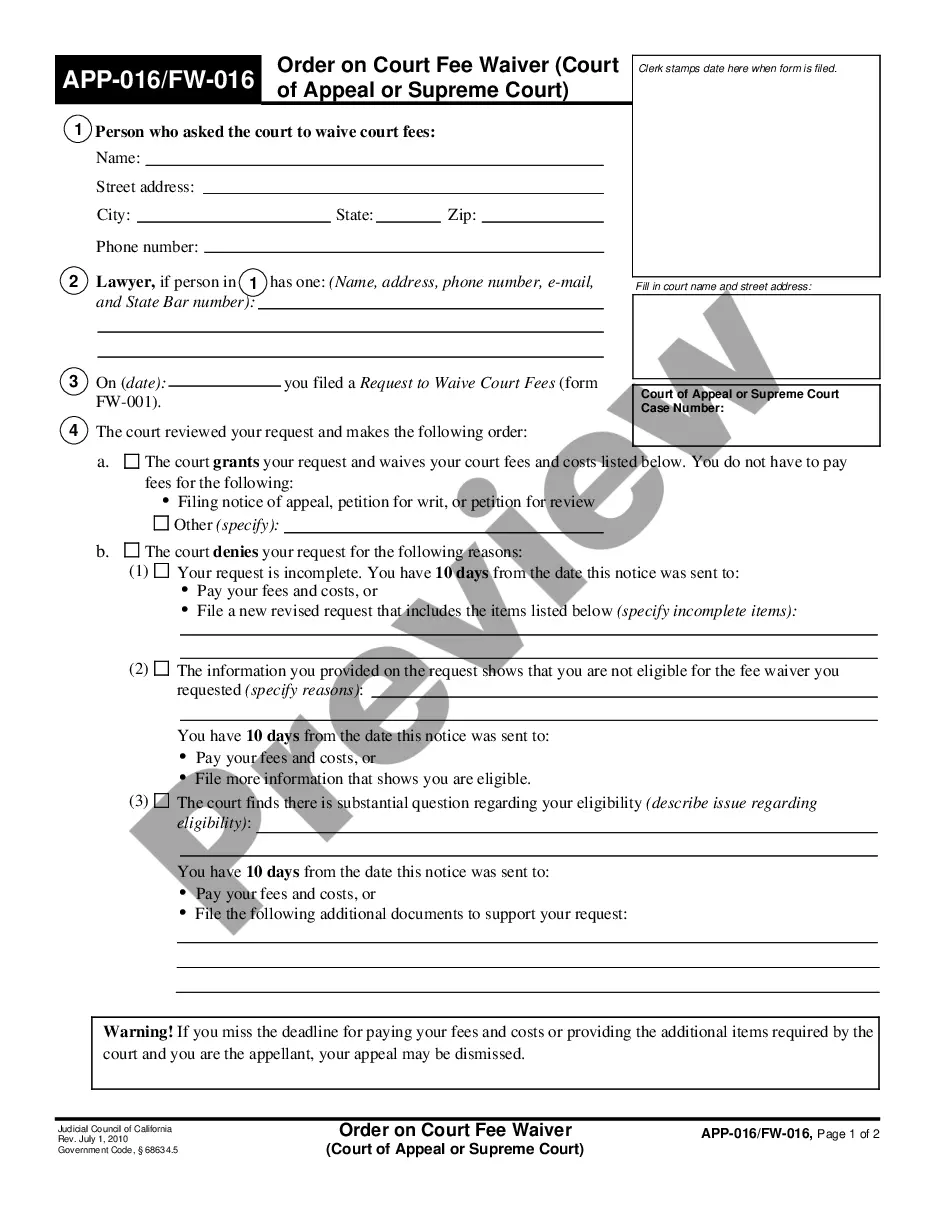

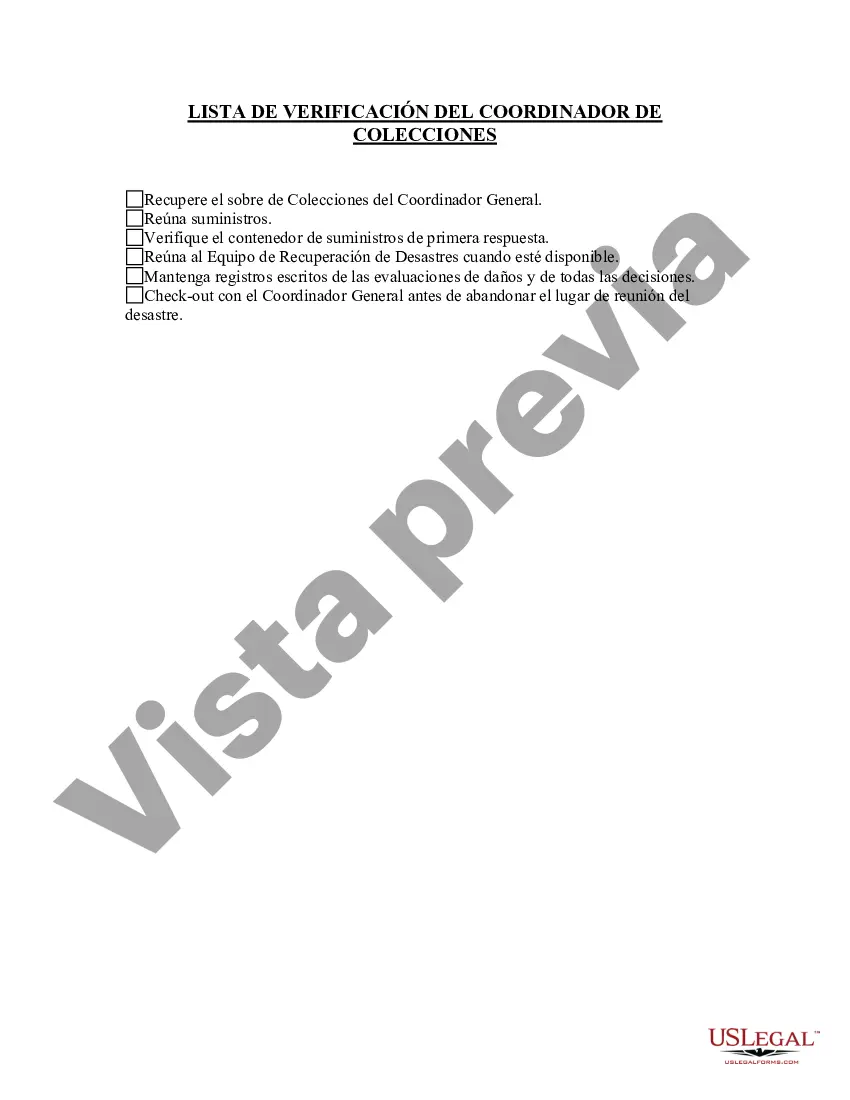

San Diego, California Collections Coordinator Checklist: A Comprehensive Guide for Efficient Debt Management Keywords: San Diego, California, Collections Coordinator, Checklist, debt management, efficient, operations, responsibilities, tasks, deadlines, compliance, documentation, communication, negotiations, legal procedures, follow-ups, reporting. Introduction: The San Diego, California Collections Coordinator Checklist is designed as an essential tool for Collections Coordinators to efficiently manage debt operations, ensuring adherence to legal procedures and optimized results. This comprehensive checklist encompasses various responsibilities, tasks, and deadlines that a Collections Coordinator must effectively handle in the vibrant city of San Diego, California. 1. Initial Setup Checklist: — Understand and familiarize oneself with the company's debt collection policies and procedures. — Obtain necessary access to databases, systems, and software tools. — Establish effective communication channels with the internal team, stakeholders, and external debtors. — Review and comprehend relevant federal and state laws governing collections practices in San Diego and California. — Ensure compliance with necessary licensing and documentation requirements. 