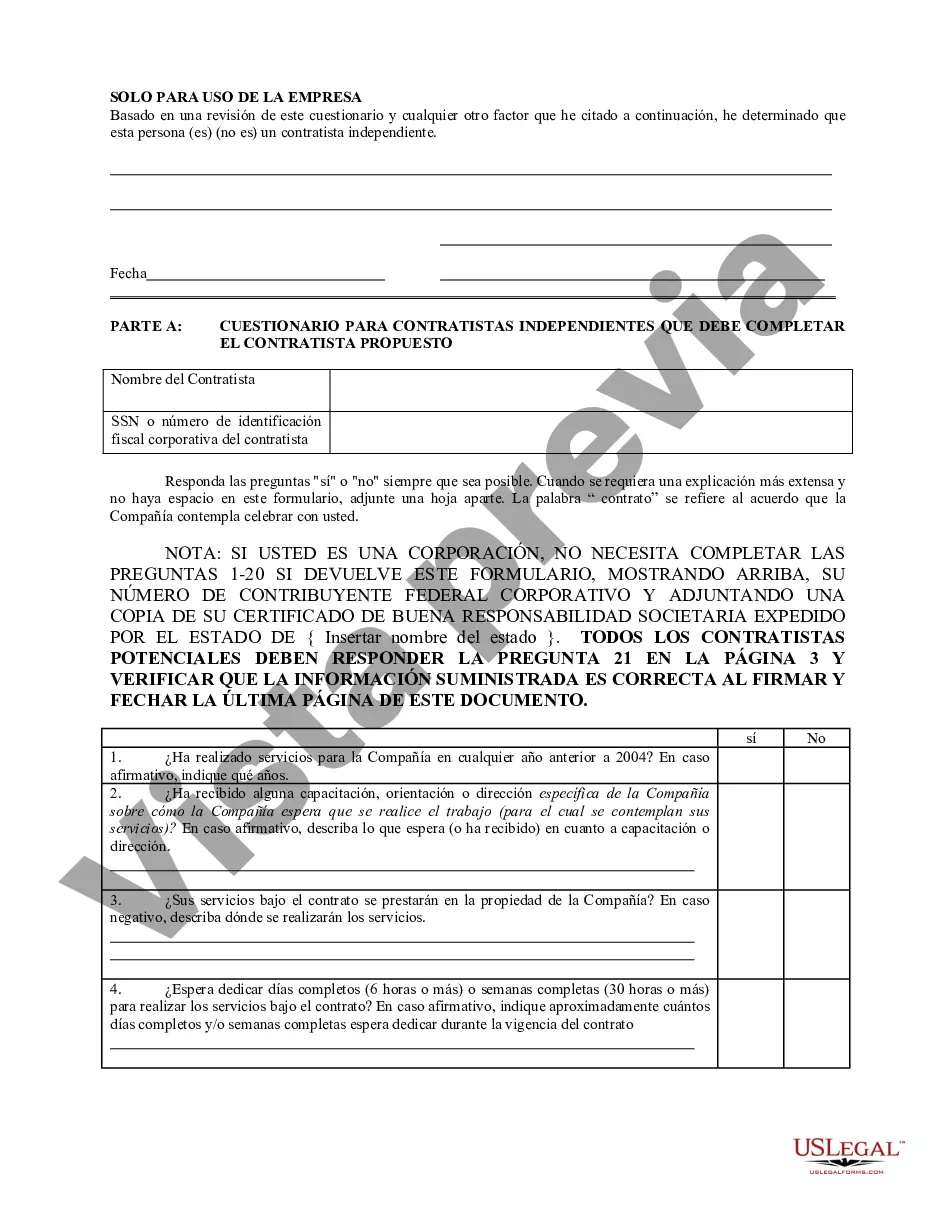

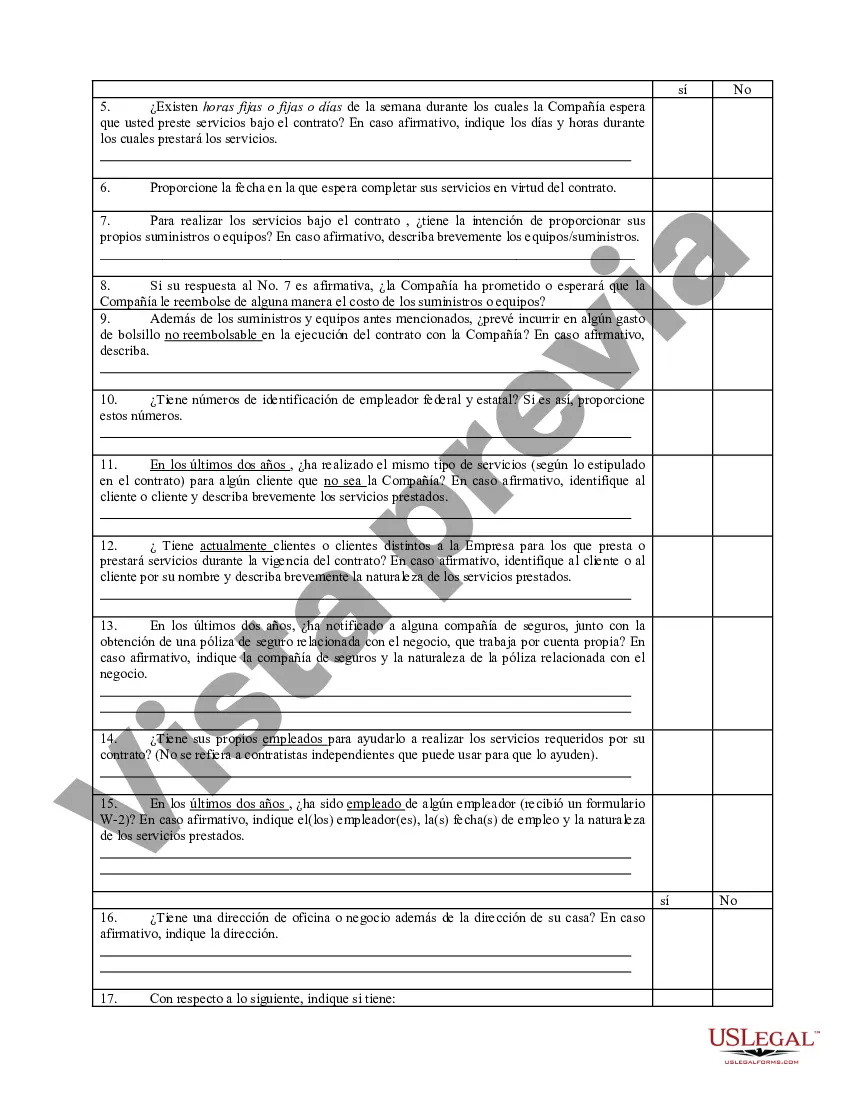

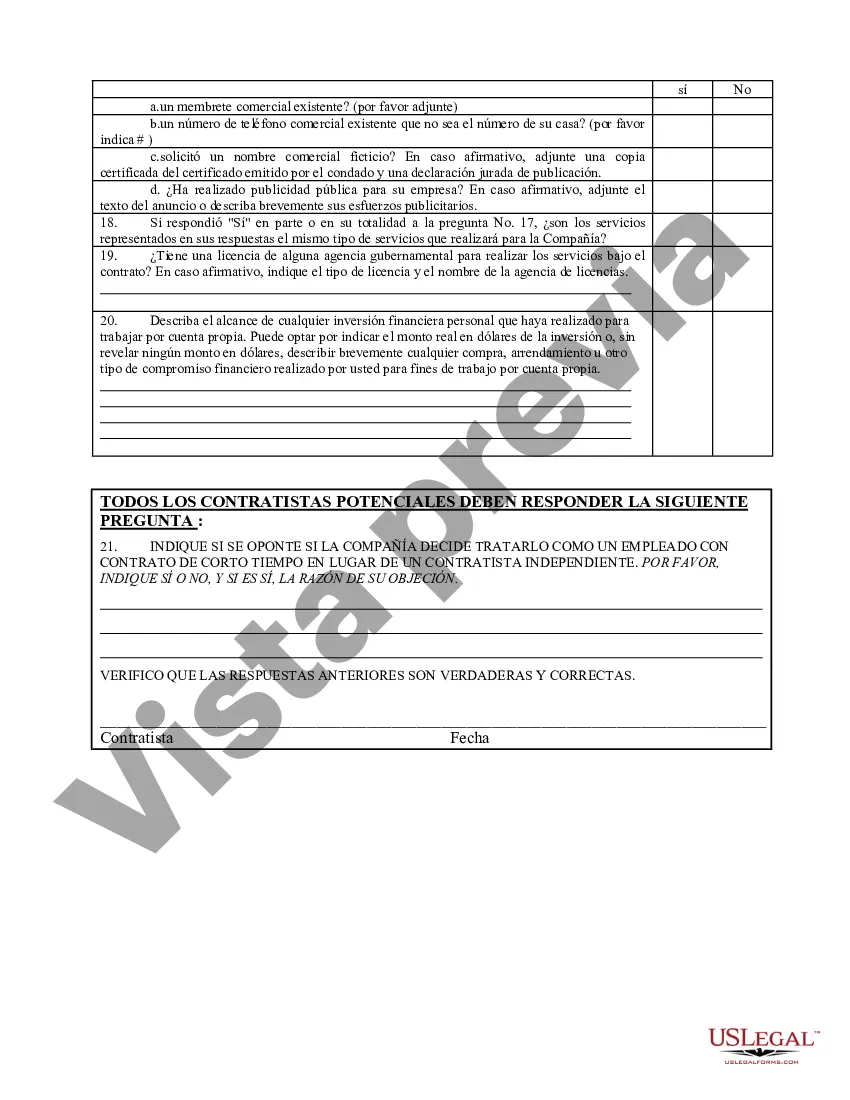

Contra Costa California Self-Employed Independent Contractor Questionnaire is a comprehensive form designed to gather essential information from self-employed individuals operating in Contra Costa County, California. This detailed questionnaire helps authorities and organizations understand the nature of the individual's self-employment, adhere to legal requirements, and ensure compliance with tax laws and regulations. By completing this questionnaire, self-employed contractors provide crucial details regarding their work structure, income, business nature, and other relevant aspects. The Contra Costa California Self-Employed Independent Contractor Questionnaire typically consists of multiple sections covering different aspects of self-employment. The questionnaire may cover the following key areas: 1. Personal Information: This section includes basic personal details of the contractor, such as name, contact information, social security number, and business address. 2. Business Description: Contractors are required to describe the nature of their business activities, including the products or services they offer and the industry they operate in. This aids in determining the contractor's line of work and industry classification. 3. Legal Structure: Here, individuals indicate whether they operate as a sole proprietor, partnership, limited liability company (LLC), or corporation. This helps establish the legal structure of their business. 