Travis Texas Collections Coordinator Checklist: A Comprehensive Guide for Efficient Debt Collection Management In the realm of debt collection management, the Travis Texas Collections Coordinator Checklist serves as an indispensable tool to ensure seamless workflow and successful recovery of outstanding payments. This detailed checklist outlines a step-by-step process for collections coordinators operating in the Travis County, Texas area, enabling them to skillfully navigate through various tasks and obligations in the debt collection journey. Keywords: Travis Texas, Collections Coordinator, Checklist, debt collection management, outstanding payments, workflow, debt collection journey, step-by-step process, obligations, Travis County. Types of Travis Texas Collections Coordinator Checklists: 1. Recollection Checklist: This variant of the Travis Texas Collections Coordinator Checklist focuses on the initial preparatory stages of debt collection, covering essential activities such as reviewing accounts, gathering debtor information, assessing legal options, and devising an effective collections' strategy. 2. Communication Checklist: Effective communication is crucial in debt collection efforts. This type of checklist emphasizes the importance of maintaining clear and timely communication with debtors, clients, and relevant parties. It includes tasks such as sending demand letters, making phone calls, documenting conversations, and ensuring compliance with communication regulations. 3. Documentation Checklist: Maintaining accurate and comprehensive documentation is vital for legal and audit purposes. This checklist aids collections coordinators in organizing and updating essential documents, such as contracts, invoices, payment agreements, and supporting evidence. It also ensures compliance with record-keeping requirements. 4. Legal Compliance Checklist: Debt collection activities must adhere to federal, state, and local laws governing debt collection practices. This type of checklist helps collections coordinators stay knowledgeable about relevant regulations, such as the Fair Debt Collection Practices Act (FD CPA) or the Texas Debt Collection Act. It ensures compliance with statutory requirements, thereby mitigating legal risks. 5. Payment Monitoring Checklist: Tracking and monitoring debtor payments form a crucial part of collections coordination. This checklist assists in recording and reconciling payments, setting up payment plans, managing delinquencies, and identifying overdue accounts that require further action. 6. Reporting Checklist: Generating comprehensive reports is essential to provide clients and stakeholders with the necessary insights on collections progress. This checklist enables collections coordinators to compile and analyze relevant data, generate reports, and deliver valuable metrics illustrating the success and effectiveness of debt collection efforts. By utilizing the Travis Texas Collections Coordinator Checklist, debt collection professionals can streamline their workflow, optimize efficiency, maintain legal compliance, and increase the likelihood of successful recovery of outstanding payments. Whether operating in pre-collection tasks, communication management, documentation, legal compliance, payment monitoring, or reporting, this checklist serves as a valuable resource for collections coordinators in Travis County, Texas.

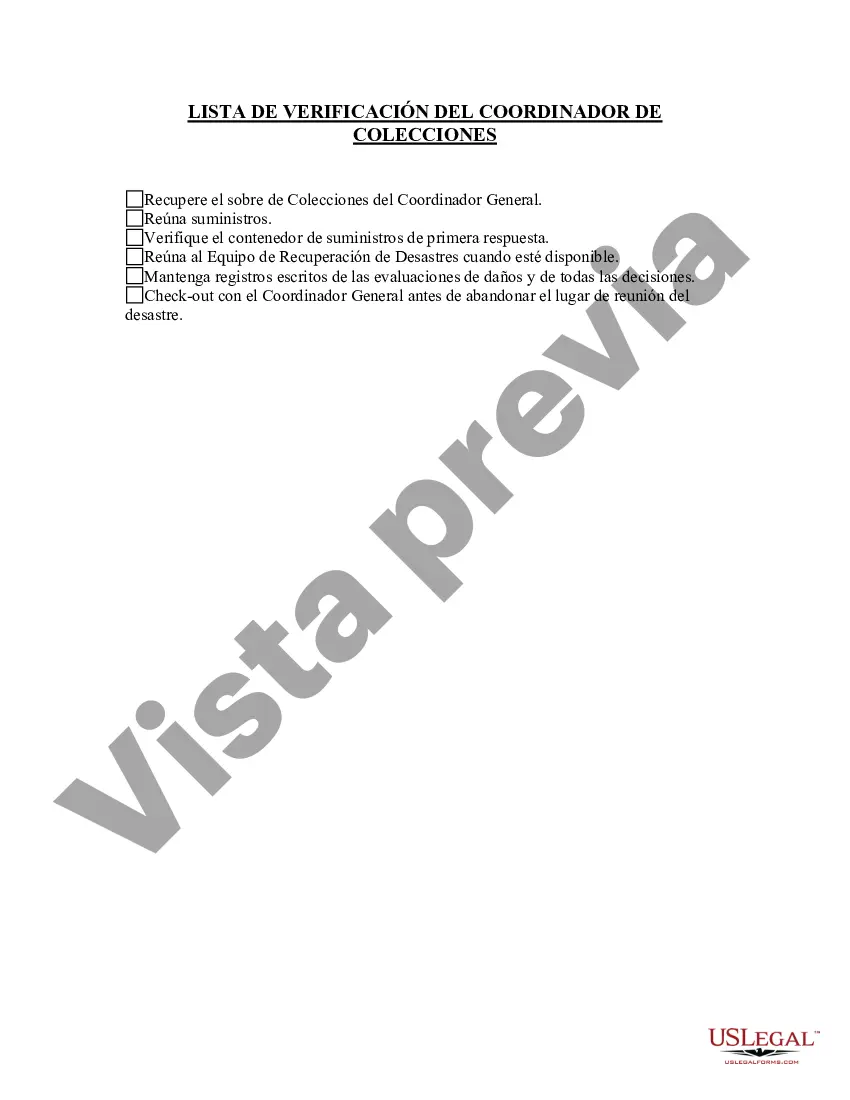

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Lista de verificación del coordinador de colecciones - Collections Coordinator Checklist

Description

How to fill out Travis Texas Lista De Verificación Del Coordinador De Colecciones?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a Travis Collections Coordinator Checklist suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Travis Collections Coordinator Checklist, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Travis Collections Coordinator Checklist:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Travis Collections Coordinator Checklist.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!