2. Collection Operations Checklist: — Prioritize collection efforts based on age, amount, and viability of debts. — Maintain accurate records of debtors, including contact information, payment history, and dispute details. — Regularly update debtor files with any relevant information. — Schedule and perform outbound calls, emails, and letters to debtors for payment negotiations, reminders, and resolution. — Document all communication efforts with debtors and stakeholders for future reference and compliance purposes. — Collaborate with Legal Department when legal actions become necessary to collect outstanding debts, ensuring proper documentation and compliance with legal procedures. — Execute negotiations and settlement agreements within the authorized boundaries. — Handle incoming inquiries from debtors regarding payment plans, disputes, and clarifications promptly and professionally. — Maintain a systematic approach to follow-ups with debtors, ensuring regular communication until resolution is achieved. 3. Deadlines and Reporting Checklist: — Track deadlines for payment due dates, legal proceedings, and compliance-related tasks. — Monitor and enforce compliance with industry regulations and legal requirements. — Prepare regular reports on collection efforts, outstanding debts, and recovery rates. — Maintain accurate documentation and reporting for internal auditing purposes. Types of San Diego, California Collections Coordinator Checklists: 1. Consumer Collections Coordinator Checklist: Focuses on individual debtor accounts. 2. Commercial Collections Coordinator Checklist: Concentrates on business-to-business debt collection operations. 3. Medical Collections Coordinator Checklist: Tailored for healthcare professionals and medical facilities' debt recovery processes. 4. Vehicle Repossession Collections Coordinator Checklist: Addresses the specific aspects of repossessing vehicles due to delinquent payments. 5. Legal Collections Coordinator Checklist: Spotlights the legal aspects involved in collections, including court filings and liens. In conclusion, the San Diego, California Collections Coordinator Checklist provides a comprehensive guide for efficient debt management operations. By adhering to this checklist, Collections Coordinators can ensure compliance, streamline communication, mitigate risks, and maximize debt recovery outcomes in San Diego, California's dynamic economic landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Lista de verificación del coordinador de colecciones - Collections Coordinator Checklist