4. Contractor Identification Number: If applicable, the questionnaire may ask for the contractor's identification number or license, depending on the specific requirements of their industry. 5. Taxation: This section focuses on tax-related information. Contractors need to provide details about their federal tax identification number, state tax registration number, and any additional permits or licenses required for tax purposes. 6. Income and Financial Information: Contractors are expected to disclose their annual income, revenue sources, and any associated expenses. This data helps assess the contractor's financial standing and determine tax liabilities accordingly. 7. Client Information: Contractors may be asked to provide details about their clients or companies they work for, including their names, addresses, and contact information. This information aids in identifying the contractor's working relationships and establishing any subcontractor agreements, if applicable. 8. Employment Status: The questionnaire may inquire about the contractor's employment status, asking whether they have any employees, subcontractors, or work solely on their own. This helps clarify whether they operate as a fully independent contractor or have additional staffing arrangements. These are general sections that can comprise a Contra Costa California Self-Employed Independent Contractor Questionnaire. However, depending on specific industry regulations or local requirements, there could be variations or additional sections tailored to certain professions or businesses. It's important for contractors to complete this questionnaire accurately and thoroughly to ensure compliance with legal obligations and facilitate transparent business practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Cuestionario para contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Questionnaire

Description

How to fill out Contra Costa California Cuestionario Para Contratistas Independientes Que Trabajan Por Cuenta Propia?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Contra Costa Self-Employed Independent Contractor Questionnaire, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any tasks associated with document completion straightforward.

Here's how to find and download Contra Costa Self-Employed Independent Contractor Questionnaire.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the related document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Contra Costa Self-Employed Independent Contractor Questionnaire.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Contra Costa Self-Employed Independent Contractor Questionnaire, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you need to deal with an exceptionally difficult case, we recommend using the services of a lawyer to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!