creditor's interests. — Executing garnishment orders, if required, to recover debts. Different Types of Fulton Georgia Collections Coordinator Checklist: 1. Personal Debt Collections Coordinator Checklist: — Designed for collections coordinators handling individual debt collections, including credit card debts, personal loans, and medical bills. 2. Commercial Debt Collections Coordinator Checklist: — Intended for collections coordinators managing debts owed by businesses, including outstanding invoices, accounts receivable, and business loans. 3. Government Debt Collections Coordinator Checklist: — Targeted at collections coordinators working for government agencies, responsible for retrieving unpaid fines, taxes, and other debts owed to the government. Conclusion: The Fulton Georgia Collections Coordinator Checklist provides collections professionals with a strategic approach and essential tools to efficiently recover debts. By implementing these checklists, coordinators can navigate the complex process of debt collection while adhering to legal guidelines and improving the chances of successful debt recovery.

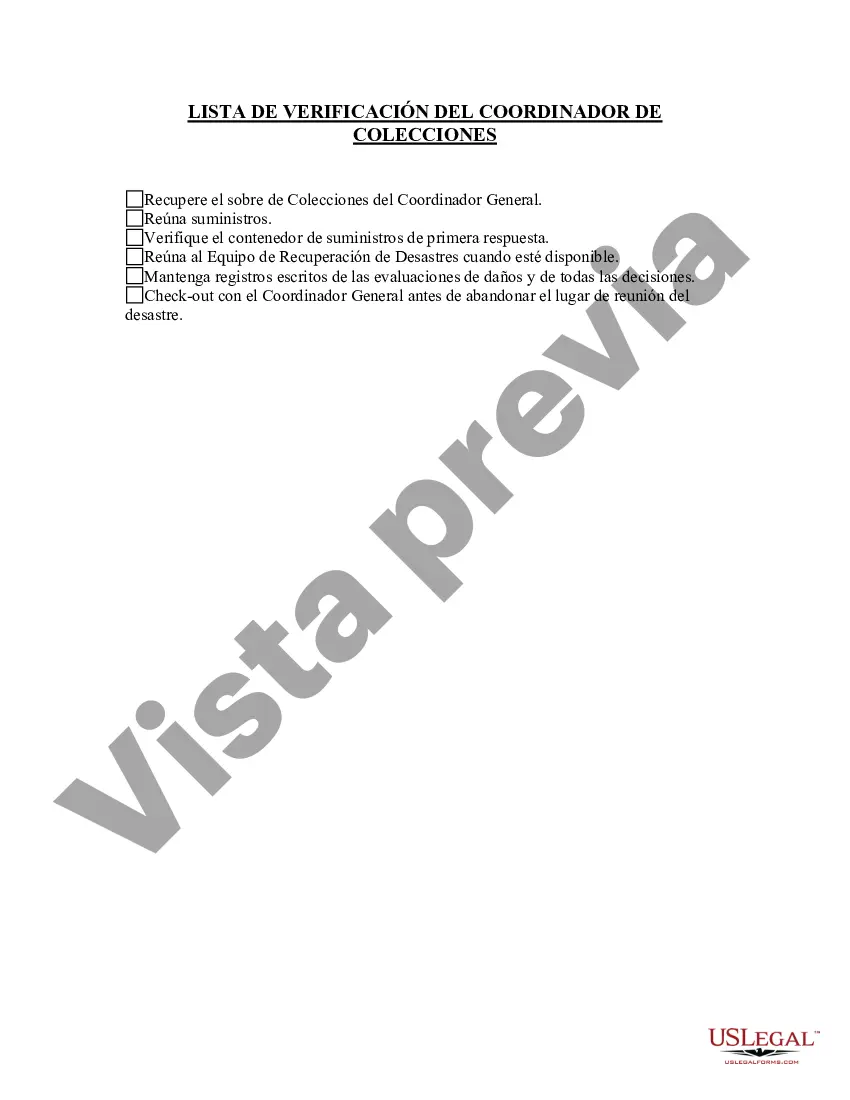

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Lista de verificación del coordinador de colecciones - Collections Coordinator Checklist

Description

How to fill out Fulton Georgia Lista De Verificación Del Coordinador De Colecciones?

Draftwing documents, like Fulton Collections Coordinator Checklist, to manage your legal matters is a tough and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for a variety of cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Fulton Collections Coordinator Checklist form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Fulton Collections Coordinator Checklist:

- Ensure that your template is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Fulton Collections Coordinator Checklist isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start utilizing our service and get the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!