Description

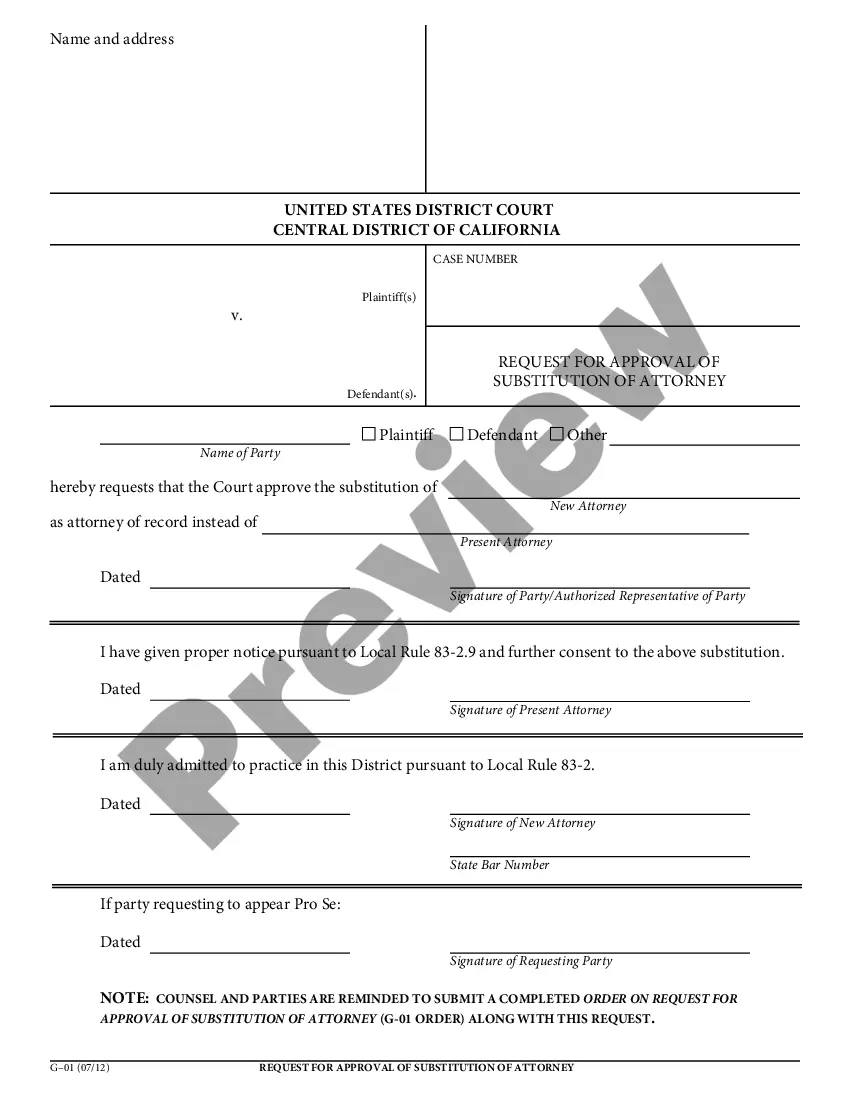

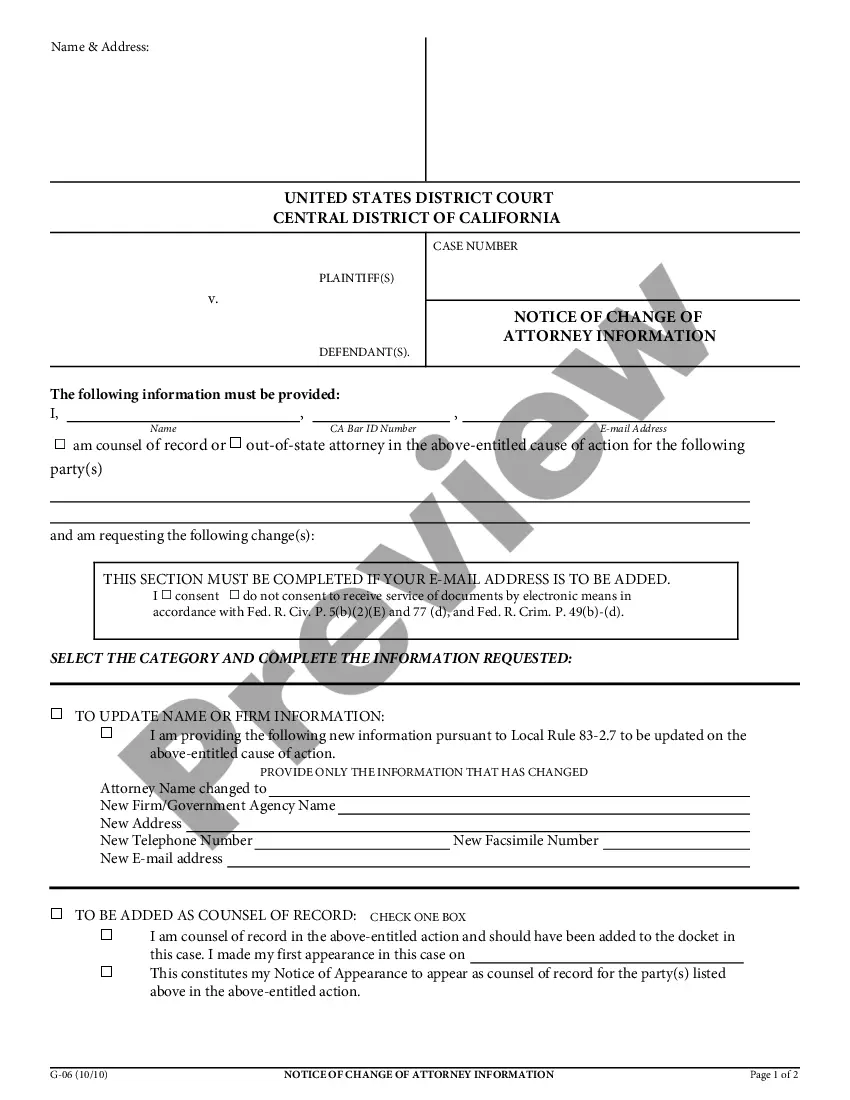

How to fill out San Diego California Lista De Verificación Del Coordinador De Colecciones?

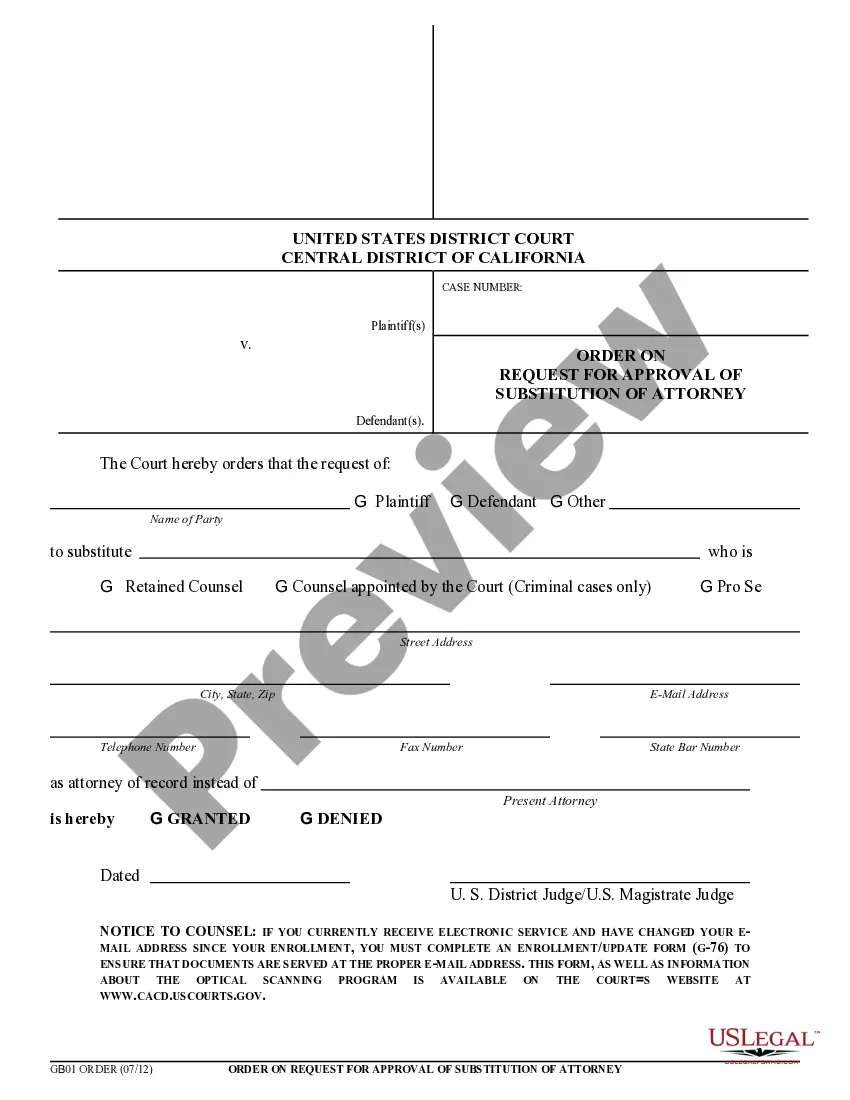

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the San Diego Collections Coordinator Checklist.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the San Diego Collections Coordinator Checklist will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the San Diego Collections Coordinator Checklist:

- Make sure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Diego Collections Coordinator Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!